AstraZeneca: Robust Performance And Promising Growth Initiatives

Summary

- AstraZeneca's Q2 2023 financial performance showed a 6% increase in total revenue, driven by growth in product sales and alliance revenue.

- AZN stock is exhibiting optimistic growth, with a steady rise in earnings per share and expected revenue growth.

- AstraZeneca's management highlighted exciting growth initiatives, including positive trial outcomes and potential advancements in the standard of care for certain diseases.

hapabapa

Company Overview

AstraZeneca (NASDAQ:AZN) is a leading biopharmaceutical company, with a focus on discovering, developing, manufacturing, and commercializing prescription medicines. Their portfolio spans multiple sectors including oncology, cardiovascular, renal and metabolic diseases, respiratory and immunology, and rare diseases, with a range of marketed products such as Calquence, Enhertu, Brilinta, Farxiga, Fasenra, and Soliris. Additionally, they provide treatments for respiratory syncytial virus, influenza, and COVID-19. The company, incorporated in 1992 and headquartered in Cambridge, UK, collaborates with several partners globally for innovative research and development in various diseases.

The following article provides an in-depth analysis of AstraZeneca's Q2 2023 financial performance, highlighting their growth initiatives and upcoming clinical trials, and recommends a "Buy" stance due to their strong potential and robust financial health.

Financial Performance

In their Q2 2023 report, AstraZeneca exhibited a solid growth pattern. The total revenue saw a 6% increase, reaching $11.42 billion, up from Q2 2022's $10.77 billion. The primary drivers of this increase were a 2% rise in product sales to $10.88 billion, and a more than two-fold increase in Alliance Revenue, reaching $341 million. Additionally, operational efficiency significantly improved, leading to a four-fold surge in operating profit to $2.46 billion.

The report also highlighted a substantial 35% reduction in the cost of sales, falling to $1.96 billion. This reduction contributed to a 22% growth in gross profit, amounting to $9.46 billion. Profit figures both before and after tax showed notable increases, resulting in a more than five-fold boost in earnings per share, jumping from $0.23 to $1.17.

The substantial growth in Alliance Revenue can largely be attributed to the major contributions from drugs such as Enhertu and Tezspire. Collaboration revenue reached $193 million, primarily driven by a license payment related to COVID-19 monoclonal antibodies.

Therapy-wise, the oncology, CVRM (cardiovascular, renal, and metabolism), and R&I (respiratory and immunology) sectors experienced considerable growth, while the V&I (vaccines and immune therapies) sector saw a noticeable decline. Despite facing competitive challenges from Nexium's generic versions in Japan, the Rare Disease sector saw modest growth due to the performance of Ultomiris and Strensiq, but overall, the Other Medicines category experienced a significant decrease.

AstraZeneca Shows Optimistic Growth and Profitability

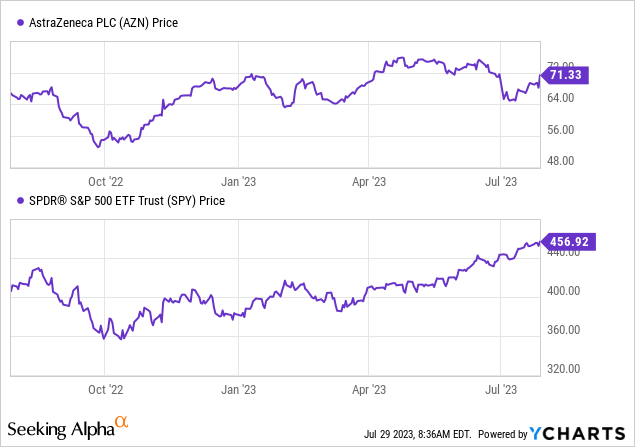

Taking a look at Seeking Alpha data: AstraZeneca's stock is exhibiting an optimistic growth trend with a steady rise in earnings per share [EPS] forecasted, from $3.67 in 2023 (a YoY increase of 10.07%) to $5.02 in 2025 (a 20.44% YoY rise). The revenue is also expected to grow YoY from $45.57B in 2023 to $54.02B in 2025. The valuation is mixed, with a forward P/E of 18.67 and a trailing twelve months [TTM] P/E of 45.74. The company has shown remarkable growth in revenue, with a 3-year compound annual growth rate [CAGR] of 20.2%. Its profitability metrics are strong with a gross profit margin of 84.3% and a return on equity of 13.05%. Momentum over the past year has been modest, with a one-year return of 0.96%.

AstraZeneca maintains a healthy capital structure with a market cap of $212B, total debt of $32.47B, and cash of $5.81B. Their ability to manage and pay down their debt is something to monitor. The firm does offer a forward dividend yield of 2.89% with a payout ratio of 55.34%.

AstraZeneca's Q2 Earnings Call Highlights Exciting Growth Initiatives

In their Q2 earnings call, AstraZeneca's management detailed several exciting growth initiatives. The first half of the year saw eight positive pivotal trial readouts, and the company had a significant presence at ASCO, showcasing the promising pipeline of their existing and potential medicines. Highlights include the Tagrisso ADAURA trial for early-stage EGFR mutated lung cancer and ADAURA trial data for advanced ovarian cancer.

