Physicians Realty Trust: A Case For M&A

Summary

- Physicians Realty Trust is perhaps the best candidate for M&A among REITs in the Medical Office Building market.

- Physicians Realty is the smallest of five major REITs active in that space, both the share price and the dividend have been flat for years, yielding minimal real returns.

- With few avenues available to significantly improve results, a sale to a larger peer could reduce the cost of capital, reduce overhead costs, and potentially achieve beneficial local market concentration.

- Welltower Inc. appears to be the most likely buyer. I would not be surprised to see an acquisition in the next year.

pamelasphotopoetry/iStock via Getty Images

Investment Thesis

Physicians Realty Trust (NYSE:DOC) is the smallest of the five major REITs active in the Medical Office Building ("MOB") market. Total returns for the last five years have barely matched inflation, with the share price and the dividend flat in nominal terms, and declining in real terms.

Total revenue growth has slowed, and General and Administrative ("G&A") costs as a percent of revenue have been unchanged at ~ 8%, nearly 3X the rate for the largest healthcare REIT.

DOC appears to be operating effectively, but has no clear path to significantly improving per share results.

An M&A transaction (as a seller) might offer shareholders both an opportunity to monetize current assets, and/or to carry on in a larger REIT with a lower cost structure.

Among the public REITs, Welltower Inc. (NYSE:WELL) seems the most likely buyer, although an acquisition by Healthcare Realty Trust Incorporated (NYSE:HR) or private investors would also be possible.

DOC is perhaps the best acquisition candidate in this space; large enough to move the needle, small enough to be readily feasible to multiple buyers, and with a nearly pure MOB asset set. I would not be surprised to see DOC acquired in the next year or so.

The MOB Space

I last wrote about the MOB space in a September 2022 article, outlining the players, the relatively poor results achieved, some of the factors that make the MOB space challenging, and some potential options available to the REITs. In this article I'm going to focus on another potential option, M&A.

There are now five major players in the MOB space: Welltower Inc., Healthpeak Properties, Inc. (PEAK), Ventas, Inc. (VTR), Healthcare Realty Trust, Inc., and Physicians Realty Trust. Global Medical REIT Inc. (NYSE:GMRE) is both significantly smaller and operates in a largely different asset market; it's not considered a peer, and I'm going to largely exclude it from further consideration.

