Danaher: I'm Buying This Compounder On Any Weakness

Summary

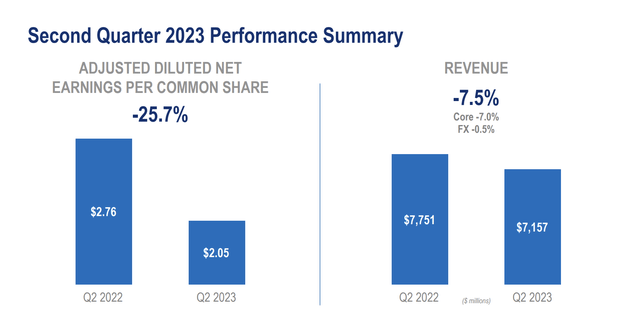

- Danaher Corporation reported solid Q2 2023 earnings with revenue of $7.16B (7.6% YoY decline) and EPS of $2.05 (25.7% YoY decline).

- The company's Danaher Business System (DBS) helped navigate challenges, maintaining revenue, earnings, and cash flow expectations.

- DHR's outlook suggests a decline in core revenue due to the COVID-19 impact, but it remains well-positioned for double-digit annual free cash flow growth, making its current valuation fair.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

May Lim

Introduction

It's time to talk about one of the two stocks in my portfolio with a sub-1% dividend yield: Danaher Corporation (NYSE:DHR).

This healthcare-focused corporation is currently my 8th-largest investment after I aggressively added to it during this year's various sell-offs.

My most recent article, titled Danager Sells Off - I'm Buying, was written in April when the stock sold off more than 6% after earnings.

Since then, the stock has risen 14%, as just-released earnings have caused the stock to break out from the downtrend that started in 2021.

This downtrend was fueled by rising rates and evaporating COVID benefits. While both of these headwinds are still an issue, they are quickly fading, allowing investors to focus on the company's core business again, which continues to fare extremely well.

In this article, I'll cover these numbers and explain why I'm a buyer on any corrections down the road.

So, let's get to it!

A Quick Look Into DBS

In the second quarter of 2023, Danaher reported a solid performance despite facing a more dynamic (read: challenging) operating environment.

- Revenue came in at $7.16 billion, which is 7.6% below the prior-year result and $40 million above estimates.

- Adjusted EPS came in at $2.05, which beat estimates by $0.03. However, it's a 25.7% year-on-year decline.

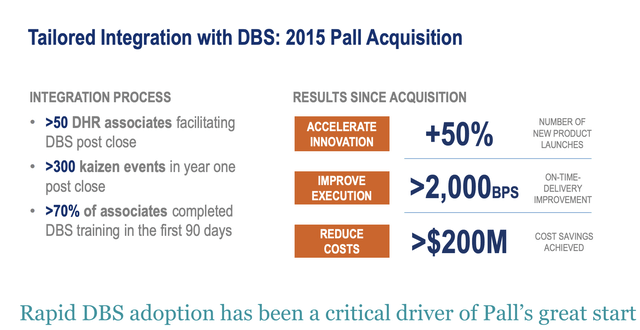

Before we dive into the segment performances, Danaher attributes its success in this challenging environment to the Danaher Business System ("DBS"), which enabled them to navigate challenging conditions effectively.

By mitigating supply chain constraints, enhancing productivity, and improving manufacturing throughput, the company managed to maintain its quarterly revenue, earnings, and cash flow expectations.

DBS is the company's philosophy to efficiently run its $190 billion M&A-focused company.

According to the company:

DBS is not only the set of business processes and tools our operating companies use on a daily basis, but is more broadly our culture. As reflected in our logo, DBS features five core values (the “Core Values”):

1.The Best Team Wins

2.Customers Talk, We Listen

3.Kaizen* is our Way of Life

4.Innovation Defines our Future

5.We Compete for Shareholders

Danaher Corporation

*A Kaizen Event is designed to support an effective, short-term brainstorming session that focuses on a single challenge and improves an existing process. The term is loosely translated from the Japanese to “change for the good.” - Six Sigma Daily

Without going into too much detail, this system allows the company to gain an increasing competitive edge in its industry. The company aims for strong core revenue growth and higher margins, which fuels free cash flow.

In addition to its dividend, free cash flow is used to acquire new companies that are integrated into its DBS system, allowing the company to accelerate revenue and free cash flow growth.

I often compare these companies to someone playing Monopoly. The moment someone has a competitive edge (i.e., more houses than the other players), the odds are that this person will win, as rent collection is higher, allowing that person to buy even more houses and hotels.

