After Rising 36%: Why Carlisle Remains One Of My Favorite Dividend Growth Stocks

Summary

- Carlisle Companies has shown strong dividend growth potential with 46 consecutive annual hikes, making it an appealing dividend growth stock.

- Despite challenges in 2Q23, Carlisle's pivot towards innovative building products and Vision 2030 plan supports sustainable value creation.

- CSL's positive financial performance, solid margins, and shareholder-friendly actions make it an attractive investment with a target price of $350.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

olm26250

Introduction

On May 15, 2023, I wrote my first (bullish) article, covering dividend aristocrat Carlisle Companies Incorporated (NYSE:CSL).

In that article, I highlighted a few key factors that were a major part of my decision to make it a major part of my dividend growth portfolio.

CSL has 46 consecutive annual dividend hikes, which means it is four years away from becoming a dividend king!

- Since 2011, the company has hiked its dividend by 14% per year.

- The most recent hike was announced on August 4, when CSL hiked by 38.9%.

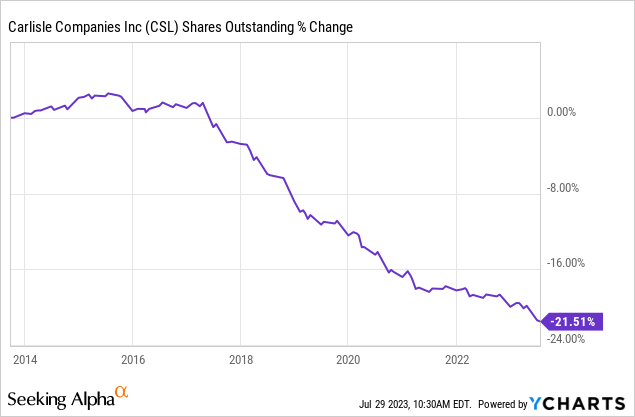

- The company has bought back 21% of its outstanding shares since 2017.

While I had high expectations, the company blew my expectations out of the water, as it soared more than 30% since then. It's now 36% above its 52-week low and, as a result, my third-largest dividend growth investment.

In this article, we'll discuss the company's earnings and my strategy to accumulate more CSL stock, as I believe it's one of the best dividend growth stocks money can buy.

So, let's get to it!

The Ongoing Business Transportation

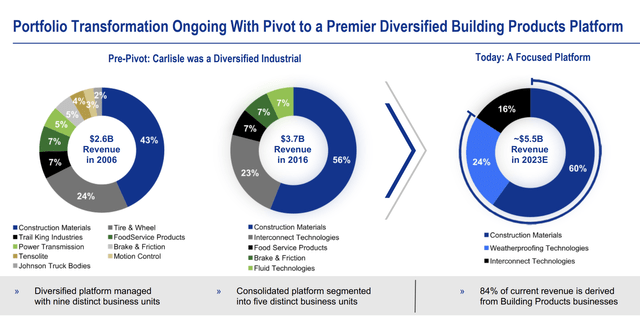

In my May article, I discussed the company's four business segments.

- Carlisle Construction Materials ("CCM") - 58% of 2022 revenue.

- Carlisle Weatherproofing Technologies ("CWT") - 24%

- Carlisle Interconnect Technologies ("CIT") - 13%

- Carlisle Fluid Technologies ("CFT") - 5%

This has changed.

The company started the 2Q23 earnings call by highlighting its commitment to continuously improving its businesses and its decision to pivot towards becoming a building product pure play.

The recently announced sale of CFT is a major step in fulfilling this goal, as it further emphasizes the company's desire to be a superior capital allocator and drive shareholder returns.

Carlisle Companies

Essentially, the company's pivot towards an innovative building products portfolio focuses on providing energy-efficient solutions to benefit from the trends in greenhouse gas reduction and increased demand for green buildings and products.

Carlisle aims to further increase sales from Building Products businesses and is committed to achieving sustainable value creation under their new strategic plan, Vision 2030.

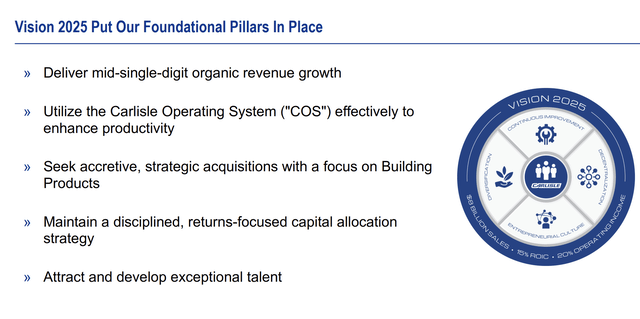

The foundational pillars of Vision 2025 continue to guide the company's strategy, including driving organic revenue growth, utilizing the Carlisle Operating System for efficiency, making synergistic acquisitions, and maintaining a returns-focused capital allocation strategy.

