United Airlines: Making A Comeback

Summary

- United Airlines is expected to recover from the impact of COVID-19, with 2022 revenues surpassing pre-pandemic levels, making it an attractive opportunity for investors.

- The airline is innovating by investing in Electric Vertical Takeoff and Landing (eVTOL) aircraft, planning to launch the world's first air taxi route in Chicago by 2025.

- Despite risks such as flight delays, cancellations, and intense competition, United Airlines' financials are strong and its entry into electric air transportation could increase its market share.

Editor's note: Seeking Alpha is proud to welcome AlmaStreet Capital as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Jeenah Moon

Thesis

United Airlines Holdings (NASDAQ:UAL) is one of the world's largest air transportation companies by both fleet size and revenue. Headquartered in Chicago, IL, United Airlines offers a wide range of passenger and cargo destinations through the Star Alliance. In 2023, United Airlines Holdings was ranked the third-largest airline in the world with a fleet size of over 800 planes servicing more than 300 destinations. The stock tanked almost 70% from November 2019 through May 2020 due to the impact of COVID on travel demand. Though it hasn't surpassed its pre-pandemic price of about $92.80 per share, we have seen a recovery with steady growth in the past year. With 2022 revenues surpassing pre-COVID levels, I believe investors have an attractive opportunity to enter before the returning growth of travel is fully priced in. Other analysts from Seeking Alpha and Yahoo Finance give this stock a buy rating and find it to be valued between $45 and $80 with an average price target of $64.07.

Global Network And Strong Presence

When it comes to recognizing United Airlines' strengths, there are two things that stand out about the airline. The first of which is the strong brand awareness the company holds among airlines. Companies that can make themselves known to a large majority of the target market are much more likely to retain their customers and build loyalty. This stands to be the case with United Airlines which is reported to have a current brand awareness of 84%. Along with the market share, United has been able to draw in 83% of first-time users as returning customers. I see returning customers as a great sign since any business needs customers it can depend on to support its revenue in the future. Furthermore, consumers view airlines much like they view their favorite smartphone brand, car company, or shoe brand. Brand name matters and UAL certainly delivers in that sense. Additionally, being a member of the Star Alliance gives United access to more than 192 destination countries to support United Airlines' growing demand. This is an alliance that competitors Delta (DAL), Southwest (LUV), and American Airlines (AAL) are not members of, allowing UAL to provide more opportunities for travel to prospective travelers.

Breaking into the EV World

To stay ahead of the game, companies must find ways to be innovative. One of the ways United Airlines is continuing to innovate is by getting involved with Electric Vertical Takeoff and Landing (eVTOL) aircraft. These electric transportation vehicles resemble helicopters and are designed to be able to fly up to 100 miles one way before needing charging. Back in 2021, United Airlines made a $1 billion purchase of 100 eVTOL Midnight aircraft. They plan to use these aircraft to launch the world's first air taxi route in Chicago between the Chicago O'Hare International Airport and world-class heliport, Vertiport. This route is expected to go live in 2025 turning a 35+ minute drive into a 10-minute flight. Not only is eVTOL travel cheaper than traditional forms of air transportation, but it is also in line with Archer and United's goal to decarbonize air travel. Overall, United Airlines' entry into electric air transportation can build depth to the market it already services, and on top of that, it could drag in customers from other markets given that this service will be the first of its kind. I believe this a great opportunity for United Airlines to steal some of the market share from other big players because it is willing to do something innovative.