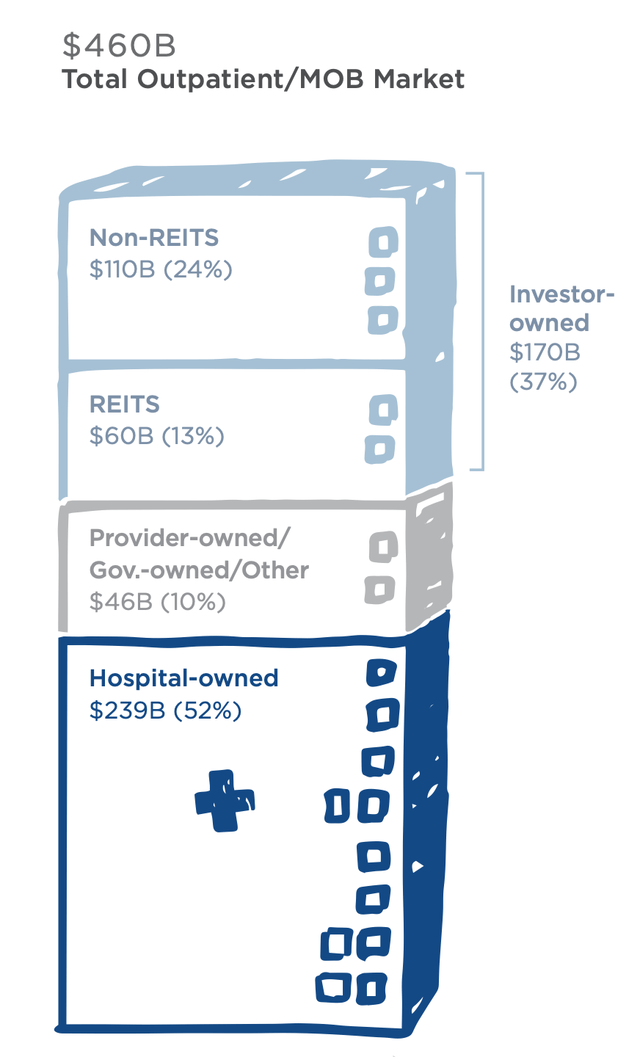

The HR May 2023 Investor Presentation lays out the overall situation. The public REITs only own about 13% of the total MBO assets in the U.S., and only about 35% of the investor owned assets. Achieving sufficient market share to create pricing power is difficult.

The MOB Market (HR Investor Presentation)

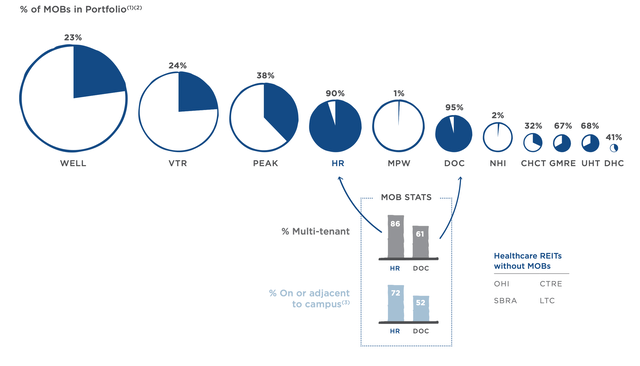

Among the public REITs, HR and DOC are nearly pure play MOBs. WELL, VTR, and PEAK are larger, but MOBs don't dominate their assets. The graphic below illustrates both the relative size of the REITs and how MOB focused they are. We will treat HR and DOC as 100% MOBs going forward.

Distribution of MOBs by REIT (HR Investor Presentation)

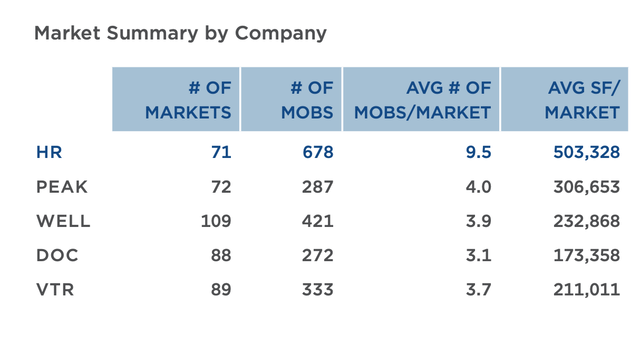

To quantify this a bit more, one more graphic:

MOB Count by REIT (HR Investor Presentation)

All of these companies are focused on high quality buildings, on or near leading hospital campuses, in the top 100 markets.

Although each REIT will emphasize the superiority of their portfolio - on campus vs. near campus, percentage of investment quality tenants, etc., these ~ 2,000 buildings appear more similar than different to my eye.

Back of the envelope, the first figure above suggests that if the REITs own 2,000 buildings, the non-REITs own about 3,7000. Assuming 5,700 investor owned properties, HR owns only about a 12% share of the investor owned market, WELL 7%, and DOC 5%.

All of these portfolios that have been carefully curated for years by experienced professional managers; there is probably not much low hanging optimization fruit.

They have similar buildings, and relatively small market share; the moats are pretty narrow.

The M&A Option

Facing limited optimization opportunities and narrow moats, increasing scale via M&A might provide one way to improve performance. To keep things manageable, we are going to look at three M&A options:

- WELL buys DOC

- WELL buys DOC and HR

- HR buys DOC.

Why these three? WELL is the most likely buyer due to its size and previous expressed interest. WELL made an unsolicited and ultimately unsuccessful $4.8 billion bid to purchase HR in May 2022, while HR was in the process of acquiring Healthcare Trust of America (then HTA, no longer listed).

