Twilio: Rapid Growth To Profitable Growth

Summary

- Twilio, a leading internet services and infrastructure stock, is expected to see significant growth due to increasing demand for customer data.

- Twilio expects its first non-GAAP profitable year in 2023 due to cost-cutting measures. However, GAAP EPS is not expected to be profitable until 2027.

- The stock trades at a high earnings multiple, but management expects 25% sales growth over the next 3-5 years and consistent improvement in operating margins.

Drew Angerer

Investment Thesis

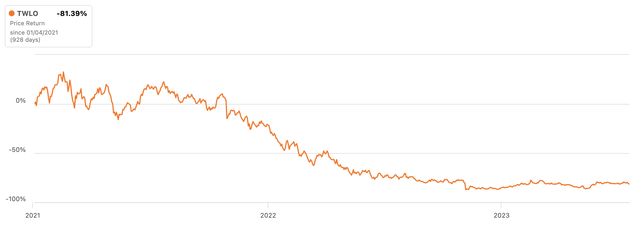

Twilio (NYSE:TWLO) is down 85% from its all-time high, and I believe now is the perfect time to start accumulating shares.

The stock has been consolidating in the 60s since late May and is ready for a move higher once management gives good news (Increasing profitability or demand). Businesses now more than ever need to stay connected to their customers, or they risk losing them. That is why I love Twilio. Twilio offers the perfect service to help businesses efficiently reach current and potential customers, and it is becoming a daily need for Twilio's customers.

In my view, the stock has plenty of room to run, and earnings this week could be the tipping point.

Company Catalyst

Twilio is the #1 ranked top internet services and infrastructure stock on Seeking Alpha. It is the market share leader in multiple niche categories for the quickly growing Communications Platform as a Service (CPaaS) and customer data platform (CDP) industries. The CPaaS industry is expected to have a 31% growth rate from 2022 to 2023. Multiple catalysts are expediting the growth of the industry, including:

Previously, only tech giants like Facebook and Google could see every one of those customer behaviors, and correlate it to commerce. They monetized it through ads. But with privacy changes afoot, that business model is less and less tenable." Companies are more desperate than ever to gain information and stay connected with their customers and that's where Twilio steps in.

Twilio's massive customers base includes AirBnb, Uber, Yelp, Fox, and a renewed partnership with Google, among many others. The newest Fortune 500 company to show interest and partner with the company is Amazon. It was announced Friday, July 28th that Amazon had taken a 1% stake in the company acquiring 1.7 million shares worth $108 million. This is another multi-billion dollar company looking to connect and reach customers more easily and efficiently. Twilio will be in the center of it all providing services to businesses of all sizes.

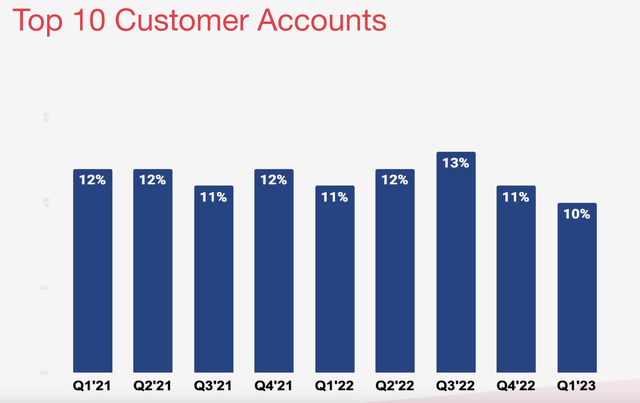

Even with these huge name-brand customers, Twilio still has over 300,000 active accounts. In Q1 2023, the top 10 customers accounted for their lowest percentage of sales ever, at just 10% of revenue. Total revenue grew by 15% in Q1, and management expects 25% total sales growth over the next 3-5 years.

Top 10 Customers % of Sales (Twilio Investor Relations)

Twilio operates through two main segments: its Communications business and its Data & Applications business. The Communications business is more established and mature, and as CEO Jeff Lawson puts it, is transitioning from "rapid growth to profitable growth." The company has been cutting costs and becoming more efficient, which is where they hope to see the bulk of the increase in profits and earnings per share (EPS). The Data & Applications business is still in the high-growth phase, and management has stated that they expect this segment to grow at 30% year-over-year (YoY) for the next 3-5 years. Additionally, this business has better profitability margins.

