P/F Bakkafrost: Pay Attention To Faroe Salmon, It's A 'Buy' (Rating Upgrade)

Summary

- I have a positive outlook on Bakkafrost stock, a top-10 fish farming company, due to its strong business model, growth potential, and expert management.

- Bakkafrost has a significant advantage as it holds almost 50% of all fish farming licenses in the Faroe Islands, one of the best salmon farming locations globally.

- Despite volatility in share prices, the company has performed well, with excellent results for 1Q23, including all-time high revenues and positive operational EBIT segment-wide.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

hxyume

Dear readers/followers,

In this article, I'll show you my case for Bakkafrost (OTCPK:BKFKF), a company I've covered and owned for a number of years. It's one of those companies that I own for the sake of its growth and expansion potential. It has a very strong moat in its sector, a very strong business model, and is expertly managed by a group of people that know the business and the business model very well.

I have a stake in Bakkafrost, and it's one I'm potentially interested in expanding at the right price.

I love companies I can "put in my mouth", as cited by the character Robert Axelrod on the show Billions. I try to at least own shares in some companies where I can use, drink or eat the products myself. This is one such company - and I can put the products the company makes in my mouth.

Let's re-review Bakkafrost and update on the company in 1Q23 - because Salmon is a superfood of the future, and it's my firm stance that one should be invested in it at the right price.

Updating on Bakkafrost - Plenty to like about Faroe Salmon

So, my last article on Bakkafrost was actually a few years back - and the company has done a "turnabout", essentially yielding zero percent RoR in 3 years. That is of course, unless you did what I did, which was selling the company at significant overvaluation, and then buying it back at a mix of undervalued prices, especially the prices seen during last fall.

I believe that I know well when to "BUY" and when to not "BUY" this company, as well as when it's time to rotate shares.

Bakkafrost is, understandably, not a company for everyone. Thinly traded in its ADR with barely more than 3000 shareholders worldwide, it would be glad to be considered a microcap or nanocap by any standards - but I believe it is appealing enough in itself that it could be considered a good investment even by NA standards - at least if you're the sort of investor that's open to these sort of potential investments.

Despite its smaller overall size, Bakkafrost remains a top-10 fish farming company - that's global. It's based in Glyvrar on Eysturoy on the Faroe Islands, a series of islands north of the British Isles that hold a total population of ~52000. In my original article, I showed you a picture of the capital of the Faroe Islands, which can be compared to the capitals of areas like the Yukon.

The fact that Bakkafrost employs over 1,000 people makes them the largest employer on the entire island. It's also family-owned to a percentage of 20%, which is extremely rare for a global business like this, and has a history going back at least 60 years.

Bakkafrost IR (Bakkafrost IR)

I want to reiterate one of the primary reasons for owning Bakkafrost - that is that they have almost 50% of all the fish farming licenses in all of the Faroes, one of the best salmon farming locations in the entire world. The way that Faroe law is structured, specifically The Faroese aquaculture act, prevents foreign investors from owning more than 20 percent of a Faroese aquaculture company. This represents a major moat for this company, and unless the law changes (highly unlikely), it's relatively timeless.

Foreign investors are unlikely to hold any sort of taken in a Faroese company.

Bakkafrost, despite volatility in share prices, has done well. In order to invest in this business, you need to be acutely aware of when it's cheap and when it's not.

Bakkafrost IR (Bakkafrost IR)

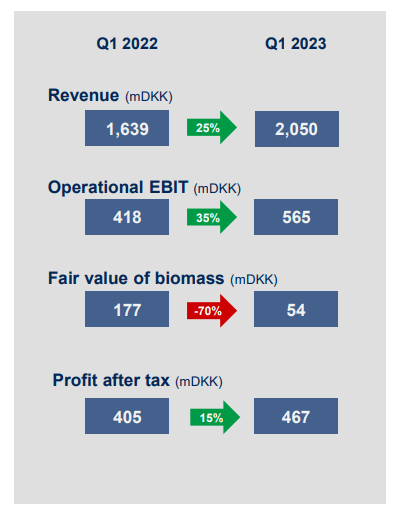

And for 1Q23, results were excellent despite headwinds. All-time high revenues for the quarter of over 2B DKK (the company reports in Danish crowns), with an operational EBIT of over 25% of that revenue. The company harvests in both Scotland and the Faroes, with almost 20k tgw. and 22,200 tonnes of feed sales, resulting in an operational cash flow of 573M DKK, and positive operational EBIT segment-wide.

