Qualcomm Fiscal Q3 Earnings Preview: The Potential To Outperform Is There

Summary

- Qualcomm Incorporated's significant cyclical headwinds will most likely continue to impact its performance in fiscal Q3 and the remainder of the year as macroeconomic headwinds remain.

- Q2 shipment data is showing the first signs of a recovery, as well as increased investments and normalizing inventories, potentially increasing demand for Qualcomm products.

- Qualcomm remains in excellent shape despite near-term headwinds, with strong market positions in the smartphone, IoT chip, and automotive semiconductor markets.

- However, risks associated with its significant exposure to China and the potential loss of Apple as a customer pose challenges and require a discounted valuation.

- I maintain my buy rating on Qualcomm, as I believe the company is trading around fair value and could potentially report a relatively strong Q3 result and Q4 guidance.

Justin Sullivan

Investment thesis

I maintain my buy rating on Qualcomm Incorporated (NASDAQ:NASDAQ:QCOM) and update my revenue and EPS estimates prior to the company’s fiscal Q3 results (expected post-market Wednesday August 2) after diving into the company fundamentals and Q2 shipment data.

Qualcomm fundamentally remains in excellent shape despite significant near-term headwinds. The company has faced challenges in its latest quarterly results, experiencing a massive deceleration in growth due to the economic downturn and declining personal electronics sales. However, Qualcomm's strong market position and technological leadership across its leading segments make it a primary beneficiary in the growing smartphone market, IoT chip market, and advanced automotive semiconductors market.

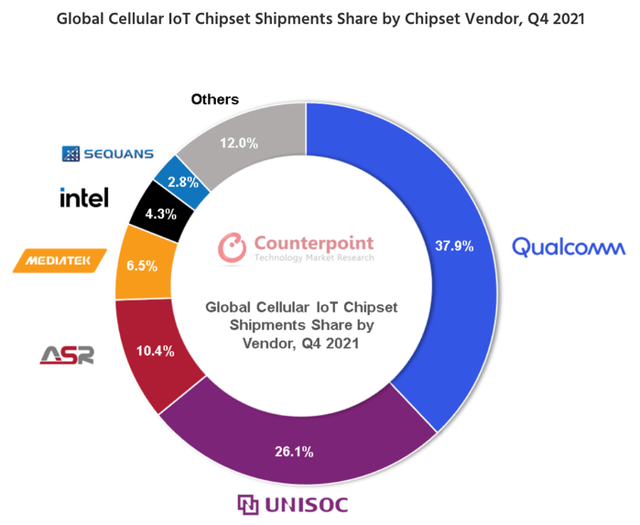

The smartphone industry remains an essential revenue source for Qualcomm, and its 30% market share positions it well to capitalize on the predicted 7.3% CAGR growth in the industry through 2029. Additionally, the company's leading position in IoT chips, with a 38% market share, and automotive semiconductors, with an 80% market share in the automotive connectivity market, bodes well for future growth as these markets continue to expand.

Despite short-term challenges, Qualcomm's healthy financials, including strong margins and ROE, and its ability to generate solid cash flows contribute to its excellent fundamental shape. The company's balance sheet allows for returning cash to shareholders through dividends and share repurchases.

Meanwhile, it is essential to acknowledge the risks associated with Qualcomm's significant exposure to China, where geopolitical tensions and unpredictable government actions could impact its revenue potential. Additionally, the potential loss of Apple (AAPL) as a customer could pose challenges as the company accounts for around 20% of Qualcomm’s FY22 revenue.

In this article, I will take you through the latest developments and financial results and update my estimates and view on the company accordingly.

