Western Union: 15% Upside Potential On Improving Transaction Trends

Summary

- Leading cross-border money movement company, Western Union, traded lower following the release of their Q2 results.

- Results showed a positive turn in transaction growth and promising trends in their retail unit.

- But outsized revenue contributions from their business in Iraq due to changes in the country's central bank policy heavily skewed overall results.

- While further progress is necessary in some areas, the company is showing that their current strategy is working.

- At current trading levels, I view shares as undervalued by at least 15%.

martinrlee

Western Union (NYSE:WU) is making headway in the all-important transaction metric. But they still have work to do on the revenue side of the equation. A lopsided benefit out of the Iraqi market that is likely to fade later in the year complicates an investor's assessment on the trajectory of transactions and revenues moving forward. WU accomplished enough in Q2, however, to show that their current strategy is working.

Western Union Q2 Earnings Summary

WU reported a beat on both revenue and earnings of +$120M and $0.12/share, respectively. At the topline, revenues grew 9% on a constant-currency basis due in part to transaction growth in their core business, but mostly because of significant tailwinds out of Iraq resulting from a change in their central bank policy earlier in the year.

At 21.8%, adjusted operating margins were down 150 basis points ("bps") YOY but up 130bps sequentially. Continued investments in the company's Evolve 2025 strategy partially contributed to the negative impact. But on the flip side, returns from the initiative enabled savings on marketing spend. In addition, WU realized additional net savings from their operating expense redeployment program.

Looking ahead, the higher revenues out of Iraq enabled an increase in the full-year adjusted revenue and EPS outlook. Adjusted revenue is now expected to be in the range of down 1% to up 1%, a 300bps improvement from their prior range. Expectations for adjusted operating margins were left unchanged at 19% to 21%. But EPS is expected to be up $0.10/share at the midpoint.

Market Reaction To WU Q2 Results

Shares rose over 4% immediately following the release in extended trading. But the gains were quickly shed on the day after. At the end of the trading day, shares closed lower by about 1.5%. This could have been attributable to the broader market sell-off, in which all three indexes ended the day in the red.

YTD, the stock still lags the broader markets, down nearly 13%. Losses over the past year are worse, at 27%.

Seeking Alpha - Basic Trading Data Of WU

WU is up 14.5% since my last update, where I rated shares as a "buy". But the S&P (SPY) is up by the same.

Though trading multiples have expanded since then, the stock still trades at just 5.8x trailing EBITDA. That's well below their five-year average of 6.5x. The forward earnings multiple also lags the five-year average by about three turns.

Key Takeaways From WU Q2 Results

Positive Transaction Growth

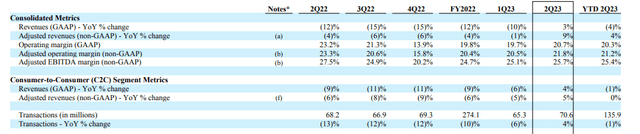

A persistent sore point for WU had been negative transaction growth. For the past eight quarters, for example, YOY transaction growth was negative. Q2 marked a new beginning, with positive consumer-to-consumer ("C2C") transaction growth of 4% or 2% when excluding the outsized impact from Iraq.

WU Q2FY23 Earnings Release - Summary Of Key Performance Metrics

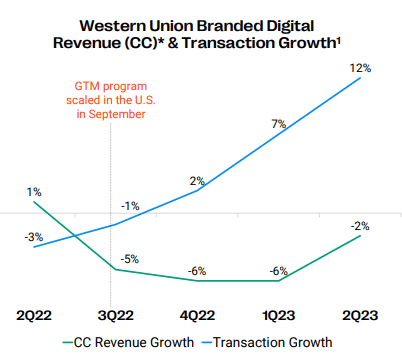

Driving the overall gain was 12% YOY growth in digital transactions. This follows 7% growth in the first quarter. The increase, however, didn't translate to revenue growth.

And that wasn't unexpected. In fact, the WU team viewed it as a healthier business trend than what had been reported in prior quarters. In Q2 of last year, for example, transactions were down 3%, but revenues were up 1%. This year, transactions were up 12%, with revenues down 2%.

WU Q2FY23 Investor Presentation - Graph Showing Revenue/Transaction Growth In Branded Digital

The growth in transactions resulting from digital strength and new customer additions is what CEO, Devin McGranahan, has consistently strived for. The belief is that if customers grow, then transactions will grow. Revenues may trail, as they did in Q2, but it, too, is expected to eventually grow.