This also lead to the dividend proposal of 10 DKK, around 15.6 NOK per share, payable in May, so it's already paid, and at the time was a yield of around 2.3-2.5%. Not high, but the yield for this company is very rarely at a high level. That's also one of the drawbacks of the company in the context of other salmon companies because companies like Mowi (OTCPK:MHGVY) have a far better yield. Of course, Mowi also doesn't have the Faroe advantage.

Remember, when it comes to Salmon companies, the main exposure and the main variable that dictates share price is the global market price for Salmon. The reason the company faceplanted during 3Q22 was a dip in the market price for salmon.

Bakkafrost IR (Bakkafrost IR)

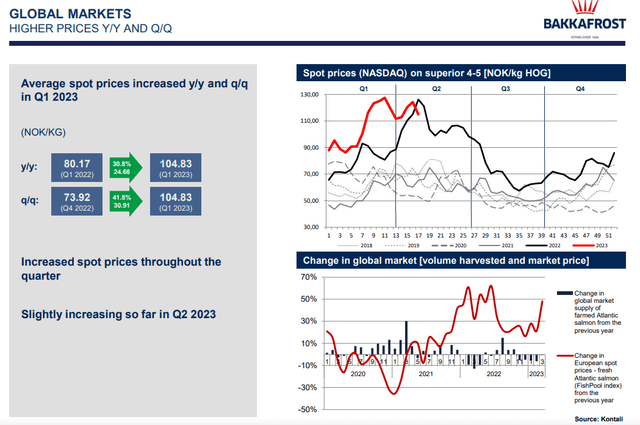

If you want to be an investor in Salmon companies you need to either follow someone like me who has the daily update on Salmon prices in his bookmarks, or you need to start following it yourself - because profit without either is difficult. As you can see, Global salmon prices have remained at a steady higher and higher level over the past few years, and while we may see drawdowns as a result of higher supply, as in 2022, the overall thesis I presented you with on Mowi still applies for Bakkafrost. The demand for salmon is almost guaranteed to outstrip the supply on a forward basis given what capacity is available today and where the industry, and global macro as a whole is going.

So I remain at a generally positive view of Bakkafrost.

Overall, the salmon markets saw a drop in global harvest volume during 1Q23, of around 6%, which also impacted sold quality given that there was less available. However, given pricing trends, this was not an issue for company profitability - almost all relevant KPIs went in the right direction.

Bakkafrost IR (Bakkafrost IR)

This also resulted in significant margin improvements, with 46% margin improvements in Scotland, 7.6% in VAP, and 6.11% in the Faroe Islands. The company is, as I mentioned more volatile than your typical salmon company.

Given the very strong start to the year and current industry trends though, I'm at a high rate of conviction for this company and what I believe it will deliver going forward.

The company remains a fundamentally appealing business. Its biological assets are worth over 3BDKK and the company has a high equity ratio of over 63%.

The company is traded on the Oslo stock exchange under the native symbol BAKKA. Looking at the comp-specific profitability trends, the company is without a doubt one of the better companies on the market here, in terms of profit.

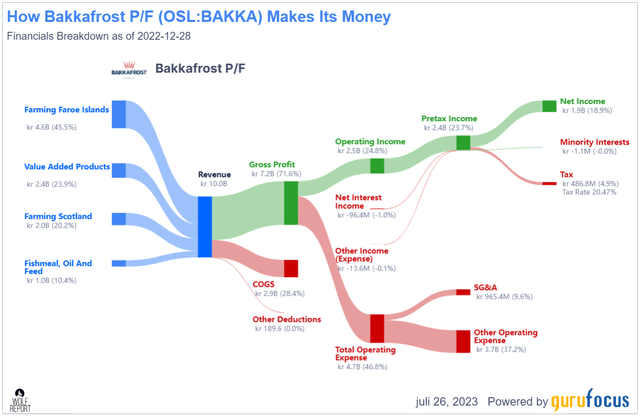

Gross margins are almost 70% due to its full vertical integration, and a net margin of almost 20%, which is class-leading. The company has one of the lowest COGS I've seen for this sort of company, but of course, has relatively high OpEx - but not due to SG&A.

It's a very streamlined organization.

Bakkafrost Revenue/net (GuruFocus)

Fundamentals remain absolutely solid. The company has a low net debt of just over 2.3B DKK, but funding for the company is up impressively over a short period of time, and Bakkafrost has full access to financing close to 7B DKK if we include the available accordion. Net of current debt, that's almost 5B DKK that the company could move on if it needed - and this is for a company with a total current market cap of less than $4B.

I'm going to show you the valuation here, and you'll probably understand why I consider this one a very attractive overall buy.

Bakkafrost Valuation - It's a positive one.

