Walgreens Boots Alliance: The Business Model Is Structurally Broken

Summary

- The article discusses Walgreen's challenges with its core business model.

- WBA is struggling against competitors like Costco, CVS, and Walmart.

- Walgreens still looks overvalued. It had negative free cash flow in three of the last five quarters.

Justin Sullivan

Finding well-known companies and brands that are trading at historically low levels is hard. While many once highly thought of and successful companies that began to struggle have not been good investments, some people find popular companies trading at a low-level appealing.

One well-known company that has fallen on very hard times over the last several years is Walgreens Boots Alliance (NASDAQ:WBA). This once successful company operates in the US under the names Duane Reade and Walgreens brands. The company uses the Boots, Benavides, and Ahumada brands in Europe, Latin America, South America, and Asia. Walgreens also has a wholesale pharmaceutical distribution business in Germany.

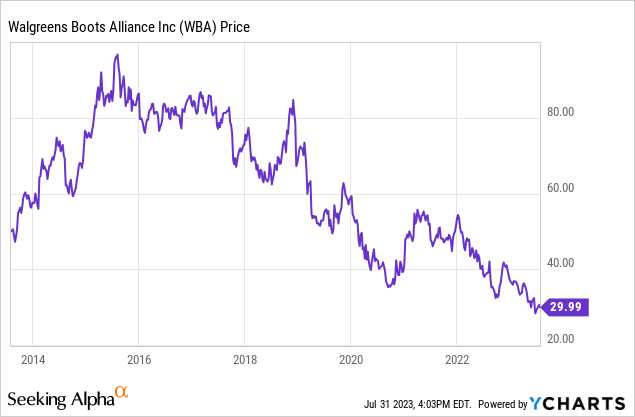

Walgreens had a good run prior to 2015, but the stock is down 21.5% including total returns, and the company has also sold-off 20.43% in the last year. The S&P 500 is up 221.11% during the same time frame.

Today, I rate Walgreens a sell. The company's business model is broken, and this retailer is struggling both domestically and abroad. In the U.S. Walgreens is facing intense competition from better run companies such as CVS (CVS), Costco (COST), Walmart (WMT), and increasingly now Amazon (AMZN) as well. The company's sales growth and cash flow continues to slow, the net margins have collapsed, and the core businesses is struggling overseas as well. The stock looks overvalued using several metrics.

Walgreen has had negative free cash flow in three of the last five quarters, and while analysts are projected that the company's cash flow next year will cover the dividend, estimates continue to come down.

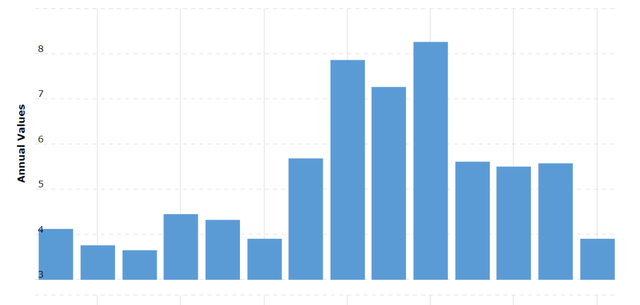

A chart of Walgreen's cash flow (Macrotrends)

Walgreens free cash flow has fallen from $3.20 a share in 2020, to $2.21 a share last year, and analysts are projecting free cash flow to continue to slow.

Walgreens has a 46.6% payout ratio, the company will likely only be able to pay the current dividend borrowing money, but with rates going up and the company dealing in credit rating downgrades, that should be a feasible alternative either. Moody's downgraded a significant part Walgreens unsecured senior debt to Baa3 from Baa2 in January of this year.

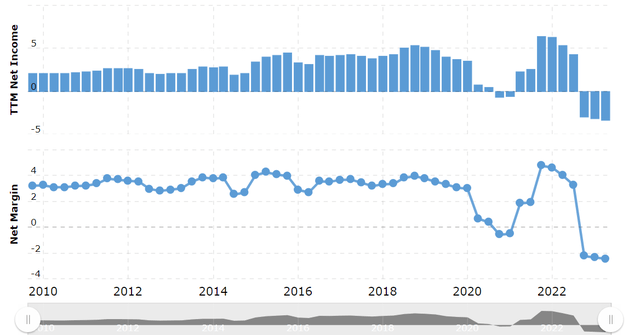

The company's net income and net margins have also collapsed.

A chart showing Walgreens net income and net margins (macrotrends)

Walgreens is also struggling to compete with companies such as CVS, Costco, and increasingly now, Amazon, for multiple reasons. Amazon recently increased move into the online telehealth and prescription drug business with the company's recent closing in February of their deal with One Medical. While Walgreens saw a short-term increase in sales during the pandemic as people relied on the company's pharmacy for boosters and COVID testing, the pandemic is over now, and the company's continued structural flaws in the business model remain.

Costco and Walmart offer better value than Walgreens, and CVS has bigger stores with more products as well. These companies also have better management teams, and each has innovated better than Walgreens. CVS's purchase of Aetna has given the company an advantage over this company in the pharmacy and medical business. Walgreens was relying in significant part on people coming into the stores to visit the pharmacy during COVID who also purchased other products at the store, and the pandemic ending has hurt the company significantly. Walgreens administered 4.8 million vaccines in the third quarter of last year, but in the past quarter the company only administered .8 million vaccines.

People are also increasingly getting medicine online from the drive thru, so the people using the pharmacy aren't shopping in the store as much. Walgreens did purchase Village-MD, and the company's parent, City-MD, but those acquisitions have been fairly small, and these decisions haven't fundamentally changed the company's failing business model, with sales from these two new entities at around $2 billion. Walgreens continues to struggle overseas as well. The company recently announced the closing of 450 stores, with 300 of those being in the United Kingdom.

This is why Walgreens also still looks overvalued at 7.44x expected forward earnings. Analysts are only currently projecting the retailer to grow earnings at 4-6% over the next 5 years, and estimates for the company continue to come down significantly as well. Walgreens also trades at 24.73x forecasted forward EBITDA and 17.82x expected forward EBIT. The industry average is 13.64x likely forward EBITDA, and 15.72x predicted forward EBIT.

Walgreen is struggling with a number of structural and short-term issues right now. While the company should be able to handle some immediate challenges such as the larger than expected $230 million dollar settlement with San Francisco over Opioid sales, the core business model remains broken. Walgreens has been much slower than competitors to innovate and adopt in the fast-changing retail and health care industry, and the management team of the company has not been impressive. While Walgreens is one of the most well-known brands in the US, investors should be able to find better value in the market right now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.