Carlisle Companies

With that in mind, the second quarter was challenging but also full of positive news.

2Q23 Was A Tough But Good Quarter

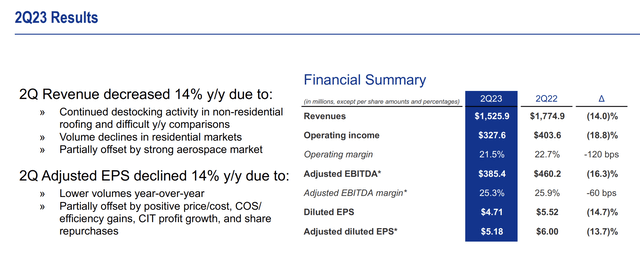

While Carlisle remains bullish on its long-term value creation runway, the company acknowledged near-term headwinds impacting the Building Products businesses.

Extreme temperatures across North America have negatively affected contractors' ability to work on roofs safely. Economic uncertainty, tighter financing conditions, and a tight labor market for roofing contractors led to project delays.

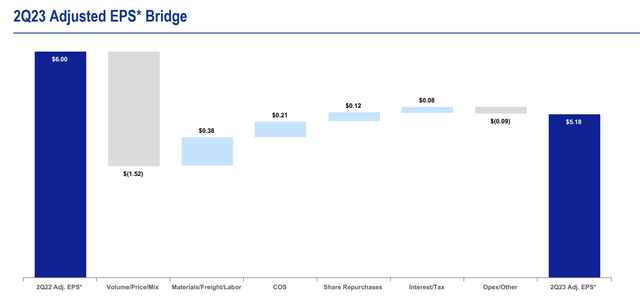

As a result, the company generated $1.5 billion in revenue, which was $80 million lower than expected and 14% below the prior-year quarter. Adjusted EPS came in at $5.18. That's 13.7% below the prior-year quarter result.

Carlisle Companies

However, Carlisle still anticipates strong demand for their energy-efficient building products, especially for non-residential reroofing products.

During the 2Q23 earnings call, management expressed confidence in its ability to meet the growing need for energy-efficient solutions, reduce carbon emissions, and gain market share and margin through customer satisfaction and Carlisle's operating system.

Carlisle Companies

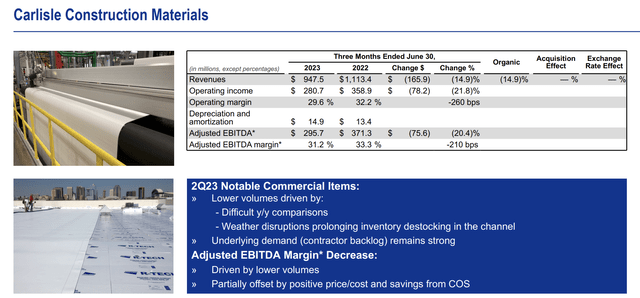

With that in mind, the CCM (Carlisle Construction Materials) segment reported second-quarter revenues of $948 million, a 15% decline compared to the previous year. The drop was caused by ongoing destocking in the supply chain, as well as the aforementioned disruptive weather conditions and project delays.

Carlisle Companies

Despite the revenue decline, the segment showed strength in its financial performance, with an impressive adjusted EBITDA margin of 31%, benefiting from positive price costs during the quarter.

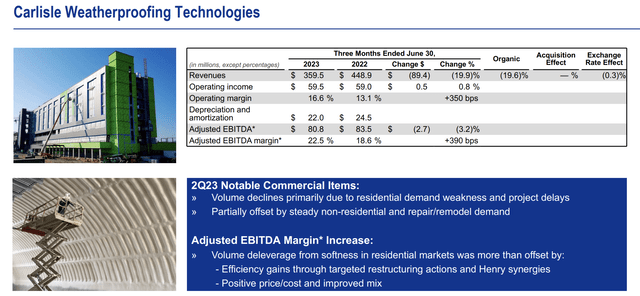

In the CWT (Carlisle Interconnect Technologies) segment, revenue decreased by 20%, primarily due to continued softness in residential demand.

However, the adjusted EBITDA margin improved significantly, expanding by 390 basis points compared to 2Q22, reaching 22.5%.

Carlisle Companies

The positive margin growth was a result of the company's focus on integrating Henry (a 2021 acquisition), capturing targeted synergies, implementing COS (Carlisle Operating System), and making substantial investments in operational enhancements to drive efficiency in the businesses.

