Zevia Drops Guidance On Supply Chain Logistics Issues

Summary

- Zevia sells a variety of stevia-sweetened consumer beverage products.

- The company recently reduced its forward revenue guidance due to supply chain logistics problems.

- Risk-on investors may see a bargain in the stock price drop, but I'm Neutral [Hold] on ZVIA until we learn more about management's response to the issues.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Linda Hall/iStock via Getty Images

A Quick Take On Zevia

Zevia PBC (NYSE:ZVIA) went public in July 2022, raising approximately $150 million in gross proceeds from an IPO that priced at $14.00 per share.

The firm sells a range of canned beverages with no sugar or calories and sweetened by the stevia plant extract.

I previously wrote about Zevia in September 2022 with a Hold outlook.

The company has recently announced supply chain logistics issues that will slow revenue growth and has reduced its forward revenue guidance.

I’m Neutral [Hold] on Zevia until we learn more details about the impact of these challenges and management’s response.

Zevia Overview And Market

Encino, California-based Zevia was founded to design and market consumer beverages that have no sugar and are naturally sweetened by the stevia plant.

Management is headed by President and Chief Executive Officer Amy Taylor, who has been with the firm since March 2021 and was previously president and Chief Marketing Officer at Red Bull.

The company’s primary offerings include:

Sodas

Energy drinks

Teas

Mixers

Kidz

The company distributes its products via distributors across the United States and Canada.

According to a 2021 market research report by Market Research Future, the global non-alcoholic beverages market is forecast to reach $1.07 trillion by the end of 2024.

This represents a forecast CAGR of 4.61% from 2021 to 2024.

The main drivers for this expected growth are the growing popularity of energy/sports drinks and increasing consumer demand for product choice.

Also, the market is segmented by packaging type, product type, distribution channel and region.

Major competitive or other industry participants include:

The Coca-Cola Company (KO)

Keurig Dr Pepper (KDP)

PepsiCo (PEP)

National Beverage (FIZZ)

Monster (MNST)

