Skyworks Solutions: A Good Long-Term Investment

Summary

- Skyworks Solutions is diversifying away from its heavy reliance on Apple, which will make it less risky as an investment.

- The company is expected to see a recovery in the smartphone market and significant growth in the automotive segment.

- Skyworks Solutions has solid financials and is trading at a fair price, making it a good long-term investment.

metamorworks

Investment Thesis

With the company’s earnings just around the corner, I wanted to take a look at Skyworks Solutions (NASDAQ:SWKS) to see what the revenue outlook is going to be going forward, what the financials tell me, and come up with a reasonable valuation that I would like to get it on according to my risk/reward appetite. I think that the company is a well-oiled machine that is starting to diversify away from one big elephant of a customer and in the future, it will be less dependent on it, which will be a positive for the company and will make it less risky as an investment. According to my valuation, the company is a buy at these prices for the long run.

Outlook

Mobile Phone Market

I’ve covered many other semiconductor companies that have been manufacturing different components for smartphones, and all of them have said the same thing. The smartphone market has seen a slump in demand due to inventory buildup. I think that we have seen the bottom of this trend and in 2024, companies will start to report some decent results in the smartphone business. I don’t think this revenue segment is going to provide much in terms of amazing revenue growth, however, I do think that the company will see a nice recovery here going forward. I would say back to the levels we’ve seen before the cycle began.

Apple’s (AAPL) expansion into more regions worldwide means that the phone company is going to continue to have a solid revenue stream from these new areas and their loyal customers that are already fully connected within the Apple ecosystem. This is of course a very positive for Skyworks because as of FY22, Apple accounted for 56% of total revenues.

Automotive

This is the segment I think the company will see a good growth rate for many years to come, which will also help it diversify away from being dependent heavily on Apple’s business. The segment is projected to grow at an outstanding rate for the next 7 years, as more governments give tax breaks/subsidies to people and companies to buy and produce more electric vehicles that will be less harmful to the planet. It is projected to grow at a 17.8% CAGR until 2030, and I believe that SWKS will be able to capture decent revenue growth in this segment.

Although the segment is still quite small compared to the mobile segment, I do believe that this will ramp up in the next couple of years and will become a decent revenue stream, which will make the company much more diversified, thus making it less risky in my opinion.

The Elephant in the Room

Many investors are worried about the company’s heavy reliance on Apple, which is even more pronounced now that it is in the process of building a new office for engineers to have production of chips made in-house sometime in the future. Yes, that is a very valid reason for hesitation, however, I don’t see Apple dropping the components produced by SWKS anytime soon because this process is going to take quite some time and will cost a lot of money on the research and development side of things. Apple, which has a lot of money to throw around and to reach the goal of being self-sufficient, may not be successful in these efforts if the chip they would produce is of lower quality than the chips from SWKS.

I do think that the revenue from Apple is safe, but I am also happy that the company is moving in the right direction in terms of diversifying its revenue streams away from Apple. Ideally, by the time Apple starts to use its connectivity chips, SWKS will have diversified away from Apple and the loss of revenue would be minimal, but that will take quite a long time, just like it will take a while for Apple to be self-sufficient.

Financials

As of Q2 '23, the company had around $1B in cash and marketable securities, against around $1.5B in long-term debt. In my opinion, this is not a bad position to be in, especially if the company is making solid operating income consistently and is operating cash flow positive. Debt is a good way to help run your business if the annual interest on debt is manageable, which is for SWKS. The interest coverage ratio stood at around 32x, meaning that EBIT can cover the annual interest on debt 32 times over. For reference, many analysts suggest that a coverage ratio of 2x is considered good, so the company has no insolvency risks.

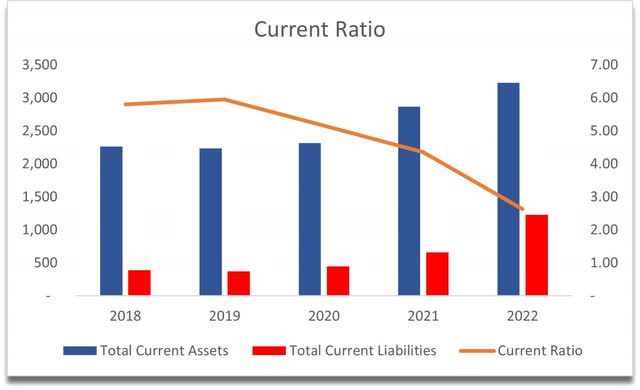

SWKS’s current ratio has come down from something I would consider very inefficient to around my preferred range, which is around 1.5-2.0. In my opinion, anything above 2.0 I view it as the company isn’t using its assets, especially the cash pile, very efficiently. It could be using the excess cash to accelerate growth, enter new markets, or just reward shareholders in some other way, like share repurchases or dividends.

