AGNC: A Coming Turning Point For Investing

Summary

- AGNC's asset value has been significantly impacted due to heavy investment in the bonds market but is now relatively stable.

- The Federal Reserve's hawkish stance and expected rate increase by year-end could further affect AGNC.

- The end of rate hikes may be in sight, potentially opening up a safer investment opportunity.

- Still, we believe that enough stabilization has occurred that we have begun purchasing stock.

MoMo Productions/DigitalVision via Getty Images

AGNC (NASDAQ:AGNC), like others investing heavily in bonds or other similar instruments, has had its asset value destroyed while the cash generating power reached the ceiling, or is it above the ceiling? In the past, our focus on AGNC dove into viability. Can it survive the coming rapid interest rates changes? With the Federal Reserve much closer to pivoting from hawkish stances toward a holding pattern, our focus shifts to understanding dividend and capital growth. Our follow-up continues with discussing the safety of the dividend and whether AGNC continues as a valuable dividend paying investment option. In our view, it is. The Federal Reserve seems poised to lift rates a quarter of a percentage point one more time later in the year. If so and it signals the end, we can ask, did the proprietor just turn the investor sign to open? Let's go find out. But before we do, a reminder, another article titled: Strong And Lasting Differentials Support AGNC's Strong Cash Performance, included a lengthy discussion on the marketplace conditions. We continue discussing that topic.

The Quarter & Business

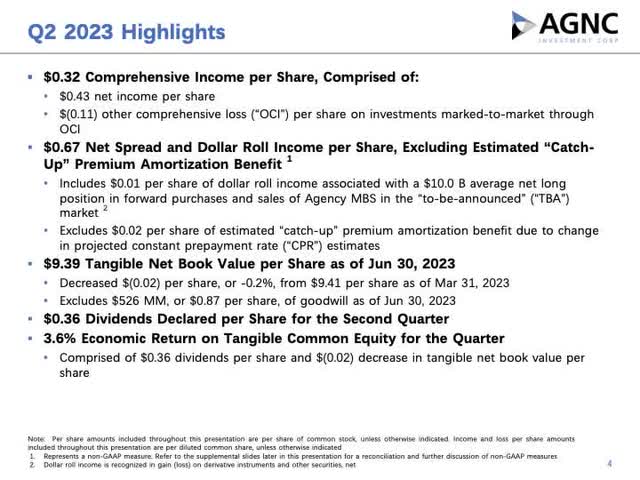

AGNC reported a reasonable quarter shown in the next slide.

The company reported a slightly positive $0.32 income per share, Dollar Roll results of $0.67 hindered quarter over quarter by smaller asset size and a lift in economic return equaling 3.6%. Management opened with this interesting remark:

"Market conditions in the second quarter, on balance provided further support for our favorable investment outlook for agency MBS and made us increasingly confident that we are at the forefront of one of the most compelling investment environments that we have experienced in our 15-year history."

Continuing, "The average projected life CPR on our portfolio at the end of the quarter was largely unchanged at 9.8%." The quarter average equaled 6.6% slightly up from March at 5.2%.

Assembled next is a six quarter review of important operational performance factors. To write the least, volatility, unsettled markets have ruled, mostly, until now.

| Critical Results Summary | March 22 | June 22 | Sept. 22 | Dec. 22 | March 23 | June 23 |

| Spread % | 2.0 | 2.7 | 2.7 | 2.7 | 2.9 | 3.3 |

| Earnings (Dollar Roll) | $0.76 | $0.83 | $0.75 | $.84 | $0.70 | $0.67 |

| Leverage | 7.7 | 7.4 | 8.7 | 7.4 | 7.2 | 7.2 |

| Hedging % | 98 | 121 | 118 | 124 | 114 | 119 |

| Cash (Billion) | $5.2 | $2.8 | $3.6 | $4.3 | $4.1 | $4.3 |

| Asset Value | $17.72 | $11.43 | $9.08 | $9.85 | $9.41 | $9.39 |

Key business indicators have flattened or improved during the last few quarters. Of most importance for us is the increase in spreads and the stabilization of asset value.

The rest of our dive focuses on details about the above management opening statement.

Model

During the questioning answer portion, Richard Shane of JP Morgan Chase summarized expertly the active factors used in managing this type of business. He begins with, "this is not an easy business," followed with the basic decision, play with the stacks, manage leverage and play with hedging. In an orderly fashion, increased leverage increases capital return and vice versa; increased hedging reduces capital and the final, the stack, determines protection. Playing in the stack refers to defining percentages for the types of instruments held, 5 year, 10 year etc.

AGNC is focusing on the Agency MBS. As of the end of the June quarter, total assets equaled $58 Billion of which $44 Billion were 30 year Agency MBS. During calls, management spends a significant amount of time highlighting the advantages of the MBS and included for the first time a slide illustrating this.

At this point, MBS investments are trading slightly above high corporate grade bonds. The long-term natural differentials average is lower in the 75 basis point range. In the prepared remarks, management wrote,

"new production Agency MBS give investors the ability to earn a 5.5% yield on a security that is backed by the explicit support of the U.S. government. This combination of yield and credit quality makes Agency MBS appealing to a wide range of investors on both a levered and unlevered basis."

Investors are finding higher yields with a level of maintained safety.

There is another factor, duration gap, time difference between assets and liabilities, which in a negative or inverted curve becomes a drag on performance when positive. The company is operating with a slightly positive gap of 0.4 years preparing for the yield curve reversal. At a future time, positive durations revert from drags to tailwinds. Something investors should watch.

