Commercial Vehicle Group: Up +50% Year To Date, But Risk/Reward Is Still Favorable

Summary

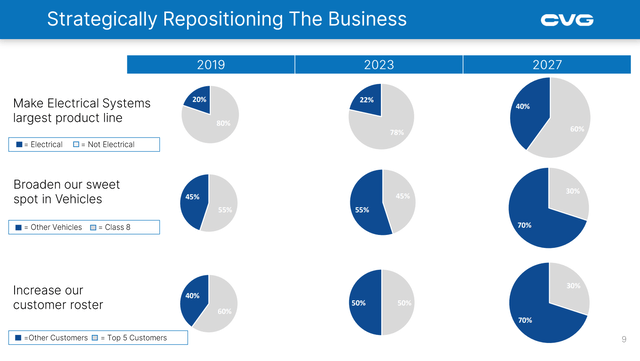

- Commercial Vehicle Group is attempting to reduce its reliance on the Class 8 truck market and increase its ties to the EV market.

- If they are successful and achieve their 2027 financial guidance of $1.5 billion of revenue with a 9% EBITDA margin, the stock looks quite undervalued.

- In this article, I’ll discuss why I think there is a good chance this transition is successful and why I am assigning the stock a $15 price target.

1933bkk

Commercial Vehicle Group, Inc. (NASDAQ:CVGI) and many other stocks in the S&P Construction Machinery & Heavy Trucks Index have bounced back from March lows when recession fears were highest. With cyclical stocks like this, it is always best to invest when sentiment is lowest and cyclical weakness is obvious. This means that investors in this stock should have some sort of opinion about the macroeconomic environment in order to maximize returns. This is a supply side driven approach to investing and in addition to requiring knowledge of trucking sector and economy, it also usually requires investors to be patient and have a long term holding period.

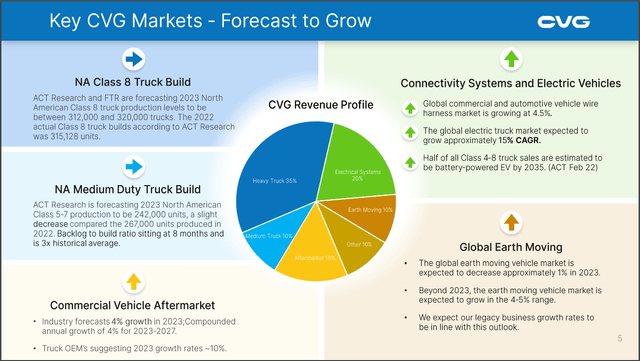

Commercial Vehicle Group's cyclicality comes from its connection to Class 8 trucks, as 35% of its revenue is tied to the production of those trucks. Markets for all trucks are sensitive to economic trends but this is especially the case for Class 8 heavy duty trucks. The company is working on moving away from these vehicles in an attempt to make financial results less cyclical.

Commercial Vehicle Group Revenue Profile (Q1 2023 Earnings Presentation)

In this transition away from Class 8 trucks, the company plans to replace the lost revenue with revenue from electric vehicle customers. The company seems to be having success with this transition at the moment. In the Q1 earnings call, management reiterated that their new business win rate is on track for $150 million per year and that most new business win revenue will come within their electric systems business which is tied to electric vehicle production.

$150 million per year is impressive as it's about 15% of the current annualized revenue run rate. EV production is a secularly growing industry and if Commercial Vehicle Group is more tied to this market than it is the Class 8 truck market, it will lose some of its cyclicality.

If they are able to keep this success going and achieve their medium term financial target of $1.5 billion in revenue with a 9% EBITDA margin in 2027, the stock looks very cheap. In the short term however, the company must navigate any economic weakness given its cyclicality. I will discuss Commercial Vehicle Group's 2016 financials to illustrate how sensitive the company is to fluctuations in GDP and the Class 8 truck market.