Speaking of efficiency, the company’s ROA and ROE are very good in my opinion. These are well above my minimum of 5% for ROA and 10% for ROE. This tells me that the management is utilizing the company's assets and shareholders' capital efficiently and creating value.

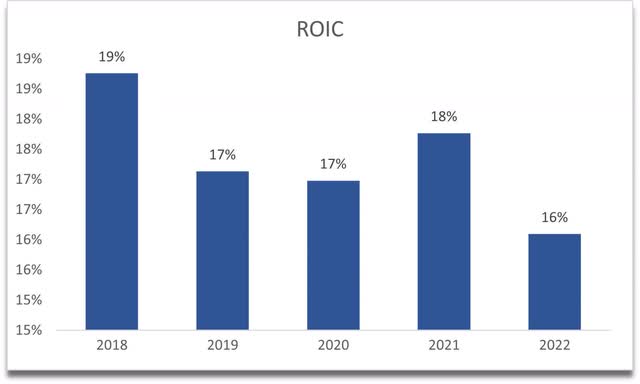

The company seems to also have a competitive advantage and a decent moat, however, when compared to previous years, ROIC is at the lowest in 5 years. It is still above my minimum of 10% but I know the company could do better.

Return on invested capital (Author)

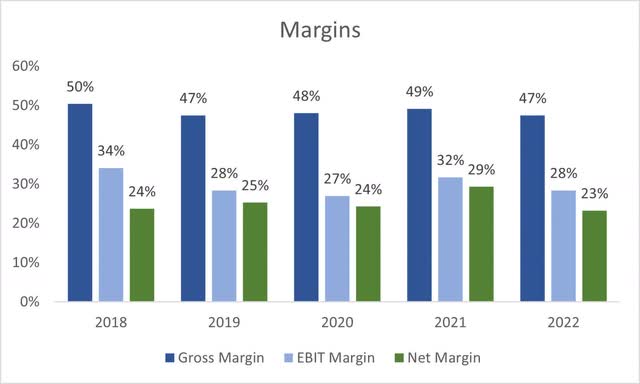

In terms of margins, I think these are quite good. Again, I can see that in FY21 the company was more efficient and profitable, which makes sense because the negative sentiment in the mobile industry wasn’t as prevalent as it was in ’22. I think the company will be able to become more efficient in the near future once the segment starts to improve, which should be some time at the end of '23, at least that's what the experts have been saying.

Overall, it looks like the company has very solid financials with very little that would worry me. I think the slight dips in the above metrics are temporary and the company will get back to the same efficiency that it saw in FY21.

Valuation

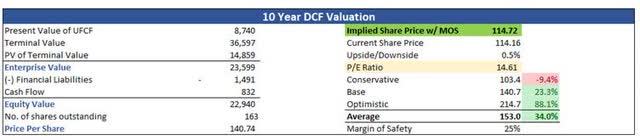

For the base case, I decided to increase revenues by around 8% because I see a lot of potential in the Automotive segment, and with time, I think it will become one of the top revenue generators for the company.

For the optimistic case, I went with 12% CAGR, while for the conservative case, I went with 6% CAGR over the next decade.

I can also see slight improvements in margins, so I increased gross and operating margins by around 200bps over the next decade, which will bring net margins from around 23% in FY22 to around 27% by FY32.

On top of these assumptions, I will add a 25% margin of safety, which is the lowest I would like to give to any company that has a nice balance sheet. With that said, the company’s intrinsic value is $114.72 a share, implying that the company is trading at a fair price and is a good buy in my opinion to start a long-term position.

Closing Comments

In my opinion, the company is going to be just fine in the years to come. The company will manage to diversify its revenue streams away from dependency on Apple, and I think the boost to revenues will be substantial which is going to be fueled by the very promising automotive industry.

I do think it's a good price to enter a position, but I wouldn't be surprised if we see a lot of volatility throughout the remainder of the year because of the negative sentiment in the mobile phone market.

I like the risk/reward profile here, and I will be listening to their earnings report, which comes sometime in the beginning of August to see what the company sees in terms of inventory and sentiment going forward.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.