Revisiting The Simple Retirement Portfolios - H1 2023 Update

Summary

- I introduced the Simple Retirement Portfolios to investors more than three years ago.

- Portfolios are meant to provide retirees with a simple way to invest their retirement savings, but with greater yields and performance than comparable funds and indexes.

- The portfolios have generally accomplished their goals, outperforming during 2023, and since inception. Yields are higher too.

- Interested in retirement portfolio ideas and funds? Read on.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

adamkaz

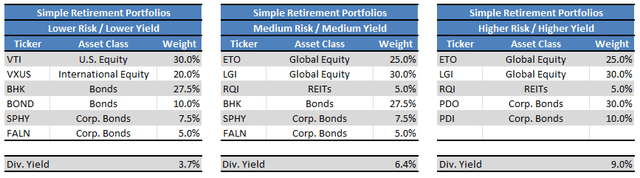

I introduced the Simple Retirement Portfolios close to three years ago. Portfolios are meant to provide retirees with a simple, yet effective way to invest their retirement savings, with varying levels of risk, yield, and passive / active exposure. Portfolios hold a diversified set of equity and fixed income funds, with diversified exposure to most relevant asset classes. Portfolios were originally as follows:

Seeking Alpha - Chart by Author

I'm doing semi-regular updates on these portfolios and their performance. The following article is the update for the first half of the year.

Investment markets had a roaring start to the year, with most asset classes posting strong gains and returns. Equities have seen double-digit gains across the board, with the S&P 500 more than 20%, and the tech-heavy Nasdaq-100 up a whopping 44%. Bonds have seen weaker gains, due to being an overall lower-risk, lower-return asset class, and as Fed hikes continue to pressure bond prices. Still, these have generally seen positive total returns, and higher yields to boot.

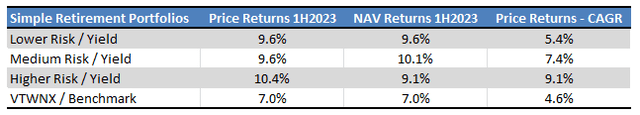

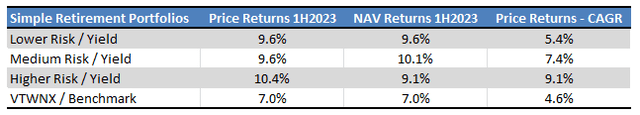

The simple retirement portfolios themselves, and their underlying funds, saw strong returns too, averaging 10.0%. Returns were quite similar for all three portfolios. All three outperformed their benchmark, the Vanguard Target Retirement 2020 Fund Inv (VTWNX), for the year, and since inception.

Seeking Alpha - Chart by author

In general terms, portfolio returns were driven by strong asset class returns: portfolios were up because markets were up. Other factors mattered too, including alpha, leverage, discounts / premiums, and small shifts in asset allocations, but the impact of these were quite small.

These portfolios went through their first (small) market cycle, experiencing a bear market in 2022, followed by a swift recovery in 1H2023. Portfolios outperformed throughout the cycle, due to stronger gains during bull markets, including YTD. Losses were higher during bear markets too, but less so, and bear markets are rarer too.

In my opinion, and based on prior performance, the risk-return profile of the medium risk and higher risk portfolios is quite strong, and very compelling. Both have significantly outperformed their benchmark since inception, with only a moderate increase in losses during the most recent downturn. The risk-return profile of the lower risk portfolio is weak, as gains have been slightly higher, but risks and prior losses were moderately higher. These results were partly the result of portfolio selection and construction, and partly the result of market conditions: everything was down in 2022, but at least the higher-yielding asset classes delivered strong dividends.

Simple Retirement Portfolios - Overview and Analysis

I'll start with a brief overview of the construction and rationale behind the portfolios. Feel free to skip this section if you've read my previous articles on the subject.