Overall, Twilio offers a great product that helps businesses leverage their products and offerings to stay connected with customers. Twilio is a leader in the industry and has taken the steps to show the importance of becoming profitable. I believe that with steady mid-twenty sales growth and the urgency to have steady profits, TWLO will be a long-term winner. We know that customers will not abandon the company's product seeing how the company has performed in current conditions, which shows me that this cloud company could be here to stay. In a historically high-margin industry I believe TWLO has the product and discipline to turn things around.

Company Overview

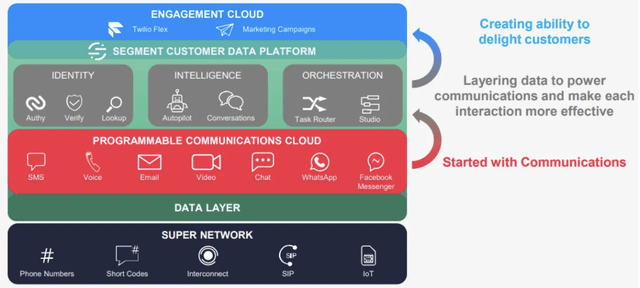

Twilio's Communications business accounted for 86% of sales in 2022. This segment allows developers to build, scale, and operate customer engagement within software applications. In simpler terms, Twilio allows companies to send messages and alerts to customers. For example, the notification you get on your phone when your Uber arrives, the text you receive when your Airbnb room is ready, and the alert on Yelp that your table is ready at that 5-star steakhouse are all made possible by Twilio.

Twilio's Data & Applications business is smaller but faster-growing, seeing 19% growth vs. 14% in Communications, based on the company's last 10Q. Twilio's Data platform provides businesses with access to real-time data about their customers. Management believes that data can be used to personalize marketing campaigns, improve customer engagement, and make better business decisions. Twilio's Applications platform provides businesses with a variety of pre-built applications that can be used to build and scale their applications. Twilio's application offerings include:

- Twilio Studio: An easy-to-use visual builder that allows businesses to create custom applications without writing code.

- Twilio Flex: A cloud-based platform that allows businesses to build and scale contact centers.

- Twilio Engage: A platform that allows businesses to create and manage customer journeys.

Product Offerings Overview (Twilio Investor Relations)

Twilio's two operating segments put the company in a unique position for growth. Its data & application business will provide faster growth and expansion in the coming years, leading to a higher valuation multiple. This segment is also more profitable and will help expand earnings, driving the stock higher. The communications side of the business will help retain customers and keep loyalty. It will provide steady cash flow that will ultimately drive customers into spending money on data & applications to help them become more efficient and drive consumer spending efficiencies.

Stock Thoughts

Profitability

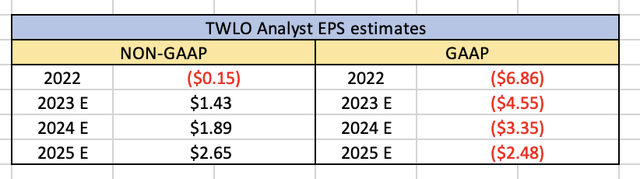

Twilio has yet to see a year with positive earnings per share (EPS), whether it be GAAP or NON-GAAP. It is important to know and look at both when evaluating Twilio. For those who do not know, GAAP EPS is a standardized accounting method that every public company must meet, regardless of industry or business type. NON-GAAP EPS is the company's own calculation tailored to its operations and financing methods. Although most people look at NON-GAAP EPS, which tells a better story about the business itself, the numbers can be misleading.

