El Pollo Loco Q2 2023 Earnings Preview: A Sentiment Arbitrage Heading Into Earnings

Summary

- El Pollo Loco is expected to announce second-quarter financial results, with analysts predicting modest revenue improvement compared to last year.

- The company's physical footprint is expected to expand, with new store openings projected for 2023.

- Despite mixed comparable store sales, El Pollo Loco saw significant growth in net income and improved cost structures in the first quarter, creating a favorable risk-to-reward opportunity for investors.

- This is especially true when you add in how shares are priced at the moment.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Wolterk

In the coming days, the management team at restaurant chain El Pollo Loco Holdings (NASDAQ:LOCO) is expected to announce financial results covering the second quarter of the company's 2023 fiscal year. Leading up to that time, analysts don't have much optimism that this year will be materially better than last year was. Interestingly, this flies in the face of how the company performed during the first quarter of the year relative to the first quarter of 2022. Naturally, this discrepancy should encourage investors to keep a close eye on the business, since financial performance reported for the quarter will go a long way toward determining the direction shares take over the next couple of months. In the event that management can pull off another stellar quarter, upside potential for investors should be quite appealing. But even if they match what analysts anticipate, the picture is likely to be positive. In fact, absent anything significantly negative coming out of the woodwork, I would argue that the overall picture for the business offers shareholders A favorable risk to reward opportunity.

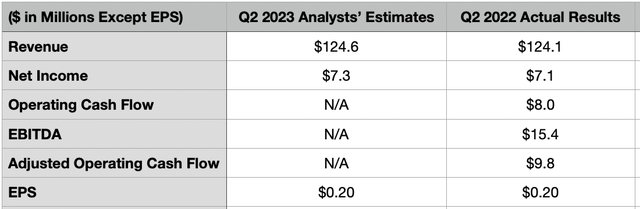

A look at current expectations

After the market closes on August 3rd, the management team at El Pollo Loco will report financial results covering the second quarter of the company's 2023 fiscal year. The current expectation is for the enterprise to report revenue of about $124.6 million. This represents only a very modest improvement over the $124.1 million the company reported during the second quarter last year. I find it difficult to imagine financial performance coming in that week year over year. This is because current guidance calls for a continued expansion of the company's physical footprint.

You see, as of the end of the most recent quarter, the firm had 490 restaurants in operation. 187 of these were company owned, while the remaining 303 were franchised. The overall number in operation remained unchanged from the number that the company had at the end of 2022. But from the end of last year through the end of the first quarter, one of the firm’s company-owned locations became franchised. Current guidance for 2023, however, calls for between 3 and 5 new company-owned stores being opened, while 6 to 9 new franchised locations should be opened. Of course, we do not know the timing of these openings, so it is theoretically possible that the store count may have remained unchanged from quarter to quarter. And if that's the case, the loss of 1 company owned store to become franchised on a year-over-year basis could cause overall revenue to fall modestly. This is a possibility if we assume that comparable restaurant sales will come in weak year over year. However, I find it difficult to imagine that the company would wait until the second half of 2023 to open up all of these locations.

On the bottom line, the picture also looks mediocre according to analysts. Earnings per share are forecasted to come in at only $0.20. That would match the earnings generated during the second quarter of 2022. But because of a change in the number of shares outstanding, it would translate to a modest increase in profits from $7.1 million last year to $7.3 million this year. I understand that current economic conditions are uncertain. However, as you will see shortly, this would mark a meaningful turnaround compared to how the company has performed in 2023 so far.

Recent performance is encouraging

The reason why I have such a difficult time believing that the second quarter will be as boring as what analysts forecast is because the first quarter of this year was anything but. Year over year, revenue for the company grew 4.1%, climbing from $110 million to $114.5 million. This increase was driven by a growth in restaurant count from 481 locations to 490. Overall company owned locations dropped by one, but this was more than offset by an increase in franchised locations from 293 to 303. Comparable restaurant sales were not quite as exciting, inching up by only 0.8%. But the improvement here was rather uneven, with company-owned locations experiencing growth of 3.8% while franchised locations contracted by 1%. Even this, however, showed a bit of weakness in some respect for the while the company did benefit from a 6.3% increase in average check size, the number of transactions at locations dropped by 2.4%. Ideally, you would want to see both of these increase, since the alternative shows that fewer patrons are visiting your restaurants.