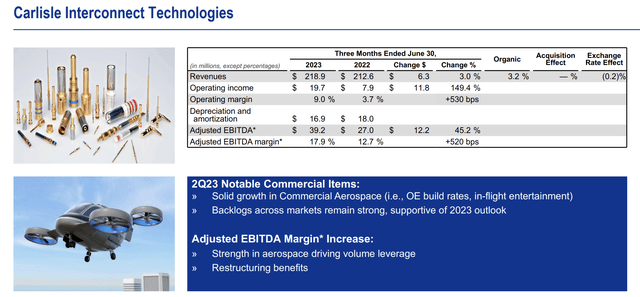

Looking into the company's smallest segment, the CIT (Carlisle Interiors) segment experienced a 3% increase in revenue during the second quarter of 2023.

The growth was driven by strength in the commercial aerospace platforms, benefiting from the rebound in demand for new aircraft.

Carlisle Companies

Hence, CIT's adjusted EBITDA margin also saw a substantial expansion of 520 basis points, reaching 18%. This was achieved through price realization, leveraging restructuring activities, and gaining efficiencies from COS implementation.

A Rosy Outlook

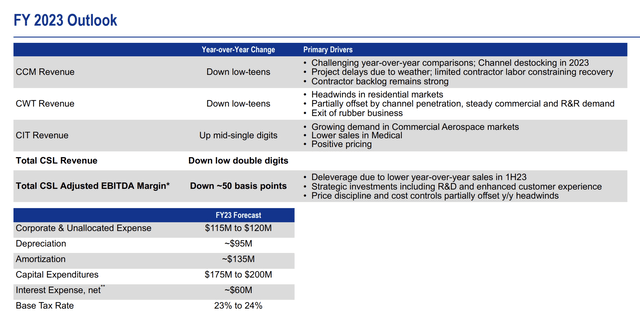

Carlisle provided updated guidance for 2023. For CCM and CWT segments, the company expects revenues to decline year-over-year in the low teens range.

However, for the CIT segment, the company anticipates revenue to increase year-over-year in the mid-single-digit range.

As a total company, Carlisle now expects year-over-year revenue to decline in the low double digits.

The reasons behind the lower revenue expectations include the same factors that affected the second quarter: destocking in the channel, disruptive weather conditions, and project delays.

Carlisle Companies

While this guidance is far from bullish, Carlisle remains optimistic about its EBITDA margins for the full year. Despite the double-digit revenue decline, they expect consolidated margins to decline by only 50 basis points year-over-year in 2023.

This outlook is attributed to the solid execution by their teams, disciplined pricing strategies leading to improved price/cost capture, operational efficiencies, and effective cost management through continuous improvement efforts.

In other words, all the factors that have allowed the company to enhance its bottom line are providing support when it matters most.

Balance Sheet & Shareholder Distributions

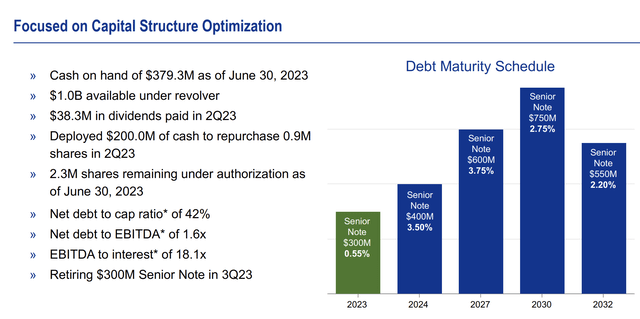

As of the end of the second quarter, Carlisle had $379 million of cash on hand and $1 billion of availability under their revolving credit facility. The company has just $300 million in maturities this year and a net debt ratio of 1.6x EBITDA. The EBITDA interest coverage ratio exceeds 18x. The company enjoys a BBB+ credit rating.

Carlisle Companies

During the quarter, the company generated $196 million in cash flow from continuing operations and invested $30 million in capital expenditures.

Carlisle also deployed $200 million towards share repurchases and paid $38 million in dividends. They still have 2.3 million shares available for repurchase under their share repurchase program.

In addition to a dividend aristocrat track record with 15% average annual dividend growth over the past five years and a sub-20% payout ratio, the company has bought back a fifth of its shares over the past ten years.