Red Bull

Emerging brands

Zevia’s Recent Financial Trends

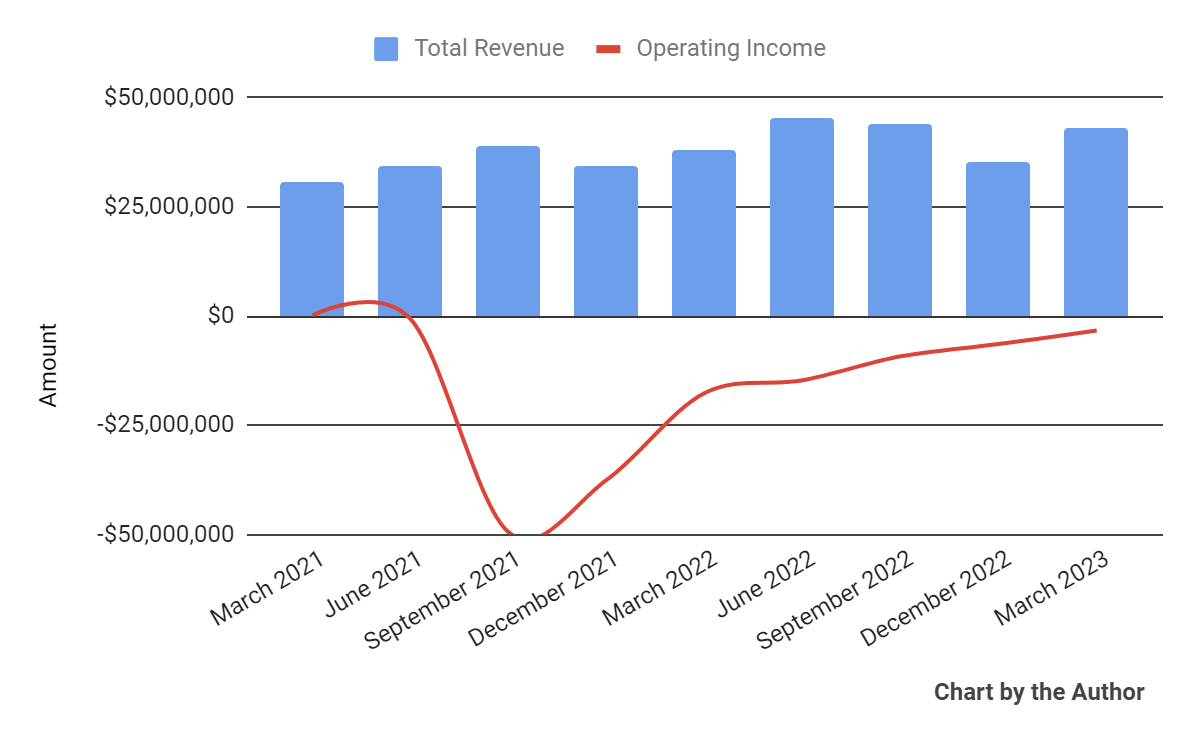

Total revenue by quarter has produced the following trajectory; Operating losses have made significant progress toward breakeven.

Total Revenue and Operating Income (Seeking Alpha)

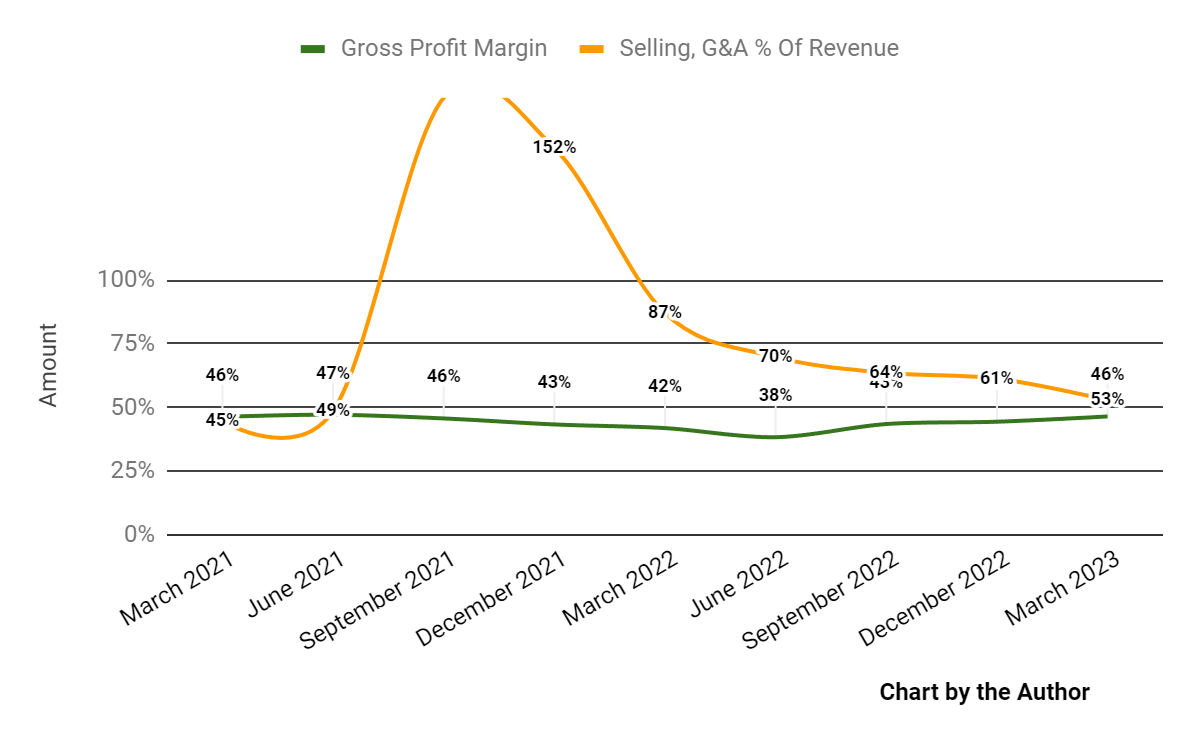

Gross profit margin by quarter has trended higher recently; Selling, G&A expenses as a percentage of total revenue by quarter have moved lower in recent quarters.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