Qualcomm fundamentally remains in excellent shape despite significant near-term headwinds

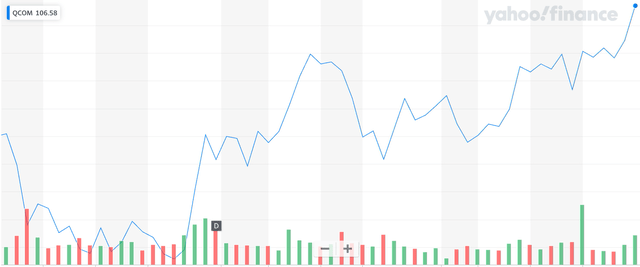

Qualcomm investors have seen quite the ride over the last quarter. Shares fell from a Q2 pre-earnings share price of $116 to a low of $102, to then rebound by 26% to a share price of just below $130. This rebound was at least in part driven by positive economic data throughout the quarter and several positive news releases like a new AI partnership between Qualcomm and Meta Platforms (META) and positive smartphone shipment data.

Qualcomm share price performance over the last three months (Yahoo Finance)

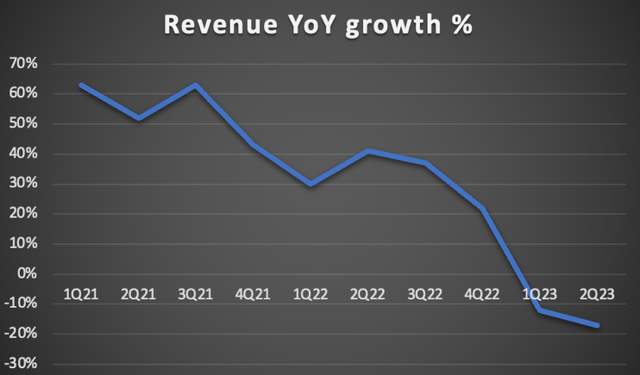

This positive news was very much needed for Qualcomm as its latest quarterly results were definitely not to write home about. The company has seen a massive deceleration in growth as it went from reporting COVID recovery growth rates of around 40% to reporting a revenue decline of 17% in just nine months.

In addition, margins have fallen quite fast due to the company still investing heavily in R&D despite the significant slowdown in top-line growth. It was just last quarter that the company did not grow its R&D sequentially for the first time in multiple years.

Based on the Q2 financial performance, it is easy to see why the share price fell after the fiscal Q2 earnings report and why the company has been trading at a discount to many of its semiconductor peers. It is heavily impacted by the slowing consumer spending and the overall decline in personal electronics sales. With the economy still struggling for traction, a quick recovery for Qualcomm is not expected, explaining the depressing guidance issued by management last quarter.

Meanwhile, the company fundamentally remains in excellent shape despite the significant near-term headwinds. The company is a leader across all three of its leading segments, which is a testimony to its technological leadership. Through this, it can take market share from competitors and report growth that outperforms the industry.

In the smartphone industry, it consistently holds a market share of around 30%. This makes the company a primary beneficiary of the growing smartphone market, which is predicted to grow at a CAGR of 7.3% through 2029.

Furthermore, the company is the leading supplier of semiconductors used to power IoT devices. It holds a 38% market share as of the start of 2023 and has been expanding this market share rapidly over recent years. Mordor Intelligence expects the IoT chip market to grow at a CAGR of over 16% through 2030, of which Qualcomm should be a meaningful beneficiary as this will fuel its growth.

Finally, the company is also one of the leading suppliers of advanced automotive semiconductors. Qualcomm holds an 80% market share in the automotive connectivity market based on H1 shipments.

Yet, much more important is the company’s contribution to the autonomous driving industry, for which the growth in semiconductors is expected to sit around a CAGR of 38% through 2030. In this market, Qualcomm is also one of the most significant players, competing with the likes of Mobileye (MBLY) and Nvidia (NVDA).

Qualcomm has an automotive backlog exceeding $30 billion, fueled by demand for the Snapdragon Digital Chassis, the company’s most advanced automotive platform as it offers autonomous driving support, infotainment, and cloud connectivity.

Through this excellent industry exposure and the company’s proven technological leadership, it should be able to come out of the current cyclical downturn stronger, and going by the expected industry growth rates, Qualcomm has a very promising growth outlook. Investors should not get spoked by the cyclical downturn but should focus on company fundamentals.

