Galera: Even Chance Of Success Or Failure In The Upcoming PDUFA

Summary

- GRTX has a PDUFA in 10 days.

- The stock is trading sideways.

- That is because the phase 3 trial was a success, but barely.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Learn More »

Seiya Tabuchi/iStock via Getty Images

I covered Galera Therapeutics (NASDAQ:GRTX) in December 2021, and since then, the stock has lost a lot of value. It has some upcoming catalysts, so it is time to take another look.

Last time when I covered GRTX, it had just run through a rollercoster ride. In October, it “failed” a pivotal trial and went down 70%. In December, it announced that the trial was actually a success and the confusion was because of some error committed by their CRO. The stock doubled. That was an unprecedented opportunity to make money, but nobody could have anticipated it.

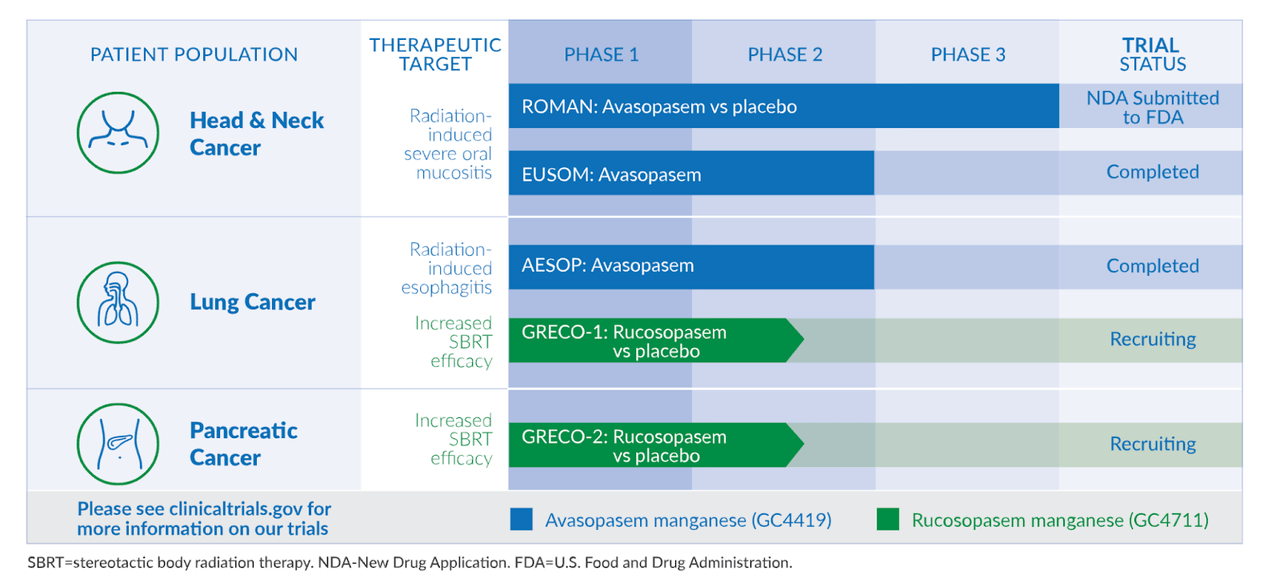

Galera’s technology improves the effect of radiotherapy on cancer patients by converting radiation-induced superoxides to hydrogen peroxide. Lead candidate is Avasopasem manganese (avasopasem, or GC4419), a selective small-molecule dismutase mimetic. The molecule is in late-stage development to reduce the incidence and severity of radiotherapy-induced severe oral mucositis (SOM) in patients with head and neck cancer. The entire pipeline is this:

GRTX pipeline (GRTX website)

The same molecule is in two other indications or stages of trials. They also have a second molecule called Rucosopasem is also targeting two indications in phase 2 trials.

The company submitted an NDA to the FDA for Avasopasem in radiation-induced SOM. In that last article I discussed their successful phase 2 trial and how analysts were surprised when the trial initally “failed.” The same 90mg dose was used in both phases, and in phase 2 it produced a 34% reduction in SOM events. Now, while the phase 3 trial ultimately succeeded, here’s what I said about the updated data:

This trial produced a much reduced 16% reduction in SOM incidences, and unlike phase 2, where the p-value was a decent 0.009, this was a barely acceptable 0.045 after correction. The trial also failed to meet the endpoint of reduction in incidence of grade 4 OM, where the p-value stood at 0.052. It's only with reduction in median days of SOM that the trial did very well. This implies that when the drug does work, it produces a durable effect - but the drug does not work everywhere.