I think investors must carefully weigh the bull and bear case scenarios for Commercial Vehicle Group's future. In this article, I will discuss why I think the current risk/reward for an investment in the stock is favorable given their 2027 guidance and recent evidence that should instill confidence in that guidance.

Business Overview

Commercial Vehicle Group has 4 main segments: Vehicle Solutions, Electrical Systems, Aftermarket Accessories, and Industrial/Warehouse Automation. In 2022, Vehicle Solutions made up 59% of revenue, Electrical Systems made up 18% of revenue, Aftermarket Accessories made up 14% of revenue, and Industrial Automation made up 9%.

The vehicle solutions segment produces and sells seats and seating systems, plastic assemblies, and cab structures and parts primarily for medium and heavy duty trucks, agriculture markets, buses and other commercial vehicles. Although the electric truck market will grow over time, most of these parts are still for ICE vehicles.

The electrical system segment sells wire harness assemblies and cable harness assemblies for vehicles in the construction, agriculture, industrial, e-commerce and electric vehicles, traditional automotive, mining, rail and military end markets.

The aftermarket accessory segment produces and sells a variety of seats, mirrors, wipers and wiper systems into the commercial MD/HD truck, military and specialty power sports vehicles, electric vehicle, office and home office markets.

The industrial automation segment provides parts and assemblies for warehouse automation in the e-commerce, warehouse integration, transportation and the military/defense markets.

Past Financial Performance

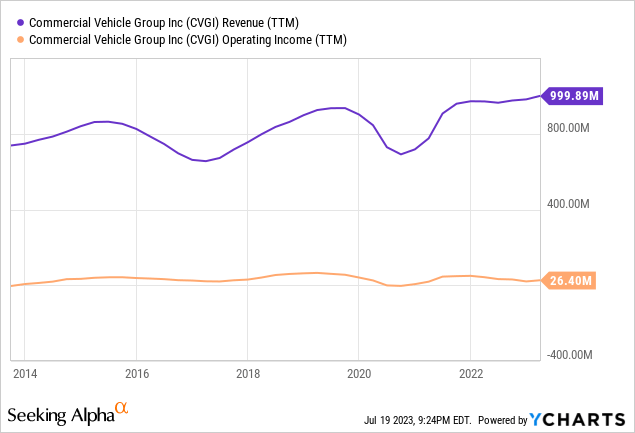

Over the past decade there hasn't been much of a consistent trend to revenue and earnings growth. From 2013 to 2022, revenue has grown at a 3% CAGR from $747 million to $981 million while operating income declined from $16 million to $10 million. There have been large fluctuations between that, for example when operating income more than doubled over the two year span from 2016 to 2018, but in the long run the stock has reflected this lack of growth in earnings as it's only up about 25% since the start of 2013.

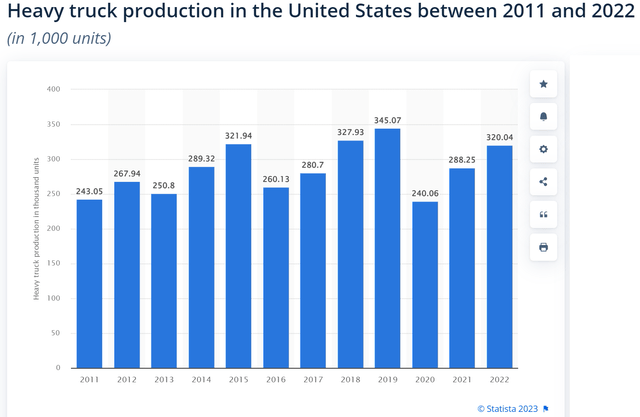

However within the 2016-2018 period when operating income doubled, the stock rose almost 400% from the start of 2016 to its peak in 2018. The drop in operating income in 2016 was attributable to the decline in heavy duty truck production in 2016.

In the Q4 2016 earnings call the CEO at the time explained the reason for the financial weakness. He said:

Our consolidated revenues for 2016 were down 20% for the full year as compared to 2015 challenged by tough market conditions. Global truck and bus segment revenues were down 26% versus prior here and global construction and agriculture segment revenues were down 7%... As expected, our results were most heavily impacted by the North American heavy-duty truck production levels which were down 29% in 2016 to about 228,000 units.

