Antero Resources Reports Improved Capital Efficiency And Increased Production Guidance

Summary

- Antero generated only $14 million in free cash flow in 1H 2023, despite over $200 million in benefit from changes in working capital.

- It highlighted improved capital efficiency, though, allowing it to increase production expectations without changing its 2023 capex budget.

- It also believes it can hold production at these improved levels with a 10% lower capex budget in 2024.

- This leads to a projection of $168 million in free cash flow in 2H 2023 and $679 million in FCF in 2024 at current strip.

- I now estimate Antero's value at $28 per share with long-term $3.75 NYMEX gas.

- Looking for more investing ideas like this one? Get them exclusively at Distressed Value Investing. Learn More »

imaginima

I mentioned before that Antero Resources (NYSE:AR) was likely to generate limited free cash flow in 2023. It ended up generating only $14 million in free cash flow in 1H 2023, and that was with over $200 million in benefit from working capital changes.

Going forward, Antero's free cash flow should improve though, due to increased capital efficiency (which led it to raise its 2023 production guidance) as well as better natural gas prices. Excluding working capital changes, I project Antero to generate $168 million in free cash flow in 2H 2023 and $679 million in free cash flow in 2024 at current strip.

Due to its improvements in capital efficiency and increased production guidance, I've bumped up my estimate of Antero's value by $2 per share from $26 to $28 per share at my long-term commodity prices of $75 WTI oil and $3.75 NYMEX gas.

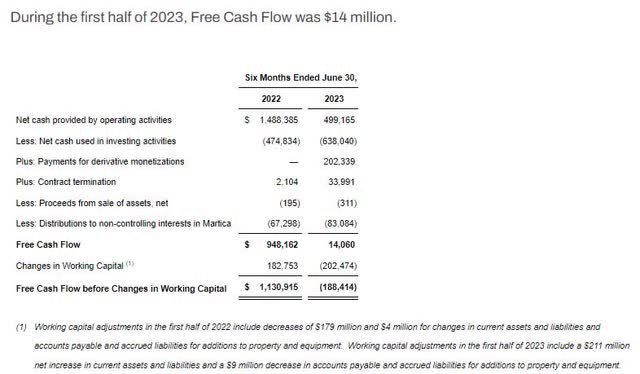

Free Cash Flow In 1H 2023

Antero reported only $14 million in free cash flow in the first half of 2023, largely due to low natural gas prices and limited hedges. It realized only $2.16 per Mcf for its natural gas after hedges in Q2 2023.

Antero's free cash flow benefited from changes in working capital, and without those changes it would have generated negative $188 million in free cash flow during the first half of 2023.

Antero's Free Cash Flow (anteroresources.com)

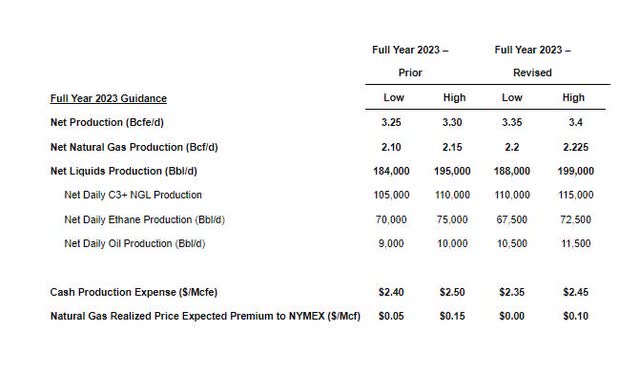

Guidance Changes

Antero made some positive revisions to its full-year guidance, increasing its natural gas production expectations by 4%, its C3+ NGL production expectations by 5% and its oil production expectations (albeit against a small base) by 16%. Antero's ethane production expectations were reduced by 3%.

Antero attributed its improved production guidance to capital efficiency gains (its capex budget was unchanged) along will strong well performance. The slight decrease in expected ethane volumes was due to the ramp up timing of the Shell ethane cracker.

Antero's Updated Guidance (anteroresources.com)

The strong well performance has also allowed Antero to improve its guidance around cash production expenses by $0.05 per Mcfe. However, Antero now expects to realize a $0.05 per Mcf lower premium to NYMEX for its natural gas in 2023.

