Ermenegildo Zegna: Strong Revenue Growth, Possible Margin Expansion (Rating Upgrade)

Summary

- Ermenegildo Zegna's stock has seen strong growth YTD, but the best is likely yet to come.

- The company's acquisition of Tom Ford International and strong demand from China led to exceptional revenue growth in the first half of 2023. Margin expansion is possible as well.

- Competitive P/S valuations and a softening in its forward P/E in the context of improved prospects for ZGN make a Buy case for it stronger now.

- Looking for more investing ideas like this one? Get them exclusively at Green Growth Giants. Learn More »

tupungato/iStock Editorial via Getty Images

The Italian luxury menswear fashion company Ermenegildo Zegna (NYSE:ZGN) has risen by 31% since I last wrote about it in January this year. The rise started in earnest in June, following its touching the lowest level of USD 11.1 for 2023 in May, to rise by a massive 37% increase. This start of this rise coincided with its dividend increase by 11% for 2023 and the purchase of its shares by management in a show of confidence in the stock after it exited from the FTSE Russell US 3000 index.

Price Chart (Source: Seeking Alpha)

Past challenges

I had given it a Hold rating, but in light of recent developments and its first half (H1 2023) revenue update earlier today, it’s a good time to relook the stock. Here, I look at them in the context of the key challenges I saw earlier in the year. They were as follows:

- Both its price gains at 18% over the past year and its forward price-to-earnings (P/E) ratio at 35x were bigger than those of even LVMH (OTCPK:LVMUY), the biggest luxury company around.

- This was despite the fact that its margins were underwhelming and revenues had shrunk marginally year-on-year (YoY) in the last quarter of 2022 (Q4 2022).

- With other big economies like those of the US and western Europe expected to soften in 2023, it remained to be seen whether a return of China’s demand could stabilise sales growth.

Acquisition bumps up growth

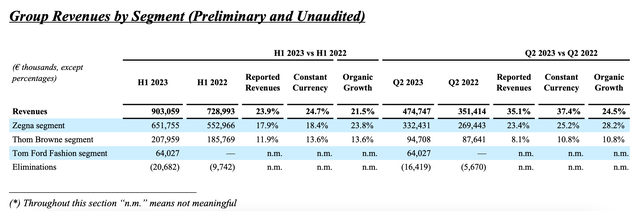

For the first half of 2023, however, the company has seen exceptional growth. Let me elucidate. First, the revenues grew by 23.9% YoY on a reported basis and 24.7% on a constant currency basis. This is actually an improvement over the company’s growth of 15% in reported terms and 11% for the full year 2022.

Now, there’s a very good reason for this bump up in growth. It completed the acquisition of Tom Ford International [TFI] in April this year, which owns Tom Ford Fashion. It now owns 100% of the brand, of which earlier owned only 15%. This acquisition follows entire Tom Ford brand’s acquisition by Estee Lauder (EL) last year, now making Ermenegildo Zegna a long-term licensee for EL.

Source: Ermenegildo Zegna

For context, the designer of the namesake brand started it after his departure from Gucci in 2004, with his collections from then having been described by Vogue magazine as “the stuff of fashion legend”. TFI earned revenues of EUR 312 million in 2022, which is about 21% of Ermenegildo Zegna’s 2022 revenues. The numbers for the fully acquired brand have shown up in the company’s financials for Q2 2023, which show its significant effect. Revenues for the quarter are up by 35.1% on a reported basis and 37.4% on a constant currency basis.

Organic growth strong on demand from China

However, it's hard to miss the fact that even the company’s organic growth, which excludes the impact of TFI, is strong at 21.5% for H1 2023, and also higher than the full year 2022 figures.

It gets better. In Q2 2023 organic growth was at 24.5%, compared to a far more muted 13.4% in reported terms and 13.1% at constant currency in Q1 2023. Growth for the previous quarter looks much softer because of the dissolution of the previous agreement on TFI, with the deliveries for the Fall/Winter 2022 collection.

As a result, the numbers from the Tom Ford products, which was earlier represented under the company’s big Zegna brand, shrank by 77.4% in reported terms during the quarter. However, even excluding the impact of these products on the figures, Q1 2023 growth was still slower at 19.1% compared to the latest quarter.

