Williams-Sonoma: We Are More Optimistic Than Before

Summary

- Since our last writing, the macroeconomic environment has significantly improved, including consumer sentiment and the inflation rate. WSM's financial performance may be positively impacted by these developments.

- The firm's dividend remains safe and sustainable despite declining sales and earnings.

- The firm remains undervalued compared to its peers in the home furnishing retail industry.

- We upgrade our rating to "buy".

Justin Sullivan

Williams-Sonoma, Inc. (NYSE:WSM) operates as an omnichannel specialty retailer of various products for home. It offers cooking, dining, and entertaining products among others.

We started coverage on this retailer slightly more than a year ago, in June 2022, with an initial "hold" rating. The primary reasons for our neutral view were:

- Solid financial fundamentals, including margin performance.

- Attractive valuation, combined with a safe and sustainable dividend and a sizeable share buyback program.

- Significant macroeconomic headwinds, including consumer confidence and inflationary pressures.

Since this writing, the firm's stock price has increased by more than 31%, outperforming the broader market, which has advanced slightly more than 21% in the same time frame.

Today, we will be revisiting our initial thesis and give an updated view, considering the latest developments in the macroeconomic environment, while also touching on some company-specific factors that may impact WSM's financial performance in the coming months and quarters.

Macroeconomic environment

Since our first writing, the macroeconomic environment has improved meaningfully. Today, our focus will be on the consumer confidence, on the inflation rate and on the health of the housing market in the United States.

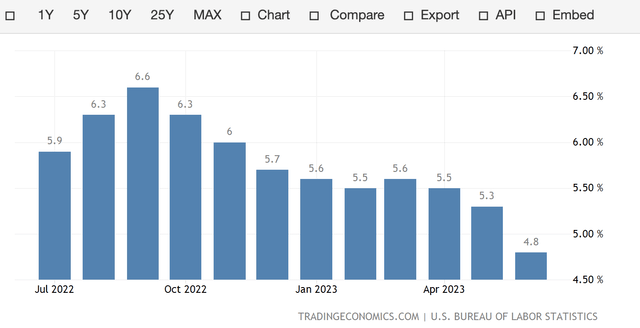

Consumer confidence

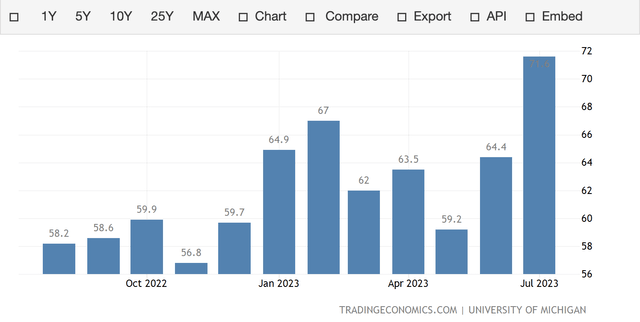

Since its lows in 2022, consumer sentiment in the United States has improved significantly. So why does it matter when talking about WSM's business?

Consumer confidence is often treated as a leading economic indicator, which may signal certain changes in the spending behavior of the consumer. A high, or improving reading means that people are becoming somewhat more certain about their financial outlook and about the state of the broader economy overall. This may lead to more spending as people are likely to be willing to give out money for non-essential, discretionary, durable items.

This may lead to higher demand for WSM's products in the coming quarters.

U.S. Consumer confidence (tradingeconomics.com)

At the same time, the firm has just been downgraded to "underperform" by Barclay's, citing depressed consumer spending, which is likely to have a negative impact on the Q2 earnings figure.

Earnings per share for the second quarter are expected to come in nearly 30% lower than a year earlier, according to consensus estimates and 13 of the last 19 EPS revisions have been to the downside.

Important to note: the same article highlights that 20 of 25 Wall Street analysts still have Hold, Buy or Strong Buy ratings on the stock. We tend to agree more with these analysts. In our opinion, a downgrade to "underperform" is not particularly surprising, especially when we also look at the Q1 earnings results, but at this point in time we believe it is a bit too late.

Before jumping onto the next section, we would like to touch upon one more company-specific factor that we think could lead to higher demand and higher sales figures for WSM. This is the recent bankruptcy filing of Bed Bath and Beyond. This also creates room for potentially opening new stores and increasing footprint in the future to capture a larger share of the market.

One of the factors that can have an influence on sentiment is actually the inflation rate. So let us look at it a bit more in detail now.