Twilio saw its highest NON-GAAP EPS in Q1 and expects its first NON-GAAP profitable year in 2023 as cost-cutting takes effect. However, the company does not expect GAAP EPS to be profitable until 2027. While this statement is concerning, the reason they are struggling to get GAAP EPS to positive is because GAAP accounting measurements take into account stock-based compensation (SBC), which makes it look worse than it actually is. The company's SBC was 17% of revenue in Q1, which is fairly high but down from the 23% high it saw in 2019. Management's current goal is to reduce SBC to 10-12% of sales by 2027.

GAAP vs. Non-GAAP EPS Analyst Estimates (Author Calculations Based on Data From Koyfin)

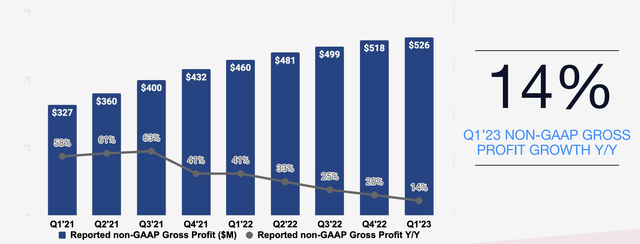

Top-line margins, also known as gross profit margins, have been contracting as costs rise in the wake of inflation and slowing demand amid recession fears. As management spends less in order to protect their own profits and efficiencies, this has trickled down and affected Twilio's profitability. Gross profit margins came in at 48.7% in the first quarter of this year, which is below the company's five-year average of 51.33%. This will most likely be temporary as prices mature and demand starts to reaccelerate.

NON-GAAP operating income, also known as earnings before interest and taxes (EBIT), came in at 42% in Q1, which was the highest in the company's history. The company showed signs of improvement in Q1, but Q2 earnings on Friday, August 4th will be a key indicator of the track the company is on. Analysts expect Q2 NON-GAAP EPS of $0.30, and in the last two years, the company has beaten EPS estimates 7 out of 7 times. With inflation and prices lower, cost cutting, possible signs of demand picking up, and a beat and raise scenario could send the stock higher. Margins and profitability will be the main things we watch going forward.

Quarterly Non-GAAP Gross Profit (Twilio Investor Relations)

Valuations

Twilio is currently trading at a forward NON-GAAP price-to-earnings (P/E) ratio of 43.3x, which is well above the sector median of 23.5x. The company trades at a premium, that I believe is well deserved given its trailing 55% five-year compound annual growth rate (CAGR). Twilio does not have a GAAP P/E yet and just started having a NON-GAAP P/E ratio in March. Since March, the average P/E has been 46x, showing that the price has been trending down.

On an enterprise value to sales (EV/S) basis, the company has become extremely cheap. This valuation metric gives us an indication of how the company is valued based on its sales rather than earnings in the P/E ratio. Twilio's forward EV/S is 2.14x, which is below the sector median of 3x and well below its five-year average EV/S. This tells us that sales have been increasing faster than the company's value, indicating that it the company could be undervalued. However, due to stringent market conditions currently and high interest rates, the P/E ratio is more valued and important to the markets and investors.

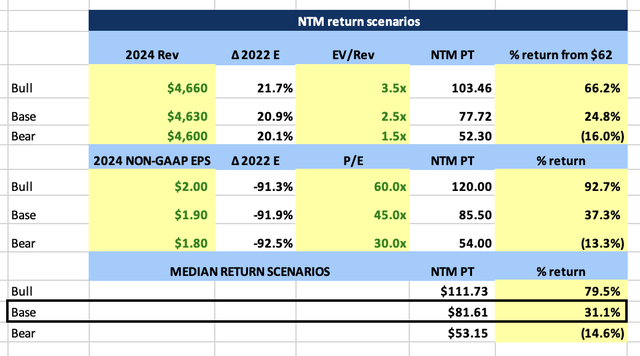

Below, I have attached my 2024 price target scenarios based on forward analyst sales and EPS expectations. If you are curious about how the scenario table calculations are generated read my previous article "Celsius Holdings: High Growth Energy Drink" where I break down and explain how I use price target return scenario tables. Anyways, according to my calculations based on analyst estimates for earnings, the stock currently trades at an enticing 5.6x risk-to-reward (R:R) ratio. The stock does have a 1.37 beta, meaning it is more volatile than the overall market (S&P 500). Therefore, I would only recommend Twilio as a holding for growth investors willing to take on more risk. At $62 per share currently, Twilio could be a steal for investors who are willing to bear a little bit of risk and are in it for the long haul.