Additionally, interim data from the DESTINY-Pantumor02 trial for HER2-expressing advanced solid tumors show promising results. The management discussed three key trials: FLAURA2 for EGFR-mutated non-small cell lung cancer, DUO-E for advanced endometrial cancer, and MATTERHORN for gastric cancer, each showing positive results in terms of survival and progression-free survival.

The management also mentioned the TROPION-Lung01 trial for Dato-DXd, revealing a statistically significant improvement in progression-free survival in non-small cell lung cancer cases. The company is also exploring the combination of Dato-DXd with immune checkpoint inhibitors in ongoing trials. The outcomes from these initiatives could potentially redefine the standard of care in these diseases.

My Analysis & Recommendation

Upon reviewing AstraZeneca's Q2 2023 report, I discern a sturdy performance in both financial and operational aspects. The company witnessed a 6% uptick in total revenue from the previous year, attributable to a significant increase in product sales and an extraordinary boost in alliance revenue. The overall efficiency of operations also saw considerable enhancement, resulting in a sizable rise in operating profit and EPS. This trend of growth signifies a firm that is adeptly maneuvering its strategic course and bolstering its standing in the biopharmaceutical realm.

I'm notably optimistic about the array of successful trial outcomes, an indicator of a future-facing pipeline that spans various medical sectors. AstraZeneca is making impressive strides in the field of oncology, as evinced by multiple pivotal trials bearing positive outcomes and 22% YoY revenue growth. This momentum in drug innovation and evolution could potentially overhaul the standard care protocol in specific diseases and catalyze long-term expansion for the organization.

Nevertheless, it's important to remain cognizant of the hurdles AstraZeneca might encounter, especially in the rare disease area and other drug categories, where the competition is intense. With Nexium encountering generic rivalry in Japan, the company will need to capitalize on its innovation conduit to preserve a competitive foothold in the market.

From an investment standpoint, AstraZeneca emerges as an appealing choice for long-term investors, particularly those drawn towards healthcare and biotechnology. Forecasting an optimistic EPS growth trajectory for the ensuing years, a robust capital structure, and a steady dividend yield, the company presents an opportunity for consistent returns. Furthermore, considering the company's dedication to addressing significant medical gaps and the compelling potential of its ongoing trials, AstraZeneca could present substantial growth opportunities moving forward.

Projecting into the future, AstraZeneca's trajectory appears quite bright. Successful ongoing and future clinical trials will surely enhance the company's product array, and by extension, its market standing. It's also imperative that the company sustains its operational efficiency drives, thereby increasing profitability while continuing to invest in research and development.

As an investor, I would recommend a "Buy" stance for AstraZeneca. The firm's sturdy financial performance, promising pharmaceutical pipeline, and strategic growth undertakings make a compelling argument for investment. Its dedication to the discovery and development of innovative medical solutions offers an invaluable proposition for those considering investment in a company that could potentially sculpt the future of healthcare.

Risks to Thesis

When the facts change, I change my mind.

Although I am bullish about AstraZeneca's potential and have thus issued a "Buy" recommendation, it's crucial to bear in mind that all investment ventures entail some level of risk, and this case is not an exception.

Primarily, a significant risk centers around the unpredictable landscape of the pharmaceutical industry. The process of drug development is intricate and fraught with potential hurdles, including unsuccessful clinical trials or unanticipated side effects, leading to expensive delays or even causing the termination of a promising drug candidate. AstraZeneca has several drugs in different stages of the development pipeline, and any adverse results could potentially influence its share price.

Secondly, the firm operates within a highly regulated industry. Modifications in healthcare laws or regulations, both at home and abroad, could impact AstraZeneca's profitability. This encapsulates changes in policies pertaining to drug approval procedures, pricing, reimbursement, as well as any potential legal disputes or issues.

Another risk entails the fierce competition in the biopharmaceutical industry. Despite AstraZeneca maintaining robust positions in multiple markets, there's always the hazard of market share loss to competitors. This includes competitors who may produce cost-effective generic versions of AstraZeneca's patented drugs once they expire. For instance, as previously highlighted, AstraZeneca's Nexium is already encountering generic competition in Japan.

Lastly, global economic circumstances and exchange rate volatility can affect AstraZeneca's performance. Being a globally operating firm, it is vulnerable to the risks of currency exchange rate fluctuations, which could impact its revenues and profits.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content only and should not be construed as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. Any predictions made in this article regarding clinical, regulatory, and market outcomes are the author's opinions and are based on probabilities, not certainties. While the information provided aims to be factual, errors may occur, and readers should verify the information for themselves. Investing in biotech is highly volatile, risky, and speculative, so readers should conduct their own research and consider their financial situation before making any investment decisions. The author cannot be held responsible for any financial losses resulting from reliance on the information presented in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)

A bit high as compared to the other European pharma, Glaxo, Novo N., Sanofi and even Novartis.