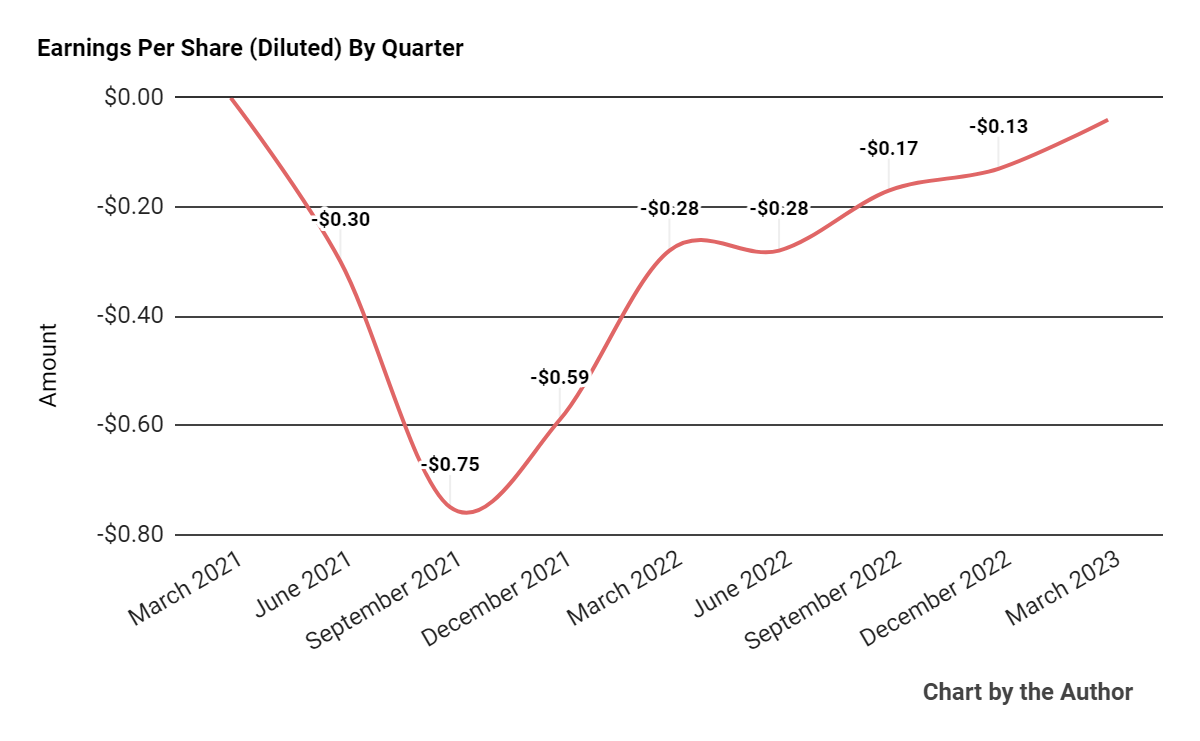

Earnings per share (Diluted) have remained negative but have made progress toward breakeven in recent quarters.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

