Capri Holdings: Too Cheap To Ignore With Further Improvement Ahead

Summary

- Capri's share price has underperformed due to weak financial results and a lack of commercial development.

- The company owns three valuable brands but has faced increased competition and a changing market, with a mediocre response.

- The business has further improvement ahead but is supported by several opportunities for growth and the strong trajectory of Versace.

- The business is trading at an FCF-Y of 17% and a 70% discount to its peers. The business looks incredibly cheap while being a potential M&A target.

Vittorio Zunino Celotto/Getty Images Entertainment

Investment thesis

Our current investment thesis is:

- We are commercially concerned with Capri, given the weaknesses shown by both Michael Kors and Jimmy Choo. Both brands are suffering from increased competition and declining interest.

- Management does not instill us with confidence but the business does have scope for near-term improvement. Its exposure in Asia is low, e-commerce growth can support margins, and Versace is growing extremely well.

- The business looks extremely cheap relative to other businesses in the industry, even if they are outperforming Capri. When also considering the potential of a takeover, Capri looks to be an attractive investment.

Company description

Capri Holdings Limited (NYSE:CPRI) is a luxury fashion company known for its iconic brands Michael Kors, Versace, and Jimmy Choo. Capri Holdings operates an extensive global retail network, offering luxury apparel, accessories, footwear, and fragrance products.

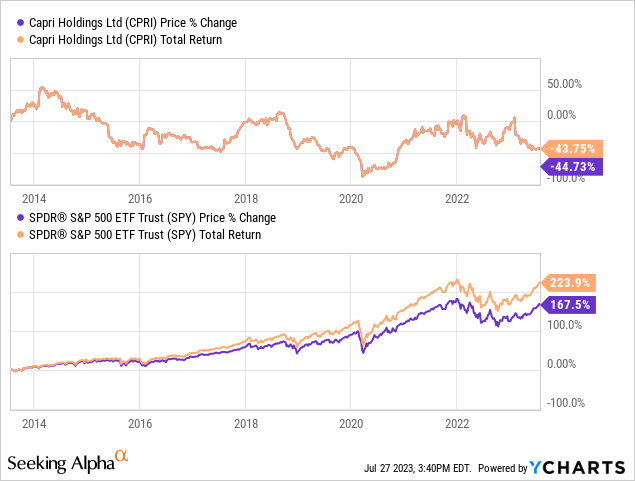

Share price

Capri's share price has significantly underperformed in the last decade, losing over 40% of its value during a period of market expansion. This is due to weak financial results and a lack of development in line with peers.

Financial analysis

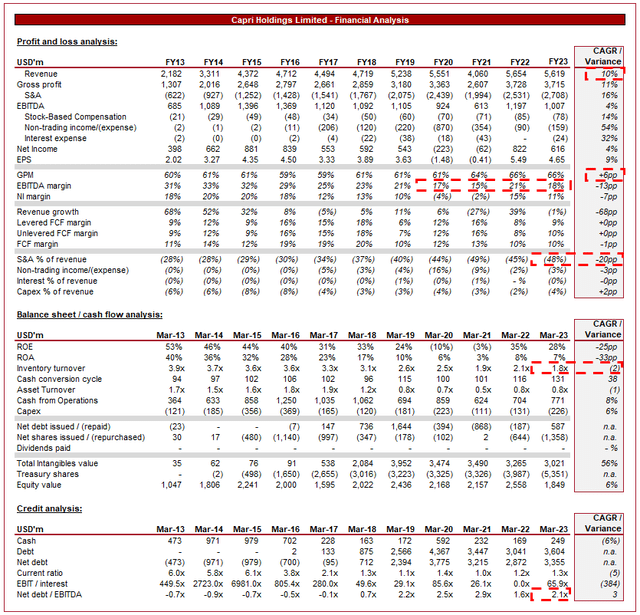

Presented above is Capri's financial performance for the last decade.

Revenue & Commercial Factors

Capri's revenue has grown at a CAGR of 10% in the last 10 years, through a combination of organic growth and M&A activity, namely the acquisition of Jimmy Choo and Versace.

