Mobileye Earnings: Making A U-Turn (Rating Downgrade)

Summary

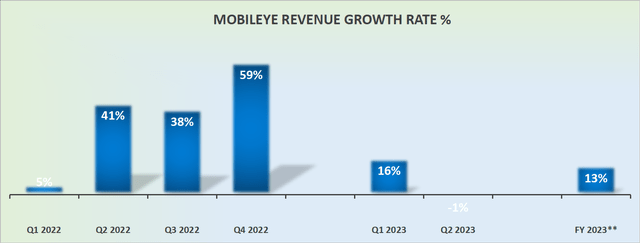

- I am downgrading Mobileye to a hold position due to its lackluster Q2 2023 results and unimpressive growth rates.

- Mobileye is a leader in autonomous driving solutions and a pioneer of advanced driver assistance systems (ADAS).

- Despite its rock-solid balance sheet and strong relationships with large OEMs, the stock is now priced at 38x next year's cash flows, which seems too rich.

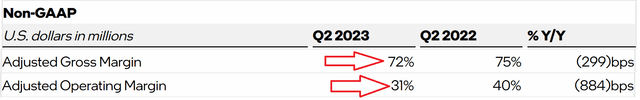

- Mobileye's revenue growth rates are struggling to gain traction, and its profitability is facing challenges as well, with adjusted gross margins compressing by 300 basis points y/y.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

NicolasMcComber/iStock via Getty Images

Investment Thesis

Mobileye (NASDAQ:MBLY) negatively surprised investors with its lackluster Q2 2023 results that saw its share price slide slightly. Arguably the most negative consideration here is that Mobileye's compelling growth rates have essentially fizzled out.

And given its unimpressive growth rates together with compressing profit margins, I no longer believe this stock is worthy of a premium multiple.

More specifically, according to my best-case estimates, this stock is now priced at 38x next year's cash flows. Too rich for what's on offer here. Even if there are some positive nuggets, such as its rock-solid balance sheet, with no debt.

Altogether, I'm downgrading this stock to a hold.

Why Mobileye? Why Now?

Mobileye is an autonomous driving solutions company. It is the pioneer behind the widely adopted advanced driver assistance systems ("ADAS").

Mobileye's comprehensive suite of purpose-built software and hardware technologies enables them to make significant advancements in ADAS and autonomous driving.

As Mobileye continues to innovate and expand its product offerings, Mobileye aims to make the mass deployment of autonomous driving solutions across different auto companies. Here's a quote from Mobileye's Q2 2023 results that echoes that insight:

Future business highlights of the quarter included tangible evidence of the depth of our relationship with VW Group and an expansion of meaningful engagements for our advanced portfolio to 9 large OEMs. VW Group's engagement across our entire product portfolio is quite encouraging as it underlines the scalability and flexibility of Mobileye's technology platform

Indeed, the whole value proposition of Mobileye is that they have a broad offering of products and that auto companies can adopt a range of products from their portfolio. However, that vision doesn't appear to be translating into strong execution.

Revenue Growth Rates Are Struggling to Gain Traction

Mobileye has a mightily compelling narrative. But a compelling narrative can only take a company so far. After a while, investors start to ask for the fundamentals to back up the rhetoric.

And on this front, I now believe that Mobileye is struggling. Not only due to the most obvious consideration that Q2 2023 delivered negative y/y revenue growth rates. Although that sort of growth rate is clearly misaligned with a company that describes itself as a fast-growing and leading ADAS system company.

But looking further ahead, Mobileye's upward revised guidance approximates a decimal point increase. Meaning that, with more viability into the whole of 2023, Mobileye hasn't got much in the way of positive news to materially upgrade its full-year revenue outlook.

And this poses a problem when it comes to its valuation.

Profitability Struggling to Come Through

In my previous analysis, I said,

Mobileye continues to remind investors that, in 2024, the business could see substantial operating leverage.

[...] If we roughly assume that this year, Mobileye Global reports approximately $800 million in cash flows from operations, this leaves the stock priced at 41x forward its cash flows from operations.

While this is clearly a lot cheaper than it was a few weeks ago, the fact remains, this is not the cheapest multiple going amongst tech companies.

With the benefit of yet another quarter's results, I can see that my analysis above was woefully optimistic. We are halfway through 2023, and rather than Mobileye being on target to reach $800 million, Mobileye's H1 2023 cash flows reached approximately $200 million.

A more realistic estimate for Mobileye's cash flows from operations now points to approximately $500 million in the best-case scenario.

Or put in other words, even if Mobileye finds some way to reignite its prospects and substantially increase its cash flows, I now no longer believe that Mobileye could reach $800 million of operating cash flows either this year or perhaps even in 2024.

Why did I change my mind? What made me so aggressively downgrade my estimate?

Consider this, Mobileye's adjusted gross margins have compressed by 300 basis points y/y. This shows how much Mobileye is having to sacrifice in terms of margin to deliver strong revenue growth rates.

But then recall that even then, the growth rates in the current quarter were less than alluring.

All in all, I'm now thinking that if we were to make an aggressive estimate for Mobileye and presume that it did in actuality reach $800 million of cash flows next year, this would leave the stock priced at 38x next year's cash flows.

However, the critical difference now is that I'm significantly more aware that this is in fact an aggressive estimate. And furthermore, a company that is growing at less than 20% CAGR on the top line, as Mobileye clearly is, doesn't deserve a premium valuation multiple.

The Bottom Line

I am downgrading Mobileye to a hold due to its lackluster Q2 2023 results and unimpressive growth rates.

The company, a leader in autonomous driving solutions and a pioneer of advanced driver assistance systems (ADAS), has seen its growth rates fizzle out, and its profit margins are compressing.

Despite its rock-solid balance sheet and strong relationships with large OEMs like VW Group, the stock is now priced at 38x next year's cash flows, which seems too rich for what it currently offers.

Mobileye's revenue growth rates are struggling to gain traction, and its profitability is facing challenges as well, with adjusted gross margins compressing by 300 basis points y/y.

While there were hopes of substantial operating leverage in 2024, the reality is that its H1 2023 cash flows reached only around $200 million, significantly lower than previously anticipated.

The company's growth rate on the top line is below 20% CAGR, leading to the conclusion that it doesn't warrant a premium valuation multiple.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

Our Investment Group is focused on value investing as part of the Great Energy Transition. For example, did you know that AI uses thousands of megawatt hours for even small computing tasks? Join our Investment Group and invest in stocks that participate in this future growth trend.

I provide regular updates to our stock picks. Plus we hold a weekly webinar and a hand-holding service for new and experienced investors. Further, Deep Value Returns has an active, vibrant, and kind community. Join our lively community!

We are focused on the confluence of the Decarbonization of energy, Digitalization with AI, and Deglobalization.

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

DEEP VALUE RETURNS: The only Investment Group with real performance. I provide a hand-holding service. Plus regular stock updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.