Randstad: Reiterate Hold As I Remain Uncertain About H2 2023

Summary

- 2Q23 EBITA was €271 million, with organic growth down 5% and gross margins at 20.7%.

- The number of temps working in 2Q23 remained stable, but incremental weakness in Europe remains a concern of mine.

- I recommend to wait for 3Q23 or even 2H23 results to be out before confirming any signs of normalization are taking place.

sturti

Summary

Following my coverage on Randstad (OTCPK:RANJF), which I recommended a hold rating until there is an improvement in the overall operating environment. This post is to provide an update on my thoughts on the business and stock. I reiterate my hold rating as I await the next 2 quarters to confirm the trend of the business, especially in Europe.

Investment thesis

2Q23 EBITA was €271 million, organic growth was down 5%, and gross margins were 20.7%. However, it is important to note that EBITA would have been even higher if the €54 million integration costs and other non-recurring expenses had not been incurred.

Looking deeper into the numbers, we can see that the number of temps working in 2Q23 was stable from the previous quarter at around 600k. While April and May were affected negatively by holidays, normal seasonality was resumed in June. Although it is too soon to declare a bottom, the current trends are certainly encouraging. However, I noted that PMI data in Europe has been getting weaker over time recently, which could be a bad sign for temporary growth in Europe. The upcoming earnings report, which will confirm the segment's upward growth trends, will be a watershed moment, in my opinion. In contrast to the very robust Perm market that emerged after COVID on the back of a combination of latent demand and talent scarcity, the perm segment is now in pressure. I anticipate that the Perm market will remain weak for the foreseeable future as the economy is unlikely to pick up anytime soon.

Overall, I think the biggest overhang over RANJF stock is the unpredictability in Europe, which hasn't yet experienced the kind of declines seen on the US market, which dropped by double digits in 1H23. My main concern is that Europe will be the next region to experience a significant slowdown in growth, which will have a negative impact on investor sentiment. Until the macro environment becomes more clear, I will maintain a neutral rating.

US remains weak

Since the US market is more dynamic than Europe's, it inflects more quickly. Overall, we see weak trends. While automotive remains difficult, public health has been one of Randstad's most successful markets in the United States. Investors should take heart from the fact that the company has not lost any customers despite the fact that its revenues have dropped due to lower demand from existing customers. In other words, once the macro environment improves, growth should follow.

Balance sheet

Management has my respect for their careful attention to making sure the company doesn't run into any liquidity problems. The company has net debt of €1.2 billion, or 0.5x net debt to EBITDA, according to the balance sheet.

Valuation

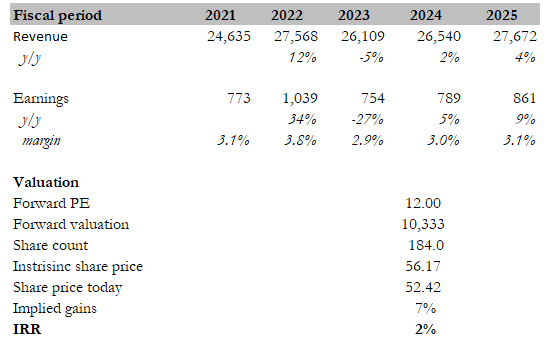

I believe the fair value for RANJF based on my model is $56.17. My model assumptions are that: RANJF is going to see a weak FY23 as macro conditions continue to pressure the business. Recovery is likely to take place in FY24, but I would not be too optimistic about it; hence, I modeled 2% growth. FY25 is the year where we should see RANJF recover back to historical growth rates. Margins should improve minimally, as the restructuring results show.

Peers include: Hays, PageGroup, Adecco, and ManpowerGroup. The median forward revenue multiple peers are trading at is 12x, the expected 1Y growth rate is -3%, and the leverage ratio is 0.9.

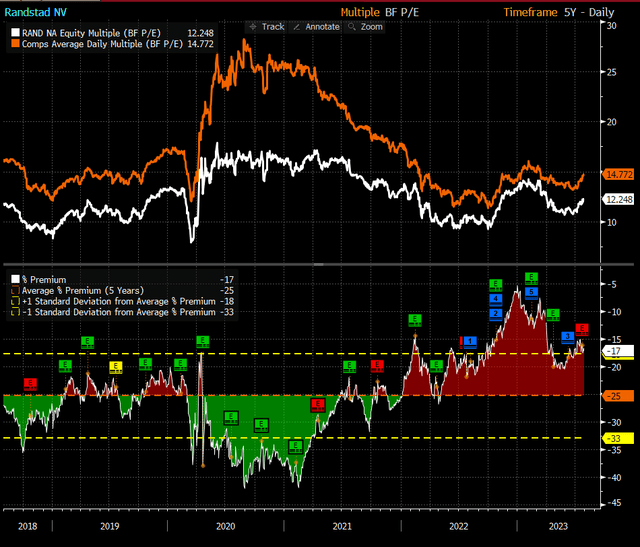

I expect the RANJF valuation multiple to stay at the current levels as there are no immediate catalysts that I can foresee will drive a rerating, especially when it is trading in line with the industry.

Own calculation

Bloomberg

Conclusion

While there are encouraging signs of stability and potential recovery, the unpredictability of the European market remains a concern, and the US market also shows weakness. The upcoming earnings report will be crucial in confirming growth trends. The company's balance sheet appears stable, but macro conditions may continue to pressure the business in the short term. I don't foresee any immediate catalysts for a valuation rerating, as such will maintain a neutral rating until the macro environment becomes clearer and the business shows sustained improvement.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.