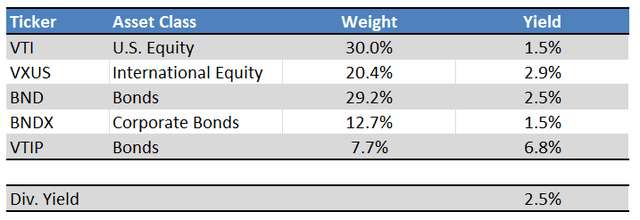

The Simple Retirement Portfolios are based on the Vanguard Target Retirement 2020 Fund (VTWNX). VTWNX invests in a diversified portfolio of low-cost fixed income and equity index funds and is aimed towards recent retirees. Asset allocations change every quarter to reduce risk as retirees age.

Balanced funds, including VTWNX, generally provide retirees with superior returns than equity index funds. This includes those indexed to the S&P 500, as the said index is simply too volatile to fund the monthly income needs of the average retiree. I've done the math on this here.

VTWNX seemed like a perfect low-risk fund for retirees, so I used it as the basis for my model portfolios. The portfolios used VTWNX's holdings in May 2020 as a starting point. Current holdings are only marginally different. These were as follows:

Vanguard Corporate Website - Chart by Author To construct the portfolios, I simply swapped some of VTWNX's holdings for stronger, higher-yielding alternatives with the potential for market-beating returns.

I created three portfolios, some more closely tracking their benchmark than others.

A lower-risk portfolio with few changes meant to closely track VTWNX but with the possibility of some excess returns and income.

A medium-risk portfolio with some more changes, somewhat tracking VTWNX, and with the possibility of excess returns and income.

A higher-risk portfolio with significant changes, less concerned with tracking VTWNX, and with the possibility of substantial excess returns and income.

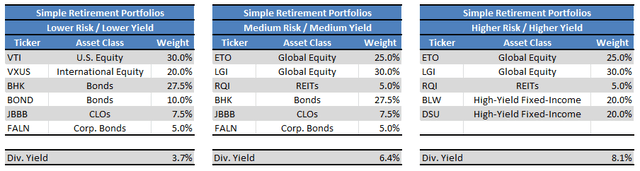

The resultant portfolios were as follows.

Seeking Alpha - Chart by Author

Simple Retirement Portfolios - 1H2023 Performance Analysis

Lower Risk / Yield Portfolio

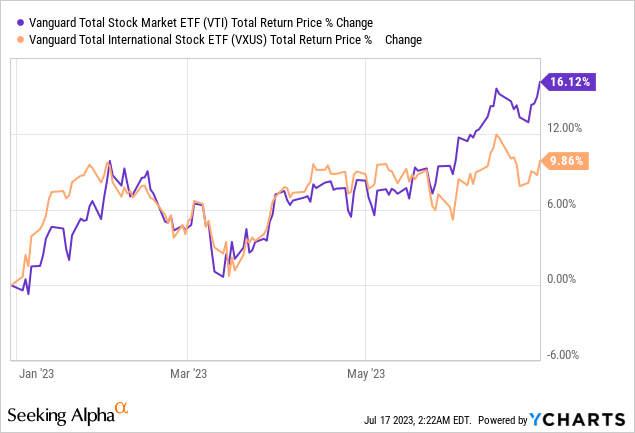

The lower risk / yield portfolio outperformed its benchmark during 1H2023, with gains of 9.6% versus 7.0%.

Gains were driven by strong equity returns, with the fund's U.S. equity investments up 16.1%, international equity up 9.9%.

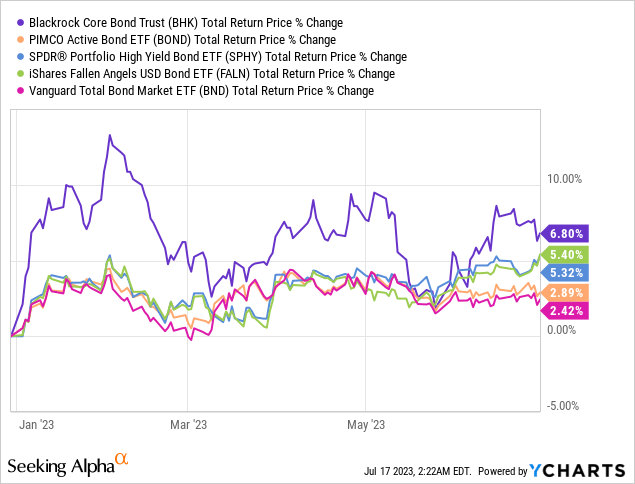

Outperformance was driven by bond outperformance, with every single bond fund in the portfolio outperforming bond benchmarks.