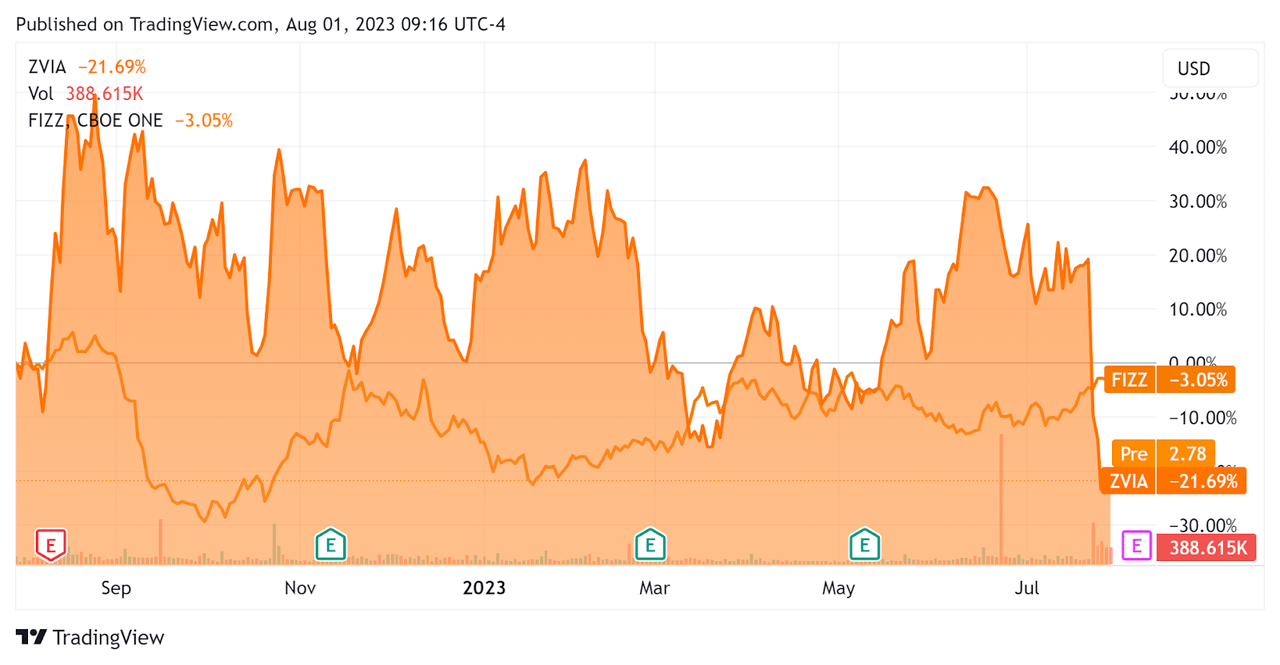

In the past 12 months, ZVIA’s stock price has fallen 21.69% vs. that of National Beverage’s (FIZZ) drop of 3.05%, as the chart indicates below.

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $56.0 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash used was $2.9 million, during which capital expenditures were $2.9 million. The company paid $20.4 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Zevia

Below is a table of relevant capitalization and valuation figures for the company.

Measure [TTM] | Amount |

Enterprise Value / Sales | 0.3 |

Enterprise Value / EBITDA | NM |

Price / Sales | 0.8 |

Revenue Growth Rate | 15.8% |

Net Income Margin | -14.9% |

EBITDA % | -19.3% |

Net Debt To Annual EBITDA | 1.7 |

Market Capitalization | $192,160,000 |

Enterprise Value | $52,490,000 |

Operating Cash Flow | $19,000 |

Earnings Per Share (Fully Diluted) | -$0.62 |

(Source - Seeking Alpha)

As a reference, a relevant partial public comparable would be National Beverage (FIZZ); shown below is a comparison of their primary valuation metrics.

Metric [TTM] | National Beverage | Zevia PBC | Variance |

Enterprise Value / Sales | 4.1 | 0.3 | -92.5% |

Enterprise Value / EBITDA | 23.3 | NM | --% |

Revenue Growth Rate | 3.1% | 15.8% | 413.4% |

Net Income Margin | 12.1% | -14.9% | -- |

Operating Cash Flow | $161,660,000 | $19,000 | -100.0% |

(Source - Seeking Alpha)

Commentary On Zevia

In its last earnings call (Source - Seeking Alpha), covering Q1 2023’s results, management highlighted the growth in its gross margin by ‘realizing price in the market and materially reducing cost in our business.’

Apparently, those positive trends were subsequently reversed in a company outlook after the earnings call that noted supply chain logistics problems resulting in reduced fulfillment and subsequent revenue shortfalls.

Management said they expect the supply chain issues to be resolved by ‘the end of 2023.’

Total revenue for Q1 2023 rose 13.9% year-over-year and gross profit margin increased by 4.6%.

