Santander Wants To Ride Brazil's Next Wave

Summary

- Brazil's economy is showing signs of recovery, with banks expected to benefit from an anticipated interest rate cut and a state-sponsored debt renegotiation program.

- The performance of Brazilian banks over a 10-year period indicates that the sector could be entering a new growth phase, with Santander being a key player.

- I expect that Santander will be more benefitted than other banks by the interest rate cut, fueling its Net Income, ROE and Dividends through a decrease in funding costs.

- Santander stock is a good buy opportunity not just for its capital appreciation, but also due to its expected Dividend Yield close to 10%.

Lux Blue

Banks Are Cyclical and Brazil's Recovery May Have Just Started

This is the first article of what I expect to be a series analyzing Brazilian Big Banks. The first one is Santander (NYSE:BSBR) as I believe it was, along with Bradesco, the most affected by the increase in the interest rate and could therefore see a rebound soon. It's no secret that Banks are intertwined with the economy and it seems that Brazil may have finally turned a corner after the pandemic, mainly due to some of the following:

- A highly anticipated Interest Rate (SELIC) cut in August, which would likely signal the start of monetary policy easing.

- The expectation that the delinquency peak has already been reached and could improve going forward, especially after the start of the state-sponsored program "Desenrola" which aims to boost debt renegotiation between consumers and banks.

- Inflation slow down with Brazil's CPI annualized at 3.16% in June compared to 5.77% in January and 10.07% in July of 2022.

- The numerous upward revisions of Brazil's GDP to close to or above 2% by the government, the central bank (BACEN) and the Focus Report which is a poll by all banks on where they think key economic metrics will be for the near future.

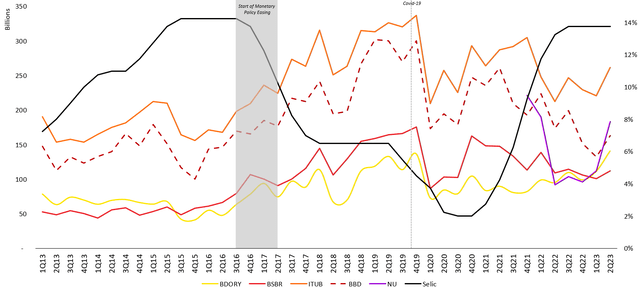

Let's see the banks' performance in a 10 year period of what is probably a full economic cycle in Brazil. We will start comparing Santander with Banco do Brasil (OTCPK:BDORY), Itaú Unibanco (ITUB), Banco Bradesco (BBD) and Nubank (NU). The last time interest rate was as high as today was during 2015 and 2016 (14.25% then vs 13.75% now).

SELIC Rate x Banks Market Cap (BACEN, B3, Author)

Note that 3Q16 was the last full quarter without changes in the interest rate, so we can equal it to 2Q23 if the expected rate change happens in August. I've resumed below the price appreciation for each of the Banks and we can see that following the SELIC rate decrease during 4Q16 all banks had significant performance during the following four quarters. Even better, at the peak in 4Q19 two had more than 100% appreciation without including dividends.

Banks Stock Performance During Last Monetary Policy Easing (Author)

For potential investors in Santander, it's interesting to note that it lost only to Banco do Brasil in total return until the peak. Banco do Brasil is usually more volatile and in the same way it drops more than the others, it goes up faster when the recovery arrives. Note also that the bottom was likely in 4Q15, almost one year before the rate decrease, while, if the future confirms, the bottom seems to have arrived only in 1Q23 or less than six months before the expected rate decrease. You know the classic: "history doesn't repeat itself, but it often rhymes" and if it really does this time, Banks look like a very solid play.

How Does Santander Compare To The Other Big Banks

Historically, Brazil has been dominated by 5 big banks: Caixa Federal (148 million customers), Bradesco (101 million), Itaú (96 million), Banco do Brasil (74 million) and Santander (61 million). On our analysis, Caixa Federal isn't considered as it is not listed and we are including Nubank as it has surpassed Santander in number of customers with 65 million. Santander is relatively new compared to the other 5 big banks I mentioned as it entered the market through an acquisition in 1997 and made two other relevant ones: Banespa through a privatization offer in 2000 and ABN Amro's subsidiary in Brazil in 2007. It has been a listed stock since 2009 and is 90% owned by Santander España (SAN) - for simplicity, if I write Santander it means the Brazilian subsidiary, while the parent company I'll always refer to as Santander España.

