Pharvaris: FDA Lifts Clinical Hold, Progresses HAE Drug Development

Summary

- Pharvaris, a clinical-stage company, has reported a cash position of €135 million as of March 31, 2023, indicating an operational runway of approximately 18 months at current loss rates.

- The company's product pipeline, including PHVS416 and PHVS719, targets bradykinin-mediated diseases like HAE, with the FDA recently lifting a clinical hold on the IND application for deucrictibant.

- Despite promising developments, Pharvaris faces risks including potential off-target effects, unforeseen safety issues or insufficient efficacy in clinical trials, and regulatory hurdles.

MF3d

Pharvaris (NASDAQ:PHVS) is a clinical-stage company that has garnered a significant amount of interest due to its novel approach to treating hereditary angioedema (HAE) and other bradykinin-mediated diseases. The key to the company's potential success lies in its use of small-molecule bradykinin B2-receptor antagonists, a new approach that could fundamentally reshape treatment paradigms in the field.

Financial Update

Pharvaris reported a cash and cash equivalents position of €135 million as of March 31, 2023, a reduction from €162 million at the end of 2022. This decrease primarily reflects the operational spending necessary for the advancement of the company's pipeline.

The company's R&D expenses remained relatively stable at €13.7 million for Q1 2023, a minor increase from €13.5 million in Q1 2022. This stability indicates consistency in the company's investment in its drug development programs, a key factor for a biotech company's long-term growth prospects.

A more substantial increase is noted in the G&A expenses, which grew from €5.9 million in Q1 2022 to €7.3 million in Q1 2023. This rise could be attributed to growing operational requirements as the company's product candidates advance in their respective clinical trials.

With a quarterly loss of €22.6 million in Q1 2023, the company's burn rate can be estimated at approximately €7.5 million per month. Using this figure, and given the current cash position of €135 million, Pharvaris has approximately 18 months of operational runway at the current total loss rates. Despite the losses, these numbers are not unexpected for a company in the drug development stage. However, continued scrutiny of financial metrics will be crucial to assess Pharvaris's sustainability and ability to deliver on its clinical objectives.

Product Pipeline

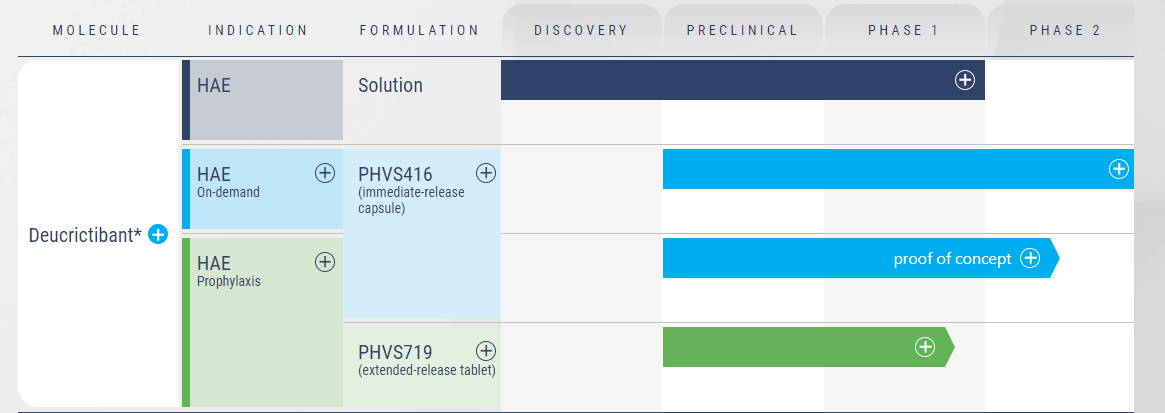

Pharvaris's product pipeline, anchored by PHVS416 and PHVS719, is highly promising, both products exploiting a shared mechanism of action - blocking the bradykinin-B2-receptor, which is pivotal in mediating HAE attacks.