Selling, G&A expenses as a percentage of revenue fell by 34.2% year-over-year, indicating sharply improved efficiency, while operating losses dropped by 81.3%.

The company's financial position is solid, with ample liquidity, no debt and a small use of free cash in the past 12 months.

As a result of the supply chain issues, management reduced revenue guidance to $165.5 million for the full year of 2023, or year-over-year revenue growth of only 1.5%.

If achieved, this would represent a sharp drop in revenue growth versus 2022’s growth rate of 17.9% over 2021.

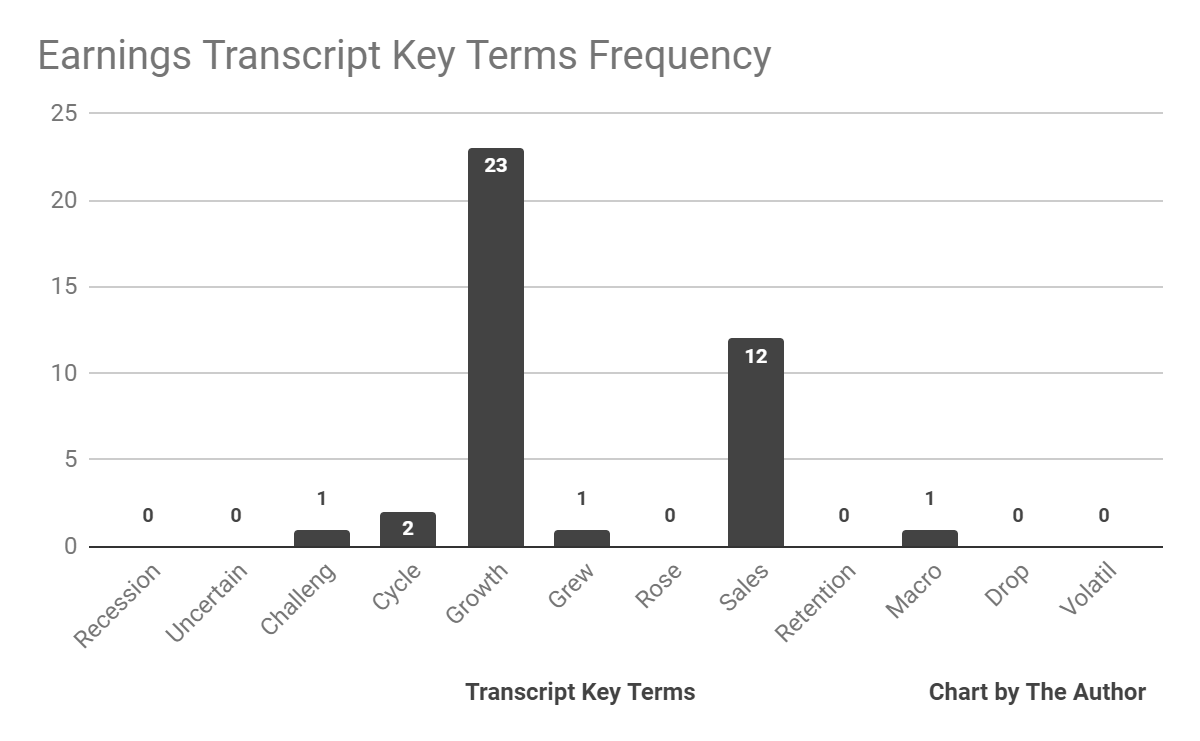

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below.

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited ‘Challeng[es][ing]’ once and ‘Macro’ once.

Regarding valuation, in the past twelve months, the firm's EV/Sales valuation multiple has been flat, bookended by a valuation bump at the beginning of the period and a sharp drop at the end of the period, as the chart from Seeking Alpha shows below.

EV/Sales Multiple History (Seeking Alpha)

A potential upside catalyst to the stock could include faster-than-expected supply chain logistics improvements.

However, until we learn more about the challenges facing the company, and management’s specific corrective measures, I’m Neutral [Hold] on ZVIA.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.