Dow: Challenging Q3, Buy Reiterated

Summary

- Despite a challenging quarter and lower volumes, Dow Inc's Q2 EBITDA was positive. Lower debt and a solid remuneration policy offer downside protection.

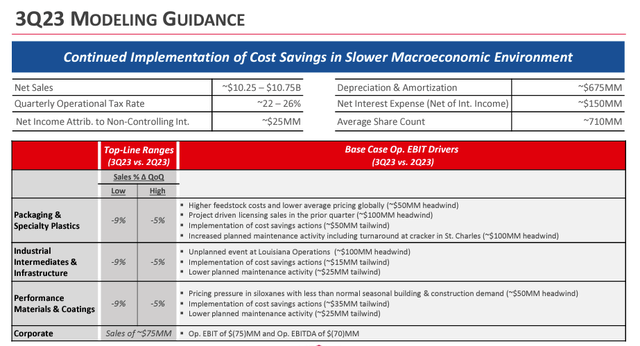

- Dow is guiding a Q3 EBITDA level of approximately $1.3 billion, anticipating chemical spread contraction in H2.

- With lower-than-expected Q3 EBITDA estimates, we maintained our buy rating. This is due to a superior asset mix and a positive view of 2024 volumes combined with cost-saving initiatives.

jetcityimage

Yesterday, Dow Inc released its quarterly update (NYSE:DOW). Here at the Lab, we have a long-standing buy rating on the chemical player, and looking back to our "Comments On 2022 Q2," our buy was supported by 1) a new revenue recognition model and "the economy of scale disruption." For now, we entered an economic slowdown with expectations of lower company earnings. In our analysis, additional polyethylene and methylene diphenyl isocyanate industrial capacity will pressure Dow's selling price and profitability. As reported in Q1, "While we are worried about 2023 demand (and we are pricing Dow below Wall Street consensus estimates), we are confident that the risk/reward is skewed on the upside for 2024+."

Q2 Results

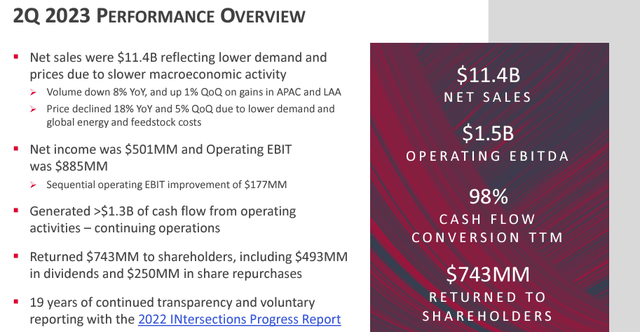

After analyzing Dow Q2 results and Q3 expectations, we can say that the company will face a more challenging quarter. Therefore, our 2023 view on lower demand and profitability pressure was correct. Despite that, Dow Q2 EBITDA was very much in line with consensus expectations. In number, the company reported an EBITDA of $1.53 billion, with average Wall Street analyst estimates at $1.52 billion. Looking one year back, Q2 2023 EBITDA is down by approximately 50% and up by 13% on a quarterly basis.

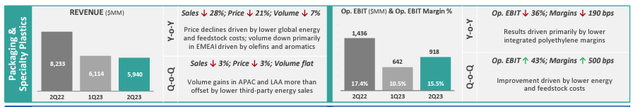

Cross-checking estimates, the packaging division was a positive outlier for almost $160 million. This was supported by higher profitability thanks to lower energy costs. Within the segment, as expected, polyethylene results were a minus (Fig 1). In detail, quoting the company: "Results driven primarily by lower integrated polyethylene margins." Industrial Intermediates were also weaker than anticipated, with a quarterly negative performance of 63%. The company reported weakness in siloxane pricing. Perf. Materials & Coatings was also down on higher maintenance costs and price.

Performance Materials & Coatings performance division

Looking at the aggregate level, volume decreased by 8% but was up by 1% quarterly. The negative performer was the EU area, partially offset by gains in LatAM and APAC. Compared to last year, prices declined by 18% and 5% sequentially. This negative outcome was recorded in all operating segments and geographical areas. This is due to the client's lower demand. A negative contributor was the Sadara JV which recorded losses of $57 million versus equity earnings of $195 million last year.

Changes in Estimates

Dow is guiding a Q3 EBITDA level of ~$1.3 billion, below consensus by 18%. Ind. Intermediates & Infrastructure is forecasted to have headwinds for $200 million due to higher maintenance costs, planned maintenance, and lower sales. On the polyethylene-related business, we again anticipate chemical spread contraction and a negative impact on H2 margins. At the same time, we expect an improvement in the PMC earnings with higher volume in Q3 (quarterly seasonality will also help).

To support our buy rating investment thesis, we should report the following:

- Dow cash flow from operations reached $1.3 billion in the quarter, with a conversion of 98% in the past year;

- In Q2, the company returned to shareholders $743 million. This includes a quarterly dividend payment of $493 million and $250 million in buyback and is our downside protection;

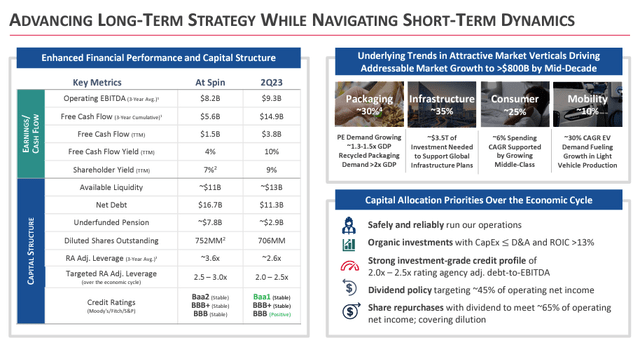

- There are no significant debt maturities until 2027 with fixed interest payments (and no P&L volatility after the EBITDA margin). In addition, pension unfounded is not anymore a concern;

- There is a cost savings initiative for $1 billion that, according to the CEO, is on track. The CEO reported, "The actions we outlined in January are on track to deliver $1 billion of cost savings this year, and we continue to benefit from the solid financial position and focus on cash flow generation we have demonstrated since Spin."

Conclusion and Valuation

In Q1, we increased our target price from $52 to $60 per share. Following lower-than-expected Q3 EBITDA estimates, we should slightly decrease our target price, still maintaining a buy rating. However, this is not the case. Dow has a superior asset MIX compared to peers with best-in-class feedstock availability. We should also mention a solid balance sheet with a tasty quarterly dividend per share payment. After the Spin, Dow became a more profitable company with lower leverage, which is not very well priced by the market. This is not justified. Our last analysis shows a $60 valuation using a multiple of 5.5x; however, Dow EV/EBITDA has always been around 6.5x. This is the reason why we are providing an overweight valuation. Downside risks include 1) additional capacity expansion from competitors, 2) prolonged low-margin with compressed price, and 3) lower product demand in the EU.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.