Financials

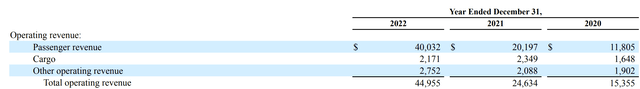

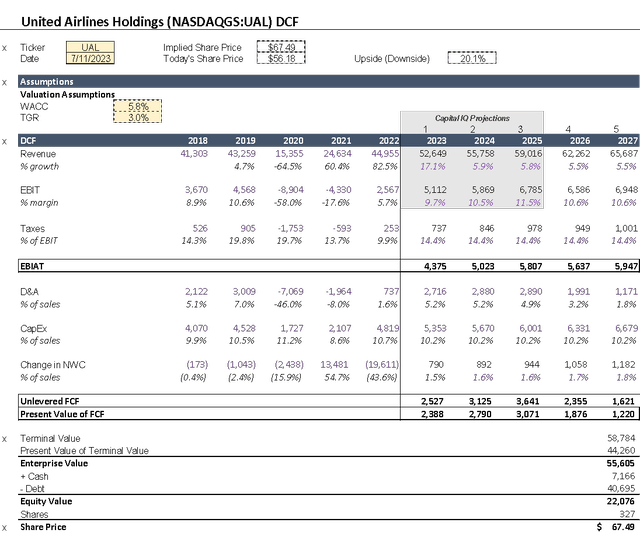

United Airlines is just one of the many airlines that were severely impacted by the COVID-19 pandemic. Revenues plummeted 64.7% In 2020 causing profit margins to go negative in 2020 and 2021. United Airlines finally surpassed pre-pandemic levels in 2022 with a revenue growth of 82.9% over 2021. Of course, this massive growth is just during the recovery stage and I expect revenue growth rates to fall to around 5.8% by 2025. I think we will see double-digit growth for 2023 compared to 2022 and my personal expectations for the years following are within the 4-6% range which can be seen in my DCF model. We are still recovering from COVID and demand is still getting back up, but naturally, this will start to slow down in the coming years as people fulfill their pent-up travel wishes. Profit margins are expected to hit 7.18% in 2025 surpassing 2019's 7.0% margins. This gives optimism that UAL can reach the efficiency it once had. In Q1 of 2023, United Airlines generated a record-high quarterly operating cash flow of over $3 billion. The main source of United Airlines' revenue is from passenger flights and luggage making up an average of 82.6% of its revenue over the past three years. Cargo and Other revenue have made up on average 13.4% and 14.6% of United Airlines' revenue respectively. Other revenue consists of third-party business revenue like maintenance services, frequent flyer redemptions, flight academy, and group handling. This is a testament to the company's strong recovery and financial management post-pandemic. United's debt situation, while still a concern, is being managed effectively. The company has been proactive in reducing its overall debt burden and has done so by $4.6 billion over the past 12 months. Keep in mind that this is a highly leveraged business with a debt to equity of over 500% so this is a positive sign for the company's long-term financial health. I would definitely want to see continued reductions going forward to create a more recession-resistant business so this will be a thing to watch for now. Looking ahead to the upcoming earnings, I believe United Airlines is well-positioned for a strong performance. With the recovery in travel demand and the busy travel months of June and July, I anticipate strong revenue and a likely beat of analyst expectations of $14 billion. Management is seeing even stronger demand in the summer months and weaker demand in the winter than in past years, so I think analysts might be underplaying this.

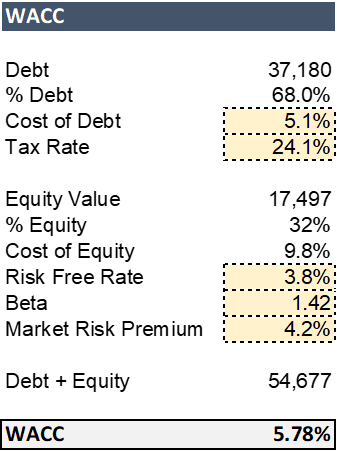

DCF and Comparable Multiples

I foresee United Airlines continuing to push its own limits and continue to grow in the coming years. In support of this outlook, my Discounted Cash Flow (DCF) model and Weighted Average Cost of Capital (WACC) calculation yield a positive outlook for investors. I used a tax rate assumption of 24.1% which is an average of United Airlines' effective tax rate over the past five years and the risk-free rate of 3.81% is based on the treasury rate. These assumptions used in my calculation of United Airlines' WACC yielded a discount rate of 5.78%.

