SoFi Earnings: Tale Of 3 Trends, Customer, Revenues, Profits

Summary

- SoFi Technologies, Inc. experienced a slowdown in customer adoption and projects a material revenue growth rate decline for the rest of 2023.

- Despite improving profitability, the company's revenue growth rates are decelerating.

- SoFi's bullish full-year outlook revision may not prevent revenue growth rates from reaching around 30% CAGR by the end of 2023, a significant drop from previous periods.

- While the balance sheet is stronger with about 30% cash, the stock's valuation, assuming optimistic 2024 assumptions, appears fairly priced, considering the company's still largely unprofitable and decelerating revenue growth rates.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

I going to make a greatest artwork as I can, by my head, my hand and by my mind.

Investment Thesis

SoFi Technologies, Inc. (NASDAQ:SOFI) is one of the most closely followed fintech companies. With both its passionate bulls and equally vehement bears. But I don't see Q2 as being a win for either camp.

The negative aspect that surfaced in the quarter is that its customer adoption curve is showing signs of deceleration. And similarly, SoFi's outlook for the remainder of 2023 indicates SoFi's revenue growth rates could exit 2023 at around 30% CAGR, a material slowdown from this last year.

On the other hand, a significant positive element from the quarter is the pace at which SoFi is increasing its profitability.

For my part, I remain neutral on this stock.

The Most Important Indicator: Adoption Curve

I've often stated that the single most insightful aspect of the health of a business is its customer adoption curve.

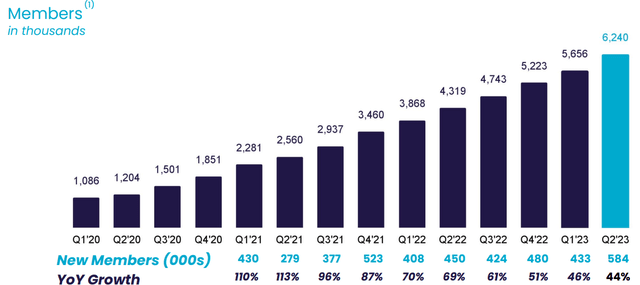

This time last year, SoFi's member growth rates reached 69% y/y. And yet, this time around, its member growth rate decelerated to 44% y/y. With around 6 million members, I don't believe that we are seeing a slowdown due to the law of large numbers.

In actuality, I believe, given the higher interest rate environment, SoFi is no longer the only fintech company offering depositors high savings rates, and given the greater availability of product choice, competition for depositors is now rapidly increasing, which weighs down on SoFi's appeal as the ''default'' consumer digital financial services super app.

Revenue Growth Rates Upwards Revised A Meager Amount

SoFi bullishly upwards revised its full-year outlook by approximately $30 million. Perhaps, by the time 2023 is completed, SoFi's full-year revenues will be around $2.2 billion versus the current guidance of around $2.0 billion.

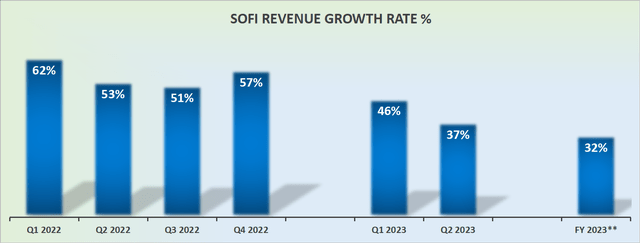

One way or another, I believe the message is clear, that SoFi's revenue growth rates are decelerating. I don't believe that investors should expect on SoFi to exit Q4 2023 growing its revenues by more than 40% y/y.

Particularly given that Q4 of last year is such a high hurdle for SoFi to cross. Even if we presume that SoFi's Q4 2023 adjusted net revenues reach $570 million, this would put SoFi's Q4 revenues growing at around 30% CAGR. A significant drop from the 57% y/y reported in the same period a year ago.

What's more, for this $570 million of adjusted net revenues, I've presumed that H2 is meaningfully weighted towards Q4.

Is that such a bad outcome? It truly depends on what the market is fundamentally expecting from SoFi?