For example, when Danaher bought Pall in 2015, it focused on a smooth integration using DBS principles. It led to 50% more new product launches, higher customer satisfaction, and significant cost savings.

Also, speaking of Pall, in May, Danaher completed the combination of Cytiva and Pall Life Sciences, creating what the company calls a premier global bioprocessing franchise.

Cytiva's portfolio offers end-to-end solutions across major therapeutic modalities and an innovation engine focused on helping customers bring life-saving therapies to market faster and more efficiently.

With all of this in mind, let's go back to the 2Q23 discussion.

What Happened In 2Q23, And Why Does It Matter?

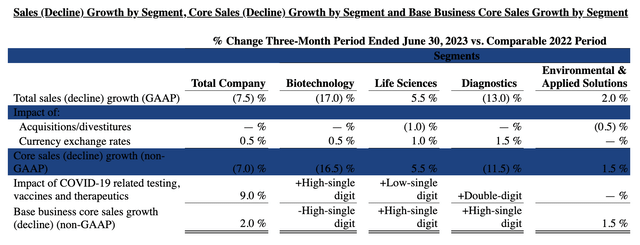

In the second quarter, Danaher's sales reached $7.2 billion, with core revenue declining by 7%. The company delivered a 2% growth rate in its base business, which was offset by a COVID-19 revenue headwind of approximately 9%.

COVID was a significant tailwind from 2020 through 2022. Now it's a huge headwind, as the pandemic has entered the history books. This means demand for testing and other COVID-related issues has fallen off a cliff.

Looking at the table below (my apologies for this horrible blue color), we see the aforementioned 7% decline in core revenue. In this case, we see that the impact of COVID-related activities was 9%, which is a huge number. Excluding COVID, growth would have been 2.0%.

Excluding items doesn't change reality. It's still a 7% organic revenue decline. However, by excluding COVID, we can assess the health of the company's core business. Everyone knew that COVID would be a headwind. That's not a problem caused by the company.

What matters is that the core business remains healthy.

Having said that, developed markets experienced a decline in core revenues in the high single digits, mainly due to the aforementioned lower COVID-19 revenues. High-growth markets saw a decline in core revenues in the low single digits, with China being down roughly 10%.

As one can imagine, these developments also impacted its margins.

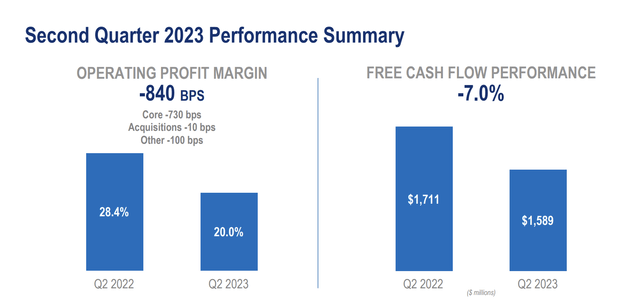

Danaher's gross profit margin for the second quarter was 56.5%, while the operating margin declined to 20% (down 840 basis points).

The decrease in operating margin was attributed to lower volume in the Biotechnology and Diagnostics segments and costs incurred to adjust the capacity and cost structure in response to COVID-19 transitioning to an endemic state.

Despite these challenges, Danaher generated $1.6 billion of free cash flow in the quarter, bringing the year-to-date free cash flow to net income conversion ratio to more than 125%, which shows its ability to generate high free cash flow. It's also indicative of high-quality earnings.

With this in mind, let's take a look at the individual performances of the company's segments, which revealed a lot about COVID developments and core strengths (and weaknesses).

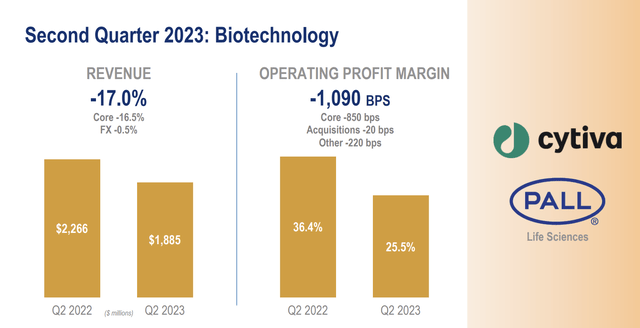

The Biotechnology segment reported a decline of 17% in reported revenue and 16.5% in core revenue during the second quarter. Market conditions in bioprocessing weakened further as the quarter progressed, resulting in a high single-digit base business decline.

Larger customers were still working through pandemic-built inventory while emerging biotech customers were conserving capital. The ongoing biopharma market correction in China also intensified during the quarter.

To address these headwinds, Danaher began actively working with larger customers to help them manage their inventory down to normalized levels.