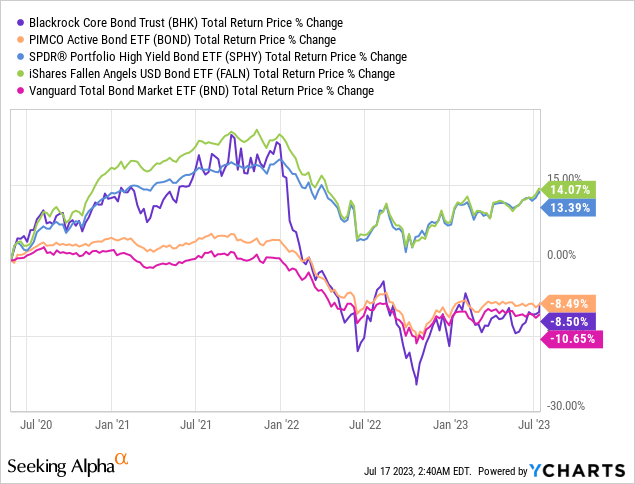

Bond fund outperformance was at least partly driven by excessive losses in 2022 which were, in turn, driven by excessive gains in 2021. On net, the funds have outperformed, although the risk-return profile of the PIMCO Active Bond Exchange-Traded Fund ETF (BOND) and the BlackRock Core Bond Trust (BHK) is quite weak.

Overall, the lower risk portfolio has performed well YTD, although nothing exceptional.

Medium Risk / Yield Portfolio

The medium risk / yield portfolio outperformed its benchmark during 1H2023, with gains of 9.6% versus 7.0%.

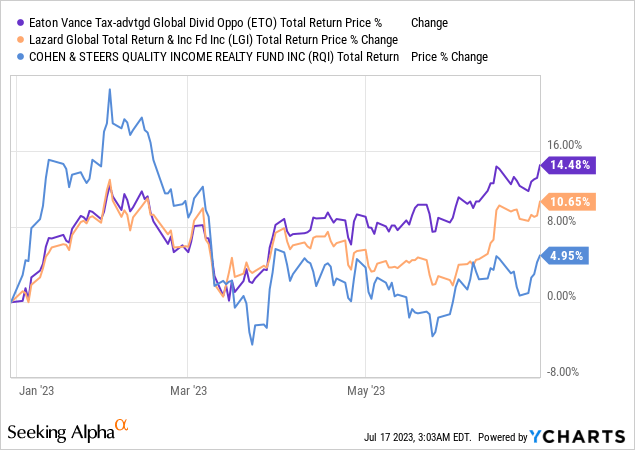

Gains were driven by strong equity returns, with the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund (ETO) seeing returns of 14.5%, and the Lazard Global Total Return and Income Fund Inc (LGI) returns of 10.7%. REITs saw much weaker gains, with the Cohen & Steers Quality Income Realty Fund (RQI), up just 5.0% during the year.