2H 2023 Outlook

At current strip prices, Antero is now projected to generate $2.258 billion in revenues after hedges in the second half of 2023. Natural gas and NGL prices are still relatively weak in Q3 2023, but it should see improvement in both those areas in Q4 2023.

| Type | Barrels/Mcf | $ Per Barrel/Mcf | $ Million |

| Natural Gas | 409,562,500 | $3.00 | $1,229 |

| Ethane | 12,995,000 | $10.50 | $136 |

| C3+ NGLs | 21,030,500 | $35.50 | $747 |

| Oil | 2,213,000 | $67.00 | $148 |

| Distributions To Martica | -$60 | ||

| Antero Midstream Dividends | $63 | ||

| Hedge Value | -$5 | ||

| Total | $2,258 |

Antero's capex budget is more heavily weighted to the first half of the year, so it is projected to end up with around $430 million in capital expenditures during the second half of 2023.

| Expenses | $ Million |

| Cash Production and Marketing Expense | $1,542 |

| Cash G&A | $75 |

| Cash Interest | $43 |

| Capital Expenditures | $430 |

| Total Expenditures | $2,090 |

Antero is now projected to generate $168 million in free cash flow (before changes in working capital) during the second half of 2023.

This would result in Antero ending up with $1.335 billion in total debt (including $192 million in credit facility debt) at the end of 2023, not including any spending on share repurchases.

Potential 2024 Outlook

Antero believes that it can now maintain its improved 2023 production guidance in 2024 with 10% less capex than 2023.

At current strip (including roughly $3.50 NYMEX gas) for 2024, Antero is projected to generate $4.919 billion in revenues. This assumes it realizes $0.05 above NYMEX for its natural gas, similar to 2023.

| Type | Barrels/Mcf | $ Per Barrel/Mcf | $ Million |

| Natural Gas | 808,475,000 | $3.55 | $2,870 |

| Ethane | 25,550,000 | $10.50 | $268 |

| C3+ NGLs | 41,062,500 | $37.00 | $1,519 |

| Oil | 4,015,000 | $64.00 | $257 |

| Distributions To Martica | -$120 | ||

| Antero Midstream Dividends | $125 | ||

| Total | $4,919 |

I've assumed that Antero's capex budget for 2024 is $950 million, down from $1.05 billion in 2023. This leads to a projection that Antero will generate $679 million in free cash flow (before working capital changes) in 2024 at current strip.

| Expenses | $ Million |

| Cash Production and Marketing Expense | $3,055 |

| Cash G&A | $155 |

| Cash Interest | $80 |

| Capital Expenditures | $950 |

| Total Expenditures | $4,240 |

Estimated Valuation

Antero's improved capital efficiency and increased production expectations boosts its estimated value to around $28 per share at my long-term commodity prices of $75 WTI oil and $3.75 NYMEX gas. This also assumes a realized natural gas price of $0.05 above NYMEX and C3+ NGL prices in the high-$30s per barrel.

That is a commodity pricing scenario where Antero should be able to generate close to $1 billion per year in free cash flow while at least maintaining production levels.

Conclusion

Antero only generated $14 million in free cash flow during the first half of 2023, and that was with over $200 million in benefit from working capital changes.

Going forward though, reduced capex (which was frontloaded into 1H 2023) and improved natural gas prices (based on strip) should help Antero generate more free cash flow. I estimate that Antero can generate $168 million in free cash flow in 2H 2023 and $679 million in free cash flow in 2024 at current strip, before any changes in working capital.

Antero ideally wants at least $3.75 NYMEX gas prices though, as it could generate close to $1 billion in free cash flow in that situation. I am using $3.75 as a longer-term natural gas price, and estimate Antero's value at $28 per share in that scenario.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various energy companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

This article was written by

Elephant Analytics has also achieved a top 50 score on the Bloomberg Aptitude Test measuring financial aptitude (out of nearly 200,000 test takers). He has also achieved a score (153) in the 99.98th percentile on the WAIS-III IQ test and has led multiple teams that have won awards during business and strategy competitions involving numerical analysis. In one such competition, he captained his team to become North American champions, finishing ahead of top Ivy League MBA teams, and represented North America in the Paris finals.

Elephant Analytics co-founded a company that was selected as one of 20 companies to participate in an start-up incubator program that spawned several companies with $100+ million valuations (Lyft, Life360, Wildfire). He also co-founded a mobile gaming company and designed the in-game economic models for two mobile apps (Absolute Bingo and Bingo Abradoodle) with over 30 million in combined installs.

Legal Disclaimer: Elephant Analytics' reports, premium research service and other writings are personal opinions only and should not be considered as investment advice. Only registered investment advisors can provide personalized investment advice. While Elephant Analytics attempts to provide reports that include accurate facts, investors should do their own diligence and fact checking prior to making their own decisions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)