Tredegar: Dividend Will Likely Be Canceled, But Risk-Tolerant Investors Should Eventually Be Rewarded For Patience

Summary

- Sales are declining as customers are emptying their inventories.

- Decreased volumes and inflationary pressures are causing a squeeze in profit margins, but recent price raises are having a positive impact.

- Interest expenses are skyrocketing due to increasing long-term debt and higher interest rates.

- The dividend will likely be canceled very soon.

- This represents a good opportunity for long-term, risk-tolerant investors with enough patience to wait for significant improvements in the company's prospects.

kynny/iStock via Getty Images

Investment thesis

Shareholders of Tredegar Corporation (NYSE:TG) have more than enough reasons to be disappointed with its performance since the beginning of the coronavirus pandemic crisis back in 2020. After an 8.60% decline in sales in 2020 and a severe contraction of EBITDA margins, it seemed that the situation was starting to improve in 2021 and 2022 as the company managed to recover lost sales while profit margins were boosted by the reopening of the world's economies and higher aluminum extrusion prices. But now, sales are falling again as a consequence of weaker demand and high customer inventories as the company is reporting order cancellations, and a further contraction in profit margins as a consequence of lower volumes, lower aluminum prices, and high production and labor costs is worrying investors as these headwinds have arrived at a time when higher interest rates and a higher debt load is causing significant increases in annual interest expenses.

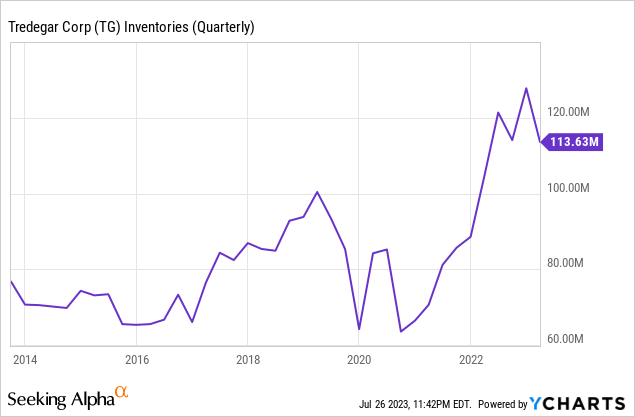

Looking back, it appears that the special dividend announced in 2020, which cost the company around $200 million, was too high, and the company is now paying interest expenses for that decision as long-term debt keeps increasing. In addition, inventories do not stop accumulating as customers are starting to cancel orders as demand is weakening and their inventories are still high.

Now, investors are worried as CEO John M. Steitz recently stated that the dividend may be canceled in the near future in order to preserve cash as the debt pile is reaching worrying heights, but in my opinion, this decision should help the company navigate current headwinds as gross profit and EBITDA margins are showing strong signs of recovery boosted by recent product price raises, and the company should eventually be able to convert some of its inventories into actual cash as customer inventories drop to healthier levels. Therefore, I consider that the 45.80% decline in the share price from 52-week highs (and 68.77% from decade-highs) represents a good opportunity for long-term, risk-tolerant investors with enough patience to wait for the macroeconomic context to offer better prospects for Tredegar.

A brief overview of the company

Tredegar Corporation is a global manufacturer of aluminum extrusions, polyethylene plastic films, and polyester films with a strong cyclical nature, so investors should carefully assess the company's situation before investing. The company was founded in 1955, its market cap currently stands at $237 million, and 24.61% of the total number of shares outstanding are owned by insiders.

Tredegar Corporation (Tredegar.com)

The company operates under three main business segments: Aluminum Extrusions, PE Films, and Flexible Packaging Films. Under the Aluminum Extrusions segment, which generated 71% of the company's total revenues in 2022, the company manufactures soft and medium-strength alloyed aluminum extrusions for a wide range of industries, including construction, automotive, consumer goods, machinery and equipment, electrical and renewable energy, and distribution. Under the PE Films segment, which generated 11% of the company's total net sales in 2022, the company manufactures surface protection films, polyethylene overwrap films, and films for other markets, including consumer technology (televisions, monitors, notebooks, etc.), digital signage, and others. And under the Flexible Packaging Films segment, which generated 19% of the company's total net sales in 2022, the company manufactures PET-based films for packaging applications.

