Cell Tower REITs: Toxic Telecom?

Summary

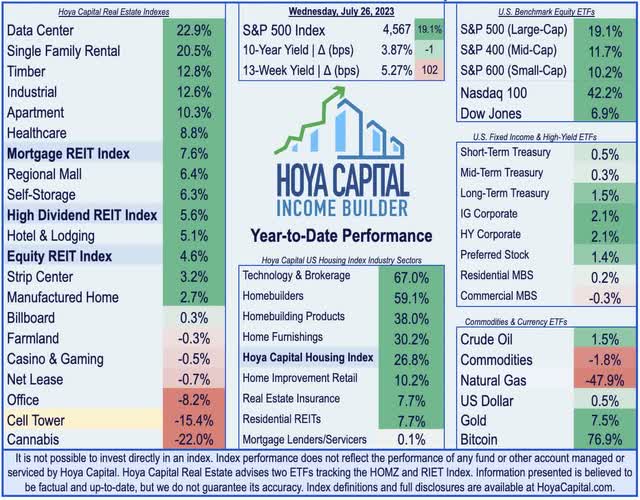

- Cell Tower REITs have been the weakest-performing property sector since the start of 2022 - lagging even the battered office sector - amid a telecommunications industry-wide slump inflamed by tight monetary conditions.

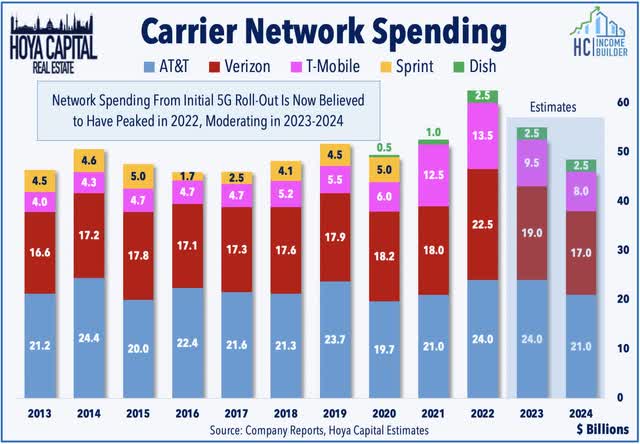

- Cellular carriers have curbed their capital-intensive network expansion plans in recent quarters following a significant wave of investment and tower equipment upgrades from 2019-2022 to deploy nationwide 5G networks.

- The latest selloff was intensified by an expose alleging that century-old abandoned phone lines owned by AT&T and Verizon are leaching toxic lead into drinking water, potentially requiring costly remediation.

- Industry headwinds are rooted primarily in the ongoing disintermediation of legacy wireline business segments towards fully wireless deployments and the mounting competition on the two industry juggernauts from within the wireless industry itself via T-Mobile, Amazon, and DISH.

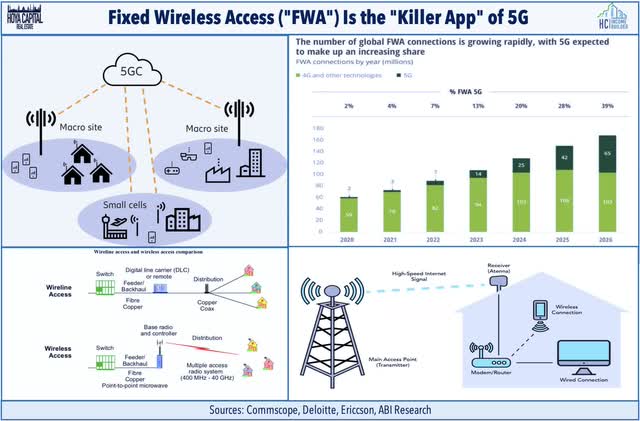

- This disintermediation has trended on a path from wired to wireless infrastructure - a path that includes the increased adoption of Fixed Wireless Access (home broadband via cell networks) - disruptions which serve to further solidify the longer-term favorable competitive positioning of these cell tower REITs.