If the market has come to terms with the fact that SoFi's revenue growth rates are slowing down, the fact that SoFi is about to exit Q4 2023 with a 30% CAGR, could be enough to reignite its share price beyond the $10 per share handle which it has several times hit only to retrace its steps.

Profitability Profile Is Improving

Put aside the contentious issue of SoFi's growth rates, we can see beyond doubt that SoFi's underlying profitability is surely set to improve. Indeed, consider this:

SOFI Q2 2023

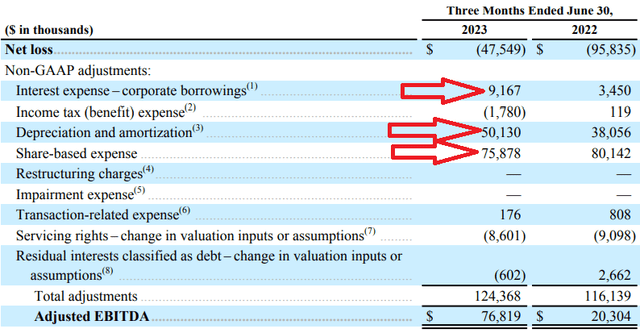

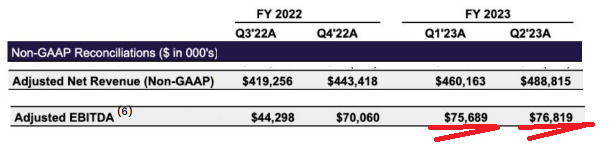

For Q2 2023, SoFi's EBITDA reached close to $80 million. Yes, we could make the argument that Q3 2023 is guided for $60 million, which is a sequential decline from Q2 2023, but investors will be hoping that SoFi is lowballing its Q3 guidance so that it could end up positively surprising investors down next quarter.

Indeed, it could be the case that Q3 could ultimately report around $90 million of EBITDA. And that's meant to be SoFi's weakest quarter, with Q4 2023 earmarked for around $130 million of EBITDA.

Simply put, SoFi is doing everything in its power to demonstrate to investors that even if its growth rates are slowly down, SoFi is now more focused on balancing growth with profitability.

SOFI's Valuation -- Fairly Valued Stock

If I were to highlight one further bullish aspect, I would be that SoFi's balance sheet now holds about 30% of its market cap as cash on its balance sheet. In other words, its balance sheet is significantly stronger than it was just 6 months ago.

All that being said, if we make some heroic assumptions about 2024, and make the case that SoFi could indeed reach $450 million of EBITDA, this would see the stock being priced at around 20x next year's EBITDA. That's not a stretched valuation, but it's hardly cheap.

Particularly when we spend a few moments inspecting SoFi's EBITDA line. Some people have said that profits are in the eye of the beholder.

But where SoFi sees profits I see costs. Case in point, the bulk of its adjusted EBITDA comes from depreciation and amortization, and stock-based compensation. Will those costs ever go away? No.

So what we are left with is a company that is still largely unprofitable, albeit improving, and with slowing revenue growth rates.

The Bottom Line

In Q2, SoFi witnessed a deceleration in its customer adoption curve and forecasts a material slowdown in revenue growth rates for the remainder of 2023.

While profitability is improving, revenue growth rates are showing signs of decline.

Despite a bullish upwards revision of its full-year outlook, SoFi's revenue growth rates are expected to be around 30% CAGR by the end of 2023, a significant drop from previous periods.

The company is now focusing on balancing growth with profitability, and its stronger balance sheet holds about 30% of its market cap as cash.

However, the valuation, assuming optimistic assumptions for 2024, leaves the stock fairly priced, considering the company's still largely unprofitable and decelerating revenue growth rates.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

Our Investment Group is focused on value investing as part of the Great Energy Transition. For example, did you know that AI uses thousands of megawatt hours for even small computing tasks? Join our Investment Group and invest in stocks that participate in this future growth trend.

I provide regular updates to our stock picks. Plus we hold a weekly webinar and a hand-holding service for new and experienced investors. Further, Deep Value Returns has an active, vibrant, and kind community. Join our lively community!

We are focused on the confluence of the Decarbonization of energy, Digitalization with AI, and Deglobalization.

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

DEEP VALUE RETURNS: The only Investment Group with real performance. I provide a hand-holding service. Plus regular stock updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)