GFL Environmental: To Trade At A Premium As It Is Deleveraging Balance Sheet

Summary

- GFL Environmental's solid waste pricing, M&As, and Environmental Services segment contributed to a 13.8% increase in 2Q23 revenue to $1.94 billion.

- GFL's deleveraging efforts are expected to reduce net debt significantly, with the company forecasted to generate around $1.5 billion in cumulative FCF by FY24.

- I expect GFL to trade at a premium to peers once it is deleveraging its balance sheet down to peers' level.

PeopleImages

Investment action

I recommended a buy rating for GFL Environmental (NYSE:GFL) when I wrote about it the last time, as I saw GFL continuing to perform very well with strong core price growth. Based on my current outlook and analysis of GFL, I reiterate my buy rating, as I expect GFL to trade at a premium to peers' as it continues to delever (deleveraging) the balance sheet.

Basic Recap

GFL provides waste management services. Services provided by GFL include the identification of hazardous and nonhazardous liquid waste, their collection, transportation, processing, recycling, and disposal.

Review

The solid waste pricing, M&As, and Environmental Services segment all contributed to the 13.8% increase in GFL 2Q23 revenue to $1.94 billion. The price growth of solid waste has risen by an impressive 10.4%, and this growth is better than the high single digits that management had predicted. This supports my previous buy thesis as solid waste pricing continues to perform strongly. Q2 volumes were down 3.5% due to the deliberate elimination of lower margin business, the closure of some non-core operations, and the rescheduling of some volume in 1Q23. Although the 4.8% organic growth in solid waste for 2Q23 represents a significant slowdown from recent trends, it should be noted that this was primarily driven by deliberate decisions to shed some lower-margin revenues, which may prove to be a margin tailwind in the long run. The near-term growth and margin improvement that pricing growth drives, in my opinion, should be the primary focus at this time.

The effect of price increases was evident in the EBITDA margin increase to 27.8% in 2Q23, which was 100bps higher than expected. Notably, solid waste margins rose 220bps to 31.6%, propelled by 315bps of underlying solid waste margin expansion but partially offset by drag from commodities, the net fuel impact, and some from dilutive M&A.

For FY23, management is anticipating an increase from pro forma guidance, to the tune of $7.4 billion in revenues and $2 billion in Adjusted EBITDA. Better-than-expected solid waste performance, in particular price, M&A, and continued outperformance within Environmental Services, are likely responsible for the upward revision to revenue projections. In addition, I see room for improvement here, as the guidance assumes neither additional M&A nor an increase in commodity prices. On the margin side of things, GFL forecasts an EBITDA margin of 27% for FY23, which is 50bps higher than pro forma's guidance.

Balance sheet

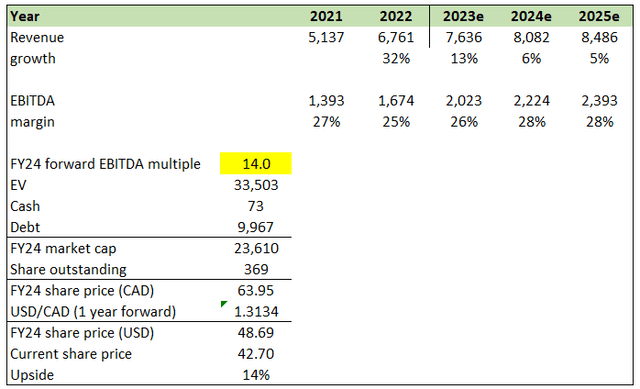

The deleveraging story continues to work well as GFL exited 2Q23 with net leverage at 4.2x, which compares well to management's expectations of 4.3-4.4x. Importantly, I believe GFL has a clear path to continue de-levering the business to less than 4x in the coming quarters as they continue to sell non-core assets and grow through pricing (high margin, which leads to high incremental FCF for debt paydown). Organically, GFL should have no issues deleveraging the business as well. Based on consensus estimates, GFL is expected to generate around $1.5 billion in cumulative FCF by FY24. Adding along the $1.6 billion worth of gross proceeds from divestitures, GFL should be able to reduce net debt by $3 billion, which translates to a net debt to EBITDA ratio of 3x in FY24 ($9.9 billion - $3 billion = $6.9 billion debt / $2.2 billion FY24 EBITDA). As GFL pays down debt, they will also benefit from lower cash interest expenses, which further drives FCF growth. I would note here that GFL has the highest net debt to EBITDA ratio amongst all the other North American environmental Service providers, such as Waste Management, Casella Waste Systems, Waste Connections, Republic Services, Heritage-Crystal Clean, Clean Harbors, and Stericycle. As GFL deleverages its balance sheet, it should also reap the benefit of being able to trade at a premium given its high expected EBITDA growth rate.

Valuation

I believe GFL can grow strongly in FY23 given the robust pricing movements so far into the year, but growth should normalize to mid-single digits, excluding M&A, which is in line with peers in the industry. The nature of GFL business and industry also means that it will not be able to grow at a high pace for the long run as it is generally driven by population (not a high growth factor) and pricing (should follow inflation). However, margins should continue to expand from here, and GFL continues to scale and grow towards bigger comps like Waste Management and Republic Services, both of which are multiple times the size of GFL and have much higher EBITDA margins.

As I mentioned earlier, I expect GFL to continue delivering its leverage profile to less than 4x, and eventually reach peers' levels, assuming no more M&As. As GFL reduces leverage and continues to increase EBITDA margin, I believe it should trade at a premium to peers given its higher expected EBITDA growth. Peers are currently trading at a median of 13x EBITDA and are expected to grow EBITDA in the mid-teens over the next 12 months, whereas GFL is expected to grow EBITDA by more than 20%.

Suppose GFL trades at 14x EBIDA in FY24; I believe there is still 14% upside from today's share price.

Risk and final thoughts

Any drop in the number of deals that are ultimately closed could have an impact on the growth rate. The potential for synergies may also be diminished if GFL is unable to effectively integrate the businesses it has acquired.

Overall, GFL performance remains strong, and I reiterate my buy rating for the company. The robust solid waste pricing and the effect of price increases have contributed to revenue growth and improved EBITDA margins. The ongoing deleveraging efforts are progressing well, with GFL expected to reduce net debt significantly and benefit from lower cash interest expenses. As the company continues to grow and improve its leverage profile, it should trade at a premium to peers due to its higher expected EBITDA growth rate.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.