- Hoya Capital Income Builder members get exclusive access to our real-world portfolio. See all our investments here »

Bill Oxford

REIT Rankings: Cell Towers

After producing sector-leading returns from 2015 through 2021, Cell Tower REITs have been the weakest-performing property sector since the start of 2022 – lagging even the battered office sector - and bringing valuations to levels below the REIT industry average for the first time ever amid a telecommunications industry-wide slump inflamed by tight monetary conditions. Within the Hoya Capital Cell Tower REIT Index, we track the three Cell Tower REITs which account for roughly $160 billion in market value: American Tower (AMT), Crown Castle (CCI), SBA Communications (SBAC). We also track Uniti Group (UNIT), which owns a fiber-optic cable network that connects digital communications infrastructure. Cell tower REITs comprise roughly 12% of the market capitalization of the REIT sector - the single-largest real estate property sector weight.

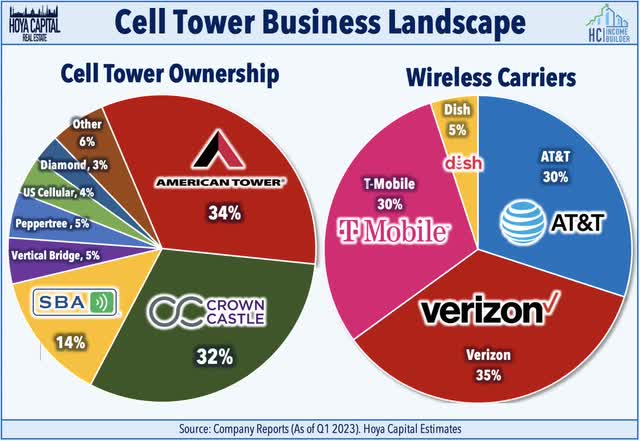

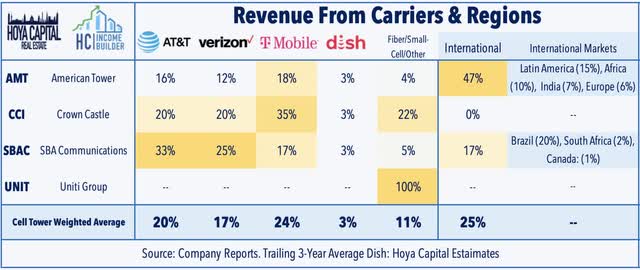

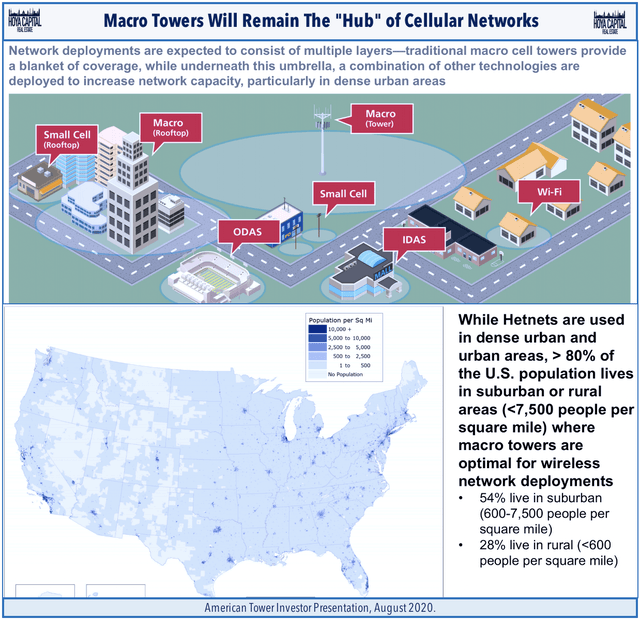

Cell Tower REITs' relative dominance over the real estate sector is dwarfed by its even more impressive dominance over the telecommunications sector, as these REITs control nearly 75% of wireless communication infrastructure in the U.S. and more than 50% in several major international markets. These REITs are the landlords to the four nationwide cellular network operators in the U.S.: AT&T (T), Verizon (VZ), T-Mobile (TMUS), and DISH Network (DISH), and own 50-80% of the roughly 140k macro cell towers in the United States and a significant share of multi-tenant "small cell" infrastructure. Six additional companies own portfolios of at least 2,000 towers, including DigitalBridge (DBRG), U.S. Cellular (USM), and private equity firms Peppertree Capital, Diamond Communications, Palistar Capital, and Tillman Infrastructure.

