Corsair Gaming: Not Buying At These Prices

Summary

- Corsair Gaming's financial outlook is uncertain due to the ongoing challenges in the PC market, which could affect the company's revenues and margins.

- Despite Corsair's positive management outlook, I advise potential investors to be patient due to the company's inconsistent profitability and the current risk/reward profile.

- While Corsair may have potential for long-term growth, it would be more appealing to investors if the share price was around 24% lower than its current level.

Ivan Pantic

Investment Thesis

With 2nd quarter earnings just around the corner, I wanted to take a look at Corsair Gaming (NASDAQ:CRSR) and its financials to see if it would be a good time to jump in with a small investment. In my opinion, the headwinds of the PC market and the peripherals associated are going to persist for a little while longer, which will affect the top and bottom-line figures of the company for at least the remainder of the year. I believe that an investor who’s looking to start a position in the company should be patient because at these price levels, the risk/reward profile is not to my liking.

Outlook

I was listening to the latest quarter conference call, and I was surprised that the management was rather positive about the near future. The company is heavily involved in the PC gaming market with the many peripherals, accessories, and memory that they offer. I've covered in the past some companies related to the PC market and their outlook for the remainder of '23 and the first half of '24 is rather bleak.

In the first quarter of ’23, PC shipments were down 30% worldwide, while in the second quarter, the shipments decreased 16.6%. It does look like the bottom appeared to be reached in the first quarter, however, these numbers are still quite bad, and it looks like growth will not be back until all inventory levels normalize in ’23 and start to pick up sometime in ’24.

I know that the company is well diversified in its offerings, but all of them revolve around the PC segment, which is still seeing a lot of softness in demand and that will continue to affect the company’s revenues and probably margins in the short term.

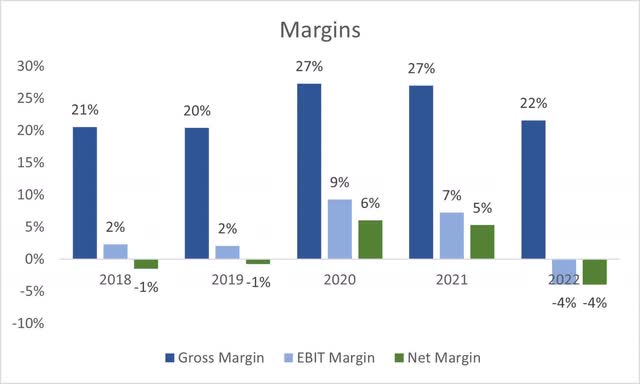

Margins

Speaking of margins, I cannot assume that the company is going to be able to fix margins in the upcoming couple of quarters with the softness we are seeing in the PC market. I can assume that over the next decade, these will have to improve because cycles come and go and advancements in technology are rapid, which improves efficiencies over time.

What I will do for my model is take analysts’ estimates for ’23 and ’24, which looks like operating margins improved significantly from the year before to get the same EPS as they estimate (around 60 cents for ’23 and 77 cents for ’24).

I would like to see the cost-cutting measures the company took last year worked out and the company starts to make a profit without the adjusted GAAP numbers, as I'm not a fan of these types of metrics.

Financials

As of Q1 ’23, the company had around $180m in cash against $220m in long-term debt. This is not a bad position to be in if the company is making decent money. Corsair is not very consistent in this area. Three out of the last five years the company has had a negative EBIT which may add to the risk for the company, as many people do not like companies that have any amount of debt on their books. This could potentially be bad if the company isn’t able to pay off its interest expense as it continues to lose money, however, the company has enough cash on hand and is operating cash flow positive which means that it would be able to pay off annual interest expenses on debt. The company is also looking to be operating income positive for FY23, so in my opinion, the debt isn't an issue.

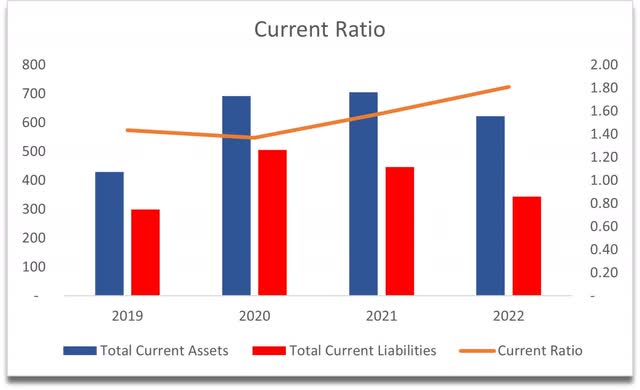

The company’s current ratio is acceptable and has been around the area I would consider healthy. I don’t think this will change anytime soon, especially now that the company has seen the worst of the softness in demand in ’22.