Business Model

Capri's business model revolves around the design, marketing, distribution, and retail of luxury fashion products under its three distinctive brands.

The company operates through three segments: Michael Kors (69% of FY23 revenue), Versace (20%), and Jimmy Choo (11%), each targeting different customer demographics and fashion preferences. Through these brands, the company is able to target the entirety of the fashion industry, from the affordable segment through Michael Kors to Luxury through Versace. This maximizes the company's expertise in the industry, allowing each brand to benefit from shared competencies.

Further, brand diversification is critical for larger fashion houses in our view, as tastes and preferences usually change over time. As a result of this, relying on a single brand to remain relevant over an extended period of time is highly risky. With 3 brands, Capri is far from eliminating this risk but is in a better position than many others.

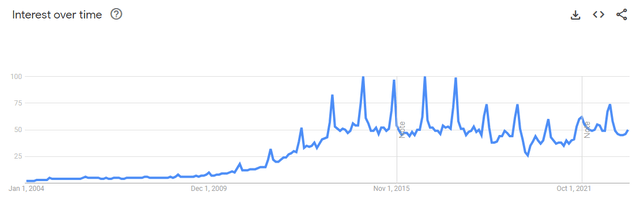

In order to remain competitive in the fashion industry, innovative and unique marketing is fundamental to driving consumer interest. This is of course underpinned by quality designs but with the power of social media, designs are increasingly homogenizing. We believe marketing has been a key area of weakness for Capri, as its brand development has been disappointing. As the first graph illustrates, the interest in Michael Kors has declined gradually since 2016, with very little success in stabilizing this.

We believe this stagnation is due to a combination of e-commerce and fast fashion, contributing to substantially more competition. E-commerce has offered consumers the ability to easily shop around, comparing options and discovering new, international brands, that would otherwise not be easy to reach. Further, fast fashion has allowed consumers to access luxury designs at affordable prices, which social media has contributed to making the dominant request. This has made it difficult for Michael Kors to justify its value proposition when the brand has been forced to follow the homogenized design philosophy.

The business is slowly responding appropriately, however. Michael Kors is improving its social media messaging (19 million Instagram followers), it is combining its brand with fashion-forward designs and is increasingly partnering with influencers to improve reach. Its early days but we could see an upswing if the brand can become interesting again.

The struggling consumer interest is not just with Michael Kors but Jimmy Choo, also, as the following illustrates. Our view on why this has been the case is less clear cut but overarchingly, it seems Management lacks the expertise to navigate the luxury segment effectively. The Jimmy Choo brand was built heavily on hype and once this subsided, the response has been poor.

Finally comes the most recent acquisition, Versace. The Versace brand is synonymous with luxury but has never reached the heights of its cultural peers such as Gucci, Dior, and LVMH. One of the reasons for this was an unwavering commitment to its design philosophy, which was too rigid of an approach in our view. This has subsequently loosened, with a modernization process in recent years, driving increased interest.

In conjunction with its focus on growth across the three brands, e-commerce must be promoted. Many of its peers have been driving customers in-house, allowing them greater control over the customer experience and improving sale economics. This lends well to a personalized marketing approach. With Capri's margins sliding in recent years, this could be a smart way to reverse this.

A usual characteristic of Capri is its lack of exposure to Asia. Many of the luxury brands in particular boast over 50% of sales to the region, whereas Capri is at 15% (Versace 21%). This is likely another reason for its mediocre growth trajectory, as much of the demand for fashion is not from this region. Expanding its presence in countries such as China is critical and a key goal for Management. With the Chinese economic opening up following the end of the constant lockdowns, now is a greater opportunity.

Brand weakness calls into question the competitive position of Capri. If this cannot be turned around, market share will continue to be lost and growth will slow. Versace is the outlier here and Management must be careful not to derail this trajectory that predates their ownership.