In Q2, the vision was in play with positive transaction growth. It should be said too that the gains coincided with a 20% increase in new customers during the period. Ideally, investors would have preferred to see revenues cross through the positive mark this quarter, but I, nevertheless, expect a turn to the positive later this year or early next.

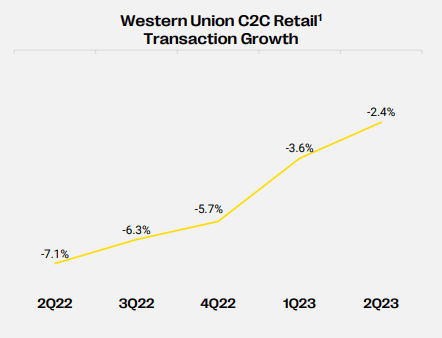

Improving Retail Trends

WU's retail business has been steadily improving. Given the size and dispersion of the business, recovery is expected to take more time. But over the past two quarters, it appears the recovery has accelerated. The business improved 210 basis points ("bps") from Q4 into Q1 and then another 120bps into Q2.

WU Q2FY23 Investor Presentation - Graph Showing C2C Retail Transaction Growth Since Q2FY22

Efforts to stabilize the business via their Evolve 2025 plan are evidently working. One aspect of the program is to improve customer engagement and retention. And several initiatives launched during the quarter appeared to produce the desired results, perhaps nowhere more than in the engagement of support staff.

Refund support calls, for example, were down 20% during the quarter. And overall agent support calls were also down 30%. This is despite increasing transaction volumes in recent months. Also, the percentage of refunds processed by their agents without call center support surpassed 50% of all refunds processed globally. That's up from in the mid-teens range previously.

The positive progress in these customer-focused metrics provides confidence that WU can return to positive transaction growth in the near-medium term.

The Iraq Uplift

Beginning in March 2023, WU experienced a significant uptick in business originating out of Iraq. This was attributable to a change in the Iraqi Central Bank's policy regarding how banks can move money out of the country. With WU not subject to those policies, customers that traditionally used banks switched over to remittance providers, such as WU.

On the U.S. side, the federal government recently announced measures impacting 14 Iraqi banks, some of which were WU's agents, according to company filings. This could ultimately drown out the positive impact in the coming months. Management acknowledged this as well in their conference call.

The uplift through Q2, however, has been significant, perhaps too significant. Total revenues were up 9% on a constant currency basis. But Iraq's contribution was a whopping 10%. WU beat revenue expectations by +$120M on +$1.17B in quarterly revenues.

But +$100M of that beat was attributable to the business in Iraq. If the tailwinds fade, is WU on course for disappointment in the back half of the year? It's a good question to consider and one that prospective investors should keep in mind.

Is WU Stock A Buy, Sell, Or Hold?

WU's business in Iraq contributed significantly to Q2 results. And this favorable contribution isn't expected to last, at least in its current form. This could weigh on WU's results in the back half of the year. Digital revenue growth also didn't cross into positive territory despite double-digit transaction growth. This, no doubt, disappointed investors.

But despite these considerations, I view the outlook as positive. While digital revenue growth was negative, it was 330bps improved from the start of the year. And looking ahead, I expect growth to reach the 0% mark later this year on double-digit transaction growth. In my view, growth parity between transactions/revenue on the digital side would be a significant milestone for WU since scaling off their go-to-market strategy last fall.

I also expect a full recovery of their retail business due to newly launched initiatives meant to improve their customer experience. Positive data surrounding customer support in Q2 served as evidence that these initiatives are working.

The likelihood of a complete stabilization in the retail business and the expectation for further growth on the digital side can support a reassessment of the stock's trading multiple. Over time, I see shares tracking back to a 6.5x EBITDA multiple. But for now, I see a 6.0x multiple as appropriate, given the improvements that still need to be made.

At an expected EBITDA target of 1.1B, shares would be fairly valued at about $14.30/share. Though this is above the consensus Wall Street price target, which stands at about $13.15/share, I believe it is attainable. At my estimated price, shares would have an implied upside potential of about 15%, excluding the returns from the dividend payout, which is currently yielding 7.5%. This provides confidence to maintain shares as a "buy."

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.