VTR and PEAK could be buyers as well, but it would be a relatively bigger purchase for them, with arguable less gain than WELL could provide.

HR made a major consolidation acquisition in 2022, and all the factors that motivated their interest in acquisition still seem to be relevant.

I think DOC is the most likely target. It's large enough to move the needle even for WELL, small enough to be readily feasible for multiple buyers, and provides a nearly pure investment grade MOB asset set.

WELL buying both DOC and HR provides a look at what a really aggressive consolidation option might look like.

We will do this analysis on a simple "everything stays the same" basis, i.e. revenue, NOI, market cap; just add things up.

In all these cases, one should keep in mind that private non-REIT investors have a bigger market share than the REITs, and they might be either future sellers or buyers.

WELL Buys DOC, or DOC + HR

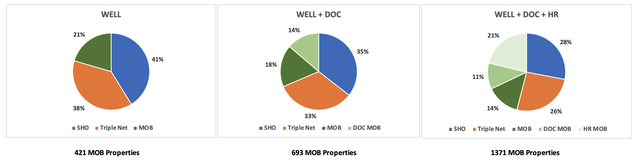

WELL has, per the 2022 Annual Report, three segments, Senior Housing Operated ("SHO"), Triple Net, and Outpatient Medical i.e. MOBs.

Measured in terms of Net Operating Income ("NOI"), we show in the three graphics below the segment split for WELL today, WELL + DOC, and the WELL + DOC + HR. SHO is the slice in blue, Triple net the slice in orange, and MOBs the slices in shades of green. All numbers are EOY 2022.

WELL M&A Options (Company data, chart by author)

The aggressive acquisition option would certainly move the needle for WELL. WELL's market cap should increase from ~ $40 billion to $50 billion. WELL's MOB NOI would shift from ~ 21% today, to 34% with DOC, then 46% with DOC + HR, making them by far the dominant REIT in the MOB space, and increasing their lead in the overall Health Care space.

HR Buys DOC

This is the simpler case, since we can assume for our purposes both HR and DOC are 100% MOBs .

HR grows from 678 properties to 950. NOI grows by a third from $723 million to $1092 million, market cap from $7.5 billion to $11 billion. HR would be - by a larger margin than today - the dominant REIT in the MOB space.

Why Bother with M&A?

There are at least three identifiable benefits to such M&A consolidation deals; lower cost of capital, reduced G&A, and "clustering", i.e., achieving locally significant market share.

As DOC puts it in their 2022 Annual Report from a risk assessment perspective:

In particular, larger REITs that target health care properties may enjoy significant competitive advantages that result from, among other things, a lower cost of capital, enhanced operating efficiencies, more personnel, and market penetration and familiarity with markets.

One might say the goal here is to be that "larger REIT" and enjoy those significant advantages.

Cost of Capital

WELL has an S&P rating of BBB+, DOC and HR are BBB. Higher rating will normally be reflected in lower cost of capital.

Operating Efficiency

We will assess operating efficiency by the fraction of Total Revenue required to pay G&A cost. Both the total revenue and G&A numbers used below come from the 2022 Annual Reports.

G&A costs might include compensation for executives and board member (and perhaps other employees), IT system costs, legal and accounting fees, travel costs, and headquarters costs. These costs may be essentially flat, or vary with respect to the volume of activity.

For example, accounting fees for the public company annual report may be essentially the same whether owns REIT owns 200 properties or 600 properties.

Post merger headcount will normally be reduced compared to the pre-merger numbers. Per their Annual Reports, WELL had 514 employees at year end 2022, and DOC had 101. HR had 583 at 31 March 2023.

Some REITs attract a degree of criticism for their expenses, often related to executive compensation or expenses that may appear extravagant. In this study, the median total compensation in 2022 of 28 S&P 500 CEOs in Real Estate was $13.0 million. That may be a noticeable fraction of G&A.