Capri faces competition from other luxury fashion companies and high-end retailers. Some key competitors include LVMH (OTCPK:LVMHF), Dior, Prada (OTCPK:PRDSY), Gucci (OTCPK:PPRUF), Balenciaga, Burberry (OTCPK:BURBY), Tapestry (TPR), Zegna (ZGN), and Ralph Lauren (RL). Versace is comfortably competing well, as evidenced by its record revenue in FY22, but we believe the other two brands are currently losing market share and influence relative to their peers. Rarely in fashion is a strong brand dead and gone, however, and we see hope with Michael Kors at the very least.

Margins

A major concern for Capri has been its margins, which have consistently declined, falling to 18% on an EBITDA level. The margin disparity between brands is high, with Versace having an OPM of 14%, Jimmy Choo at 6%, and Michael Kors at 22%. This implies dilution is ahead, as Versace continues to be the key growth brand (although higher demand will mean less discounting, so the impact will be softened).

Margin issues are a fundamental reflection of demand. If interest improves, reduced discounting is required by Jimmy Choo and Versace, while Michael Kors can offset the other two.

Industry analysis

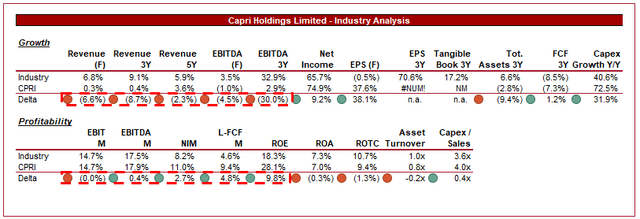

Apparel, Accessories and Luxury Goods (Seeking Alpha)

Presented above is a comparison of Capri's growth and profitability to the average of its industry, as defined by Seeking Alpha (27 companies).

Capri performs moderately relative to its peers. The business is slightly more profitable, particularly in FCF, although not to any material degree. The key concern is growth, where the business materially underperforms, illustrating its declining market share during a period of healthy growth for the industry.

Valuation

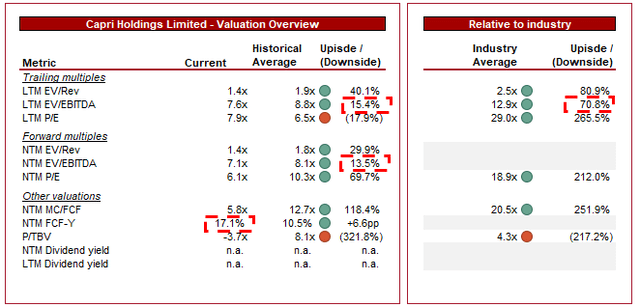

Capri is currently trading at 8x LTM EBITDA and 7x NTM EBITDA. This is a discount to its historical average.

A discount to its historical average is justified in our view, owing to its declining margins, stagnating interest in both Michael Kors and Jimmy Choo, and the difficulties with regaining traction in the fashion industry. A discount to its peer group is also justified, owing to the declining market share and relative financial weakness.

The degree to which the business is trading at a discount looks attractive. At an FCF-Y of over 15%, an FCF multiple of 6x, and a 71% discount to its peers, the business is unquestionably undervalued. The business is far from perfect but every asset has a price, and this one looks good.

M&A

Many have suggested Capri is a great takeover target for the likes of LVMH or Kering... it's not. With its current margins and size, Capri would be dilutive. Even with economies of scale, we struggle to see this panning out favorably for either.

This said, a merger with Tapestry? (or another non-luxury fashion conglomerate), this we could see. Tapestry has an EBITDA-M of 20%, a far more agreeable level that could be a win-win for the two.

With rates where they are, the Venn diagram of a cash-rich and non-margin dilutive businesses is currently non-existent, but over the medium term, we could see a transaction occur.

Final thoughts

Capri has quite a few issues, namely achieving sustainable organic revenue and margin growth. This said, the business owns fundamentally valuable brands and is positioned appropriately to improve its trajectory. Versace is doing well and should be left alone, Michael Kors is showing signs of life and needs incremental tinkering. Jimmy Choo needs a creative refresh to reinvigorate interest.

Despite the issue, we believe the valuation significantly undervalues the business. This is an industry where M&A is frequent, reducing the downside risk for investors, even if the share price continues to slide.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LVMHF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.