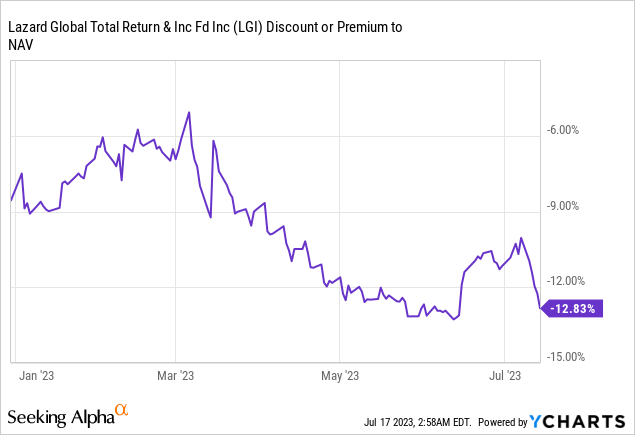

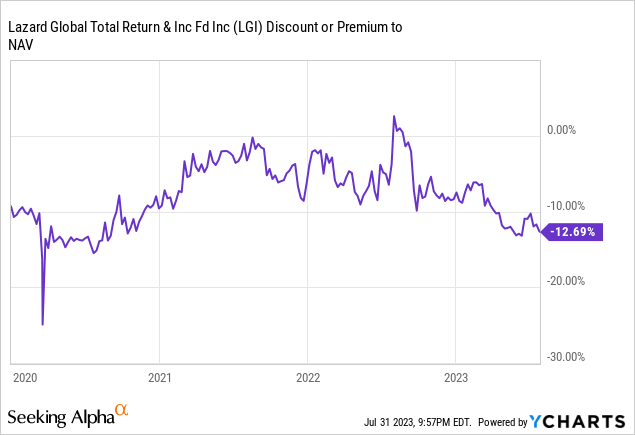

Of the above CEFs, only LGI's discount moved, widening from around 8.0% earlier in the year to 12.8%. Widening discounts reduced the fund's returns, but these were still quite strong, and the portfolio as a whole outperformed.

LGI's discount is somewhat wider than average, although the fund did trade cheaper during early 2020:

Seems like a particularly compelling time to invest in LGI. I last covered the fund here.

The medium risk portfolio's bond funds are all included in the lower risk portfolio as well, so their overall performance was the same.

Higher Risk / Higher Yield Portfolio

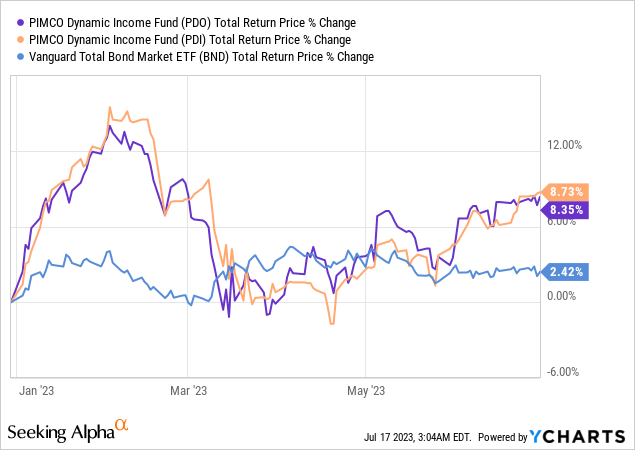

The higher risk / yield portfolio outperformed its benchmark during 1H2023, with gains of 10.1% versus 7.0%.

The portfolio's equity investments performed quite well, with the same funds and performance as the medium risk portfolio.

The portfolio's bond investments performed quite well too, with gains 8.4% - 8.7%.

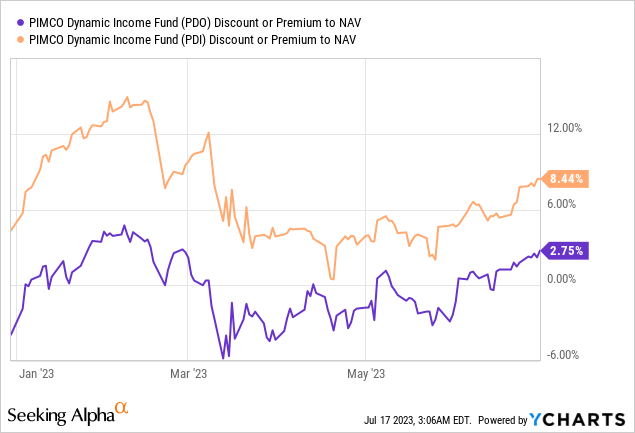

Importantly, gains were in part driven by widening premiums, with both funds seeing more average NAV returns.