Tredegar Corporation share price (Seeking Alpha)

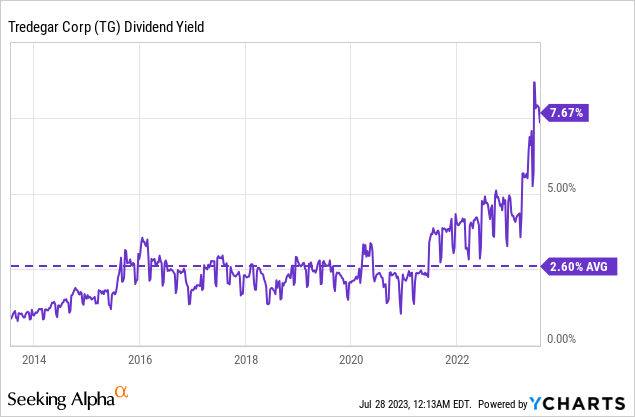

Currently, shares are trading at $6.78, which represents a 45.80% decline from 52-week highs of $12.51, and a 68.77% decline from decade-highs of $21.71 reached on August 1, 2013. Undoubtedly, this is a very significant drop in the share price that reflects strong pessimism among investors, which has left a potential dividend yield on cost above 7% for the more risk-tolerant and patient investors, and I say potential as weakening demand, margin contraction, and increasing interest expenses are generating a lot of pressure to the dividend, which will likely (and should) be canceled imminently as the CEO stated in the first quarter of 2023 earnings report.

Revenues are depressed due to weak demand and high customer inventory

After suffering a decline of 8.60% in revenues in 2020 as a consequence of the coronavirus pandemic crisis, they partially recovered in 2021 as they increased by 9.42%, but weak demand and customer destocking recently started to negatively impact revenues again as they declined by 14.41% year over year during the fourth quarter of 2022, and by 19.21% (also year over year) during the first quarter of 2023 despite a sequential increase of 1%, and the management has no clue as for the timing of a potential recovery.

Tredegar Corporation quarterly revenues (Seeking Alpha)

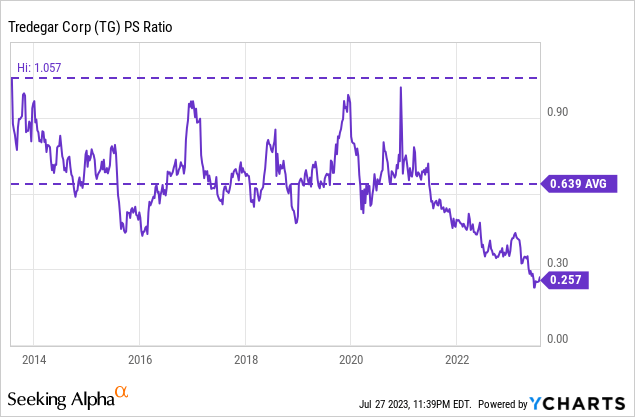

In this sense, sales should gradually stabilize as customers empty their inventories, but a potential recession as a consequence of recent interest rate hikes in order to control the currently high inflation rates represent a serious risk for the company's operations as demand could remain weak for a few more quarters. This is causing serious pessimism among shareholders as the P/S ratio significantly declined (despite significant revenue declines) to 0.257, which means the company is currently generating a whopping $3.89 in revenues for each dollar held in shares by investors, annually.

This ratio is 59.78% below the average of the past 10 years and represents a 75.69% decline from decade-highs of 1.057 reached in late 2013, which reflects strong pessimism among investors, in my opinion, due to four main reasons. First, due to the recent decrease in revenues as a consequence of weakening demand and high customer inventories. Second, due to an ongoing contraction in profit margins caused by declining volumes, increased production costs, and lower aluminum extrusion prices. Third, due to a recent surge in interest expenses due to higher debt levels and interest rates. And fourth, due to increasing concerns of a potential recession as a consequence of recent interest rate hikes. Of course, the imminent dividend cancelation is also keeping dividend investors on the sidelines.

