SGS: Currency Headwinds Hide Strong Underlying Performance, Buy On Weakness

Summary

- SGS is a leader in the TIC sector: Testing, Inspection & Certification space.

- The reported revenue increased slightly but hid the 8% revenue growth at constant currency.

- The stock is currently trading at about 24 times earnings and free cash flow but will likely never get really cheap due to its moat.

- Due to the low Implied Volatility ratio, the option premiums are pretty low, which may make writing an out-of-the-money put option difficult.

- Looking for a helping hand in the market? Members of European Small-Cap Ideas get exclusive ideas and guidance to navigate any climate. Learn More »

Manuel Milan

Introduction

SGS (OTCPK:SGSOF) (OTCPK:SGSOY) is one of the global leaders in the TIC industry (Testing, Inspection and Certification). As explained in my previous article, the company has a worldwide presence but Europe still accounts for almost half of the total revenue.

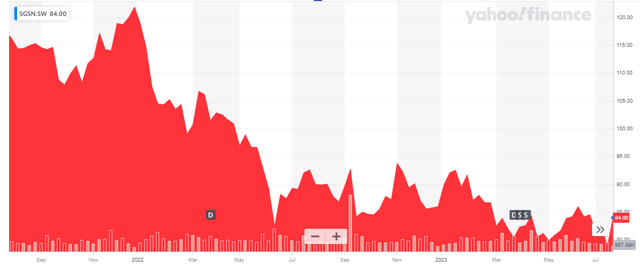

Yahoo Finance

SGS is a Swiss company and it shouldn’t come as a surprise its Swiss listing is more liquid than any of its secondary listings. The company is trading in Switzerland with SGSN as its ticker symbol and the average daily volume is approximately 360,000 shares (for a total monetary value of approximately 30M CHF per day). There are currently approximately 184M shares in circulation (this is adjusted for the recent 1:25 stock split where 1 share was split in 25 new shares), the market capitalization is approximately 15.5B CHF based on the current share price of around 84 CHF per share (which is approximately 5% higher than the share price when the previous article was written.

Nicely on track in the first half of this year

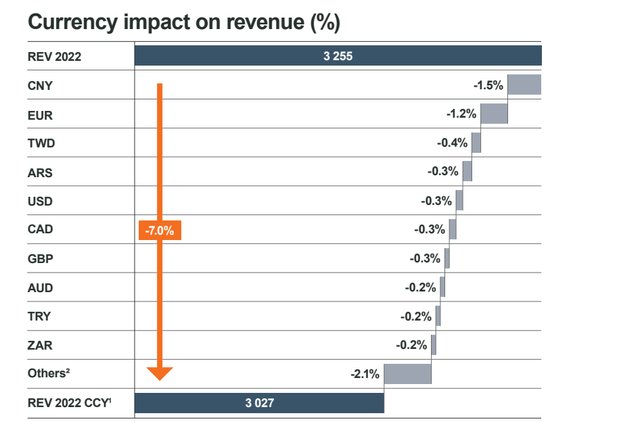

SGS’ underlying performance was actually pretty strong. Although the company reported a revenue increase of just under 1%, excluding the impact from FX changes, the revenue actually increased by 8.5% at a constant currency basis.

SGS Investor Relations

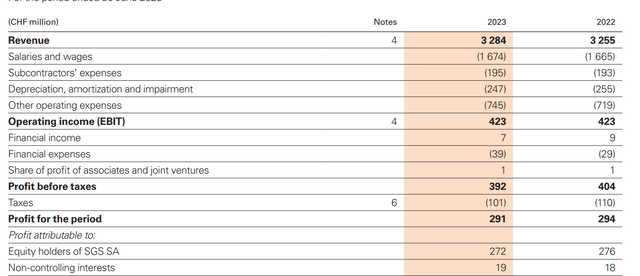

Looking at the reported numbers, the total revenue indeed increased to 3.28B CHF and fortunately for SGS, most of its operating expenses remained under control: the total amount of salaries increased by just 0.5% while the subcontractors’ expenses increased by just 1%. The main culprit is the ‘other operating expenses’ which are the only reason why SGS reported just a flat EBIT of 423M CHF. The company did not elaborate on what caused the increase in these other operating expenses but looking at what the main elements were in FY 2022 (consumables, travel expenses, rent expenses) it’s not difficult to imagine inflation played an important role there.