Medical Properties Trust, Inc. (MPW), for instance, has attracted some attention for their corporate aircraft (it appears to be a $60 million dollar Gulfstream G600).

G&A Numbers

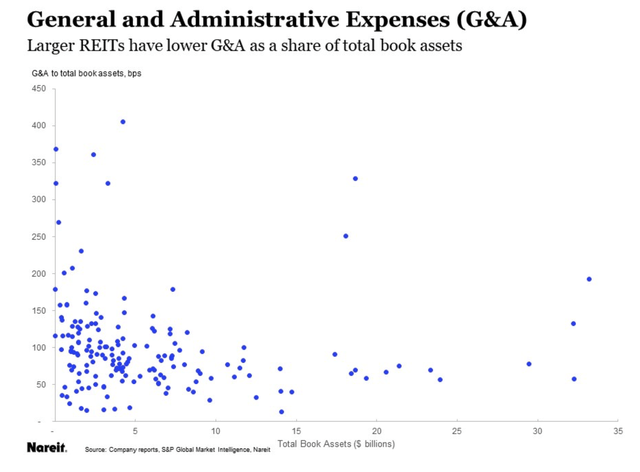

We'll start with the general case. Nareit published data in 2018 showing G&A costs vs. size, measured by book assets. This is for all REITs. The metric used here for G&A is basis points ("bps") of Total Book Assets. The dispersion is higher for smaller companies, but the trend seems pretty clear.

G&A Costs vs. REIT Size (Nareit)

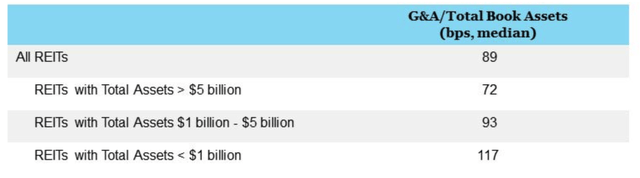

Running the numbers for the data from this plot, they get the results below. It's expensive to un smaller REITs.

G&A Cost Numbers vs. REIT Size (Nareit)

McKinsey and Company discuss typical G&A ranges by industry in this 2016 article. A Green Street article in 2018 discusses the importance of REIT G&A here. They both prohibit direct use of their information, but you can read it at the links.

Material Incentive to Merge

Reductions in the burden of G&A cost have been specifically cited as a material incentive for REIT mergers.

One example is the series of acquisitions by Prologis, Inc. (PLD); the 2018 acquisition of DCT Industrial Trust, Inc. (was DCT, no longer listed) reducing joint G&A by $30 million and for PLD from 49 bps to 43 bps, the 2020 acquisition of Liberty Property Trust, Inc. (was LPT, no longer listed) where the strategic rational cited reducing joint G&A by $48 million and for PLD from 45 bps to 38 bps, and the 2022 acquisition of Duke Realty Corporation (was DRE, no longer listed) reducing G&A from 35bps to 29bps. PLD reports G&A as a percentage of Assets Under Management. This is a 41% reduction in the burden G&A imposes on investor returns.

