New York Community Bancorp Gets Upgraded By J.P. Morgan And Still Trades Under Book Value

Summary

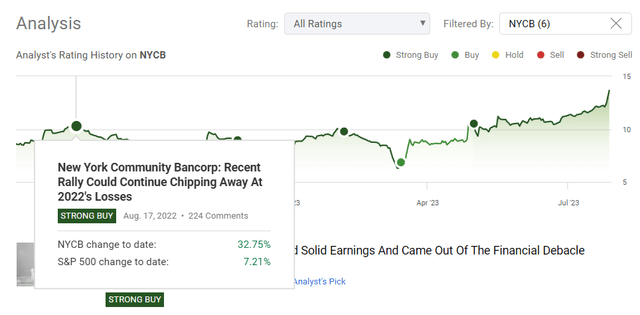

- New York Community Bank shares have appreciated by 32.75% since last year, outperforming the S&P.

- J.P. Morgan upgraded NYCB shares to overweight, citing the company's transformation and potential market share growth.

- NYCB reported strong Q2 earnings, with increased net interest income and potential for further operating performance.

PM Images

Sometimes you can find unloved stocks going against the grain and generate a sizable profit, and in other occurrences, you can miss something and make a sizeable mistake. I have been on both sides, as nobody can correct everything. In the case of New York Community Bank (NYSE:NYCB), going against the grain has certainly paid off. Since my article almost a year ago, shares have appreciated by 32.75% compared to 7.21% for the S&P. On March 15th, during the height of the Silicon Valley failure and regional banking crisis, I maintained my conviction that NYCB shares have appreciated by 99.71% compared to the S&P, gaining 17.74%. I had gone from very bullish to bullish due to uncertainties, and after Q1 earnings were released, I returned to my very bullish stance as I felt the numbers warranted it. NYCB reported strong earnings on July 27th, and while shares are hovering around their 5-year highs, I think they could go higher. I am still bullish on NYCB, but due to the recent run, I think there is less room for appreciation than before.

NYCB's strong earnings prompted J.P. Morgan to upgrade shares from neutral to overweight

On Friday, July 28th J.P. Morgan upgraded shares of NYCB to overweight from neutral. They called NYCB a potential massive market share taker. Steven Alexopoulos wrote the following in the not from J.P. Morgan in the upgrade:

"When we look at the transformation of the company that has occurred over the past year, which includes not only acquiring the vast majority of the team from Signature but also now acquiring six teams from the former First Republic, with ~$120B of assets behind the company and a new energy under CEO Tom Cangemi, we see New York Community emerging as a potential massive market share taker over the next several years,"

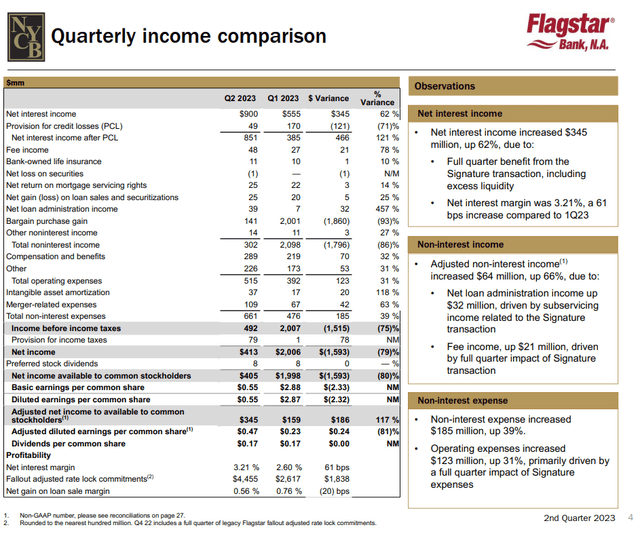

Q2 2023 was a strong quarter for NYCB, representing the first quarter with all three legacy franchises intertwined into one entity. Leading up to this report, NYCB has acquired Flagstar Bank, and recently assets from Signature. The earnings delivered were strong enough to grab J.P. Morgan's attention and demonstrate the benefits of diversifying NYCB's loan portfolio and deposit composition. NYCB delivered a top and bottom line beat, coming in with $0.47 on non-GAAP EPS, beating estimates by $0.16, and $1.2 billion in revenue which was ahead of estimates by $315.8 million. NYCB is unlocking untapped potential through economies of scale, which is shown in the underlying numbers.

