Hims & Hers Health: Giving Investors Another Bite At The Apple

Summary

- Hims & Hers Health has lagged the market for the past couple of months.

- The business is executing well and is unprofitable as it is investing heavily to grow revenue instead of earnings.

- A bargain valuation and strong growth outlook make shares a no-brainer for long-term investors in my view.

Nastasic/E+ via Getty Images

Many growth stocks have enjoyed the broader market's rally over the past few months, but Hims & Hers Health (NYSE:HIMS) hasn't been one of them. The stock is down more than 30% since May.

This dip, which came after a remarkable multi-month run from lows of roughly $3, could be a compelling buying opportunity to continue adding before shares eventually move higher.

I'll detail my investment thesis for Hims & Hers below and demonstrate what makes the stock a compelling buy today for long-term investors.

Hims & Hers Health's ten-second pitch: The company provides a convenient and satisfying user experience by delivering healthcare services directly to patients.

Breaking down the company

To elaborate, Hims & Hers Health is a digital healthcare company. Patients can consult with professionals for numerous conditions on the company's app or site, receive a prescription, and have it filled and delivered.

There is a product and services platform for both men and women, treating conditions such as sexual health, mental health, dermatology, and hair loss. Hims & Hers Health started with taboo conditions that patients might prefer to treat discreetly but has steadily expanded its offerings.

The first objection I typically hear about Hims & Hers is that the company isn't unique. It's true. There is competition from private competitors, and incumbent healthcare companies like UnitedHealth (UNH) have waded into direct offerings.

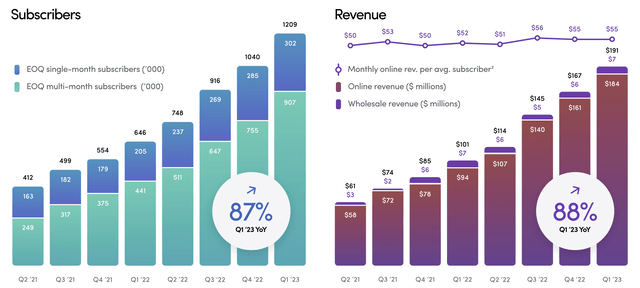

Hims & Hers Health operating metrics as of Q1 2023. (Hims & Hers Health)

While that's a fair concern, it's hard to dispute that it hasn't prevented Hims & Hers from operating at a high level. The company was only started in late 2017 and has exploded to more than 1.2 million subscribers and grown revenue at a near-triple-digit pace.

The company has nailed its branding and appeals to patients. Successful companies aren't always unique; Starbucks (SBUX) coffee is just coffee. But years of successful branding and growth built that moat over time. We could be seeing Hims & Hers do this in real time.

Compelling business economics

Hims & Hers also carries terrific margins, despite bears calling out competition as a primary threat. This is a very non-capital-intensive business with roughly 80% gross profit margins.

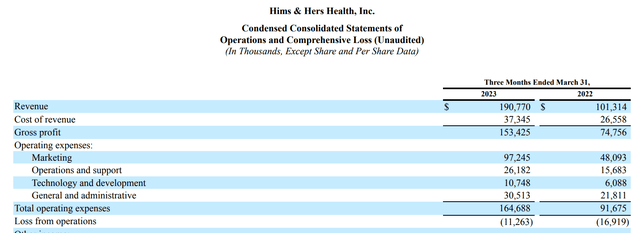

However, the business is still losing money on an operating basis. Why? A massive marketing spend would be the culprit here. Hims & Hers is spending about 51% of its revenue on marketing.

Hims & Hers Health Q1 2023 10-Q (Hims & Hers Health)

Management's relentless marketing spend could have something to do with the stock's decline since these earnings results. But long-term investors should see value here.

Hims & Hers states that it's retaining more than 85% of cohorts that buy for at least two years, and customer acquisition costs are repaid within the first 12 months. In other words, Hims & Hers is successfully building a recurring revenue stream of high-margin repeat buyers. Management should frankly lean into this until there's sufficient market saturation in my opinion.

A potential launching point for market-beating returns

Hims & Hers is still a young company that must continue executing well to prove itself. It's a smaller name; a market cap of just $1.7 billion could mean it's less followed than other names on Wall Street.

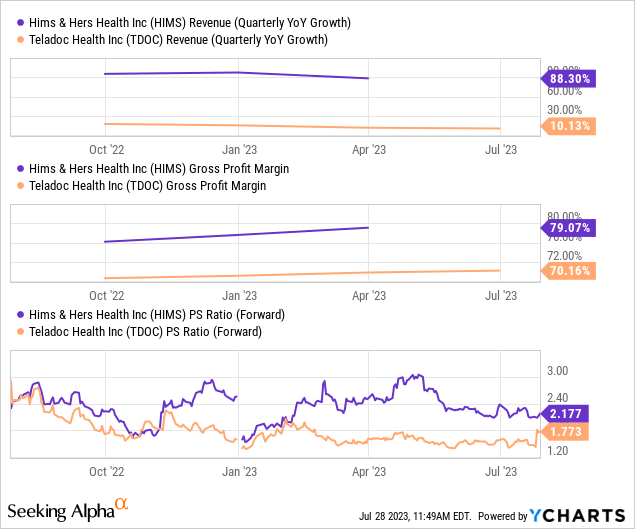

Otherwise, it's hard to figure out why a business doing around $830 million in sales in 2023 (nearly 60% year-over-year growth) at 80% gross margins could trade at just two times revenue.

The market values the stock similarly to Teladoc (TDOC), but Hims & Hers has higher margins and a far-superior growth rate.

Even with a conservative forward outlook -- say, the valuation stays flat moving forward, the business will still grow 60% this year, trickling down to investors as returns. At some point, when the company focuses on profits, I believe it will become profitable in a hurry if it can maintain its current margins.

What to look for in Q2 earnings

The company has Q2 earnings in the coming days. Investors should expect more of the same -- investing heavily to grow its customer base.

Hims & Hers has beaten analysts' revenue expectations every quarter since going public, so the company is building an excellent track record for under-promising and over-delivering.

Hims & Hers Health quarterly revenue versus analyst estimates. (Seeking Alpha)

Personally, I'll be looking for another revenue beat. I was writing this with questions about the company's product pipeline, but that's been answered. Hims & Hers recently announced its expansion into heart health. I look forward to hearing more about this during the company's earnings call.

Thesis risks

Remember that healthcare is a very competitive industry. Even big tech companies like Amazon (AMZN) are pushing into the space. So far, it hasn't prevented Hims & Hers from putting up stellar growth. Still, investors should watch for any dramatic slowdown, which could signal that competitors are making inroads.

Secondly, regulators are often looking at the broader healthcare industry. There is a risk anytime a business is issuing prescription drugs to patients. While nothing seems imminent, investors must beware of any potential crackdown on virtual care companies like Hims & Hers Health.

That said, this young company is executing at a high level in a notoriously fractured yet enormous healthcare market. The stock should reward patient investors if Hims & Hers keeps delivering as it has.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HIMS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.