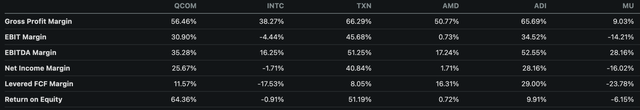

Financially, the company also remains in good shape. Especially compared to its equally cyclical peers the company maintains a very strong margin profile and ROE. Through this, it generates solid cash flows, allowing it to maintain a healthy balance sheet with $6.7 billion in total cash and a long-term debt position of $15.5 billion. The debt has increased by $2 billion so far this fiscal year but remains in line with its historical averages. A bit more negative is the cash position, which, although up $600 million so far this fiscal year, is far lower than its historical average, making the company slightly more leveraged. Still, the cash position is sufficient to fund its investment plans and debt is manageable once growth returns.

QCOM and peers margin comparison (Seeking Alpha)

This healthy balance sheet also allows the company to keep returning cash to shareholders through both dividends and share repurchases. This is what I wrote after the company’s Q2 results:

Last quarter Qualcomm returned $1.7 billion to shareholders through share repurchases ($903 million) and dividends ($834). Also, Qualcomm grew the dividend by 7%, which is a decent increase considering all circumstances.

Shares now yield a decent 2.47%, which sits 50% above its sector median but 7% below its 5-year average. Qualcomm has been growing its dividend for 19 consecutive years now. Still, the payout ratio is a very safe 28%, indicating that even a significant cyclical downturn does not pose any threat to this dividend. Also, it leaves plenty of room for solid increases going forward. Especially with the solid long-term growth outlook for Qualcomm, dividend growth should remain strong.

What to expect from Qualcomm’s Q3 earnings report

Later this week, on August 2, Qualcomm will report its fiscal Q3 earnings. Management has guided for revenue to be between $8.1 billion to $8.9 billion, down 22% YoY at the midpoint. This guidance was significantly below the Wall Street consensus prior to the Q2 earnings report but these estimates have now come down and sit at the midpoint of management’s guidance. It is safe to say that expectations are not overly high.

The guidance reflects management’s expectation of macroeconomic headwinds to persist, especially in the smartphone industry where they continued to see inflated inventory levels for customers and flat sequential growth in handset shipment numbers. As long as customer inventories remain high, orders for new chips will remain depressed. Furthermore, operating expenses are expected to remain flat sequentially, which, in combination with a sequential decline in revenue will not bode well for EPS. This is what I wrote previously:

EPS is expected to come in between $1.70 to $1.90, down close to 40% YoY due to a lower revenue base and continued investments. And indeed, this is far from good. Also, QCOM management is not expecting to see a meaningful improvement in the fourth quarter of its fiscal year.

Qualcomm expects handsets to be down at least by high-single digits for the full year, partly fueled by a delayed recovery in China. An earlier expected recovery tailwind from China has stayed out so far, which is why Qualcomm has chosen not to incorporate any Chinese economic improvements into its outlook for the rest of the year. Overall, after the Q2 earnings releases, management saw no bottom of the cycle in sight.

Yet, looking at the latest data, there is an improvement, at least in some regions. India, for example, saw a stabilization of the market as shipments were only down 1% YoY in Q2, a significant improvement from the 20% decline in Q1. Sequentially, shipments were even up 18%, causing improved inventory levels, according to Canalys.

Crucially, Qualcomm’s most important market, China, saw the first signs of a modest recovery in Q2. Shipments declined by just 2.1% YoY in Q2, which is not all that bad. Yet, this minor decline is expected to persist throughout 2023, according to IDC, meaning that a real recovery in China is not expected this year.

Global smartphone shipments fell 7.8% YoY and 1.2% sequentially in Q2, driven by more significant declines in the US and Europe and roughly in line with Qualcomm’s expectations. Yet, again, this is showing the first signs of a modest improvement as there are signals of growing investments and reduced inventories, which should also bode well for Qualcomm as reduced inventories and growing investments will drive higher demand for its products. Still, IDC now expects global shipments to be down 3.2%, down from a previous expectation of 1.1%. At the same time, it now projects a recovery in 2024 with about 6% growth in shipments expected.