Even with that mixed data regarding comparable store sales, El Pollo Loco really performed well on the bottom line. Net income more than doubled from $2.1 million to $4.9 million. In addition to benefiting from the growth in revenue, the company also saw some of its cost structure improve. At the company-owned locations that it has, it's all food and paper costs drop from 29.5% of sales to 27.5%. That decrease, management said, actually came from a reduction in overall transactions for the business, with some of that benefit more than offset by higher prices for said products. So in that regard, the drop in transactions at its locations provided some benefit. At the same time, labor and related expenses dropped from 34.8% of sales to 32.2%. This decrease, management said, was largely the result of price increases that more than offset higher costs.

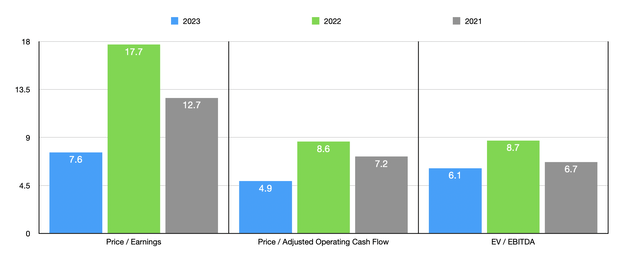

Outside of net profits, there were some other important profitability metrics to note. And it would be wise for investors and market watchers of the company to monitor these when management reports results in the coming days. Operating cash flow, for instance, went from negative $2.3 million to positive $3.8 million. If we adjust for changes in working capital, it nearly doubled from $5.6 million to $9.8 million. And finally, EBITDA jumped from $8.5 million to $12.2 million. As you can see in the chart above, the results experienced during the first quarter of this year mark a turnaround from how the company performed in 2022 compared to 2021. Although sales increased during that time, profits and cash flows came under pressure because of higher expenses that more than offset the benefit of higher revenue.

It's truly difficult to know what to expect when it comes to the rest of the year. Management has not really provided any guidance on this front that would allow us to know what kind of profits or cash flows to anticipate. If we assume that the first quarter is indicative of how the company will perform for the rest of the year, we would get an estimate for net profits of $48.5 million. Adjusted operating cash flow would be $75.3 million, while EBITDA would come in at $69.9 million. In the chart above, you can see how shares are priced using these estimates, as well as using the actual results for 2021 and 2022.

In the event that the 2023 estimates turn out to be right, shares of the business look very cheap. But even if we assume that financial performance will revert back to what we saw in 2022, the stock still seems to have some upside potential. In the table below, you can see these 2022 data stacked up against the results of five similar firms. Using both the price to earnings approach and the EV to EBITDA approach, two of the five companies ended up being cheaper than El Pollo Loco. And using the price to operating cash flow approach, only one of the firms was cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| El Pollo Loco | 17.7 | 8.6 | 8.7 |

| Potbelly Corp (PBPB) | 25.8 | 14.2 | 11.1 |

| The ONE Group Hospitality (STKS) | 19.5 | 11.0 | 8.3 |

| Dave & Buster's Entertainment (PLAY) | 15.5 | 5.6 | 6.7 |

| Jack in the Box (JACK) | 13.7 | 10.8 | 10.0 |

| Portillo's (PTLO) | 95.9 | 16.4 | 25.7 |

Takeaway

Since I last wrote about El Pollo Loco in an article published in early January of this year, shares have seen an upside of 6.4%. Although I rated the company a ‘buy’ at the time, this upside did fall short of the 18.7% increase seen by the S&P 500 over the same timeframe. Because of this, I consider my call so far to be disappointing. But this doesn't mean that the company makes for a bad prospect in the grand scheme of things. Performance for the second quarter, if analysts are correct, will be mediocre. But it's difficult to imagine that scenario coming into play after seeing such a robust first quarter. In my mind, this difference between reality and expectations, combined with how cheap shares are on both an absolute basis and relative to similar firms, creates a favorable risk to reward opportunity that investors would be wise to consider taking advantage of.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.