2024 Price Target Scenarios (Author Calculations Based on Data From Koyfin)

Twilio's stock price peaked in February 2021 at $457 per share, with a market capitalization of $70.8 billion. Today, it sits at $62 per share and has a market capitalization of just over $11 billion. I am not saying I believe Twilio will or will not reach its inflated all-time high during the COVID rebound rally. However, I do believe that the base case price target of $81 per share, which would not even be a $15 billion market capitalization, is a reasonable target given management's goals and estimates. This is a company that I will continue to watch closely and hold.

Risk

There are three main risks to consider when looking at Twilio. First, the company operates in a very competitive industry that is always evolving. Twilio works with many Fortune 500 companies that are always looking to become more efficient. This means that competition can come from both emerging and established players. It is important for Twilio to dominate its niche of the market and become essential to companies' success. Management's goal is to make sure the service they offer is not expandable to clients when they need to cut cost.

The second risk to weigh is the companies struggling margins. Morningstar Analyst believes:

Because of pass-through fees from network operators, the company's gross margin profile is materially lower than software peers. We, therefore, think the company's margins will ultimately be structurally lower than those of peers. These fees cover messaging over the company's super network. While they are passed on to customers, rising fees drive lower gross margins for Twilio. Further, it is possible that the firm may experience reluctance on the part of customers to accept price hikes or it may slow usage growth.

The third risk to watch is the company's valuation, specifically its price-to-earnings (P/E) ratio. Profitability is what is most important to investors and the market currently, so this is something to keep an eye on. Twilio is still a very young company, so it is difficult to tell what the typical range for the stock's valuation should be. However, we can use the industry averages that has companies with similar growth rate to get a general idea when comparing.

At a P/E ratio of 44x, if sales were to slow down, the price of the stock could start to fall. This is because a P/E ratio of 44x would no longer be justified if sales growth slowed down. On the other hand, if sales growth sped up to 40-50%, a P/E ratio of 55x-60x could be justified.

It is important to remember that the stock traded at a P/E ratio of over 400x and an enterprise value-to-sales ratio of 23x when it was at its peak price in 2021. The stock then dropped 90% from its all-time highs to its current all-time lows. This shows that valuation contractions can always occur when analysts believe that earnings growth will not be as good as expected. With Twilio, be prepared for both the good and the bad.

TWLO Price Return Since 2021 (Seeking Alpha)

Conclusion

Twilio is not a cheap stock, but its sticky product and steady mid-twenty growth rates make me confident that it will meet or exceed market return rates over the next 5-10 years. Management is taking steps to increase profitability and satisfy shareholders. Twilio is in the right industry at the right time, and its customers have become extremely reliant on its products, which help the business scale and generate profits while expanding their customer engagement and reach.

Twilio is not a stock for everyone, but those with a long-term view and an interest in technology and growth may find a winner in TWLO. I expect Twilio to be a big winner in my portfolio in the long term, as the need for B2B and B2C engagement continues to drive services and experiences for businesses worldwide. Twilio is the leader in cloud communications platform as a service (CPaaS) and will benefit the most from the industry's high-paced growth. I suggest accumulating shares of the stock as long as it sits under $70 per share. Q2 earnings will either provide an even better buying opportunity or prove why the stock should be higher.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TWLO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Jake Blumenthal is a Registered Investment Advisor and Portfolio Analyst with Meridian Wealth Management, an SEC Registered Investment Advisor. The views and opinions expressed in the following content are solely those of Jake Blumenthal and do not necessarily reflect the views and opinions of his employer, Meridian Wealth Management. The content provided is for informational purposes only and should not be considered as financial advice or a recommendation to engage in any investment or financial strategy. Readers are encouraged to conduct their own research and consult with a qualified financial professional before making any investment decisions. Meridian Wealth Management does not endorse or take responsibility for any content shared by Jake Blumenthal outside of his official duties at the company.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)