While the impact of high rates and COVID headwinds are an issue, the company is upbeat about this segment's future, as it sees an increasing number of biologic and genomic medicines in development and significant regulatory approvals for groundbreaking therapies.

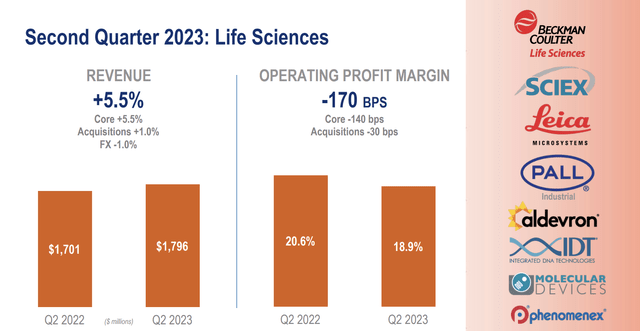

The Life Sciences segment reported a 5.5% increase in revenue, with core revenue also rising by 5.5%. This growth was driven by high single-digit expansion in the base business.

The Life Sciences instrument businesses, including Leica Microsystems and SCIEX, contributed to mid-single-digit core revenue growth.

Strong demand in the life science, research, academic, and applied markets, particularly for advanced instrumentation, helped offset softer performance in the pharma and biopharma sectors.

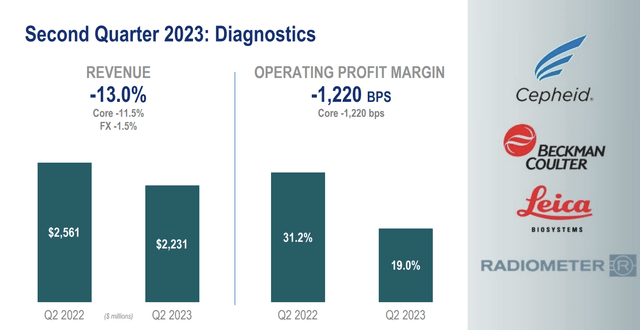

In the Diagnostics segment, reported revenue decreased by 13%, and core revenue declined by 11.5%.

The significant decline was primarily due to lower COVID-related respiratory testing volumes at Cepheid, which more than offset high single-digit growth in the base business. Despite this, the clinical diagnostics businesses achieved mid-single-digit core revenue growth, which is good news given that the main focus is on its core business.

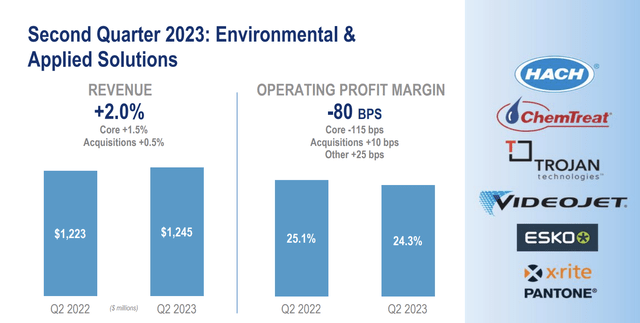

The Environmental & Applied Solutions segment, which will be spun off later this year, reported revenue growth of 2% and core revenue growth of 1.5%.

As the first table in this article displayed, this segment has no COVID exposure.

Water quality core revenue saw mid-single-digit growth, while product identification declined mid-single digits. In water quality, solid growth was driven by DBS-led execution in industrial and applied end markets, with a strong performance at ChemTreat and Hach.

Trojan also experienced strong equipment sales and order rates due to continued investment in larger municipal projects.

During the 2Q23 earnings call, Danaher mentioned that the spin-off, which will be called Veralto, is on track to be finalized in the fourth quarter.

The Veralto team is planning an Analyst Day in Chicago on September 6, which means we'll get a lot more data very soon.

Outlook & Valuation

In 3Q23, Danaher expects core revenue in the base business to decline by low single digits year-over-year. Total core revenue is expected to decline in the low to mid-teens percent range, primarily due to lower demand for COVID-19 testing, vaccines, and therapeutics.

The third quarter adjusted operating profit margin is expected to be approximately 26%, reflecting efforts to adjust cost structures and capacity in response to COVID transitioning to an endemic state, especially within the Diagnostics and Biotechnology businesses.

That said, for the full year 2023, Danaher anticipates low single-digit core revenue growth in the base business due to near-term challenges in bioprocessing.

Total core revenue is expected to decline high single to low double digits for the year, mainly due to lower demand for COVID-19 testing, vaccines, and therapeutics.

The full-year adjusted operating profit margin is projected to be approximately 29%.

