PDI: Still Bullish On This Nearly 14% Yielding CEF

Summary

- PDI is an income play for investors, with a focus on generating a continuous stream of income rather than capital appreciation.

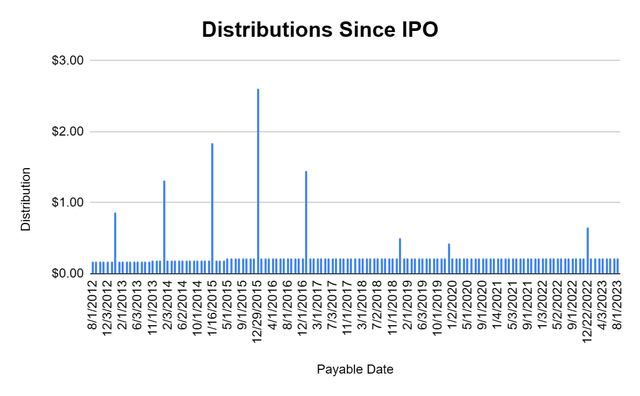

- PDI has generated consistent monthly distributable income for investors since its inception, offsetting any declines in share price.

- PDI provides diversification through investments in various fixed-income sectors, offering opportunities that may not be accessible to individual investors.

PM Images

PIMCO Dynamic Income Fund (NYSE:PDI), as many Seeking Alpha Contributors have a neutral viewpoint on this CEF. I won't beat around the bush, this is an income play for me. I am not looking to beat the market, and I am not concerned about capital appreciation. For some investors, this viewpoint doesn't work in their investment thesis, and that is fine. When I am getting paid 13.92% on my money, I don't need it to appreciate, if it trades within a range, I am perfectly content. The powers of compounding interest will do the work for me. If your investment goal is to beat the market, there are other investments that would better align with your goals, but if you're looking for an ongoing continuous stream of income paid monthly, PDI could be an interesting CEF for your income-producing portfolio. The Fed raised rates again, and you can generate over 5% APY from several risk-free investments, making finding yield from traditional equities less exciting. If you are looking for yield in a high-rate environment, PFI hasn't missed a monthly distribution, and shares look as if they have bottomed out. I continue to hold PDI while reinvesting the monthly distribution and plan on adding to my position under the $20 level.

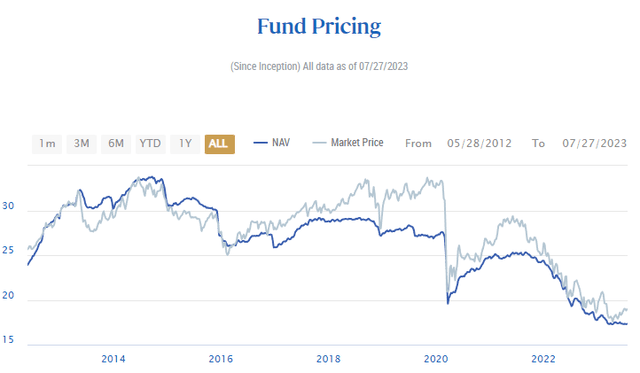

Shares of PDI have declined, but the income generated has offset the losses

In today's society, instant gratification has become normalized. We walk around with smartphones and can access the internet from the palm of our hand. From entertainment to banking, everything is one click away. As an income investor, I am not concerned with short-term price fluctuations, as I am looking at a much longer time horizon. There are some that would look at PDI's chart, and because it doesn't resemble the capital appreciation many big tech companies have realized, they wouldn't consider PDI as an investment. PDI went public on 5/30/12 at $25 per share, and since its inception has declined -23.8% to $19.05. While PDI has declined since inception and its peak, it's generated 151% of its original share price in distributable income since going public. This is why PDI is very interesting and why I look at income investing much differently than others.

Some investors couldn't see themselves holding an investment for over a decade, while others, such as myself, have no problem watching the income roll in month after month. Since PDI's inception, it has generated 141 consecutive months of distributable income for investors. The core distribution has delivered $28.09 per share, while $8.28 was generated through special cash distributions. In addition to distributions, shares of PDI have thrown off $0.90 in long-term capital gains and $0.46 in short-term capital gains.

When I look at PDI, I see a CEF that has produced $37.29 of distributable income since inception. If you had purchased PDI at its IPO, the distributable income has more than paid for the shares, and you have a free asset that is still producing $2.65 in annualized income paid monthly at a rate of $0.2205 per share. This also doesn't consider the powers of compounding interest and what the share count would have been if the distributions were reinvested rather than taken as income.