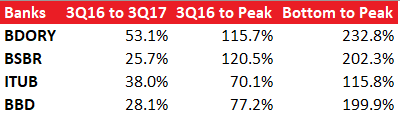

It's important to understand the timing of acquisitions and the IPO because it's possible to see that the Price-to-Book (P/B) Ratio for Santander, at the beginning of the period in question, was closer to Banco do Brasil and far from Itaú and Bradesco. However, after 2016, Santander was able to close the gap and, most recently, it's Bradesco who's now trending below Santander and Itaú. That most likely happened due to the impressive financial performance of Santander between 2013 and 2022. Revenue grew to R$ 100 billion from R$ 55 billion (+77%), Net Income to R$ 12.6 billion from R$ 2.1 billion (+500%) and Equity to R$ 82 billion from R$ 63 billion (+31%). Nubank is excluded from the graph as their P/B is currently around 7. Note that numbers are on a "Last 12 months basis".

Price-to-Book Ratio of Brazil's Big Banks (BSBR IR, BDORY IR, ITUB IR, BBD IR, BACEN, Author)

The graph above shows that P/B still has a lot of room for improvement as it peaked close to 2.5 in 2019 and is currently at 1.3 for Santander and 1.5 for Itaú. A P/B rerating for Santander to its latest peak would merit, without considering the increase in Equity for the next years, an 92% gain. Note that Banco do Brasil has always traded at a discount versus the average of the other three and it continues to do so, probably because investors are always discounting the fact that it is public owned.

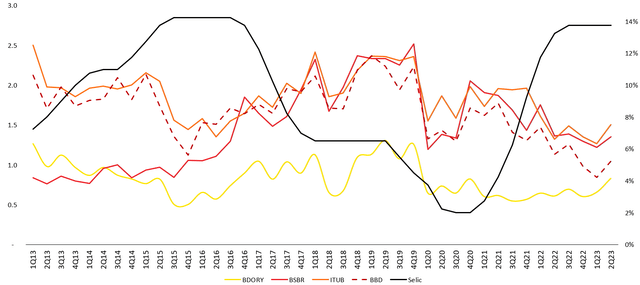

The picture for Return-on-Assets (ROA) ratio isn't as good as for the P/B. The nosedive that started in 2022 wasn't due to ballooning Assets, but to Net Income dropping like a rock due to higher provisions for NPLs and higher funding costs with the market. Bradesco has the same two issues I just mentioned so it has a similar trend, while Itaú was able to hold flat and Banco do Brasil impressed everyone with a stellar performance.

Return-on-Assets Ratio of Brazil's Big Banks (BSBR IR, BDORY IR, ITUB IR, BBD IR, BACEN, Author)

Similar to the ROA, the Return-on-Equity (ROE) shows that after an incredible push from 10% in 2014 to 20% in 2019, Santander's ROE is back to close to 10%. Bradesco is in the same situation as Santander, while Banco do Brasil and Itaú seem to be fully recovered.

Return-on-Equity Ratio of Brazil's Big Banks (BSBR IR, BDORY IR, ITUB IR, BBD IR, BACEN, Author)

In sum, it's clear that when analyzing only these metrics, Itaú is ahead of the pack. Santander continues to have a P/B in line with Itaú, but based on ROA and ROE, it looks like Mr. Market is giving a bigger chance to Santander to prove it's worth than to Bradesco. Both have similar negative trends in ROA and ROE, but Santander commands an almost 40% higher P/B. In the next section, we'll deep dive on the Financials and see what's more accurate: the P/B in line with Itaú or the ROA and ROE in line with Bradesco.

Explaining the Financials

Following Q2'23 results that showed some improvement in Net Interest Margin (NIM), it's important to review and estimate how probable it is for Santander to achieve a Net Income close to R$ 15 billion like it did in 2019. The stock will likely react once that path is clear as today Net Income for last 12 months is only R$ 8.8 billion.

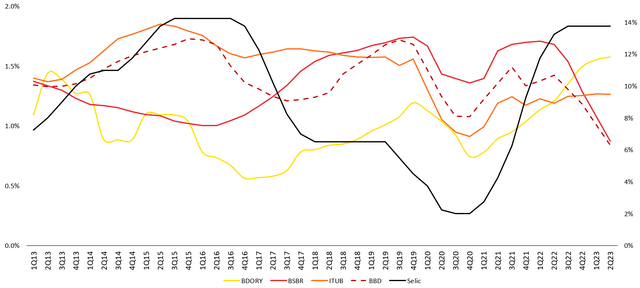

Net Interest Margin

To understand the health of Santander's NIM we need to review two things: the spread (i.e. the difference between how much it receives on a loan and how much it pays for the funding) and the provision for Nonperforming Loans (NPL). In terms of spread, Santander faces a similar issue when compared to Bradesco, both have to take more funding from the market to make ends meet - Itaú and Banco do Brasil, on the other hand, are able to fund their operations with customers money and depend less on the market. The key reason to highlight this is that funding costs with the market adjust with no delay once the interest rate goes up, while with customers the banks know that the deposits are stickier and tend to raise rates slower than they charge on their loans - thus allowing for more net interest margin at the beginning of an interest rate hike cycle.