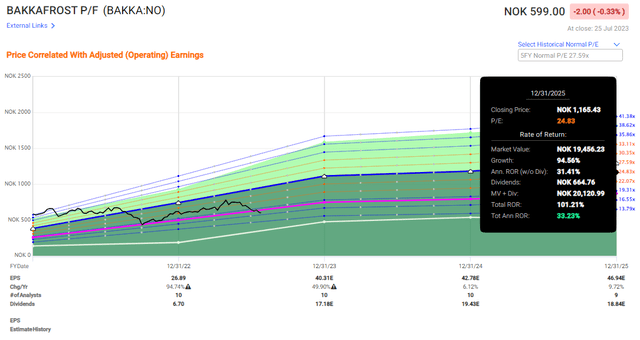

The upside for Bakkafrost at this price is easily above 15% per year if you consider even a portion of the company's premium due to its high growth rate to be relevant. When it comes to this company, I happen to do that.

I believe Bakkafrost, based on its growth estimates of 40-50% this year, followed by stable double-digit growth to manage about a P/E of 17-25x. On the absolute low side, which by the way is below where the company is currently trading, this gives us an upside of 13.57% at a P/E of 16.55x, for the most profitable salmon farming company out there.

What about the bullish case, as opposed to the bearish one?

Bakkafrost Upside (F.A.S.T graphs)

Triple-digit RoR, dear readers.

As I usually tell my clients, the highest likelihood of outcome is in somewhere "in between" the extremes of the bullish and the bearish. The fact that this comes at a very good likelihood for a double-digit upside outcome means that I am interested in the company at a price of 600 NOK for the common share.

Based on very positive 2023 results, I would give Bakkafrost a conservative price target of about 680 NOK/share. This is well below the current S&P Global average.

The average S&P Global PT comes to around 500 NOK/share. That's from 6 analysts following the company with a range from 450 to 550 NOK.

However, these targets make absolutely no sense. Bakkafrost trades at 599 NOK per share as I am writing this article, and out of 6 analysts, 4 are at "BUY" or "Outperform" - and this is despite a PT that's over 100 NOK below the current share price.

So what we have here is the very rare situation of a reverse conviction problem. Usually, analysts give very high price targets but then fail to give ratings that correspond to this. In this case, the analysts give trough-PTs but then despite this continue with their "BUY" targets.

I believe it to be a good idea to invest in Bakkafrost here because you're investing in the apex (profitability-wise) of Salmon-farming. That's also why my position in Bakkafrost is larger than that In Mowi, despite the overall higher yield in the mainland Norwegian competition.

There are definitely risks to salmon farming. The largest risk factor for the company concerns farming, where Bakkafrost is exposed to biological and climate risks such as storms, diseases, algae blooms and other things. There are also overall pricing risks, which I've shown you can be quite volatile.

But if you understand the trends, and keep an eye on them, I don't believe that it's at all impossible for you to determine with a decent amount of accuracy when to enter, and when to "leave" the investment.

It's worth noting that valuation multiples for Bakkafrost are usually/almost always far higher than for competitors. Competitors in the segment include Mowi (OTCPK:MHGVY), SalMar (OTCPK:SALRF), and Leroy Seafood (OTCPK:LYSFF) - there are a few more, but these are the main ones.

Because of this, here is my updated thesis for Bakkafrost. And do yourself a favor - go out and try some salmon!

Thesis

- I do need to mention that I at one point owned Bakkafrost shares acquired at a share price of 200 NOK/share. This was years ago and shows just how early I started accumulating stock in this company, which I view as the best in its field. I sold these later when the company hit close to 800, with the plan of buying them back when the company dropped.

- I did this the second time around when the company dropped below 500, then again when it touched 400 NOK, only to sell again at close to 750 NOK/share.

- Now we're back to the third time. This time I bought at 549 NOK not long ago, I've raised my PT due to growth targets, and I give the company a PT of 680 NOK this time around. I'd trim once again at 775 NOK or above.

- That makes the company a "BUY" for me here.

Remember, I'm all about:

1. Buying undervalued - even if that undervaluation is slight, and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn't go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

This company is overall qualitative. This company is fundamentally safe/conservative & well-run. This company pays a well-covered dividend. This company is currently cheap. This company has realistic upside based on earnings growth or multiple expansion/reversion.

I can't call Bakkafrost "cheap" here - it's just not possible. But it fulfills every other criterion I hold for a solid investment.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management/wealth management for a select number of clients. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MHGVY, BKFKF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment, and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved. The author's intent is never to give personalized financial advice, and publications are to be viewed as research and company interest pieces. The author owns the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in the articles. The author owns the Canadian tickers of all Canadian stocks written about.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)