Verizon: Market Misunderstanding Offers A Golden Dip-Buying Opportunity

Summary

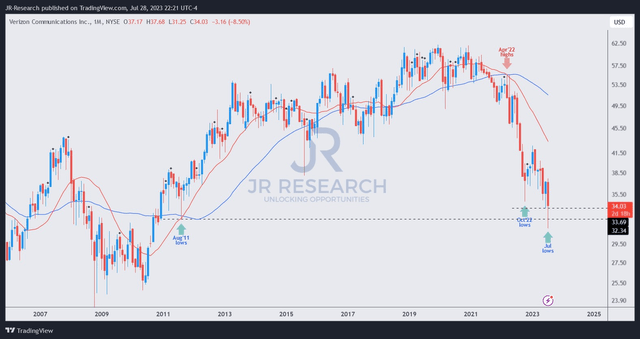

- Verizon took out new lows this month over the lead cables concerns, falling to levels not seen since August 2011. However, buyers have returned to defend stoutly.

- The massive capitulation in VZ has seen significant buying interest from dip buyers as some weak-income investors likely fled. However, a long-term bottom in VZ appears primed.

- Verizon's strong execution in Q2 and assuring full-year guidance indicate that the market's pessimism is likely overstated.

- Investors still waiting on the sidelines to add more shares should leverage VZ's robust buying support recently and capitalize on the market's irrational fear.

- Maintain Strong Buy.

- Looking for a helping hand in the market? Members of Ultimate Growth Investing get exclusive ideas and guidance to navigate any climate. Learn More »

Bruce Bennett

The once-a-decade opportunity in Verizon Communications Inc. (NYSE:VZ) remains valid despite getting hit this month due to the headwinds from its lead-sheathed cables network. Keen investors should recall that the Wall Street Journal's or WSJ's investigation had led to a massive selloff in the stock of leading telco operators like AT&T (T) and VZ as investors parsed the potential legal liabilities and clean-up costs that could follow.

I covered the matter in a previous update. As such, investors unfamiliar with the coverage can refer to it for more information. Analysts on Verizon's recent second quarter or FQ2 earnings call were palpably concerned, as they took turns to ask management about the potential impact of the lead cables issue. However, given the current state of affairs, the company was reticent to provide a detailed response. Still, it highlighted that "Verizon is taking this matter very seriously and is conducting scientific and fact-based assessments." In addition, management also informed investors that the company has engaged third-party experts to "review and measure the potential exposure to lead."

The Department of Justice or DoJ and the Environmental Protection Agency or EPA have moved forward with their investigations on the issue, putting more pressure on Verizon and its exposed peers to accelerate their investigation and provide more clarity. In addition, the EPA "has issued a directive to AT&T and Verizon, demanding inspections, investigations, and environmental sampling data concerning their lead cables within 10 days."

As such, investors assessing the recent opportunity in Verizon must continue to keep tabs on the developments on the lead cables as they unfold. Despite that, I believe the market has already reflected significant pessimism in VZ's price action, even as it stymied its initial attempt to bottom out in June. Notwithstanding that failed attempt, VZ dip buyers returned robustly since last week as they attempted to hold the critical $34 zone.

With that in mind, I parsed that investors are likely assured with management's commentary at its recent earnings call, suggesting that Verizon is on track to meet its full-year guidance.

Accordingly, Verizon delivered a solid performance in Q2, with an adjusted EPS of $1.21, surpassing analysts' estimates. The company also improved its underlying metrics, posting an addition of 8K postpaid phone net adds, reaching 612K retail postpaid phone subs.

Notably, its critical average revenue per postpaid account or ARPA rose by 4% YoY and 1.5% QoQ. As a result, it delivered a 3.5% growth in wireless service revenue, as Verizon benefited from its pricing action and more fixed-wireless or FWA adoption.

The company is confident that its FWA target rate of 4.5M subscribers at the midpoint by the end of 2025 is achievable, up from 2.3M subscribers in the recently reported quarter. The company has also started segmenting its FWA business, further customizing its offerings to potentially improve ARPA. Coupled with its 400K broadband net adds, I assessed Verizon's first-half growth underscored the market's confidence that its full-year guidance should be achieved.

Despite that, the market's concern about the lead-sheathed cables continues to dominate recent pessimism, and justifiably so. Risk-averse income investors have likely bailed out or stayed on the sidelines as they anticipate the worst outcomes leading to a significant increase in CapEx or a dreaded dividend cut.

While management's outlook suggests that it expects its CapEx projections to have peaked, uncertainties in the lead cables issue could inflict more unforeseen expenses subsequently. Despite that, with VZ falling to a new low in July, it's hard for VZ bears to argue that the market didn't reflect such challenges as it attempts to price in Verizon's exposure.

VZ price chart (monthly) (TradingView)

VZ's "A-" valuation grade, rated by Seeking Alpha Quant, suggests it isn't demanding. As such, significant bottoming opportunities should be assessed, corroborating that value-seeking dip buyers have returned as they attempt to defend against market pessimism, as VZ weak holders capitulated.

As seen above, VZ fell below its August 2011 lows this month, taking out more than ten years of gains in the process, likely spooking many investors to give up as they anticipated more punishment.

Despite that, VZ dip buyers returned as they fended a further selloff, helping VZ recover the $34 level, incidentally VZ's June 2023 lows. As such, I believe it's a pivotal development, indicating that VZ's June lows are a significant level that attracted robust buying sentiments. Coupled with management's strong execution and confidence about turning the tide in the second half, I maintain my conviction about the current buy levels for VZ.

Therefore, investors waiting for more robust buying support before returning should leverage VZ's constructive price action to add more shares.

Rating: Maintain Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn't? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Wang of JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore (NUS). NUS is also ranked among the top ten universities globally. I currently hold the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (15)

This yield will not be available 6-9 months from now and VZ business is strong!

As someone who is involved in underground utility work, I know that anything related to getting closed to lead-sheathed cables has huge costs.

I cannot imagine how many thousands of miles of these cable are still in place throughout the US.

As a VZ holder, I consider this a great risk.

It might turn out to be safer to keep them where they are instead of disturbing them which will likely create another set of problems

Perhaps. On the other hand, there is the risk of lead leaching into the ground water.

Take a look at TC energy, TRP right now an unbelievable opportunity