Weis Markets Has A Negative Risk Premium: Avoid

Summary

- I advise against investing in Weis Markets at current prices due to a negative risk premium and alternatives to buying stocks like this one.

- Despite a 3.7% increase in revenue in the first 13 weeks of the year, operating income and net income dropped by 21.2% and 17.8% respectively due to cost of sales increases.

- I believe the company's dividend is secure, with a payout ratio of around 35% and a solid capital structure, but the current valuation is still too high for investment.

Meredith Heil

When I last wrote about Weis Markets Inc. (NYSE:WMK), I beat myself up because I had taken profits too early. I whined about making "only" an 18.5% gain on my investment, and I whined about the fact that I had missed out on a subsequent 32% uptick in the share price. It seems that I forgot one of my more common quips, namely that what the market giveth, the market taketh awayeth. Since I sold my shares way back in December of 2021, they're now up only about 6.6% against a flat S&P 500. It seems that caution didn't cost me as much as I originally worried it did, because since I last wrote about the stock, the shares are down about 23% against a gain of 14.4%. So, investors who saw their wealth climb, and held on, watched as the shares fell back to Earth. This is what a "buy and hold" strategy can get you sometimes.

Anyway, I've obviously enjoyed owning these shares in the past, and the company has reported earnings since I last reviewed the business, so I thought I'd check back to see if it makes sense to buy or not. I'll make that determination by looking at the latest financial results as well as by looking at the valuation.

We're all busy people, and because of that fact, I try to offer my readers time saving tricks. I do this because I'm absolutely obsessed with trying to make your lives as pleasant as possible. You're welcome. I'm going to continue to avoid Weis Markets at current prices. While I think the business is sound, and I think the dividend is very well covered, the valuation makes no sense to me. When I bought shares in March of 2021, the shares sported a positive risk premium, because there was risk associated with stock investing that simply doesn't exist with government debt. Today the risk premium is negative, and there very much are alternatives to buying stocks like this one. We're not in the business of seeking "returns." We're here trying to find "risk adjusted returns", and in my view, any potential returns here aren't justified by the risks.

Financial Snapshot

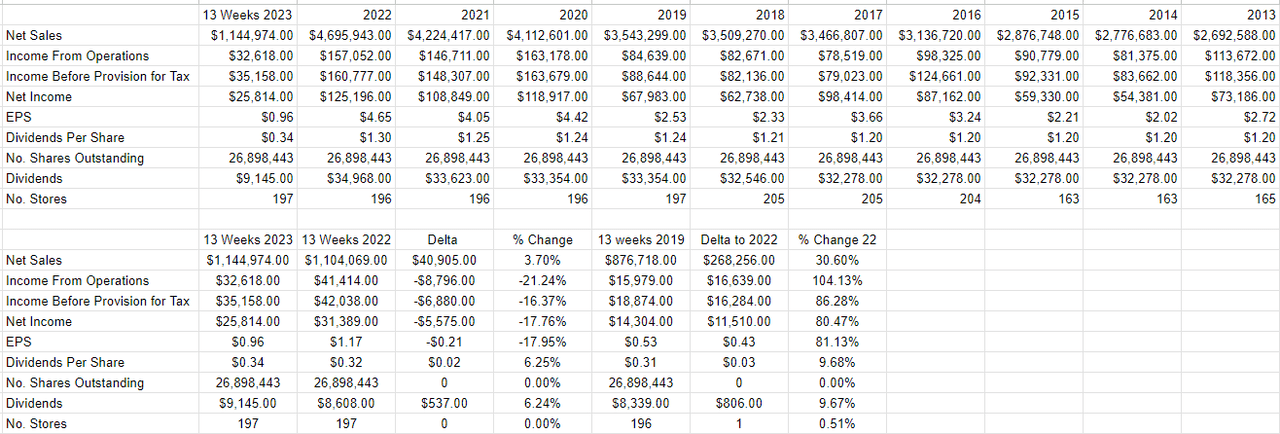

I'd say that the most recent financial results were pretty soft. Although the first 13 weeks of the year saw revenue up about 3.7% relative to the same period a year ago, operating income and net income were both dramatically, by 21.2% and 17.8% respectively. This drop wasn't caused by some one-off event, it was largely a function of the fact that cost of sales increases outstripped revenue increases. That written, I need to acknowledge that 2022 was a banner year for the firm, with revenue up fully 11% from the prior period. Thus, any comparisons to that year will be challenging. To be fair, when we compare the most recent quarter to the same period in 2019, the most recent results look spectacular. For instance, revenue, operating income, and net income in Q1 2023 were higher by about 30%, 104%, and 80.5% respectively. So, the first quarter of 2023 shows some slowing, but it was still a reasonably healthy quarter in my view.