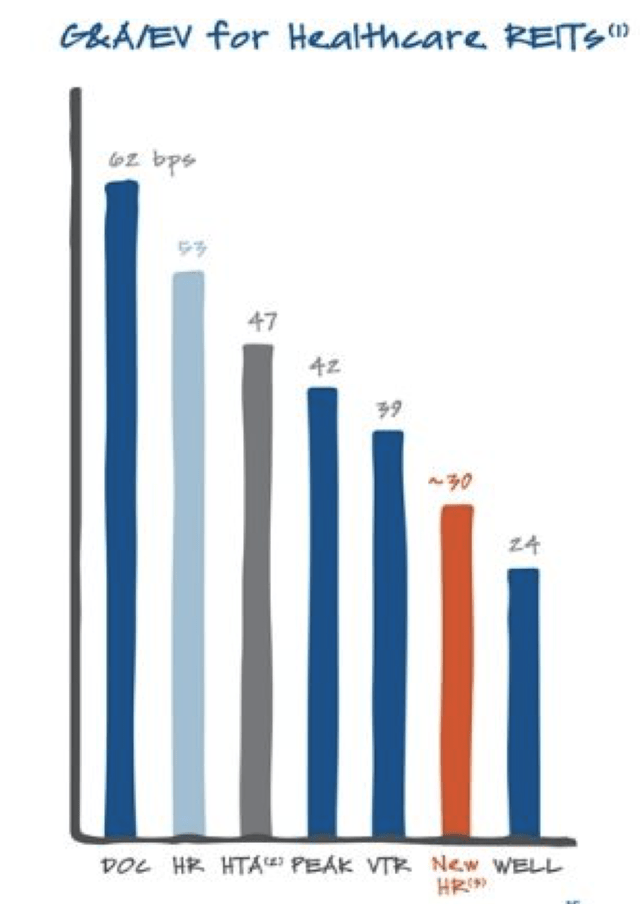

Another example, specific to healthcare REITs, is the 2020 merger between HR and Healthcare Trust of America (was HTA, no longer listed), where it was listed as a "key growth driver" in the February 2020 merger presentation, illustrated below. Note that this leaves DOC with the highest G&A costs.

G&A Cost vs. Enterprise Value (HR SEC Filings)

G&A For Healthcare REITs

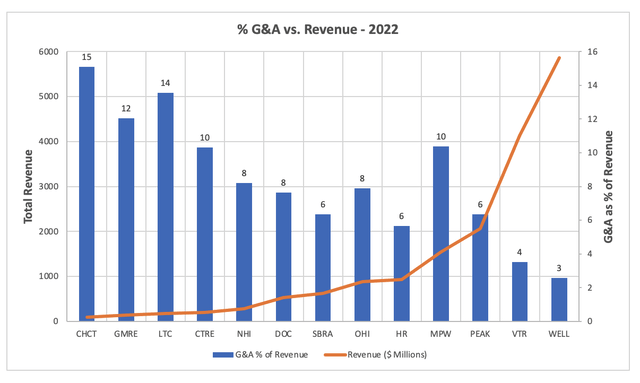

We can look specifically at healthcare REITs. I pulled the data from the 2022 annual reports for essentially all the healthcare REITs. The chart below presents G&A costs / Total Revenue for each REIT (blue bars). The tan line is size by market cap as reported by Seeking Alpha. With the exception of MPW, there is a fairly linear decline of G&A burden with size. Note also the relative burden for DOC and HR, about 3X and 2X respectively compared to WELL.

Healthcare REIT G&A (Data from company Annual Reports; Chart by author)

G&A Over Time

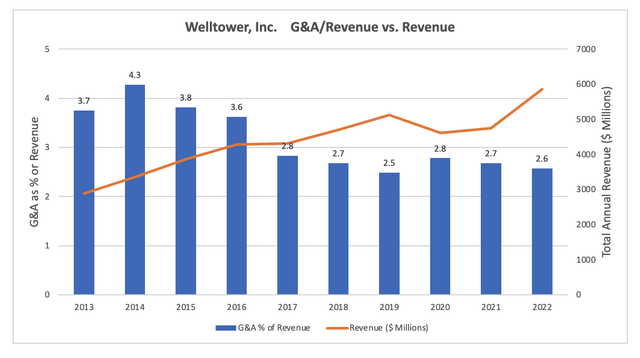

We can also take a look at the evolution of G&A over time for large, medium, and small firm healthcare REIT, with data again pulled from the annual reports.

WELL is the largest of the healthcare REITS, by a considerable margin. Total revenue (the tan line) has roughly doubled over the last decade, and G&A (the blue bars) as a percent of revenue has declines from 3.6-3.7% ten years ago to 2.5-2.8% for the last six years. The 2015 Annual Report notes that "G&A expenses for 2014 included $19,688,000 of CEO transition costs," which kicked that year up to 4.3%.