SGS Investor Relations

The pre-tax income decreased a little bit to 392M CHF on the back of a higher net finance expense of 32M CHF compared with 20M CHF in the first half of 2022. There was hardly any difference on the bottom line: the net income was 291M CHF of which 272M CHF was attributable to the shareholders of SGS. This represented an EPS of 1.47 CHF per share. That’s exactly the same result as in the first half of 2022 despite reporting a 1.5% lower net attributable income (expressed in Swiss Francs). That is obviously entirely related to the lower weighted average share count which decreased from 187M shares to 184M shares in the first half of this year.

In my previous article I also focused on SGS’ free cash flow profile to make sure the company wasn’t just posting paper profits but actually generated an attractive positive free cash flow result as well.

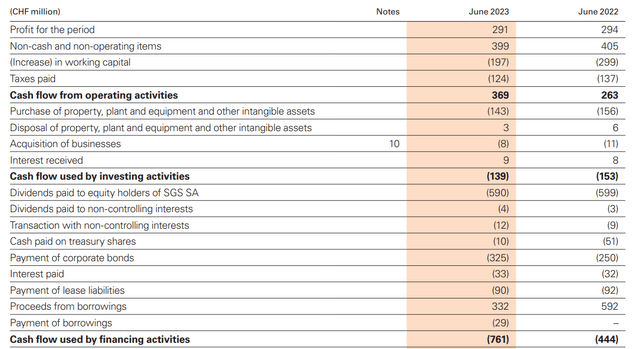

Looking at the cash flow statement below, you see SGS reported a total operating cash flow of 369M CHF. That’s okay but as you can see, this includes a 197M CHF investment in the working capital position and it includes 124M CHF in cash taxes although only 101M CHF was due based on the H1 income statement.

SGS Investor Relations

Additionally, we should deduct the 90M CHF in lease payments as well as the 33M CHF in interest payments and after making these corrections, the adjusted operating cash flow in H1 2023 was approximately 466M CHF and about 455M CHF (rounded) if we deduct a large portion of the net income attributable to minority interests and add the interest income as well.

The total free cash flow was approximately 313M CHF based on the 143M CHF capex result in the first half of the semester. Divided over the current share count of 184.3M shares, the free cash flow came in at approximately 1.70 CHF per share. That is in line with the reported free cash flow in H1 2022 (making the same adjustments).

The full-year guidance: a small hike but we may not notice the impact

The company has also reconfirmed the majority and actually slightly upgraded its full-year guidance. It now expects to generate a mid to high single digit revenue growth and improved operating margins (on a constant currency basis). This previously was a ‘mid single digit revenue growth’. While this is very encouraging, let’s not forget the important caveat here: the guidance is based on a constant currency basis and the reported revenue may be weaker than what the guidance may make you think.

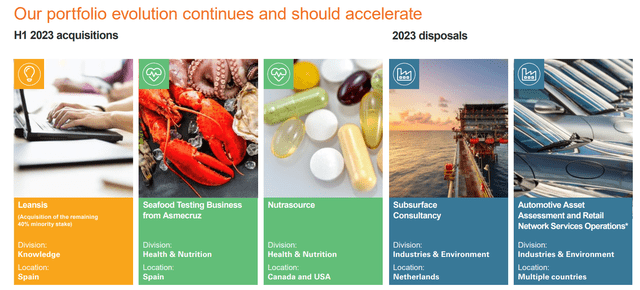

The company is also active on the M&A front but seeing how there was a net investment of just 8M CHF on acquiring new businesses, I don’t think we should expect a noticeable impact from the acquisitions (and disposals).

SGS Investor Relations

Investment thesis

In my previous article I mentioned I was pleasantly surprised by SGS’ financial performance. The full-year free cash flow result came in at 3.30 CHF per share in FY 2022 and I was hoping to see 3.50 per share in 2023. While the FX fluctuations may have a negative impact on the reported results, it looks like the company is well ahead of my target on an underlying basis (and assuming constant currency).

I have been waiting for SGS to get a little bit cheaper but it’s increasingly looking like a story where quality has a price and SGS will likely never get really cheap. I am considering writing one (or some) out of the money put options but the low Implied Volatility levels also doesn’t help the option premiums. For a P76 expiring in December, the option premium is only 1 CHF. Still better than nothing but hardly anything to get excited about.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.