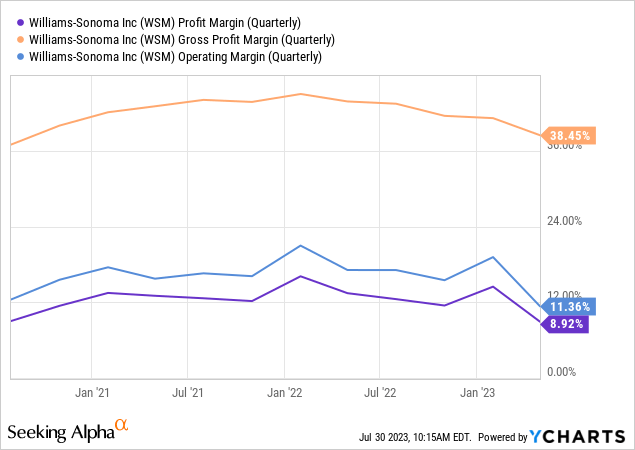

Inflation rate

The core inflation rate has been dropping rapidly from the 2022 highs, primarily fueled by the Fed's aggressive rate hikes.

U.S. Core inflation rate (tradingeconomics.com)

Falling inflation is likely to benefit WSM's business, not only because it might have a positive impact on consumer spending, but also because it may lead to positive developments in terms of input costs and SG&A expenses. If so, this may lead to margin expansions in the coming months, benefitting the bottom line results of the firm.

Housing

On the other hand, the housing market is still not in the best shape. Most indicators show that there is significant room for improvement from the current levels.

Building permits, which is a leading indicator of new housing supply, have meaningfully declined from the 2022 levels. Existing home sales have also declined compared to the prior year, however, new home sales have somewhat improved.

The Fed's rate hikes are playing a key role in the health of the housing market. Higher interest rates mean that mortgages are becoming more expensive, therefore the demand for them are softening. As most people buy their property with at least some amount of leverage, this development also impacts the demand for housing units. Looking forward, however, we do not believe that the Fed will keep hiking the rates much higher, and therefore are carefully optimistic about the improvements in the housing market in the coming quarters.

So why does the health of the housing market matter for WSM's business? Well, when people purchase a new home, they may start spending on potential upgrades, or they may redesign certain areas to better fit their needs or match their tastes. These things in general lead to a higher demand for home furnishing products and therefore also for WSM's products.

All in all, as the state of the housing market plays a key role in shaping the demand for WSM's products, we are rather cautious going forward despite the potential improvements.

Company-specific considerations

Profitability

While throughout 2021 and 2022 the firm has managed to keep its margins relatively stable, in the last reported quarter, the margins have slightly contracted.

The firm has listed several factors in their latest 10-Q, which have been contributing to this negative development of the gross profit margin:

- higher input costs, ocean freight, detention and demurrage due to the impact of supply chain disruption and global inflation pressures.

- higher outbound customer shipping costs due to out-of-market shipping and shipping multiple times for multi-unit orders.

- higher occupancy costs resulting from incremental costs from our new distribution centers on the East and West Coasts to support our long-term growth, which was partially offset by the higher pricing power of our proprietary products, our ongoing commitment to forgo site wide promotions and our retail store optimization initiatives..

They have also elaborated on what has been driving the change in the SG&A expenses:

This increase in rate was primarily driven by deleverage due to lower sales as well as exit costs of $15.8 million and reduction in in-force initiatives of $8.3 million totaling $24.1 million, partially offset by a decrease in advertising expenses and overall cost discipline.

Further, the net income margin has also been hurt by the higher effective income tax rate, compared to the prior period:

The effective tax rate was 23.6% for the first quarter of fiscal 2023 compared to 21.5% for the first quarter of fiscal 2022. The increase in the effective tax rate is primarily due to less excess tax benefit from stock-based compensation in fiscal 2023.

Looking forward, we would like to see the decline reverse. Due to the falling inflation rate, the moderating commodity prices, the easing supply chain disruptions and the improving consumer confidence this may even be possible in the coming quarters.

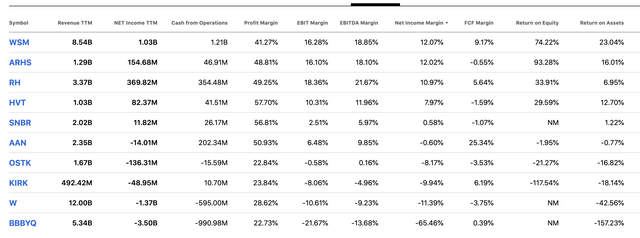

Despite this decline, WSM remains one of the most profitable firms in the home furnishing retail industry, according to several profitability measures.

