ZoomInfo: Crumbling Trends

Summary

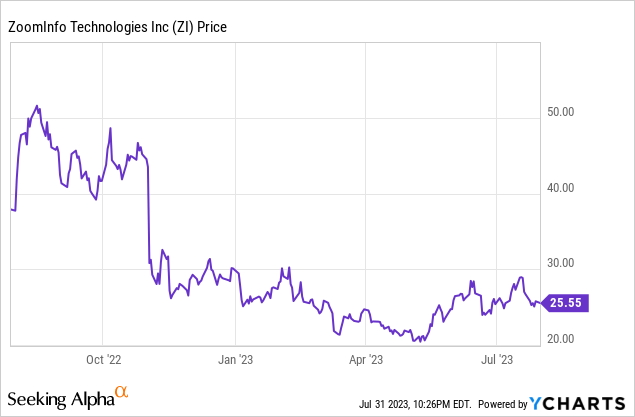

- ZoomInfo's stock dropped over 15% after reporting Q2 results.

- The company's revenue outlook was cut due to a pullback in sales headcount within its customer base.

- The company expects a weak renewal cycle in the back half of this year.

- Weakness is, in part, driven by ZoomInfo's heavy exposure to fellow software companies that are slicing down sales and marketing departments.

- Still trading at 9x forward revenue, the stock remains expensive despite its fundamental risks.

NicoElNino/iStock via Getty Images

Amid buoyant markets in the expectations for lower interest rates, it's important that we zoom out of the near-term optimism and take a hard look at fundamental results: do individual stocks, especially in the tech sector, deserve the recent rallies they've staged?

In the case of ZoomInfo (NASDAQ:ZI), this sales database/CRM company saw a massive reality check when it reported Q2 results. The stock shed more than 15% in after-hours trading post-earnings, bringing its year-to-date performance to down double digits.

ZoomInfo's Q2 trends largely played out with the risks I had laid out in my prior article on this stock: the majority of ZoomInfo license-holders are sales and marketing employees. Amid the current recession and tepid growth expectations for most companies, sales and marketing departments (alongside recruiters, which are another common type of ZoomInfo user) are getting slashed. It should come as no big surprise that ZoomInfo is seeing sharper than expected deceleration, which caused the company to cut its full-year revenue outlook (the primary drag on the stock post-Q2 earnings).

Beyond the soft near-term trends, here are the other longer-term red flags to watch out for in this stock:

- Large debt load- Unlike many tech peers, ZoomInfo is in a net debt position, and its floating debt structure exposes it to high interest costs. To offset this, however, ZoomInfo does generate strong unlevered free cash flows.

- Stiff competition- ZoomInfo is one of many CRM-style products and competes with much more recognizable names such as Microsoft's (MSFT) LinkedIn and Salesforce (CRM).

- ZoomInfo's data exchange policies may rub some potential customers the wrong way- ZoomInfo effectively offers subscribers a discount if they are willing to but their own employees in ZoomInfo's database to be searched by other ZoomInfo users. While this reciprocal exchange does make ZoomInfo unique vis-a-vis other CRM systems, it may also trigger backlash down the road.

- Not making progress on profitability- Despite a slowdown in growth rates, ZoomInfo has not made much headway in turning its focus to improving operating margins - despite laying off ~100 heads earlier this year.

Perhaps most pertinent of all: ZoomInfo is still expensive. At current share prices near $25, ZoomInfo trades at a market cap of $10.29 billion. After we net off the $660.3 million of cash and $1.23 billion of debt on ZoomInfo's most recent balance sheet, the company's resulting enterprise value is $10.86 billion.

Meanwhile, for the current fiscal year, ZoomInfo has cut its full-year revenue outlook to $1.225-$1.235 billion, representing 12% y/y growth - and a $50 million cut on both ends of the range from a prior outlook that represented 16-17% y/y growth.

ZoomInfo updated FY23 outlook (ZoomInfo Q2 earnings release)

Against the midpoint of this revised outlook, ZoomInfo trades at 8.8x EV/FY23 revenue - which is a steep valuation for a company whose growth has slowed to the low teens and is expected to decelerate even further to just 7-8% growth in Q3.

The bottom line here: macro trends are playing against ZoomInfo's favor and cutting into growth expectations as employment levels in the sales and marketing functions continue to dip. Even when we look beyond the short term and out longer term, I find competitors like Salesforce.com and LinkedIn/Microsoft to be much better equipped with other products/cross-sell opportunities that ZoomInfo will eventually be crowded out of the space. Steer clear here and invest elsewhere.