Margins are starting to improve boosted by price raises

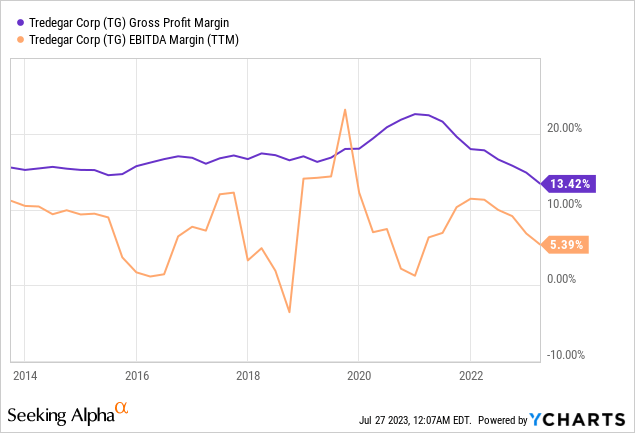

Despite the company's strong cyclical component, it has generally managed to report positive gross profit and EBITDA margins over the years, although these have historically been subject to significant volatility. After a significant decline during the coronavirus pandemic in 2020, the EBITDA margin improved in 2021 as coronavirus-related restrictions were lifted worldwide, which caused a surge in demand and higher aluminum extrusion prices, but higher labor costs, lower labor productivity (due to unabsorbed labor from weaker volumes), inflationary pressures, and higher transportation costs are currently having a significant impact on profit margins. In this regard, the trailing twelve months' gross profit margin currently stands at 13.42%, and the EBITDA margin is at 5.39%. Still, I believe the current margin contraction is of a temporary nature due to the direct link between current headwinds and the macroeconomic landscape.

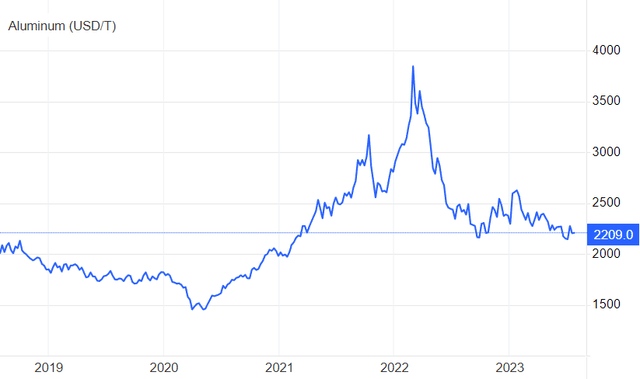

Sequentially, the gross profit margin increased to 13.37% during the first quarter of 2023 (from 10.93% during the fourth quarter of 2022), and the EBITDA margin to 4.43% (from 0.94% during the fourth quarter of 2022) as the company has recently raised the price of its products to cover higher operating costs due to inflationary pressures, but these margins are still significantly lower than in the 2021-2022 period as volumes declined by 12.7% year over year during the first quarter of 2023 in the Aluminum Extrusions segment, and orders of $27 million pounds during the quarter are significantly lower than the 41 million pounds orders reported at the end of 2022 as high customer inventory levels and weak demand expectations have caused order cancellations in the beginning of 2023. Volumes also decreased year over year in the PE Films segment, and the price of aluminum has stabilized at prices below those of 2021 and 2022.

Aluminum Commodity Price (Tradingeconomics.com/commodity/aluminum)

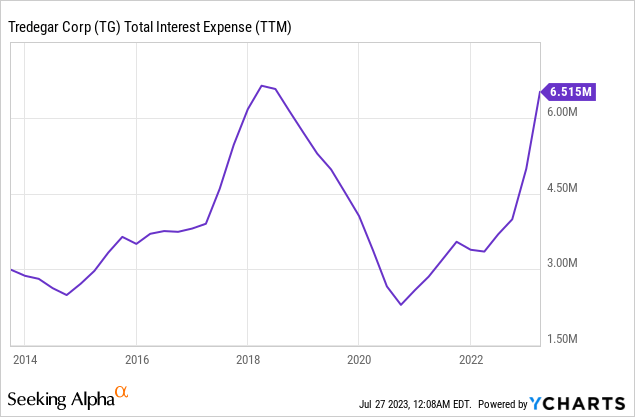

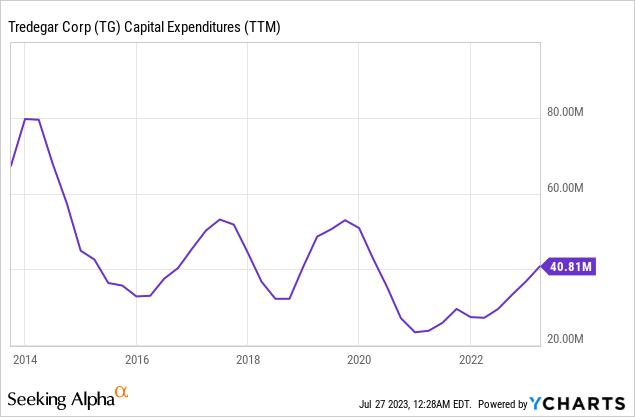

In this sense, the company is not expected to enjoy a new margin boost caused by an increase in the price of aluminum extrusions. Rather, the maintenance of sufficiently healthy profit margins now depends on the recent product price increases and on stable aluminum prices. Even so, the recent increases in debt levels and interest rates have produced a large increase in interest expenses, so it will be very important to determine how the current improvement in margins has affected cash from operations and if this is enough to cover current CAPEX and, above all, growing interest expenses.