WELL G&A Over Time (WELL data, chart by author)

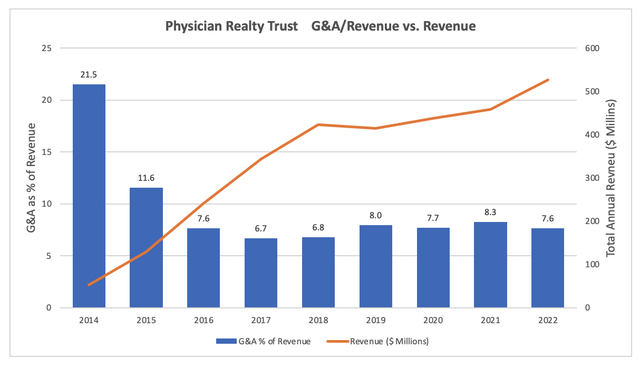

DOC is a mid sized healthcare REIT. It went public in July 2013. G&A as a fraction of revenue rapidly declined and then flatlined, as revenue continued to grow at a reduced rate. DOC does not yet appear to have realized significant economies of scale, running ~ 8% G&A.

DOC G&A Over Time (DOC data; chart by author)

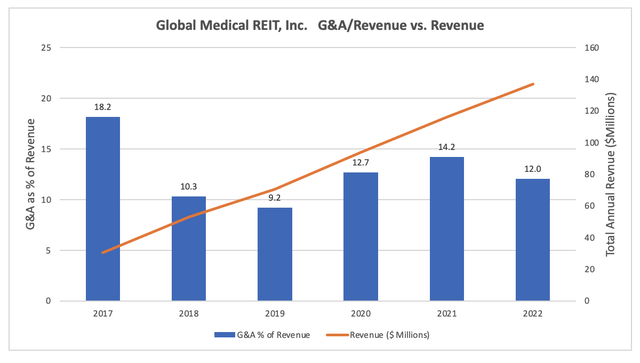

GMRE is almost the smallest healthcare REIT, and illustrates the cost challenge facing a small REIT. It went public in 2016, and stated from a smaller base than DOC. While revenue has grown rapidly, it's still relatively small, and G&A is relatively high, running 12-14% in the last few years.

GMRE G&A Over Time (GMRE data; chart by author)

Clustering Effect

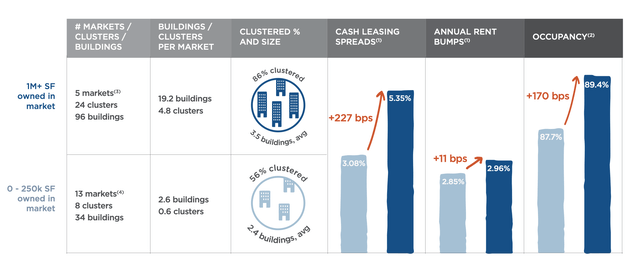

HR has identified an effect they term "clustering", i.e., achieving enough concentration in a local market to improve results. From their May 2023 Investor Presentation:

A cluster is defined as at least two properties within a geographic radius of two miles. Clusters provide operational efficiencies and greater local leasing knowledge that accelerate NOI growth.

They have some data to back this up, demonstrating advantages in cash leasing spreads, annual rent bumps, and occupancy in heavily clusters vs. lightly clustered markets.

Clustering Effect (HR May 2023 Investor Presentation)

It seems reasonable to expect that this effect could be more widely achieved with twice the number of buildings, i.e., a WELL + DOC + HR portfolio.

Analysis

If we look at Total Return over the last 5 years, WELL comes out ahead, primarily on share price increase, DOC next primarily due to its dividend, and HR last, due to share price decline, probably in reaction to its 2022 acquisition.

Viewed through the lens of real returns, with 21% inflation over those 5 years. (see Bureau of Labor Statistics inflation calculator), WELL provided a positive return for investors, DOC broke even, and HR provided a significant loss.

How might DOC, HR, and WELL view all this? This is of course entirely an outside investor's view, but let's speculate.

DOC's Motivation

What might motivate the board of DOC consider selling?