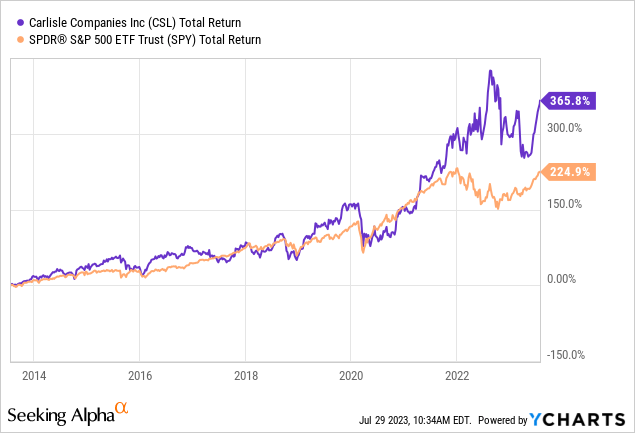

This is also the reason why the company was able to generate outperforming returns for its investors.

Over the past ten years, CSL has returned 366%, beating the stellar 225% return of the S&P 500 by a considerable margin.

I expect this outperformance to continue.

Valuation

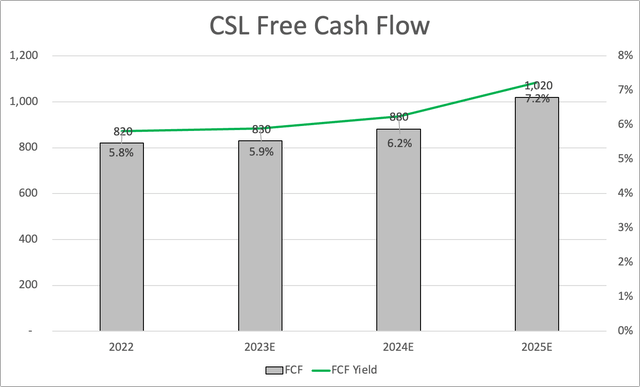

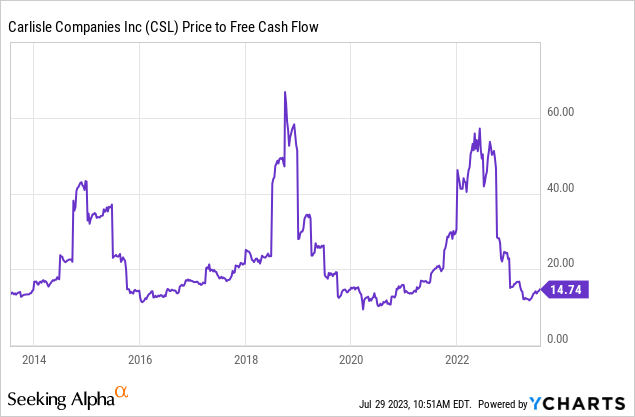

After its recent rally, I still believe that CSL is attractively valued. While 2023 is expected to remain a challenging year, analysts expect the company to rebound starting next year, followed by an acceleration that could result in a free cash flow yield that exceeds 7%.

Leo Nelissen

This means that the company is trading at 16x next year's expected free cash flow.

I do not believe that the company should trade at less than 20x free cash flow. Even 20x would be attractive, considering that annual double-digit free cash flow growth is expected to return after 2024.

Hence, my price target is $350, which is 25% above the current price.

The current consensus price target is $309. The highest price target on my radar is from Credit Suisse, which gave the company a $363 target at the end of last year.

So, my strategy is to add to my position on 10% (or bigger) corrections.

Takeaway

My bullish outlook on Carlisle has been reinforced after analyzing its second-quarter performance and future prospects. Despite facing near-term headwinds, the company's pivot towards an innovative building products portfolio, driven by energy-efficient solutions, positions it to benefit from green trends and reduced greenhouse gas emissions on top of long-term building and renovation demand growth.

While revenue may face challenges in the short term, CSL's focus on operational efficiency, cost management, and synergistic acquisitions bodes well for its bottom line. As a long-term dividend growth investor, I remain confident in CSL's ability to continue its impressive track record of dividend hikes and share repurchases, providing support for outperforming returns.

Considering CSL's attractive valuation and projected double-digit free cash flow growth after 2024, my price target is $350, implying a 25% upside potential.

I'll be looking to accumulate more CSL stock on substantial corrections of 10% or more.

With its commitment to sustainable value creation and capital allocation, CSL remains a top-notch dividend growth stock worth adding to any portfolio.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Welcome to my Seeking Alpha profile!

I'm a buy-side financial markets analyst specializing in dividend opportunities, with a keen focus on major economic developments related to supply chains, infrastructure, and commodities. My articles provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities. I aim to keep you informed of the latest macroeconomic trends and significant market developments through engaging content. Feel free to reach out to me via DMs or find me on Twitter (@Growth_Value_) for more insights.

Thank you for visiting my profile!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.