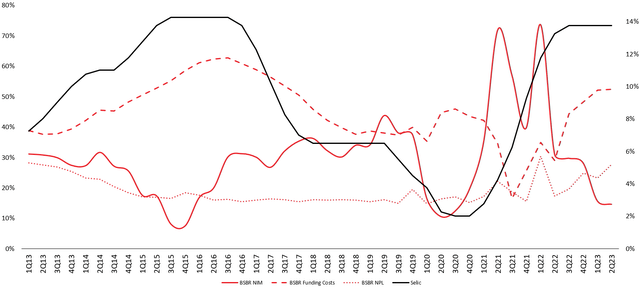

To understand how NIM, Spread and NPL behave compared to SELIC, the graph below shows NIM, Spread and NPL as a % of Total Revenue. Note that NPL is important, but is less volatile than Spread (which has a correlation of 0.53 which the SELIC rate). The drop in NIM is directly associated to the rise in funding costs with the market which is directly associated to the rise in the SELIC. If SELIC drops, funding costs drop and NIM improves. On the last cycle of monetary policy easing, NIM was close to 30% most of the time and even peaked at 40% compared to mid-teens now.

Santander Brasil NIM, Spread and NPL versus SELIC Rate (Santander IR, BACEN, Author)

Assets & Delinquency

Although the focus of this article is a more macro assessment, in any bank it's important to at least have an idea of the quality of assets and how delinquency has performed in the recent past. Santander definitely isn't in the same spot as Banco do Brasil which has a lot of civil service workers and a big presence in agribusiness or Itaú who is by far the most solid bank and has a big penetration with the wealthier. However, it's much better positioned than Bradesco as it has a good chunk of the A and B class and less exposure to pure consumption loans, while also making endeavors into the agribusiness and expanding its ecosystem.

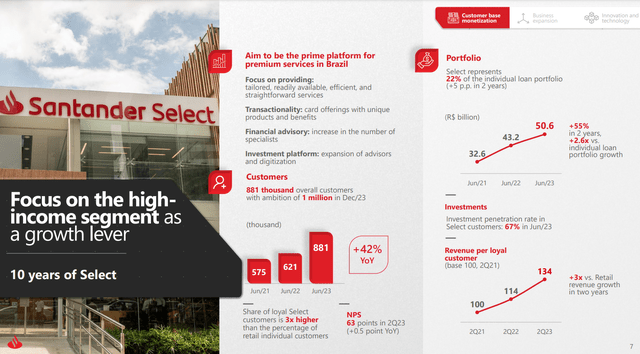

Note Santander's focus in growing the brand Select (focused on the wealthier) by increasing 42% YoY the number of customers. Select is now 22% of the loan portfolio (+5p. in 2 years) and grows 2.6x more than the individual portfolio.

Santander Select Performance in Earnings Call Q2'23 (Santander IR)

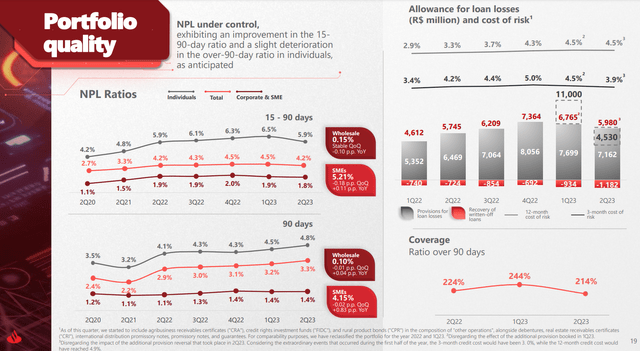

NPL performance seems to have peaked for the 15 - 90 period which could signal that an improvement on the plus 90 days period is right around the corner. Remember that there is a new program called "Desenrola" sponsored by the government and that interest rate seems poised to fall in early August.

Santander Portfolio Quality and NPL performance in Earnings Call Q2'23 (Santander IR)

Equity & Dividends

Finally, at the beginning it was said that SELIC was poised to go down and that would influence PB and ROE, thus allowing the stock price to appreciate. Both of these metrics relate to the Equity in the Balance Sheet, so let's see how that can perform in the following years based on the historical dividend policy and the statement by the CEO that ROE won't go back, in the near future, to what it once was (i.e. near 20%).