Additionally, I think the dividend is reasonably well covered, as evidenced by the fact that the payout ratio is sitting around 35%. Additionally, the company has one of the most solid capital structures I've seen with virtually no debt, and cash and marketable securities on the books of about $327.8 million, which represents a little over 9 years of annual dividend payments. Thus, the dividend is secure, in my view, and thus I'd be willing to buy this potentially growing cash cow at the right price.

Weis Markets Financials (Weis Markets investor relations)

The Stock

An investor's future return is a function of the price paid for a series of future cash flows. The more we pay for $1 of future earnings or dividends, the lower will be subsequent returns. This is as iron clad a "law" of investing as I know. For that reason, I'm loathe to overpay for an asset. My skittishness sometimes costs me gains, but as we saw with Weis Markets after my most recent article, gains can sometimes be ephemeral. I am not willing to overpay for the future profits of a business, which is why I insist on only ever buying stocks when they're sufficiently cheap.

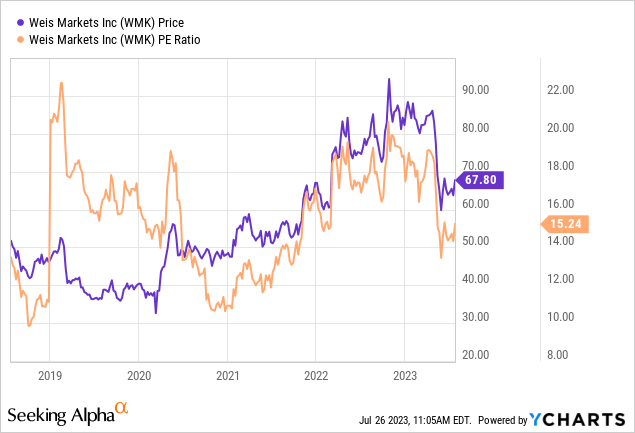

I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value, like earnings, free cash flow, and the like. I like to see a stock trading at a discount to both its own history and the overall market. I turned bullish on these shares "back in the day" as the young people say, when the PE ratio was sitting around 12.4, and when the market was assuming a growth rate of only about 1% for the shares. I took profits nine months later when the PE had risen to 16.4, and the market was then assuming ongoing growth of about 12% for the company. As I already mentioned above, the shares continue to spike higher, but many of those gains have been lost. I would rather be the person who gave up on some gains than the person who bought shares when they were too expensive, and saw their capital depleted.

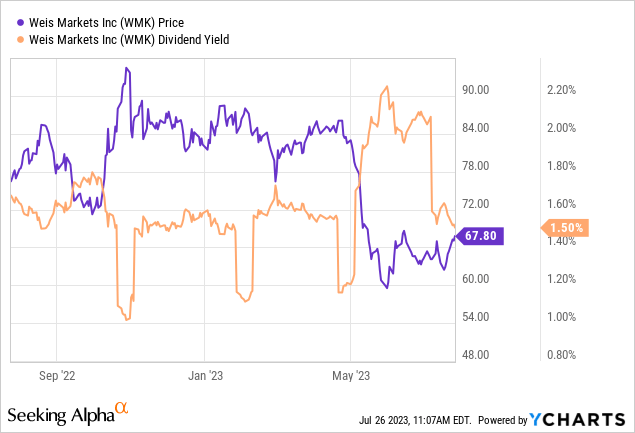

With that sermon done, we see that the valuation is no longer as egregious as it has been, but it's still about 23% more expensive than it was when I decided to buy. Additionally, the current dividend yield is very far below what an investor can receive risk free. Specifically, it's fully 240 basis points lower than the 10 year Note and is over 380 basis points lower than what an investor could receive on a 1 year risk free Bill. To put my original bullish thesis into perspective, at the time I bought back into Weis Markets, the 10 Year Note was yielding about 1.4%, and the dividend was sitting at about 2.24% . There truly was no alternative to stock ownership back then, and at least investors were being paid a positive risk premium. Today, the opposite is the case. There very much is an alternative to stocks, and people are accepting less income from stocks than they get from risk free government instruments.

In addition to looking at simple ratios, I want to try to understand what the market is currently "thinking" about a given company's future. In order to do this, I turn to the work outlined in books like Penman's "Accounting for Value" and Mauboussin and Rappaport's "Expectations Investing." The idea expressed by these books is that stock price itself has some interesting information embedded within it, including the market's future expectations for a given company. The greater the expectations, the more risky the investment. According to the approach outlined by Penman's work, the market currently "thinks" that Weis Markets will grow at a rate of about 12% from current levels. I consider that to be a bit rich.

Given all of the above, and given the alternatives available to investors, I'm going to continue to eschew these shares. If the shares continue to drop in price, I'll reconsider, but while the risk premium is negative, I see no point in investing.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.