American Express: A Terrific Stock To Put In The Wallet

Summary

- American Express is a strong company with a global presence and competitive advantages through its merchant ecosystem.

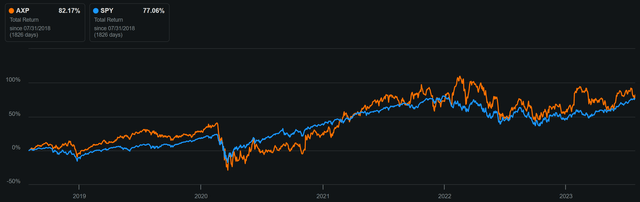

- AXP has provided strong returns to shareholders over the past 5 years, outperforming the tech-heavy S&P 500.

- Despite some risks, such as rising net write-off rates, AXP is expected to continue its revenue and earnings growth, making it an attractive investment for total return investors.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

naphtalina/iStock via Getty Images

Hunting for underfollowed bargains can be exciting, but most lesser-followed companies don't have economic moats, thereby making their long-term value proposition murkier than that of wide moat companies. That's why it's sometimes better to buy a wonderful company at a fair price.

Such may be the case with American Express (NYSE:AXP), which I last covered here back in January, highlighting its strong growth despite inflation. The stock has performed well since then, giving investors a 9.4% total return. In this piece, I provide an update on the business and discuss why AXP remains a good value for total return investors.

Why AXP?

American Express benefits from its global presence in 130 countries, providing consumers and businesses with credit services solutions. It also has a large merchant ecosystem, thereby giving it competitive advantages through its "network effect". This includes being able to offer in-network tiered discounts to its sizable customer base.

AXP has given shareholders strong returns over the past 5 years, despite not being a tech company. As shown below, it's provided an 82% total return over the past 5 years, comparing favorably to the 77% return of the tech-heavy S&P 500 (SPY) over the same timeframe.

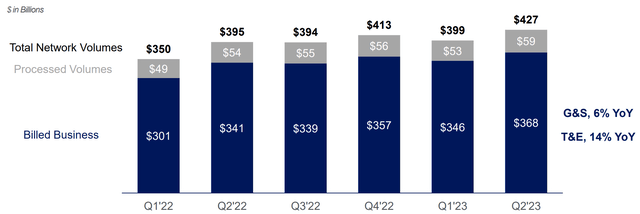

Meanwhile, AXP recently closed out another strong quarter, with EPS rising by 12% to a record $2.89 during the second quarter. This was driven by strong network volume growth of 9% YoY. As shown below, G&S (goods and services) and T&E (travel and entertainment) spending by AXP customers grew, with the latter category being very strong at 14% YoY growth.

Notably, this represents AXP's fifth consecutive quarter of record revenues as consumers are still spending in force with no signs of slowing down. Millennial and Gen Z consumers are AXP's fastest-growing cohort, representing 60% of new customer accounts acquired globally during Q2, and this group grew by 21% YoY in the U.S.

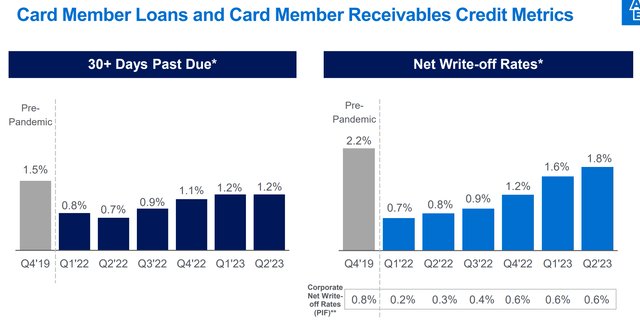

Risks to AXP in the near term is the rising net write-off rate. As shown below, this ratio has trended up every quarter since Q1 of last year. While it remains well under the pre-pandemic rate of 2.2%, this trend is worth monitoring, as consumers take on additional debt. In addition, while growth in younger consumers is great, I believe this demographic may be less responsible and knowledgeable with debt and can be more likely to default on debt than older populations.

Looking ahead, management is guiding for robust full-year revenue growth of 16% at the midpoint, and annual EPS growth in the mid-teens. What sets AXP apart from peers is that its business is not driven purely by consumer spending and carrying balances on their cards. Rather, its business relies on a fee-based model (think annual fees on premium cards with benefits) which results in a subscription-like recurring revenue stream that's more stable.

The high net worth nature of AXP's customers and the customer loyalty from premium card subscriptions, in turn, attract high-value merchants to the network such as Hilton, which recently signed a 10-year extension to provide a co-branded card with AXP. Moreover, consumer "revenge spending" remains in full force, as AXP is seeing a record number of restaurant reservations through its Resy platform, and consumer travel business reached its highest level since before the pandemic.

Meanwhile, AXP carries a strong balance sheet with a Net Debt to EBT (earnings before tax) ratio of 0.76x and a BBB+ credit rating from S&P. This lends support to the 1.45% dividend yield, which comes well-covered by a 23% payout ratio.

While AXP's dividend yield is the same as that of the S&P, it does come with a much faster 5-year CAGR of 9.9%, comparing favorably to the 5.8% 5-year CAGR of the S&P 500. Considering that AXP's customer base covers a high-quality customer base across the global economy, investors are essentially getting high-quality diversification through AXP.

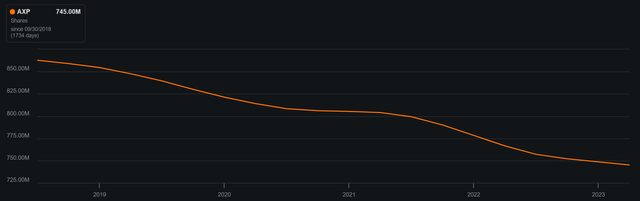

Moreover, AXP should be considered a total return stock as it returns a significant amount of capital to shareholders via buybacks. As shown below, AXP has steadily removed 14% of the outstanding float over the past 5 years alone.

AXP Share Count (Seeking Alpha)

Lastly, while AXP isn't cheap, it's not expensive either at the current price of $168.88 with a forward PE of 15.3. This is considering the strong performance, durability of the enterprise, capital returns, and analyst expectations of 12-13% annual EPS growth over the next couple of years. While some value investors may want to wait for a bigger margin of safety, it may not make much of a difference 10 years from now whether you get a 5-10% discount from today's price.

Investor Takeaway

American Express is a strong business that's providing durable revenue and earnings growth through its vast platform with subscription-like fees. With its strong network and merchant ecosystem, AXP should be able to provide solid returns for years to come. Moreover, the stock pays out the same yield as the S&P 500 but with a higher growth rate and potential for capital returns through share buybacks. While AXP isn't necessarily a screaming buy today, it makes for an attractive core holding for total return investors. As such, AXP is worth looking into as a quality addition to a well-rounded portfolio.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.