ir.pharvaris.com

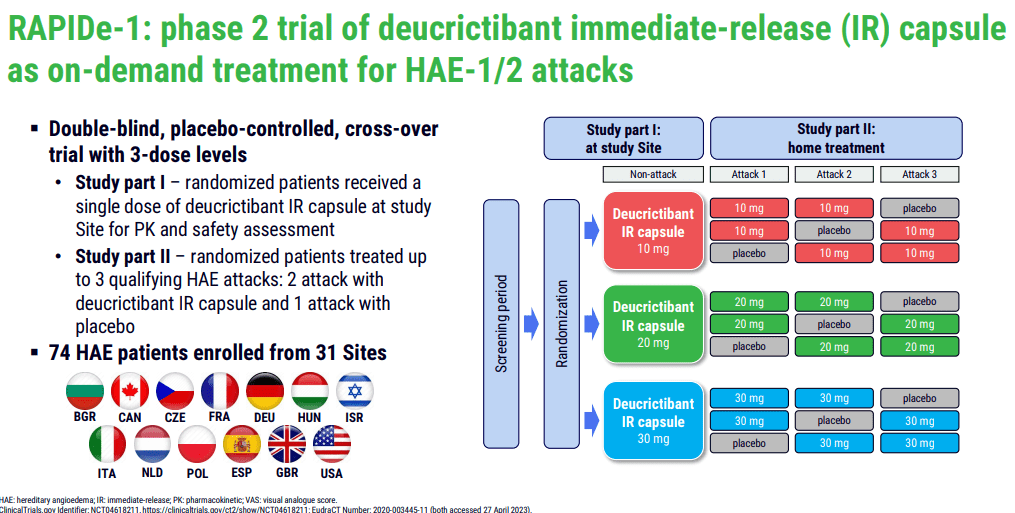

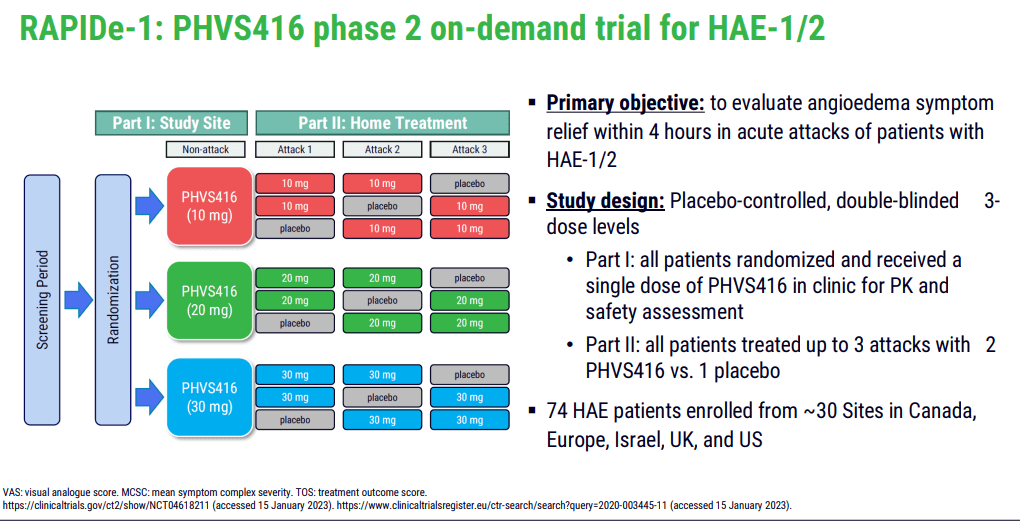

PHVS416, an immediate-release formulation of deucrictibant, is currently at the forefront of Pharvaris's product line-up. Its application lies in the on-demand treatment of HAE attacks. The successful completion of the Phase 2 trial (RAPIDe-1) in 2023 is an important milestone, as it demonstrated the drug's efficacy and safety. The trial met its primary endpoint, indicating a significant reduction in the time-to-symptom relief. Moreover, the compound exhibited a favorable safety and tolerability profile, crucial factors for approval and subsequent market acceptance.

ir.pharvaris.com

The company's second candidate, PHVS719, a sustained-release tablet formulation of deucrictibant, is intended to offer a prophylactic solution to HAE, aiming to prevent attacks with once-daily dosing. This compound, now in the Phase 2 stage (RAPIDe-2 trial), could provide an additional line of defense for HAE patients and enhance Pharvaris's position in the HAE treatment landscape. The efficacy, safety, and pharmacokinetics of PHVS719 in patients with HAE type I or II will be critical areas to monitor as the trial progresses.

ir.pharvaris.com

FDA Lifts HAE Clinical Hold

Pharvaris has received a green light from the FDA, with the removal of the clinical hold on the Investigational New Drug (IND) application concerning deucrictibant - the active component in their flagship products. This move comes after an assessment of the results from a programmed midway review of an ongoing 26-week nonclinical investigation.