Strong returns for the higher risk portfolio, although widening premiums means these might not necessarily last into the future.

Looking Forward

The portfolios constructed and funds selected are meant to be long-term investments. Changes have been, and will continue to be, infrequent, but I will keep an eye on economic, market, and industry conditions, and make changes as these evolve.

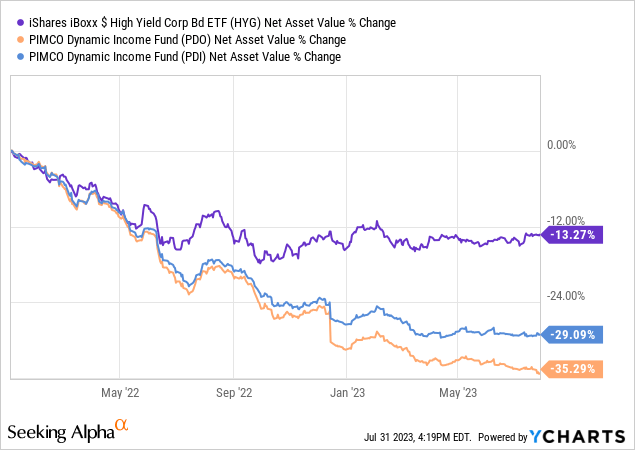

One of the biggest, most impactful market events of the past few years was the Federal Reserve aggressively hiking interest rates, leading to sharply higher interest rates across fixed-income assets, lower bond prices, and an inverted yield curve. Net investment income and distribution coverage ratios have changed for many CEFs. PDO and PDI have both seen declining coverage ratios, reaching 50% - 55% these past three months:

Distribution coverage ratios have declined due to capital losses from lower bond prices (less assets means less income), and higher interest rate expense (these are leveraged funds). Low coverage ratios could lead to declining NAVs, as has been the case for both funds since early 2022.

Lower bond prices also played a role in the above, but not all. Unleveraged high-yield corporate bond index ETFs, including the benchmark iShares iBoxx $ High Yield Corporate Bond ETF (HYG), saw much lower reductions in NAVs, so a combination of leverage and uncovered distributions were responsible for the rest.

Although distribution coverage ratios can always improve, especially once short-term rates / interest rate expenses go down, I don't feel comfortable investing so aggressively in CEFs with coverage ratios this low, and with such precipitous NAV declines.

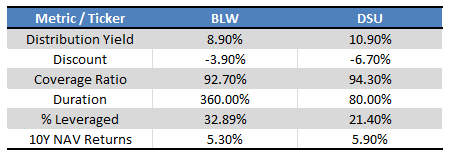

Considering the above, I've thought to replace PDI and PDO for other diversified, high-yield CEFs with more sustainable distributions. Two of my favorite choices in this space are the BlackRock Multi-Sector Income Trust (BIT), and the BlackRock Limited Duration Income Trust (BLW), both diversified, leveraged, high-yield bond CEFs with strong performance track-records. BIT does not currently trade with a compelling discount, so I replaced it with the Debt Strategies Fund (DSU), a similar, but less diversified, choice instead.

Some relevant data for both CEFs:

Seeking Alpha - Chart by Author

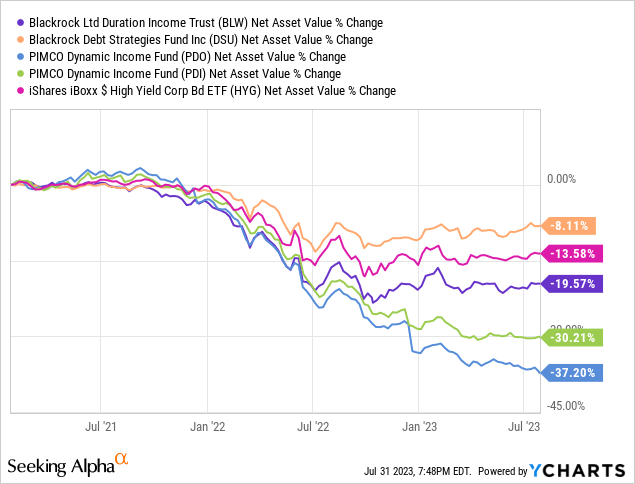

A quick graph showing their NAVs have seen much lower reductions than PDO and PDI:

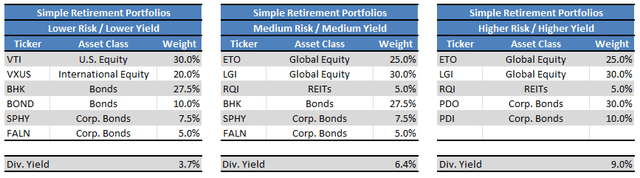

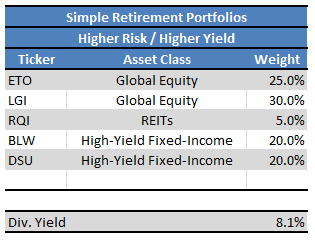

Resultant portfolios would be as follows:

Seeking Alpha - Chart by Author

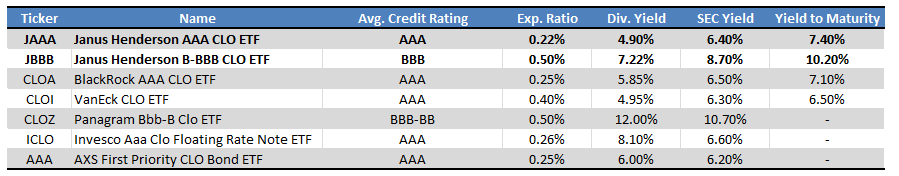

Another recent market development is the emergence of several CLO ETFs. I've found these to offer very compelling yields and risk-adjusted returns, and I've seen Steven Bavaria, Seeking Alpha's resident CLO expert, argue similarly before. I've covered several CLO ETFs in the past, a quick table with key information for some of these:

Fund Filings - Chart by Author

Of the above, the Janus Henderson B-BBB CLO ETF (JBBB) offers a particularly compelling 8.7% SEC yield, combined with comparatively safe, investment-grade holdings. JBBB could, conceivably, replace any of the fixed-income ETFs in these portfolios. I decided to replace the SPDR Portfolio High Yield Bond ETF (SPHY) with JBBB, as the lower and medium risk portfolios focused on high-yield bonds a bit more than desired in the past. Resultant portfolios are as follows:

Fund Filings - Chart by Author

Although there have been quite a few changes to the portfolios in this article, I would like to stress that these portfolios have seen very few, very infrequent changes since inception. These are meant to be long-term investments, and that has generally been the case in the past.

Some investors would prefer to invest in more diversified portfolios, with more CEFs. I think that is an incredibly reasonable preference, and one which can be easily accommodated by investing in simple, diversified index funds. Vanguard offers a fantastic suite of target retirement funds, the basis of these portfolios. For investors looking for a bit more income we have the Invesco CEF Income Composite Portfolio ETF (NYSEARCA:PCEF), an index ETF with a diversified portfolio of over 100 income-producing CEFs.

The portfolios here are more targeted because their goal isn't to match the market's returns or distributions, but to exceed them. Attempting to do so means investing in something other than the index. In this case, I thought investing in a couple of the best-performing, high-yielding ETFs and CEFs might be a compelling, effective way to do so. The portfolios have achieved their goal of outperforming in the past, although that might not necessarily be the case moving forward:

Seeking Alpha - Chart by author

Besides the above, I would also add that almost all of the ETFs and CEFs selected here are incredibly diversified, and that the portfolios themselves provide diversified exposure to most relevant asset classes. There is quite a bit of diversification to these portfolios, even though it might not look that way looking at the number of holdings.

Conclusion

The Simple Retirement Portfolios provide retirees with a simple way to invest and save during their retirement, and have generally performed well in the past. I believe that the funds selected and portfolios created will outperform in the coming years. Hopefully, the information here was of use and interest to readers and investors.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.