The Marketplace

With respect to the marketplace, rate hikes or the number thereof continue adding uncertainty in the marketplace. The Federal Reserve just raised another one quarter of a point at its July meeting. Guessing future hikes is more difficult. "But "a strong majority" of Fed policymakers expect they will need to raise interest rates at least twice more by year's end, Powell said Thursday."

Management believes that Agency MBS is "near the inflection point of this Fed policy cycle," and thus are expect the second half year could be attractive for earnings. This is one marketplace condition investors must consider.

A second arrives with more likely coming government stress. Again, AGNC noted how much of the 2nd quarter dealt with debt ceiling drama and the associated stresses. Another drama approaches in September. Past practice by Congress used continuing resolutions for government funding. It was truly a "kick the can down road" maneuver. For the first time in a long time, the House has decided to use the appropriations approach meaning that each portion of government receives its own dedicated and authorized level. The Office of the President has stated that they will not accept cuts. The House and a rich list of polling suggest that Americans want significant Federal spending cuts. We cannot see this ending without the drama of a shutdown.

Another marketplace disruption undiscussed by management, leaving us a little surprised, was crude oil and product pricing. From our most recent article on crude oil pricing, Prices For Undercapitalized Crude Oil Limps Along, we noted several strong signals supporting higher crude oil prices. Crude has already returned upward to the $80 range in recent weeks. For our own data, Gulf Coast 2-1-1 crack spreads and Gulf Coast region gasoline pricing has increased from $30 to near $40 and from $2.20 per gallon to $2.70 respectively in the past month. The idea that interest rate hikes have clamped inflation is clearly in question.

Actions

With respect toward actions, AGNC reversed its hedge targets from the March quarter lifting it higher toward 120%. Management has been moving the portfolio up the curve into longer-terms, increasing the amount by $5 Billion (approximately 10% of the hedge).

With $12 Billion in hedges rolling off in the next year, management's plan reduces the expiring entities slowly over the next year. Peter J. Federico, company CEO, offered a lengthy discussion describing the roll off and its effect,

". . .you could see a scenario where as our short-term swaps roll off over the next 12 months and then particularly throughout 2024, that could also coincide quite nicely with the scenario where the Fed is actually lowering short-term rates. So in a scenario where the Fed is lowering short-term rates, monetary policy and shifting toward an easing policy, we will likely operate with a lower hedge ratio, perhaps well under 100% at some point, which would be another source potentially of earnings potential on our portfolio."

At the end of the quarter, 70% are five years and out. This is preliminary action of preparation for when the curve reverses.

The Investment Opportunities

Management believes that transition from the ultra-accommodative monetary policy to a more restrictive stance is "largely complete and that one of AGNC’s most favorable investment environments is now emerging." Investors that buy shares of stock can expect:

- "A levered portfolio of Agency MBS plus Hedges fully mark to market."

- Current spread levels may "generate mid to upper teen returns on a go forward basis."

- Strong earnings may come in one of two means:

- Strong earnings from mortgage spreads should this environment remain.

- Or a combination of favorable earnings and net book value appreciation under tightened mortgage spreads.

AGNC is positioned to generate significant levels of cash in either scenario. The key element includes an end in interest rate hikes.

Dividend

During an interesting back and forward between management and analyst Douglas Harter of Credit Suisse in relation to the dividend, management offered a short and easy to understand answer. Federico began discussing the unhedged earning power of the existing portfolio. He stated that the net interest margin reported at 326 basis points to the unprecedented power to generate cash while referencing the dollar roll of $0.67 confirms the earnings power. He continued, adding "new current coupon mortgages, . . . hedged with a mix of 5 and 10-year swap, and Treasury hedges, earnings are in the 180 basis points range. When multiplied by the leverage at 7.5 times minus a percent in cost, the earnings equal mid-high teens. The dividend yield per share now stands at approximately 15%. The two are congruent. Before finishing the discussion Federico added this important comment:

The other thing that I would also point out is that you talked about the fact that we will have short-term swaps rolling off over the next year, and that will lead to some compression. But again, it should bring that net interest margin down more in line with the economics and our net spread and dollar roll income more in line with our dividend.

As the company's short-term instruments roll out, management is expecting dollar roll compression.

What wasn't discussed in this back and forth is increased earnings from both cash purchases once a level of interest rate stability is reached and cash obtained through lower hedging and earnings power increases from increased leverage. This fuzzy strength is yet to be determined, yet is also real and not small.

Risks

We discussed three risks above, continued rate hikes, a likely government shutdown and the likelihood of unquenched inflation. Yet, inflation has shallowed some over the past year. What we see is a much longer and prolonged period of higher rates than most might expect. The seeds of inflation aren't dying easily or nicely. The results would be higher cash generation without asset appreciation. But, with the vast majority of the assets invested in government instruments yielding unhedged at 5% plus, this investment is truly set up for managing through either scenario of flat higher rates or falling rates. We don't see a case for any cut in dividends such as others believe, thus we are buying primarily for the yield, not price appreciation. So, did the proprietor turn the investment sign to open? From our view, partially. We are buying adding significant positions to our portfolio looking for dividends in the short-term and capital growth over the next one to two years. We rate AGNC stock a buy on the basis of yield and possible future capital growth.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We just purchase a major block of stock.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.