Source: Ermenegildo Zegna

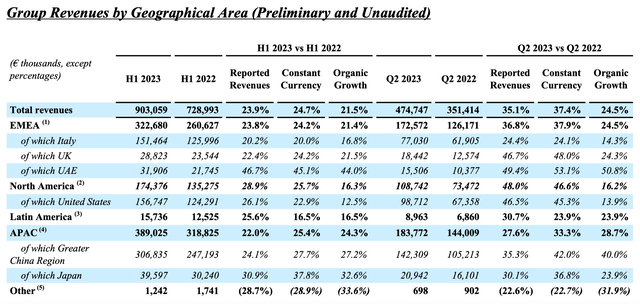

Demand from China has been a huge driver for Ermenegildo Zegna recently, which showed 40% organic growth. Since the market accounts for over 30% of the company’s revenues, it naturally has an outsized impact on total revenue growth. Along with improved growth in Japan in H1 2023 compared to full year 2022 the company has seen better revenue growth, despite a cooling off in growth across all other markets (see table above).

US market positively impacted

Specifically, the US and Italy which are the next big contributors to revenues, with shares of around 17% each, have slowed down considerably. In 2022, they saw reported growth of 53.5% and 41.3%, respectively. In H1 2023, they are down to 12.5% and 16.8%, respectively, on an organic basis. However, there’s something interesting to note in the case of the US market. In Q2 2023, its growth was at a massive 46.5% on a reported basis, on account of the Tom Ford effect.

Essentially, what we have here then is strong growth from two of its biggest markets for the company. These have been supported by the reopening of China’s economy late last year and the impact of Tom Ford International acquisition. While China’s economy isn’t growing as fast as hoped, so far, there’s no genuine slowdown on the horizon. As a result, there’s little reason to expect a dent in Ermenegildo Zegna’s growth, unless the US economy slows down considerably from here on too, which also looks increasingly unlikely.

What about profits

The latest release is a trading update, so there’s no talk of profits yet, but we will know more in August, when it releases its full results. However, going by the company’s previously disclosed numbers on TFI from when it owned a smaller stake in the brand, show a net profit margin of 5.7% from it. This is higher than its overall margin of 3.4% for 2022.

Assuming that there would be no difference in calculation of profits for the brand now, this indicates a potential improvement in Ermenegildo Zegna’s margins. Its margins have been relatively low in the past, with operating margin at sub-10% for 2022, so this is definitely a welcome sign.

What the market valuations say

ZGN’s trailing twelve months [TTM] price-to-sales (P/S) isn’t low at 2.1x, but it is competitive compared to other luxury stocks. LVMH is at 4.9x, for instance, and Kering (OTCPK:PPRUF) is at 3.3x and Richemont (OTCPK:CFRHF) is at 4.2x. A similar trend is visible for its forward P/S ratios as well. This is despite the fact that ZGN has grown faster as per its latest update compared to the rest.

Its forward price-to-earnings (P/E) ratio at 31x is however, higher than that for the rest. But going by its latest growth figures and the potential for improved earnings, I think there’s a justification for it. Further, the ratio is actually down from the 35x it was at when I last wrote about it. Considering the balance of both the P/S and P/E numbers, I believe an at least 15-20% price rise is possible now.

What next?

Call the timing of the latest acquisition a stroke of massive luck or a genius move, the company has managed to find a way to circumvent sagging sales from its important US market, which is affecting other luxury companies. A big boost from China has also supported it. There’s also hope for improved margins now. And even the forward P/E looks better than it did six months ago.

Further, in the context of its latest performance the comparatively high number makes more sense. As does its price rise compared to LVMH. In other words, the Ermenegildo Zegna story looks more compelling now. I’m upgrading it to Buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

--

This article was written by

Manika is an investment researcher and writer as well as a macroeconomist, with a focus on converting big-picture trends into actionable investment ideas. She has worked in investment management, stock broking and investment banking. As an entrepreneur, running her own research firm, she received the Goldman Sachs 10,000 Women scholarship for certification in business. She is also a public speaker, having shared her views at multiple international forums and has been quoted in leading international media.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ZGN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.