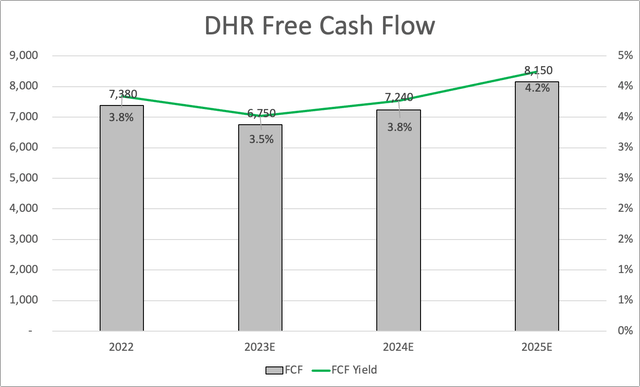

Based on this context, DHR has lost momentum. Looking at analyst estimates, the company is not expected to reach a new record in free cash flow before 2025.

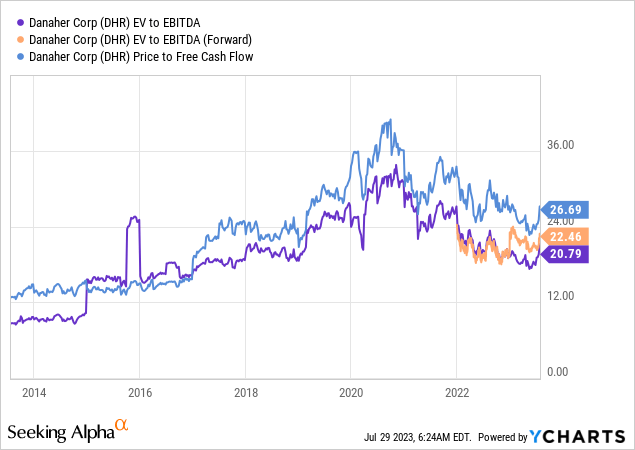

Using 2024 estimates, the company is trading at 26x free cash flow, which is fair but far from deep value.

Furthermore, the company is trading at 22.5x NTM EBITDA. As ex-COVID core revenue growth was just 2.0% in 2Q23, it's hard to make the case that this valuation is warranted.

Nonetheless, once COVID headwinds fade, the company is in a great spot to generate double-digit annual free cash flow growth, which makes the current valuation more than fair.

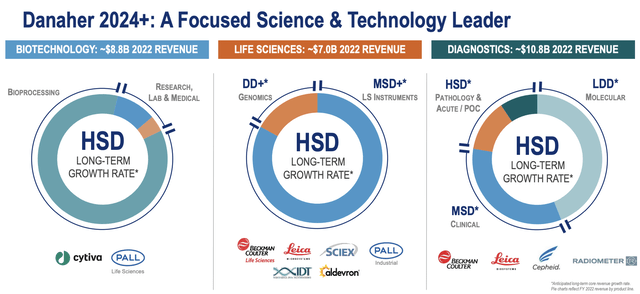

Last year, the company showed that its long-term plan (after spinning off Veralto) aims for high-single-digit annual growth in all of its segments on a long-term basis.

The current consensus price target is $274, which is 5% above the current price.

Using a 26x FCF multiple and 2025 estimates, I would put a $290 price target on the stock.

While I'm not adding more exposure at current prices, I'm a buyer on any sell-offs that exceed 10%, as that would make the long-term risk/reward much more attractive.

Also, because I have been an aggressive buyer in prior months, I do not feel the urge to chase stock price rallies.

Takeaway

Danaher Corporation has shown resilience in a challenging operating environment, with its Danaher Business System playing a key role in navigating through headwinds.

Despite a decline in core revenue due to the fading impact of COVID-related activities, the company's core business remains healthy.

With the spin-off of the Environmental & Applied Solutions segment as Veralto on the horizon and new biotech tailwinds, analysts are optimistic about the future.

While the current valuation may not appear deeply undervalued, the potential for double-digit annual free cash flow growth once COVID headwinds subside makes the stock attractive for long-term investors.

As a long-term investor, I'm eyeing potential buy opportunities on corrections, aiming for a risk/reward balance that aligns with my portfolio strategy.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Welcome to my Seeking Alpha profile!

I'm a buy-side financial markets analyst specializing in dividend opportunities, with a keen focus on major economic developments related to supply chains, infrastructure, and commodities. My articles provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities. I aim to keep you informed of the latest macroeconomic trends and significant market developments through engaging content. Feel free to reach out to me via DMs or find me on Twitter (@Growth_Value_) for more insights.

Thank you for visiting my profile!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)