For the dividend, remember that Santander Brasil is 90% owned by Santander España, so the company has a really big incentive to send all remaining cash back to Spain rather than to leave it sitting in the Balance Sheet. That is confirmed by the Dividend Yield (DY) observed in the last ten years which, excluding 2020, was usually between 60% and 90%. Although it appears that DY is in a downward trend, the Payout has increased significantly and will likely continue to do so.

Santander Brasil Dividend Yield and Dividend Paid in BRL Million (Santander IR)

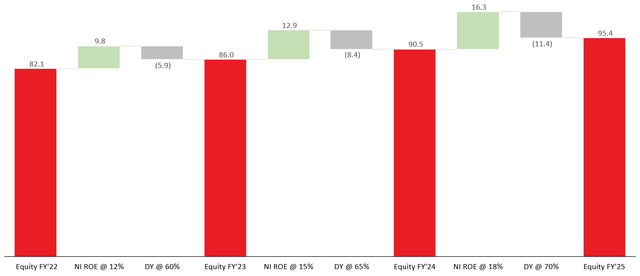

For the Equity piece, let's see how it could evolve in the following years assuming that Net Income will be a function of ROE growing from 12% in FY'23 to 18% in FY'25 and Dividend Yield will start at 60% in FY'23 and go to 70% in FY'25. If any of these two perform better than the assumptions I'm using, it would be more bullish to the stock.

Estimated Santander's Equity between FY'22 and FY'25 (Author)

Finally, if the investor buys Santander stock today, they will acquire a company with R$ 84 billion (as Q2'23) in Equity trading at 1.3 PB. If my expectations of a lower SELIC Interest Rate going forward are correct, then we may see an improvement of NIM, mainly in Santander's funding costs with the market, which would fuel Net Income, ROE, Dividend Yield and an appreciation in terms of PB. By using my R$ 95.4 billion estimate of Equity at the end of FY'25 and a PB of 2, market cap goes to almost R$ 200 billion - the equivalent of a 76% increase in the stock price or close to $11 USD at a USD/BRL of 4.70. When including the expected 8% to 10% that investors may get, we arrive at almost 30% CAGR at the end of FY'25.

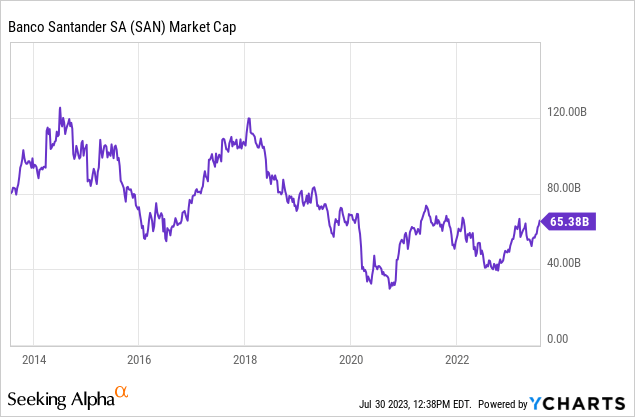

Playing Santander España

According to Santander España financial statements for 1H'23, Santander Brazil is the second biggest contributor in terms of Net Income with around 15% of total - only behind Spain. However, in terms of Market Cap it represents one third of Santander España's total value. This means that the brazilian subsidiary is very important to the overall group and a big chunk of its market cap. If Santander were to increase its market cap by the 75% I mentioned, Santander España would certainly follow and could also have a gain of similar size. For those investors who prefer to have more exposure to EUR instead of BRL or to have exposure to more than one country, than Santander España might have the same benefits as Santander.

Final Remarks

My investment thesis in Santander is quite straightforward: the ease of SELIC Interest Rate that should start in August will set off a chain reaction in Santander. Lower SELIC will improve their funding costs and their NPL provisions, thus improving Net Interest Margin to or near pre-pandemic levels. The decrease in SELIC could also trigger a higher GDP growth rate for Brazil in the coming years. More NIM means higher ROE, which translates to higher Equity and, probably, to a higher PB ratio. All that will give investors a DY of 8% to 10% and propel the stock to above $10 USD.

All of this gets jeopardized if:

- SELIC Interest Rate doesn't decrease or decreases just a bit because inflation came back roaring.

- Delinquency, even with the recent government efforts, continues to be elevated and thus dampens the expected ROE improvement and GDP growth.

- The BRL gets back to an undervaluation cycle which would then translate to a lower purchasing power for US investors.

- An operational incapacity by Santander to achieve high-teens ROE.

- Digital banks find a way to capture corporate and wealthier clients from the big banks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BSBR, BBD, ITUB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)