Omega Therapeutics: Working In Epigenetic Anti-Cancer Programs

Summary

- OMGA has an early stage program targeting various cancers using epigenetics.

- They are backed by a VC and have a decent cash runway.

- Though too early stage for my liking, OMGA is interesting.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Learn More »

Pgiam/iStock via Getty Images

Omega Therapeutics (NASDAQ:OMGA) develops epigenetic programmable mRNA medicines for a host of major diseases, although the company has a small market cap. Epigenetics is the study of the methods of changing cellular functions without changing irreversible nucleic acid sequences. Omega was founded in 2017 by Flagship Pioneering, a biotech venture fund owned and led by Noubar B. Afeyan, Ph.D., who is also the Chairman at Omega. In February, Dr. Noubar B. Afeyan bought $19mn shares of Omega in the open market.

About the company's platform, here's what Flagship says:

Omega Therapeutics is developing novel engineered and modular therapeutics, called Omega Epigenomic Controllers, that are designed to target with high specificity and downregulate or upregulate the level of expression of any of the 25,000+ human genes, individually or collectively, with controlled durability, to treat and potentially cure disease. The foundation of Omega's platform lies within the three-dimensional architecture of the human genome and its accompanying regulators, which are organized into distinct and conserved structures called Insulated Genomic Domains (IGDs). Omega's technology exploits the topology and functionality of these IGDs as druggable targets to activate the genome's innate ability to treat and cure disease.

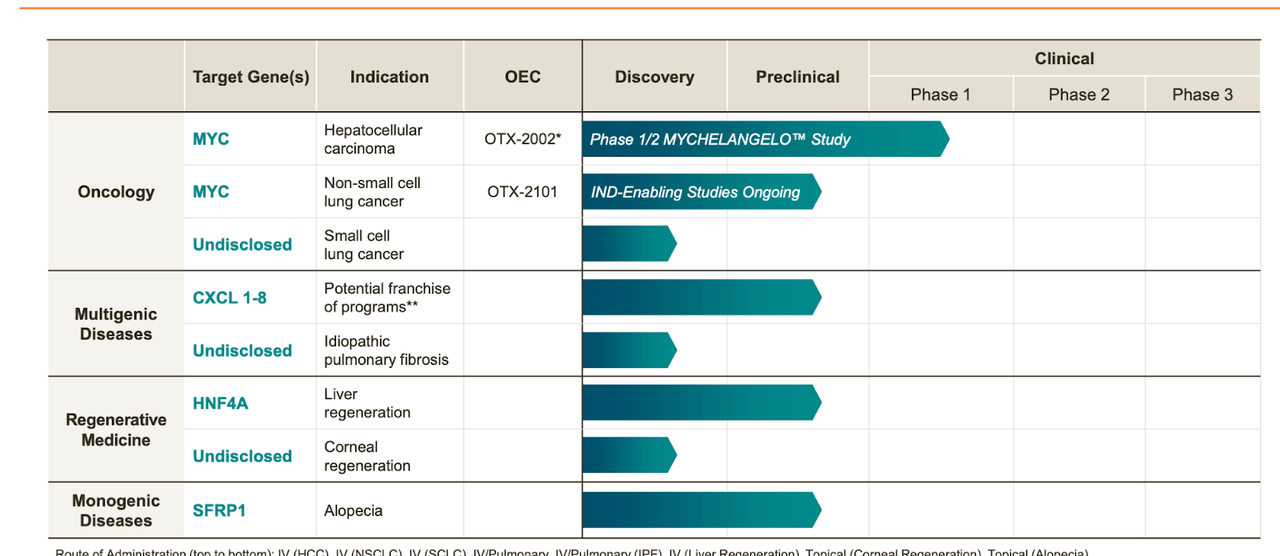

Lead asset OTX-2002 is targeting hepatocellular carcinoma in a phase 1/2 trial called MYCHELANGELO. There are 10 other assets, all of them preclinical. Here's the pipeline:

Not much to see here, these are all preclinical or discovery-stage assets, so we will be focusing only on the lead program, which at least has a clinical trial running.

This program targets the MYC oncogene, which is where the cute trial name comes from. The MYC gene is a so-called master regulator gene, responsible for a number of cancers, some lymphomas, and carcinomas and so on. If you study these early-stage companies, you will see they will give you a lot of theory about the science and the disease and its market potential and so on. These are obvious space filler content, and I tend to ignore them unless the science they are talking about has some original pedigree with them - meaning, their founder discovered the stuff. Otherwise, I want to avoid being beguiled by a lot of talk. Only data matters, nothing else does. Often, even trial data does not matter, but real life efficacy, which may be vastly different from what we saw in trials.

Last year, the company published preclinical data from OTX-2002 at the AACR. The publication stated that while Hepatocellular carcinoma (HCC') is a major cause of cancer-related deaths worldwide, there is an unmet medical need. The current treatment option is the TKI sorafenib, however, it suffers from molecular resistance caused by oncogenic c-MYC.