DOC IPO'd in July 2013. The results since 01 January 2014 (chart below) might best be described as static, or more generously as stable, particularly after the first couple of years. However, considering the real results after taking into account the 30% inflation over that period might leave an investor in an ungenerous mood.

Note the single increase in the dividend rate is 1/2 cent per quarter, in 2017. Their current 6%+ dividend may appear attractive, but is perhaps more a function of the stock's weakness than the dividend's strength.

Fiduciary duty might suggest that what looks a lot like "more of the same" is not a very satisfactory response. DOC reports that they have the highest operating margin, the highest occupancy rate, and the highest rate of investment grade tenants among their peers. That doesn't leave many levers left to pull.

They also note that construction costs are going up. This should increase the value of their existing properties. However, selling may be the only way to realize that value.

Its perhaps interesting to note that DOC's current CEO is 56 year old, and was formerly an Executive Vice President for WELL.

HR's Motivation

HR made a major acquisition in 2022 (Healthcare Trust of America, discussed above), which hasn't been well received by the market; many viewed HR as paying too much.

The chart below is for the same period as the DOC chart above. Again not an inspiring performance, especially in real terms.

But they are the largest MOB REIT today. Their G&A burden is less than DOCs. And do have a plan to increase NOI growth via increased occupancy.

Note the price decline with the 2022 acquisition. The dip shown in the dividend is an error related to the acquisition; the actual dividend since 2014 has varied from 0.29 to 0.325 per quarter, and is currently 0.31. Note that Seeking Alpha also currently reports the wrong dividend.

They may well see themselves as buying DOC rather than selling HR. Still, a WELL + DOC + HR might offer interesting possibilities for their shareholders.

The CEO of HR is 48 years old, and has been with the company since 2001.

WELL's Motivation

WELL demonstrated interest in MOBs last year in the most sincere way possible - a cash offer. They currently have the advantage of a relatively elevated stock price, which could provide a valuable currency in a stock based acquisition.

The long period of difficulty that DOC and HR have had in achieving per share growth suggests that another approach is needed.

If WELL could get a deal at an attractive price, combining the MOB assets of WELL, DOC, and HR would create an impressive position with the possibility of achieving real economy of scale, at least on a local basis.

Valuation

Seeking Alpha reports Wall Street Target Price and upside, and TTM P/AFFO as:

- DOC $15.72, 7.7% upside; P/AFFO 14.7

- HR $21.88, 11.7% upside; P/AFFO 15.1

- WELL $85.94, 6.1% upside; P/AFFO 28.4.

All three appear close to fair value, with little margin of safety. All have a Seeking Alpha Quant rating of Hold.

Investor Takeaway

DOCs performance over the last five years has been uninspiring. Revenue growth has slowed, and G&A costs as a percent of revenue have stabilized at ~ 8%. Both share price and dividend have been flat in absolute terms and declining in real terms.

As the smallest of the five major REITs in the MOB space, DOC appears to be operating effectively, but the MOB market appears to offer DOC no clear path to significantly improving per share results. DOC's G&A costs are nearly 3 times WELL's costs.

M&A (as a seller) might offer shareholders both an opportunity to monetize current assets, and to participate in a larger REIT with a lower cost structure.

Among the public REITs, WELL seems the most likely buyer, although an acquisition by HR or private investors would also be possible.

I view Physicians Realty Trust at current prices as a HOLD under the Seeking Alpha rating system. Although an investor could not count on it being acquired, I think it is a reasonable candidate, and I would not be surprised to see it happen.

Personally, I hold shares in Physicians Realty Trust, as well as HR, PEAK, VTR, and GMRE. DOC is a hold for me personally. I view it as a bond backed by real physical assets. I might consider a small addition if it retested the 52 week low at $13.28.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DOC, HR, VRT, PEAK, GMRE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not advice to buy or sell this stock. I am not an accountant or investment advisor. This article is intended to provide information to interested parties and is in no way a recommendation to buy or sell the securities mentioned. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to do their own due diligence before investing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.