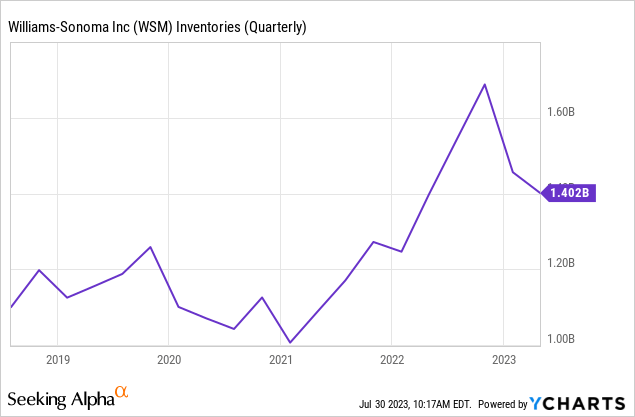

Normally, at this point we also raise our concerns about potential inventory management problems, as obsolete inventory can have meaningful negative impacts on the margins. The following chart shows how WSM's inventory levels have changed in the past 5 years.

We are definitely glad to see that the levels have fallen significantly off of the peak, and we would like to see this trend continue.

Dividends

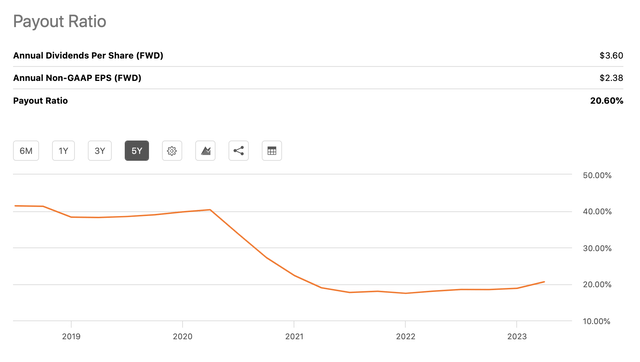

The firm has recently declared a common quarterly dividend of $0.9 per share, in line with the previous amount. Despite the declining sales and earnings, the dividends remain well covered and sustainable in the near future. The payout ratio is currently around 20%, significantly below pre-pandemic levels.

Valuation

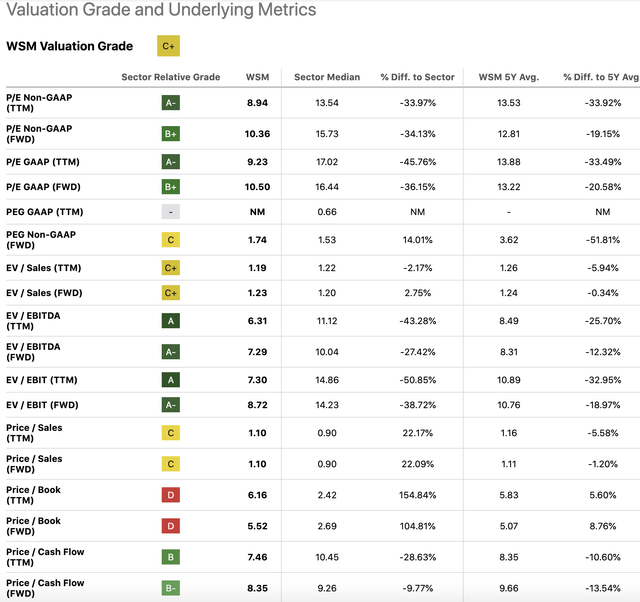

Just as in our previous article, we once again see that WSM appears to be trading at a significant discount compared to both the consumer discretionary sector median and the firm's own 5Y averages, based on a set of traditional price multiples.

Comparing to the consumer discretionary sector may be too broad of a peer group, so we decided to take a look at the WSM in comparison with some of its closest peers.

Compared to this peer group WSM is still selling at a substantial discount.

Conclusion

The macroeconomic environment has substantially improved since our last writing. Consumer sentiment has improved, while the inflation rate has moderated. These developments may have a positive impact on WSM's top- and bottom line results in the coming quarters. Be aware though, that analysts have not been all so optimistic about the near-term outlook and some have even downgraded the firm's stock to "sell".

The firm's profitability remains attractive within the home furnishing retail industry. The valuation also appears to be attractive, especially when considering the safe and sustainable dividends.

As our outlook about the overall economy has substantially improved, we upgrade WSM's stock to "buy".

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.