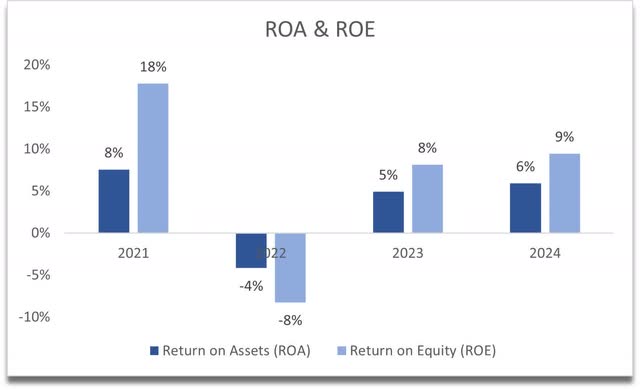

In terms of efficiency and profitability, the company has been quite inconsistent here also. I don’t like companies that fluctuate this much in these areas, however, if the company can cut down on costs going forward and become more efficient, ROA and ROE could look something like this going forward:

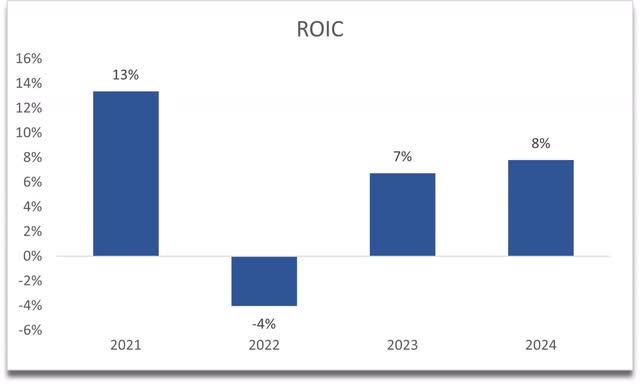

The same story can be said about the company’s competitive advantage, or lack thereof as of FY22, however, according to my conservative financial model estimates, the company, may get back some of that edge in the future if the cost-cutting measures work out. Take the forecasts with a grain of salt because these are opinion based.

Return on invested capital forecast (Author)

In terms of margins, FY22 was not very good for the company, however, the management is predicting much better results in FY23. I'd like to see margins coming back to at least the levels of FY21, but even then, they're very tight in my opinion, and would like the company to be more efficient going forward.

Overall, a lot of ifs in the above metrics need to be taken with a grain of salt. This will warrant a higher margin of safety than what I usually give to companies that have solid books. So, let’s look at what I would be willing to pay for the company.

Valuation

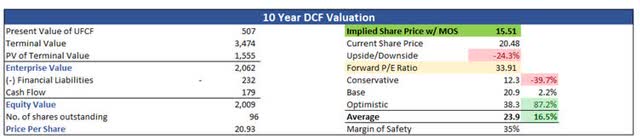

In terms of revenues, for the base case, I went with a 10.6% CAGR for the next decade. This seems to be on the more conservative side in my opinion but still very possible because some years, the company would grow at over 50% in a year, and then just in FY22 it lost around 28% over the year.

For the optimistic case, I went with 14.5% CAGR, while on the conservative side, I went with 8.6% CAGR over the next decade. All these scenarios seem to be in the realm of possibility, and I would hope the company can beat these assumptions in the long run.

In terms of margins, I decided to improve gross margins by around 500bps or 5% over the next decade, while improving operating margins to the levels seen in FY20, which seems like the average it saw, and FY22 was a tough year for a lot of companies.

On top of these estimates, I will add a 35% margin of safety to be even more conservative. The financials weren’t the best in my opinion, so I would require a higher degree of safety. With that said, I would be willing to pay $15.51 a share for such growth and potential in the long run, which means the current share price is a little bit expensive.

Closing Comments

I think the company has to show me that it has improved because the last full year of results wasn’t a good example of a company that is being run very efficiently and that has differentiated itself enough from the competition.

To be an investor in the company, my risk/reward profile is ideal at around 24% below the current price, so I will not be starting a position for now. I wouldn't sell if I was an investor in the company already either because the worst is behind for the company and so it may continue to ride the bull wave going forward, and if it does dip closer to my price point, I would look to add on such weakness and let it ride for years to come.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.