The decline in 2016 truck production was primarily due to a deceleration of US GDP, which grew 1.7% in 2016, down from 2.7% in 2015. This type of sensitivity to the economy makes investing in a business like Commercial Vehicle Group require not only a bottoms up, business focused approach, but an opinion on the economy and GDP growth.

U.S. Heavy Truck Production from 2011-2022 (Statista)

As heavy duty truck production rebounded in 2017 and 2018, revenue and operating income grew and the stock rose due to earnings growth and multiple expansion.

Investors generally don't like these types of cyclical businesses and the market generally assigns their stocks a lower multiple even on years when ROIC is high. Commercial Vehicle Group's new strategy entails being less reliant on the Class 8 truck market and attaching itself onto the secularly growing electric vehicle trend in order to reduce this cyclicality and attract investor attention.

Commercial Vehicle Group Strategic Repositioning Plan (Q1 2023 Earnings Presentation)

Valuation

Management is guiding for $1.5 billion of revenue by 2027 and a 9% EBITDA margin in 2027. I will use this as a guide post for my bull case valuation.

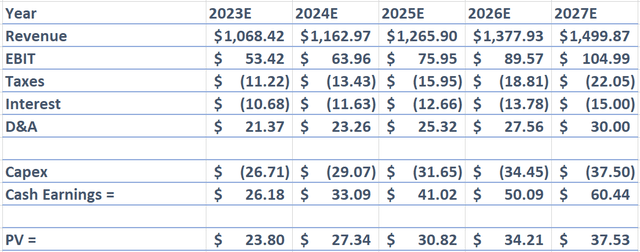

Commercial Vehicle Group DCF (Created by Author) Commercial Vehicle Group DCF Continued (Created by Author)

To get to $1.5 billion in revenue by 2027 I am assuming 8.85% growth per year. I am assuming that the EBIT margin expands from 5% in 2023 to 7% in 2027. I am assuming a tax rate of 21% and interest expense equal to 1% of revenue from 2023 to 2027. I am also assuming D&A equal to 2% of revenue through 2027 and capex equal to 2.5% of revenue through 2027. Finally I am assuming a WACC of 12% and a terminal growth rate of 2%.

All of this leads to an intrinsic value estimate of $20 or about double the stock's current price.

For a bear case, only my revenue growth and EBIT margin assumptions will change. I will assume 2% revenue growth through 2027 and for the EBIT margin to remain flat at 5%. If these assumptions are correct, the stock is worth $7.80 per share.

The midpoint between my bull and bear case price targets is $13.9 per share. Depending on your views on the success of this transition away from the Class 8 truck market and into the EV market, the weights of each price target should vary.

As of now, I would bet that there is a higher chance the transition will be successful and that the 2027 guidance will be accurate. As reported in the Q1 2023 earnings call, new business wins are ahead of schedule and are highly weighted towards the electric systems segment. Most importantly one of the new business wins was from a customer in China and this customer could act as an anchor customer to expand more into the massive Chinese electric vehicle market. To get an idea of the size of this market, in 2022, Chinese carmakers sold almost double the number of electric vehicles than did carmakers in the U.S. market.

Additionally in Q1, 40% of topline growth related to vehicle segments was from price increases while 60% was from volume increases. Reaching 2027 guidance cannot be reached from pricing growth alone and it's a good sign that, as of now, most growth in the vehicle segments is coming from volume.

Finally, while management's general positive tone regarding 2027 guidance is good to hear, their actions are speaking even louder. They have made big investments in plants all around the world in order to meet demand for new customer orders. From the Q1 earnings call, when answering a question regarding the status of these new plants, CEO Harold Bevis responded:

Yes, so Aldama, which is near Chihuahua, Mexico, is significantly ahead of schedule. We may get to open that one quarter early. And Morocco and [Ago Piata] are on schedule. Ago Piata is scheduled to produce Q4, and Morocco in Q3. And we have, they have to start up to, Joe, we have new wins for new vehicles that are ramping up both in Europe and in the United States that need our electrical systems inside of them. So we're on the clock. And we have backup plans in case some unforeseen action happens. But in the vehicle world, you have to do these things in a high quality manner. And PPAM is the term and pass quality regimens and we're on track and significantly ahead in Aldama.