Looking ahead to 2022's revenues I tapered down the growth significantly from the two prior years due to the rebound growth in 2021 and 2022 being temporary. Now that revenues are back up to pre-pandemic levels, I expect growth levels to return to the neighborhood of 4.8%. The EBIT margin was forecasted using historic values excluding the years 2020 and 2021 given that the two years are extreme outliers to United's historical trends. As interest rates dance around the high end and fuel prices refuse to fall, I used a lower terminal growth rate (TGR) of 2.7% to remain conservative for the years to come. The result we see is an implied share price of $68.41 per share which supports my thesis and reaffirms my buy rating. The company has the upward momentum of the recovery to carry them beyond previous records and the possibilities United Airlines has for growth beyond 2025 are vast. On top of that, United's financials are beginning to show signs of strength again and the company is taking the initiative to innovate. If the taxi route sees promising growth, United can work on expanding their routes to remain ahead of others who may be trying to enter the market.

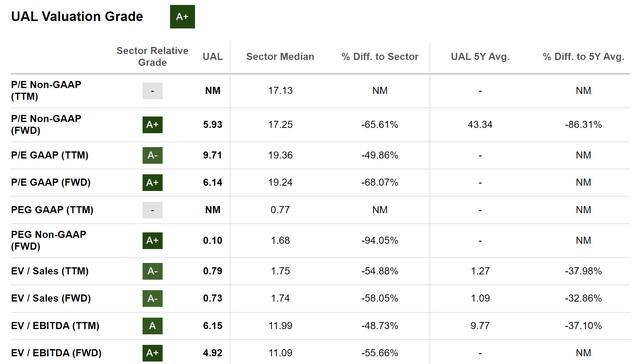

Looking at some of the valuation metrics, we can see that the stock appears to be overwhelmingly undervalued in relation to its sector. Even Seeking Alpha's Quant rating places it at an almost perfect score of 4.92. All the signs are pointing in the right direction for United Airlines, so it is hard to be anything but bullish about this stock.

Risks

As we have seen with the COVID-19 pandemic and some natural disasters, airlines are prone to flight delays, cancellations, and decreases in demand due to external events. These events are often unexpected and out of the control of airline management. Any significant changes in demand can negatively impact revenues, causing the company to lose money and the stock price to drop. My original thesis on this stock could become unreasonable if we see another significant drop in passenger flight demand. United is still in the recovery phase of the 2020 plummet and I don't believe it is in any condition to withstand another drop. One main thing to watch is the handling of the debt situation. If management isn't able to continue reducing debt, UAL will likely remain very vulnerable to economic pullbacks and would be unable to handle everything. As such, there is a real risk of the business going under if this isn't continually improved upon.

Another major risk of investing in airlines is the intense competition among large airlines. The top four airlines, American, Delta, Southwest, and United, held over 65% of the domestic market share in the 2022 fiscal year. The difference in market share among the four leading airlines is only 1.7% from first to fourth. This limits the growth potential for market share and makes it very difficult for these airlines to significantly surpass one another. Some other minor risks that United Airlines is exposed to are changes in the price of fuel and busy season delays. Ultimately, the basis of my view on United Airlines lies in its ability to innovate into new spaces and continue growth beyond historic levels. If their plans with the eVTOL taxi routes fall through and fuel prices keep increasing, I would reconsider my bullish outlook of the company

Conclusion

United Airlines had its rough patch throughout the duration of the pandemic and a lot of analysts thought it wasn't going to recover. Regardless, the company managed to pull itself back up and is getting involved with the emerging eVTOL aircraft. This move has the potential to put United above competitors by bringing something to the table that has never been done before. I believe United Airlines is due for a great comeback and it's not a company I see plummeting again anytime soon.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.