Based on this data, I expect to see a continued decline in handset revenues for Qualcomm as shipments align with their expectations and continue to decline both YoY and sequentially. Yet, I do expect their handset revenues to come in slightly better due to improved inventory levels and growing investments, which will drive higher demand for Qualcomm chips. In addition, I expect a more significant improvement in Q4, whereas Qualcomm previously guided for no improvement. Therefore, guidance might be more bullish than anticipated by analysts.

Also, the IoT and Automotive sectors are seeing positive signals. Demand for automotive semiconductors is expected to remain high due to a continued push for electrification, digitalization, and autonomous driving. Yes, growth will slow down somewhat from the incredible levels witnessed over the last couple of years, but growth will probably remain in the solid double digits.

Moreover, IoT Analytics continues to expect 16% YoY growth in IoT endpoints, of which Qualcomm is the lead semiconductor supplier. The firm sees decreased demand for IoT semiconductors but expects this to quickly recover as supply remains far below demand. The significant decline we saw last quarter was the result of equipment makers rapidly reducing inventories in response to cautious end-user spending and macroeconomic uncertainty. This effect will most likely continue in the third fiscal quarter for Qualcomm but will show an improvement from last quarter and return to positive growth by the end of the year. For Q2, a decline between 14% to 18% seems likely, up from a 24% decline last quarter.

Overall, based on the quarterly data discussed above, I am turning slightly more bullish on Qualcomm’s Q2 results. While revenue will continue to show a YoY decline, I believe Qualcomm will start to see a slight improvement in demand.

Artificial Intelligence (AI) and the company’s exposure to China and Big Tech

Before moving to the updated financial estimates, let’s quickly look at some important quarterly developments, starting with Qualcomm’s increased AI efforts.

A couple of weeks ago, Qualcomm announced that it is bringing Large Language Models (LLM) to smartphones and PCs through a partnership with Meta, leveraging Meta’s AI expertise and Qualcomm’s AI-enabled industry-leading Snapdragon chipsets. Starting next year, Meta's new LLM, LlAmA 2, will be able to run on Qualcomm chips, which should be seen as quite a meaningful development as, today, LLM’s largely run on massively complicated servers powered by Nvidia GPUs due to the sheer calculating power needed to run these models. Yet, Qualcomm and Meta are now making it possible to run these on smartphones and PCs, which opens it up to a massive unexplored market and lowers the barriers and availability of AI.

Being able to run the AI model on-device can massively reduce cloud computing costs for developers and should enhance user privacy as no data is transmitted to an external server. In addition, on-device AI processing allows for generative AI without an internet connection and enables personalization of models to users’ preferences. This is how Marktechpost summarizes the opportunity:

Overall, the partnership between Meta and Qualcomm signifies a significant step towards democratizing access to AI models, opening up exciting opportunities for developers to create AI-powered applications and ushering in a new era of on-device AI ecosystem similar to the app store explosion with iPhones.

While this is still in the very early innings and Qualcomm’s AI potential is still largely based on speculation and wishful thinking and will not result in any significant revenues in the near term. Still, the fact that Qualcomm will be one of the first to enable generative AI features on-device through its technologically superior Snapdragon chips positions it extremely favorably to grow its market share in smartphones and should allow it to potentially enter new markets. As demand for AI accelerates and this solution by Qualcomm and Meta offers several exciting opportunities, Qualcomm’s abilities here should position it extremely favorably, which I believe will bode well for its future growth. It is a very interesting factor to keep a close eye on over the next couple of years.

On a more negative note, earlier this month, Seeking Alpha reported that executives of Intel (INTC) and Qualcomm were meeting with U.S. officials in Washington to discuss a number of things, including discussions on potential further export restrictions for China. The US will most likely be announcing new restrictions over the next couple of months with regard to AI and advanced semiconductors after the announcements made in October last year.