MYC is commonly over expressed in HCC (up to approximately 70% of cases related to viruses and alcohol) and is linked to aggressive disease. Targeting MYC has been challenging because it was historically considered undruggable. That is because it had no structured binding pocket and tightly autoregulated expression. There are studies showing that disrupting MYC-insulated genomic domain (IGD) can cause a reduction in MYC expression, which can reduce sorafenib resistance.

In this preclinical study, Omega Epigenomic Controllers (OECs) were used to achieve pre-transcriptional regulation of MYC expression. Data showed the following:

The researchers are pioneering a systematic approach using mRNA therapeutics delivered by lipid nanoparticles as programmable epigenetic medicines.

They achieve the disruption of MYC expression pre-transcriptionally through precise epigenetic regulation.

The targeting of MYC in HCC is achieved with high specificity both in vitro (cell cultures) and in vivo (animal models).

The study had the following conclusions:

OECs tuneably regulate MYC mRNA and protein expression through precise epigenetic targeting of the MYC IGD

Downregulation of MYC in HCC cells results in the loss of viability of MYC-addicted cancer cells while sparing normal cells

Delivery of OECs to HCC xenograft models reduce tumor growth and is well tolerated as demonstrated by lack of animal weight change

This epigenetic control of the MYC oncogene should be potentially applicable to other MYC-dependent tumors

In this preclinical trial, OTX-2002 has been found to achieve two important outcomes in hepatocellular carcinoma (HCC) cells. Firstly, it causes a rapid and sustained decrease in the expression of the MYC gene, which is known to play a critical role in the aggressive behavior of HCC. MYC is often overexpressed in HCC and contributes to cancer cell growth and survival. By downregulating MYC expression, OTX-2002 aims to curb the cancer-promoting effects of this gene. Secondly, the treatment with OTX-2002 has been observed to lead to a reduction in the viability of HCC cancer cells, potentially inducing cell death or inhibiting their growth. These findings indicate the potential of OTX-2002 as a targeted therapy against HCC by addressing MYC overexpression.

One of the crucial aspects of a cancer therapy is its selectivity towards cancer cells while sparing normal cells. Here too, OTX-2002 has demonstrated the ability to selectively target and modulate cancer cells, specifically those of HCC, without adversely affecting normal primary cells. This selective action ensures that the therapy focuses on eradicating cancerous cells while minimizing harm to healthy tissues. Such selectivity is crucial to reduce unwanted side effects and maintain the overall health of the patient during treatment.

In these studies, OTX-2002 has shown a significant impact on inhibiting the growth of tumors associated with HCC. This means that when OTX-2002 was administered to animal models or in vitro experiments, it led to a substantial reduction in the size or progression of HCC tumors. The statistically significant inhibition of tumor growth indicates the potential of OTX-2002 as a promising therapeutic agent for combating HCC, possibly by targeting the underlying molecular pathways responsible for tumor development and proliferation.

Checkpoint inhibitors are an important class of immunotherapies that can enhance the body's immune response against cancer. Combining them with other targeted therapies can potentially result in improved treatment outcomes. In this context, OTX-2002 has exhibited a synergistic effect when used in combination with checkpoint inhibitors. This means that when OTX-2002 and checkpoint inhibitors are administered together, there is a noticeable enhancement in their therapeutic effects, leading to a more robust anti-tumor response. Such combination benefits offer new possibilities for effective treatment strategies that may improve patient outcomes, especially for those with HCC characterized by MYC overexpression. However, further research, including clinical trials, would be necessary to validate and translate these preclinical findings into potential clinical applications. The ongoing phase 1 trial is a step towards achieving that understanding.

Financials

OMGA has a market cap of $312mn and a cash balance of $137mn. Research and development (R&D) expenses for the first quarter of 2023 were $20.0 million, while general and administrative expenses (G&A) for the first quarter of 2023 were $6.0 million. At that rate, they have a cash runway of 5-6 quarters. In February, the company made an effort to raise $40mn.

The company is almost exclusively owned by PE/VC firms and institutions. Flagship owns the bulk of the company, followed by FMR LLC and others. Insiders have sporadically bought and sold stock.

Bottom Line

OMGA has some interesting early data, decent science and is backed by a fund/VC with deep pockets, whose CEO also happens to be the company's chairman. I will be watching this one closely.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

This article was written by

Dr Dutta is a retired veterinary surgeon. He has over 40 years experience in the industry. Dr Maiya is a well-known oncologist who has 30 years in the medical field, including as Medical Director of various healthcare institutions. Both doctors are also avid private investors. They are assisted by a number of finance professionals in developing this service.

If you want to check out our service, go here - https://seekingalpha.com/author/avisol-capital-partners/research

Disclaimer - we are not investment advisors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important: My Hold rating only means "I will not Buy now." I am not telling *you* to hold, because I see some risks here. But I am also not telling you to *sell*, because, a) the risks are not insurmountable, and b) you may have bought at such a low price that your risk-benefit ratio is acceptable to you. Thus, my “Hold” is a bearish rating, but it is not as bearish as a “Sell” rating.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.