This progression of the clinical hold sets the stage for Pharvaris to resume its on-demand clinical tests, including the RAPIDe-2 study aimed at the immediate response to HAE attacks. This momentous occasion signals the company's readiness to broaden its horizons, as it intends to request a conclusion to Phase 2 discussions with the FDA and gear up for RAPIDe-3, a worldwide Phase 3 examination of PHVS416.

Pharvaris continues its devotion to resolving the remaining hold on the IND application for the preventive use of deucrictibant. The compound is presently under scrutiny in a 26-week nonclinical experiment, and the company's goal is to present the results to the FDA by the end of 2023. A successful outcome would provide Pharvaris with another market entry, thereby strengthening its standing in the realm of HAE treatments.

This encouraging update, coupled with the expectation of preliminary data from CHAPTER-1, Pharvaris's Phase 2 trial for the preventive treatment of HAE using PHVS416 due by the year's end, provides a promising outlook on Pharvaris's ongoing pipeline progress.

Drug Development Risks

For Pharvaris and its product candidates PHVS416 and PHVS719, the primary risks span across diverse areas including biochemical, clinical, and regulatory facets.

Biochemically, deucrictibant, the active ingredient in both PHVS416 and PHVS719, operates by blocking the bradykinin-B2-receptor. Although this novel mechanism of action has shown promise, it also carries uncertainties. For example, potential off-target effects could arise, causing unintended consequences in non-target tissues. This can occur due to the complex interplay of biological systems, and despite thorough early-stage testing, such effects may not become apparent until later phases of clinical trials or even post-approval.

In terms of clinical risks, PHVS416 and PHVS719 are at different stages of development. Although PHVS416 has successfully completed Phase 2 trials for on-demand treatment of HAE, it still needs to undergo Phase 3 trials, which will expose the drug to a larger population and potentially unmask rare adverse events or demonstrate less efficacy than expected. Similarly, PHVS719 is now entering Phase 2 trials for prophylactic treatment of HAE, carrying the risk of unforeseen safety issues or insufficient efficacy.

Regulatory risks cannot be overlooked either. Although the FDA has lifted the clinical hold on the IND application for deucrictibant for on-demand treatment of HAE, the hold on the application for prophylactic treatment of HAE remains in place. There is a risk that the data from the ongoing 26-week nonclinical study might not meet the FDA's requirements, possibly delaying or even preventing the initiation of late-stage clinical trials for prophylactic treatment.

Competitors

In the realm of HAE therapeutics, Pharvaris finds itself amidst a competitive landscape. The key competitors are those who already have HAE treatments in the market, including Takeda Pharmaceuticals, CSL Behring, and BioCryst Pharmaceuticals.

Takeda's Takhzyro (lanadelumab-flyo) (TAK), an injectable monoclonal antibody, works by inhibiting plasma kallikrein, a key enzyme in the pathway that leads to HAE attacks. While Takhzyro has shown efficacy in preventing HAE attacks, it requires subcutaneous injections, which may not be as convenient as an oral drug. Additionally, while the drug shows a strong safety profile, there have been reports of injection site reactions, which could affect patient compliance.

CSL Behring offers two therapies for HAE: Haegarda and Berinert. Haegarda, like Takhzyro, is a subcutaneously administered C1-esterase inhibitor, aimed at prevention of HAE attacks. Berinert, another C1-esterase inhibitor, is intravenously administered for acute treatment. Both these products, while effective, necessitate parenteral administration, which can be less desirable for patients compared to oral treatment.

BioCryst Pharmaceuticals (BCRX) markets Orladeyo (berotralstat), the first and only oral drug for HAE prophylaxis approved by the FDA. Orladeyo inhibits plasma kallikrein, much like Takhzyro, but in an oral formulation. However, the oral route of administration is balanced by potential side effects, including gastrointestinal issues.

Conclusion

Pharvaris's lead product candidates, PHVS416 and PHVS719, have shown promise in clinical trials, reinforcing the potential of their novel mechanism in addressing HAE. Both the on-demand and prophylactic treatment paradigms represent significant opportunities for growth in the HAE market.

The company is financially stable, providing a sufficient runway for clinical development plans. The recent FDA decision to lift the clinical hold on the IND application for HAE's on-demand treatment is an encouraging step forward, possibly accelerating the next stages of clinical trials. However, this promising narrative must be weighed against the inherent risks of drug development.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.