There were significant synergies recognized in Q1 that could lead to further operating performance and drive the earnings power from this combined entity. NYCB's net interest income margins increased by 61 basis points to 3.21% as net interest income during Q2 came in at $900 million, up 62% QoQ. This occurred due to the Signature transaction and higher average cash balances, which indicates to me this will not be a one-time anomaly.

NYCB has become a powerhouse in the regional banking sector. On the community banking side, NYCB has the 2nd largest multi-family portfolio in the country and is the 2nd largest mortgage warehouse lender nationally. NYCB is the 8th largest bank originator of residential mortgages and the 5th largest sub-servicer of mortgage loans. In Jerome Powell's recent speech he turned a bit dovish despite an additional rate hike. The St. Louis Fed indicates that rates will decline to 4.6% in 2024 and 3.4% in 2025. If this occurs, the cost of capital will decline, which should lead to increased mortgage activity which could drive revenue and core earnings for NYCB.

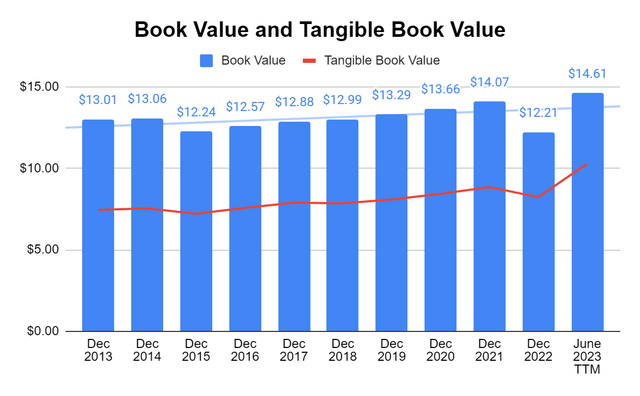

NYCB hasn't finished above the $15 level since 2016, and every time it has approached $15 shares retraced. This time could be different when taking NYCBs book value into consideration. In 2014 and 2015, NYCB traded above the $15 level, and its book value was $13.06 in 2014 and $12.24 in 2015. NYCB's book value and tangible book value are at their highest levels in a decade, while NYCB's assets are producing the largest amount of revenue and net interest income in a decade.

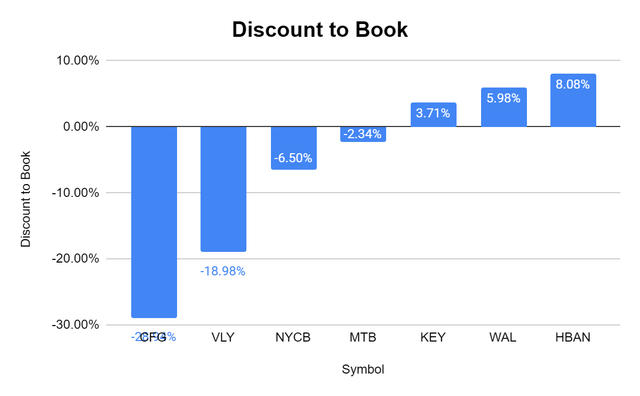

Looking at the chart above, and the annualized book and tangible book value below, shares of NYCB still look undervalued. Today, shares of NYCB trade at a -6.5% discount to book value. It's not uncommon for banks to trade at a premium to book, and in NYCB's case, trading at a minimum of a 1:1 ratio is warranted, considering the amount of net income and EPS they generate.