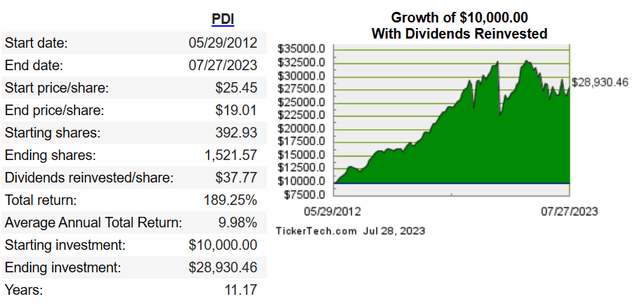

Using a dividend reinvestment calculator, I was able to see what the results would have looked like if the distributions were reinvested in PDI, and the results are impressive. At inception, PDI was paying an annualized distribution of $2.12, which was an 8.5% yield on the initial share price. An investment of $10,000 would have purchased 392.93 shares, placing the forward annualized distributions at $834.58. I took all of the distributions directly from PIMCOs site, and I came up with $37.29, while the calculator I am using came up with $37.77, so it may be placing the next quarter's distributions in its number. It's still very close, but please keep that in mind. According to the calculator, reinvesting the $37.77 of distributable income would have grown the share count to 1,521.57. Your share count would have increased by 287.24% (1,128.64 shares), while your annualized distributable income increased by 383.13% ($3,197.58). Overall you would have 1,521.57 shares valued at $29,930.46, generating $4,032.16 of distributable income from an initial investment of $10,000.

This is why I don't mind price fluctuations on income investments. I have held REITs such as Omega Healthcare Investors (OHI), and Starwood Property Trust (STWD) for 7-8 years, and while the price fluctuations have moved sideways, fluctuating to both the down and upside, my reinvested income has turned them into great investments. PDI has increased the monthly distribution over the years, and generates special cash distributions from time to time. Based on its history, you could make an investment today, and if the distribution trend continues, you would eventually get your shares for free as your forward distributable income continues to grow. Sometimes when you are looking at income investments, putting the hype aside is important because the powers of compound interest can be a powerful asset.

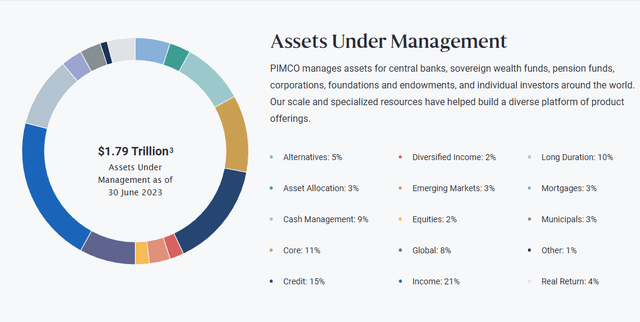

PDI provides diversification through investments I can't access

I am a large fan of diversification and have investments in many different sectors. PIMCO is one of the largest investment houses, managing over $1.79 trillion for central banks, sovereign wealth funds, pension funds, corporations, foundations, endowments, and individual investors globally. PDI has over 1,800 holdings and provides a diversified approach to generating income through opportunities I couldn't access on my own.

PDI utilizes a dynamic asset allocation strategy among multiple fixed-income sectors in the global credit markets, including corporate debt, mortgage-related and other asset-backed securities, government and sovereign debt, taxable municipal bonds, and other fixed-, variable- and floating-rate income-producing securities of U.S. and foreign issuers to meet its investment objectives. PDI's holdings are comprised of debt obligations, investment-grade debt securities, below-investment-grade debt, and other income-producing securities of any type and credit quality with varying maturities and related derivative instruments. PDI may normally invest up to 40% of its total assets in bank loans and will not normally invest more than 10% of its total assets in convertible debt securities.

While PDI has declined since inception, it's more than made up for the losses through the distributions. Shares of PDI look to be bottoming out, and while the price dispersion compared to NAV is a 9.82% premium, PDI has a history of trading at a premium and in many periods, at a wider gap. I think when the Fed starts cutting rates, and I am not optimistic it will be in 2023, the global fixed-income sectors will become more enticing. It's hard to sell investors on fixed-income sectors when the risk-free rate of return is over 5%, but as that rate declines, fixed income should see money trickle in from the sidelines. I think now is a good time to add to positions in PDI and allow the distributions to compound over time.

Conclusion

PDI has provided an ongoing stream of monthly income from multiple global fixed-income sectors that diversify my holdings. The chart isn't pretty, but I got in under $20, and PDI has been meeting my investment narrative. If I had started my investment when PDI went public, I would still be happy due to the $37.29 of distributable income it has produced. I am looking at PDI as an income investment, and from that lens, as long as the track record for distributable income stays intact, I will be very happy sitting back and allowing the powers of compounding to work their magic. I do think PDI will see some capital appreciation as rates start to decline, and getting in under $20 is a good long-term play for income-focused investors. I plan on adding more PDI before the year is finished.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PDI, OHI, STWD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (28)

www.cefconnect.com/...

For the newly investors, I consider it a money maker..Allday

They have been beating the cut drum since before the Pdi, Pci, Pko merger ....

On the contrary, the chart shows after hitting a $17.23 bottom in May a gradually recovering share price....

PDI has no ROC in its distribution and folks have been warning of distribution cuts for years and they keep steaming along even issued significant YE supplements

Pimco are wizards at using alternative strategies to cover its distribution, income is only part of that equation