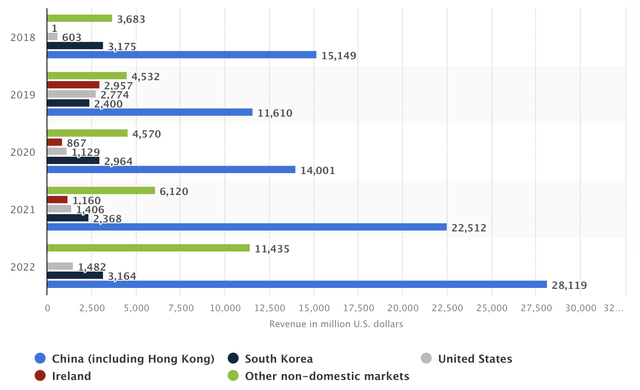

Certain AI and semiconductor restrictions could also start to impact Qualcomm. As explained above, the company plans on significantly increasing its on-device AI efforts, which could be something the US government will not be overly excited about in light of these being shipped to China. Of course, I am now speculating, but Qualcomm will not be untouchable if the US continues to increase its Chinese restrictions. Crucially, Qualcomm derives 64% of its revenues from China, making it by far the largest and most important market for Qualcomm. If the company had to start dealing with limitations in the country or would be hit with export restrictions, this could significantly impact Qualcomm’s revenue potential, which is plenty of reason for concern and caution.

Qualcomm revenue by region (Statista)

Considering everything discussed above, I view this China exposure as a significant risk for the company. As the China-US relationship deteriorates further, this is quite a big negative for Qualcomm. In addition, tensions regarding a potential invasion of Taiwan and the insecurities that come with the Chinese government and its nationwide actions that can be quite unpredictable are not helping the case either. Very recently, the Chinese government banned Micron’s (MU) products in the country due to the company failing a cybersecurity check, possibly impacting half of the company’s revenues. Being mainly dependent on China clearly is quite a risky business model, to say the least, and I believe this will need to be priced in Qualcomm’s share price.

Another important (negative) trend we have seen over recent years is big tech companies working on in-house silicon solutions for their products. We already have Amazon designing its own GPUs, Google working with its own Tensor chips, and most famously Apple replacing chips in their devices or at least attempting to.

Apple has been working for several years on replacing Qualcomm’s 5G modem with in-house silicon in its iPhones but has so far failed to design a product of the same quality. Moreover, while there were rumors that Qualcomm would no longer be Apple’s exclusive 5G modem supplier after the iPhone 15, recent reports confirm that Qualcomm will remain the exclusive supplier for the iPhone 16 family as Apple has up until today been unable to replace the Qualcomm 5G modem. Yet, this is a matter of time as it is suggested that Apple could have its first batch of modems available by 2025.

Losing Apple as a customer would significantly impact Qualcomm as Apple accounts for 20% (approximately $9 billion) of Qualcomm’s 2022 revenue, making it not hard to understand why this is quite significant for the company. And while I believe Qualcomm could quickly fill this revenue gap with growth in other segments and is working on decreasing its dependence on Apple, it remains a substantial risk in the near term.

On a more positive note, Meta has also been working on replacing Qualcomm’s chips in their VR devices, yet also without success. According to multiple sources, Meta has now reversed its strategy and will be using Qualcomm semiconductors in more of its upcoming devices. Meta is reportedly meaningfully boosting its relationship with Qualcomm to use more of the company’s leading semiconductor products on its own, pushing to the side the idea of replacing these with its own internal silicon. This is very good news for Qualcomm as this should secure a solid long-term revenue stream and eliminate the risk of losing another Big Tech customer.

Outlook & QCOM valuation

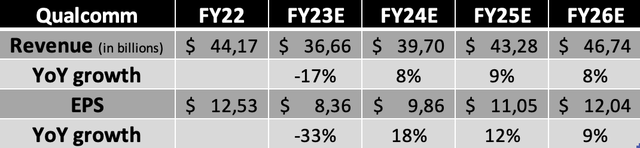

Based on everything discussed in this article so far, I have upgraded my FY23 and long-term outlook for Qualcomm and now expect the following financial results through FY26.

Financial estimates (By Author)

(This includes Q3 revenue of $8.81 billion and EPS of $1.86.)