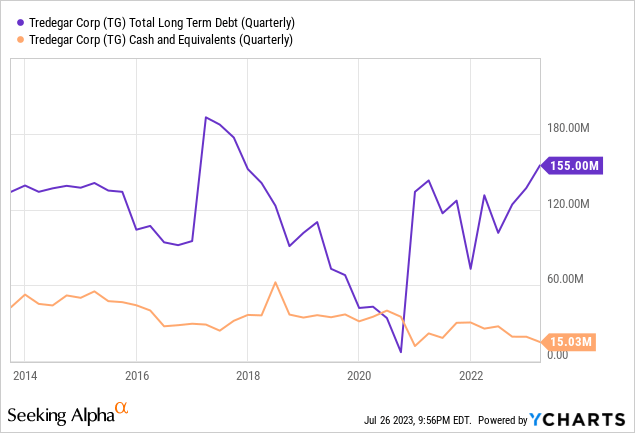

Increasing interest expenses is a reason for concern

Despite the fact that the company managed to reduce debt levels to almost zero in 2020, long-term debt recently increased to $155 million as the company declared a special dividend of $200 million, or $5.97 per share, in December 2020 following the divestiture of its Personal Care Films business segment, and cash and equivalents is very low at $15.03 million as the company remains unprofitable (in terms of cash from operations). Net debt (long-term debt minus cash and equivalents) has also increased as the company has reported negative cash from operations after capital expenditures and dividends during the last three quarters as inventories increased to unusually high levels due to customer destocking dynamics.

In this regard, the company's inventory levels almost doubled from 2020 to the present to $114 million as customers are emptying their inventories, so the conversion of said inventories into actual cash is expected to take some time before materializing as the short and medium term is very uncertain given the current complex macroeconomic context marked by raw material volatility and recessionary risks caused by interest rate hikes. Also, the management should eventually cut production capacity to make use of these inventories, which is easier said than done.

In short, the company is borrowing cash to fill its inventories with products that it is not capable of selling at a rate higher than the rate of production, which is why they are accumulating. This poses a serious problem for Tredegar as increasing debt and rising interest rates are causing interest expenses to rise to worrying heights as trailing twelve months' total interest expenses currently stand at $6.52 million. Furthermore, interest expenses reached $2.31 million during the first quarter of 2023, which means the company will pay over $9 million in interest expenses for the whole of 2023.

Given this scenario, the solution currently being considered by the management is the cancellation of the dividend as trailing twelve months' dividends paid stood at $17.3 million during the first quarter of 2023, so forgoing the dividend would save enough cash to offset the increased interest expenses (in exchange, of course, for short and medium term shareholder pain).

The dividend is at (very) high risk of being canceled

Tredegar paid a quarterly dividend of $0.04 from 1998 to 2010, but the dividend has more than tripled since then as it currently stands at $0.13 per share and quarter. If we add to this the recent drop in the share price to $6.78, we currently have a dividend yield of 7.67%, which is around three times the average of the past 10 years.

Although such a high dividend yield sounds very appealing, it actually is at (very) high risk of being imminently canceled as interest expenses derived from the recent surge in long-term debt caused by the special dividend of $200 million declared in December 2020, coupled by weakening demand and margin contraction is putting too much pressure on it. In this regard, this is what the CEO stated during the last earnings report.

If a recovery in our businesses and markets doesn't occur early in the third quarter and we are unable to get our working capital to normal operating levels, we may also need to take action to reduce or suspend our current quarterly dividend of 13 cents per share as an additional measure to help control our financial leverage.