Thus, while the updated data met the endpoint, it did so barely, and was nothing as convincing as the phase 2 trial. Anyhow, the company filed for approval by year-end 2022, and the NDA was accepted in February. The FDA gave them a 6-month priority review with a PDUFA date of August 9, 2023. That was about 10 days from now. Since the FDA does not plan to hold an advisory committee meeting, approval, if it happens, can be any day now. The NDA is based on the two trials including the one that “failed.”

In other news for Avasopasem, the molecule successfully completed a phase 2 trial, successfully reducing esophagitis in patients with lung cancer receiving concurrent chemoradiotherapy. The AESOP trial enrolled 39 patients with unresectable stage 3A/3B or post-operative Stage 2B non-small cell (NSCLC) or limited-stage small cell (SCLC) lung cancers.

Key data:

The company said 35 patients received intensity-modulated radiation therapy (IMRT) plus chemotherapy and out of these 29 patients received at least five weeks of 90 mg of avasopasem on the days they underwent IMRT.

Galera said 2 out the 29 patients experienced Grade 3 ( defined as severely altered eating/swallowing; tube feeding, or hospitalization indicated) esophagitis at any time, with neither patient experiencing Grade 3 for more than one week.

No patients experienced Grade 4 (life-threatening consequences) or Grade 5 (death) esophagitis at any point during the trial.

The company added that these data compare favorably to the data in which ~20% to 30% of these patients experienced Grade 3 or 4 esophagitis.

In terms of safety as well, the molecule had a similar adverse events profile compared to the chemotherapy arm, meaning it did not add any AEs to the treatment burden.

Financials

GRTX has a market cap of $101mn and a cash balance of $48mn. Research and development expenses were $7.3 million in the first quarter of 2023, while general and administrative expenses were $6.6 million. At that rate, the company has just enough cash to see them through 2023. Earlier, the company raised $30mn in a secondary offering.

60% of the company is in retail hands, while 40% is held mainly by institutions. Key holders include Sofinnova and Alyeska. Insiders bought small amounts of stock in the last few years, but there were no sells.

Risks

GRTX is a very small company with all its associated risks. They are also at the end of their financial tether. Normally I would not cover a company like this, but GRTX has a near term PDUFA, and a reader asked for my opinion. I should also point out once again that the trial that failed, then succeeded again, barely did that, with a marginal statistical significance. Also note that oral mucositis caused by HNCC treatment has usually been managed by a variety of generic products, as well as antioxidants, growth factors and anti inflammatory agents. As such, GRTX has an uphill work capturing the market with this sort of so-so data.

Opinion

The stock is trading midway of its 52-week range, despite having a PDUFA in 10 days. This tells me what the market fears, which is similar to what I, too, am afraid of - the phase 3 trial of Avasopasem was a disaster in every way. Not only did that CRO thing caused havoc to the stock’s share price, but the updated data was barely acceptable, and not at all comparable to the phase 2’s success. On the other hand, the drug was well-tolerated, like placebo. So there’s an even chance of rejection or approval. Those are the odds some are willing to take; some aren’t. That is why the stock is not in as celebratory a mode as one would have preferred. If I am invested, I will hold on to my shares on the even chance that it will succeed; if I am not, I will stay on the sidelines on the odd chance that it will fail.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

This article was written by

Dr Dutta is a retired veterinary surgeon. He has over 40 years experience in the industry. Dr Maiya is a well-known oncologist who has 30 years in the medical field, including as Medical Director of various healthcare institutions. Both doctors are also avid private investors. They are assisted by a number of finance professionals in developing this service.

If you want to check out our service, go here - https://seekingalpha.com/author/avisol-capital-partners/research

Disclaimer - we are not investment advisors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important: My Hold rating only means "I will not Buy now." I am not telling *you* to hold, because I see some risks here. But I am also not telling you to *sell*, because, a) the risks are not insurmountable, and b) you may have bought at such a low price that your risk-benefit ratio is acceptable to you. Thus, my “Hold” is a bearish rating, but it is not as bearish as a “Sell” rating.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.