Q2 download

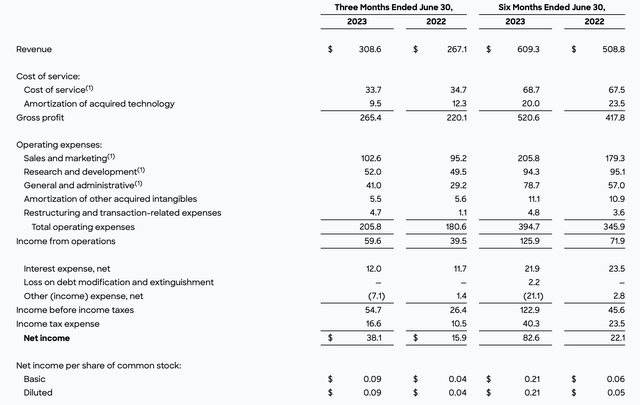

Let's now go through ZoomInfo's latest Q2 results in greater detail. The Q2 earnings summary is shown below:

ZoomInfo Q2 results (ZoomInfo Q2 earnings release)

Revenue grew just 16% y/y to $308.6 million, missing Wall Street's expectations of $311.1 million and decelerating sharply versus Q1's growth rate of 24% y/y (which, in turn, decelerated from 35% y/y growth in the preceding Q4.

The core driver here, of course, is staffing pressures at ZoomInfo's underlying client base. Per CEO Henry Schuck's remarks on the Q2 earnings call:

Our customers, sales leaders who sit disproportionately in the software vertical are reducing spending in the context of a lower growth environment. For high growth companies in particular, where the demand has been reduced and investors are expecting higher levels of profitability, these cuts have proved substantial and have meaningfully impacted ZoomInfo's ability to expand our solution.

Over the last quarter, I've talked to dozens of our high growth technology clients. All of which share a similar trajectory. I'll highlight one of them, a member of our 100k cohort as an example. In 2021, the SaaS company raised over $400 million of funding, was growing 70% year-over-year had 50 sales reps and expected that would grow to more than 100. They built that growth into their ZoomInfo agreements. In the back half of 2022 while on a path to get to breakeven in 2024 and while growing 40% year-over-year, their investors demanded something different. 40% free cash flow by the end of 2023 and scaled back growth to 5% to 10% year-over-year. Their sales team all ZoomInfo license holders went from 100 to 20 effectively overnight. Our account managers have been managing through this headwind since the beginning of the year.

As we look forward, reviewing our customer health, we no longer believe that these budgetary pressures and their corresponding downward pressure on renewals will ease in the near term. Our adjusted expectations for the full year, which now call for 12% revenue growth reflect this belief. While these results reflect a challenging time for our customers, I expected us to do better. The ZoomInfo platform delivers a compelling ROI to our customers regardless of their growth environment, and we have not done a good enough job to date in demonstrating this value to them."

The company is attempting several strategies to try to cure the near-term pressure. It's putting additional focus on product and data, adding new contact records to its database in order to sweeten the deal for prospective customers. It is also charging its own sales teams to seek new business in non-software verticals that are less impacted by the current macroeconomic climate (as a reference point, 35% of the company's overall business accrues to fellow software companies at the moment).

In spite of these efforts, however, it's clear from ZoomInfo's guidance of declining to a low of 7% y/y growth in Q3 that this will not be a quick solve. The company is expecting that its renewals, which are backend loaded in the second half of FY23, will be in a more challenged spot versus last year.

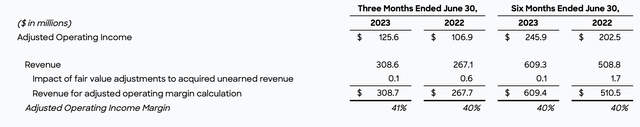

And in spite of layoffs and cost optimization in its own headcount, ZoomInfo's adjusted operating margins remained roughly flat to last year at 41%, whereas many other peer software companies with slowing growth rates have reported margin gains:

ZoomInfo adjusted operating margins (ZoomInfo Q2 earnings release)

Key takeaways

With crumbling growth rates and the threat of a poor renewal cycle in the second half of 2023, there's a lot more risk than reward for ZoomInfo, especially with the stock trading at a ~9x forward revenue multiple. Steer clear here and invest elsewhere.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.