Steven Fiorillo, Seeking Alpha

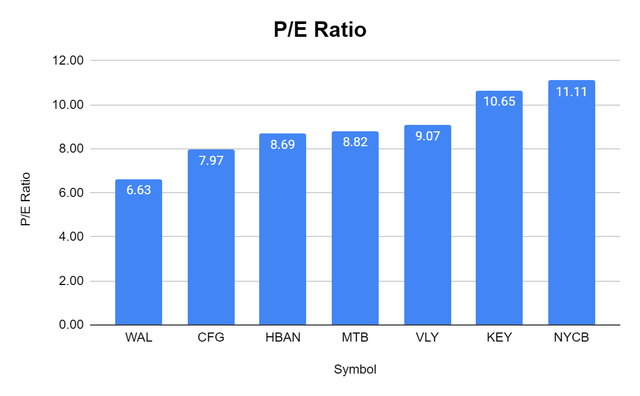

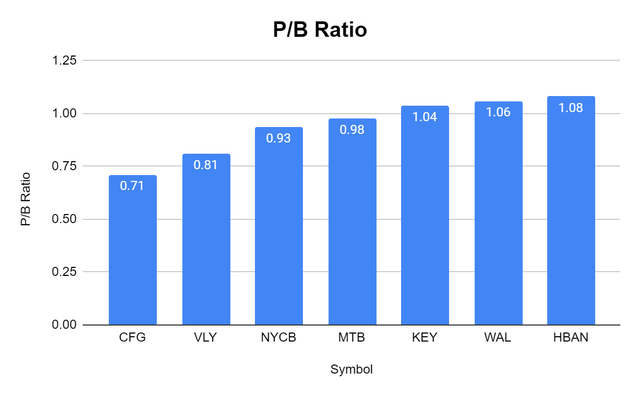

I am always interested to see how NYCB is trading compared to its peers. While I feel they are undervalued, I want to see how their P/E, P/B, discount-to-book, and loan-to-deposit ratios stack up. I will compare NYCB to the following banks:

- Western Alliance Bancorporation (WAL)

- Valley National Bancorp (VLY)

- Citizens Financial Group (CFG)

- KeyCorp (KEY)

- M&T Bank Corporation (MTB)

- Huntington Bancshares Incorporated (HBAN)

NYCB is on the high end for P/E ratios when compared to its peers as the peer group average is 8.99, and NYCB has a forward P/E of 11.11. I am not too concerned, as 11.11 is still fairly low, and NYCB is benefiting from economies of scale to generate additional revenue and net income.

Steven Fiorillo, Seeking Alpha

NYCB has a P/B of .93 compared to a .94 peer group average. NYCB is trading at a -6.5% discount to its book value, while the peer group trades at a discount of -5.57%. HBAN, which is a popular regional bank, trades at a 8.08% premium, while WAL trades at a 5.98% premium and KEY trades at a 3.71% premium. While NYCB isn't as undervalued as it once was, I think it should trade at a slight premium to book value rather than at a discount.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

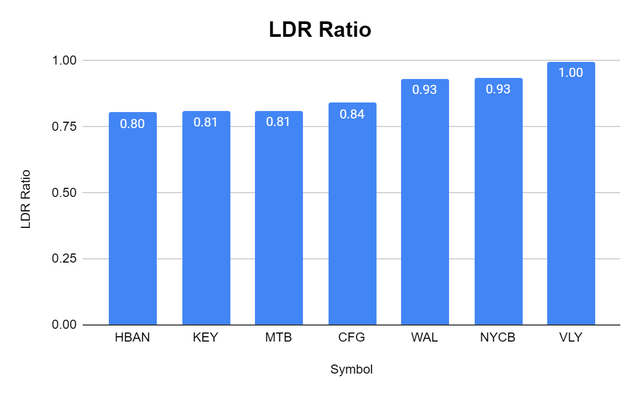

NYCB has an LDR ratio of .93. If you go back to the article I wrote on August 17th 2022, NYCB had a LDR ratio of 1.17. While .93 is still on the higher end of its peer group, I am encouraged by the work NYCB has done to significantly reduce its previous imbalance of loans to deposits.

Steven Fiorillo, Seeking Alpha

Conclusion

NYCB is no longer trading in the clearance section, but there is still value to be unlocked. I think the upgrade from J.P. Morgan could help generate interest in NYCB, and we could see some inflows as the vote of confidence could be a signal that NYCB sidestepped the regional banking crisis and emerged stronger than before with the Signature acquisition. I think shares can get back to the $15 level, and a dividend increase could be on the table in 2024, depending on how NYCB finishes the year. NYCB is positioned to benefit from the current environment of higher rates, and for when the Fed eventually cuts as they are a primary facilitator of mortgages. While I can't say I am as bullish as I was when NYCB traded in the single digits, I am still bullish as shares still look undervalued to me.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NYCB, HBAN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.