I think unless they were confident about new customer wins going forward, they would not make these big investments given the economic uncertainty of the next 6-12 months.

On top of this, the CFO purchased 10,000 shares of the stock in March between $7 and $7.50 per share. While there haven't been any purchases at the current higher price, I think that these open market buys show some level of confidence in the 2027 guidance and the long term success of the business plan.

The current risk/reward in my bull and bear case scenarios implies 100% upside versus 30% downside which is usually a good bet to make. I am rating the stock as a buy with a $15 price target (weighted average of 60% of my bull case price target and 40% of my bear case price target).

Risks

The recent resignation of the former CEO, Harold Bevis, is something to be aware of. He was the CEO of Commercial Vehicle Group for 9 years but resigned to take the role as CEO of NN, Inc. (NNBR). While it's impossible to know the reason for this, one would think it would take a great opportunity to leave Commercial Vehicle Group if the 2027 guidance is attainable. Commercial Vehicle Group management did reiterate the 2027 guidance despite this resignation but the CEO search is something to keep an eye on.

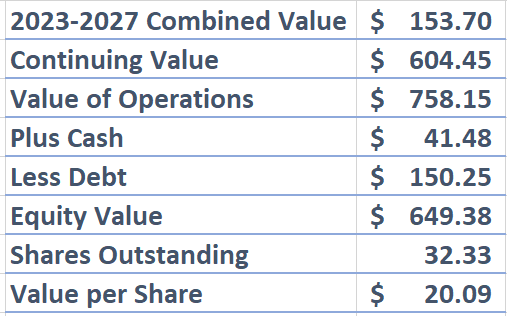

The business is also still tied to the Class 8 truck market, no matter the long term plans. This will make it very sensitive to even slight changes in U.S. GDP. If economic weakness hits, the business and stock could see a decline similar to that of 2016 and the bear case becomes much more likely to occur. However recent economic data is pointing to higher real GDP growth in the second half of 2023. In July, the Atlanta Fed's GDPNow real GDP estimate started to tick higher after falling in May and early June.

Atlanta Fed GDPNow Real GDP Estimate (Atlanta Fed)

Separate from the business risks, commercial Vehicle Group's stock is a small-cap stock. It is not too illiquid with about $4 million worth of volume traded per day, but it could have a large decline if a big shareholder sells or if there is sudden bad news. It may be best for risk-averse investors to make this a small position because of this potential volatility.

Final Thoughts

If Commercial Vehicle Group successfully achieves its 2027 guidance of $1.5 billion in revenue with a 9% EBITDA margin, the stock is currently undervalued by about 100% according to my estimates. This 2027 guidance is based on the successful transition towards relying more on selling parts for EV customers and less on selling parts for the production of Class 8 trucks. This is the long-term strategy however, and the business is still quite reliant on the Class 8 truck market which is very sensitive to changes in GDP.

In 2016 there was a slight deceleration in GDP growth which led to a 20%+ decline in Class 8 truck sales. Commercial Vehicle Group's stock dropped 80% from its peak in 2014 to its trough in 2016 because of this. If there is a deceleration in GDP growth over the next 6-12 months, the company will be hit hard and the likelihood of my bear case, which implies 30% downside, grows higher.

At the moment, I am currently placing more weight on the bull case as recent commentary, expansion into the Chinese electric vehicle market, and upwards revisions of 2H 2023 GDP estimates shows that there is positive momentum with the business transition. I am assigning the stock a buy rating and a $15 price target based on a 60% and a 40% weight on my bull case and bear case price targets, respectively.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CVGI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.