CEO John M. Steitz - Q1 2023 Earnings Report

This is why I consider the current dividend yield as a potential high dividend yield on cost in the long term, but not a reliable dividend stream in the short and medium term. In this regard, the dividend was actually sustainable before the current headwinds as the cash payout ratio was low in 2021, which means the dividend has the potential to be reinstated in the long run.

| Period | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 |

| Cash from operations (TTM by quarter) | $69.2 | $79.8 | $59.5 | $70.6 | $6.0 | $19.6 | -$4.1 | -$20.8 | $24.8 |

| Dividends paid (TTM by quarter) | $16.1 | $16.1 | $16.1 | $16.2 | $16.2 | $16.2 | $16.6 | $17.0 | $17.3 |

| Interest expense (TTM by quarter) | $2.9 | $3.2 | $3.5 | $3.4 | $3.4 | $3.7 | $4.0 | $5.0 | $6.5 |

| Cash payout ratio | 27.46% | 24.19% | 32.94% | 27.76% | 326.67% | 101.53% | - | - | 95.97% |

But as one can see, the dividend is currently unsustainable as the trailing twelve months' cash payout ratio reached 327% during the first quarter of 2022 and, although it improved in the second quarter, negative cash from operations during the third and fourth quarters made the dividend unsustainable. In addition, we must not forget that the company must cover annual capital expenditures of around $40 million as the company is currently implementing new enterprise resource planning and manufacturing execution systems, as well as upgrading the facilities located in Niles, Michigan, Carthage, Tennessee, and Newnan, Georgia.

Regarding the impact of recent margin improvement in cash from operations, the company reported cash from operations of -$9.1 million during the first quarter of 2023, inventories declined by $14.2 million, and accounts receivable declined by $5.5 million (although accounts payable also declined by $22.6 million), and the company reported a negative net income of -$1.0 million (vs. -$3.9 million during the fourth quarter of 2022) and a levered free cash flow of -$25.8 million (vs. -$14.8 million during the fourth quarter of 2022), which reflects the company's urge to cancel the dividend and preserve as much cash as possible until demand stabilizes once customers reduce their inventories. In this regard, the company is currently unprofitable and depends on the improvements in the macroeconomic landscape (and, especially, on the eventual emptying of its customers' inventories) and the conversion of its inventories into actual cash in order to deleverage its balance sheet and become again a sustainable company in the long run.

Risks worth mentioning

As expected, a 68.77% decline in the share price from decade-highs is accompanied by significant risks regarding the future of the company, and below I would like to highlight those risks that I believe investors should closely monitor.

- At this point, the wisest decision the management could make is to cancel the dividend outright in order to preserve as much cash as possible given the impact that customer destocking and increasing production costs are having on the company's operations and, in fact, this will most likely take place imminently. Therefore, the main risk that I think investors should consider is the cancellation of the dividend (although if this happens the overall risk of the investment would be significantly reduced).

- If inflation rates remain high, ongoing product price raises could not be enough to offset increasing production costs, which would put further pressure on the company's margins.

- Recent interest rate hikes to alleviate high inflation rates could cause a recession, which could cause a further reduction in demand. This would cause not only a further decline in revenues, but also a further contraction in profit margins due to even more unabsorbed labor derived from lower volumes.

- A further decline in the price of aluminum extrusions could cause a further decline in profit margins.

- If the company fails to draw on its inventories soon, cash from operations could continue in negative territory for more quarters, which could lead to a further increase in long-term debt and put even more pressure on the company's operations due to even higher interest expenses.

Conclusion

Personally, I believe that the recent fall in the price of Tredegar's shares is actually justified since the situation does not look easy in the short, medium, and long term. The company does not stop accumulating inventories as customer inventories remain high, and the recent cancellation of orders during the first quarter of 2023 suggests that they will remain high for some more quarters. This is a serious problem for the company as increasing long-term debt is causing a significant increase in interest expenses due to increased interest rates.

Still, I think it's important to remember that the company is highly cyclical, so once customer inventories are reduced to healthier levels, volumes should pick up again. In addition, ongoing price raises have started to show a positive impact on gross profit and EBITDA margins as they showed strong signs of recovery in the first quarter of 2023. Furthermore (and this is very important), the company is used to paying a dividend almost twice as high as current interest expenses, so a full cancellation of the dividend would actually be good news for shareholders as it would make the company viable in a normal macroeconomic scenario, which means current headwinds would be the main obstacle to the potential turnaround, and these headwinds are, in my opinion, of a temporary nature due to their direct link to the current macroeconomic landscape (inflationary pressures, labor inflation, increased transportation costs, weakening demand, and increased interest rates). In this regard, the imminent (almost likely) cancelation of the dividend would mean that the management has preferred to adopt a conservative stance in order to preserve the company's long-term viability in exchange for short and medium-term shareholder pain. For this reason, I believe that the recent share price decline represents a good opportunity for risk-tolerant investors with enough patience to wait for the situation to improve for Tredegar.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.