Shortly explaining these estimates, I now project Qualcomm to report revenue of $36.66 billion in FY23 as I expect Qualcomm to see improved demand for its products in the second half of its fiscal quarter. This includes my expectation for a stronger Q3 than anticipated by management. Shipment data for all three segments show improvements and a bottom in the cycle. Inventories are normalizing and investments by Qualcomm customers are growing in anticipation of new product releases in Q4. This should drive demand for Qualcomm’s products. While I am still guiding for a YoY decline in excess of 20% and an even more significant EPS decline, I expect these to come in at the high end of guidance from management and above the Wall Street consensus. In addition, I expect Q4 guidance to reflect a sequential improvement and to come in above the Wall Street consensus.

For FY23, I am projecting limited revenue growth of 8% as the economic improvement and growth in shipments will be gradual instead of the sharp V-shape recovery we saw in 2021/22 as macroeconomic headwinds remain. Growth should accelerate further in FY24 and FY26 as Qualcomm remains ultra-competitive in its respective industries. Secular growth drivers like the adoption of AI, growth in automotive semiconductors due to electrification and autonomous driving, and the overall increase in consumer electronics will drive growth for Qualcomm, which is very well positioned through its superior product offering. While Qualcomm for sure is not the fastest growing or most exciting opportunity in the semiconductor industry, I expect it to deliver solid returns to investors, also in part due to its shareholder-friendly management team.

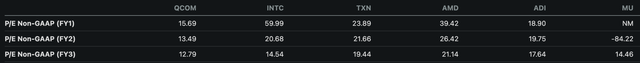

Moving to the valuation, shares are currently valued at 15.5x my 2023 EPS estimate, which is 9% below its 5-year average but much higher than the 12x when I last covered the company three months ago. Furthermore, when compared to its peers, Qualcomm continued to be trading at a discount. Its P/E non-GAAP (FY3) sits meaningfully below most of its peers.

Valuation comparison (Seeking Alpha)

Taking this into account, as well as the company’s strong market position and solid outlook, but also the significant risks that come with an investment in Qualcomm, I remain of the belief that a P/E of 15x is fair for this company. Its China exposure and the probability and effect of losing Apple as a customer over the next several years are risks that require a significant discount. Therefore, it makes sense that Qualcomm is valued below the likes of Intel, TXN (TXN), and AMD (AMD).

Still, based on a 15x P/E and my FY24 EPS estimate, I calculate a target price of $148, leaving an upside of approximately 14%. (Please note, this target price is solely based on its forward P/E and is only for indicative purposes.)

Conclusion

Going by the Q2 shipment and economic data, Qualcomm could beat the consensus estimates and report revenue and EPS on the high end of its guidance. The first signs of a bottom and possible recovery are appearing, which could boost demand for Qualcomm’s products ever so slightly. Therefore, I also expect strong guidance for Q4 with sequential flat to slightly positive growth.

Still, a real recovery will most likely only occur after the end of the year and even then this is expected to be a gradual one as the macroeconomic headwinds remain strong. Therefore, I do not expect a strong V-shape recovery as we have seen over recent years. Furthermore, as Qualcomm continues to boost its investments to maintain its technological advantage over competitors, its margin profile will probably deteriorate further, with a net income margin falling to around 25% in Q3 and Q4. This will negatively impact EPS growth.

Meanwhile, while Qualcomm is navigating a challenging demand environment in the near term, its long-term positioning remains excellent as it has a strong market position in several promising industries like Automotive and IoT. Its handset business will remain its largest segment for the foreseeable future and will supply the company with solid cash flows and a painful economic cycle every once in a while. It’s crucial that investors look through the near-term headwinds and focus on the long-term potential of the business, including its AI opportunities.

Based on a discounted P/E valuation to account for the several significant risks Qualcomm is exposed to and my FY24 EPS, I calculate a target price of $148. Going with a 10% annual return (12.5% including dividends), I believe a fair value share price sits around $131 and should leave enough downside protection and potential for solid long-term returns.

Therefore, at a current share price of $130, I maintain my buy rating on Qualcomm Incorporated.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)