The past several months also saw the emergence of tech-heavyweight Amazon (AMZN) onto the cell carrier scene. Last month, Bloomberg reported that Amazon has been talking with wireless carriers about offering low-cost mobile phone service to Prime subscribers. This week, DISH Network announced that it indeed partnered with Amazon to sell postpaid wireless plans for $25 a month for unlimited talk, text, and data services. DISH – which acquired Boost Mobile as part of the T-Mobile/Sprint merger - plans to compete as a low-cost provider by leveraging its existing satellite subscriber base and its network sharing agreement with T-Mobile and AT&T to provide immediate nationwide services as it deploys its 5G network. Given the industry skepticism over DISH’s viability, any level of success is incremental for tower REITs and not “baked in” to the numbers or guidance.

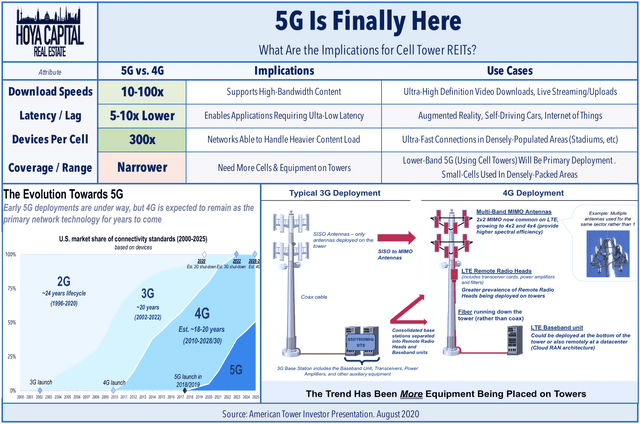

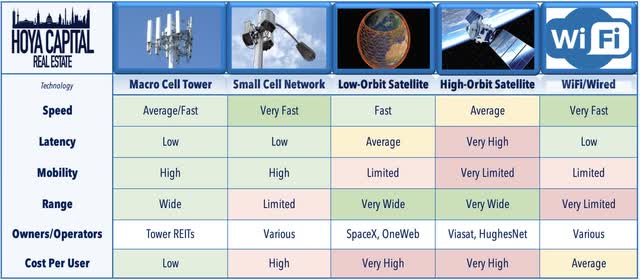

This commanding competitive positioning has given these REITs substantial pricing power amid the roll-out of 3G, 4G, and 5G wireless networks, which has translated into enviable long-term shareholder returns. While 4G networks gave us the "streaming" and "e-commerce" age, pioneered by Amazon and apps like Uber (UBER) and Spotify (SPOT), 5G networks are expected to spur a new wave of technological innovation fueled by "fiber-like" speeds and ultra-low latency over wireless nodes. 5G adoption in mobile devices has been propelled by the success of Apple's (AAPL) lineup of 5G iPhones. Nearly 60% of smartphones in the U.S. now have 5G capability, and as we'll discuss throughout this report, we continue to believe that home wireless broadband - called "Fixed Wireless Access" or "FWA" in the industry - is the true "killer app" of 5G and will significantly disrupt the traditional wireline broadband industry.

Industry Fundamentals: Toxic Telecom?

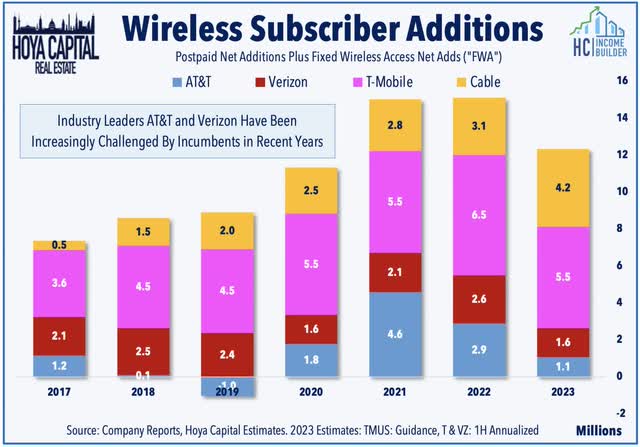

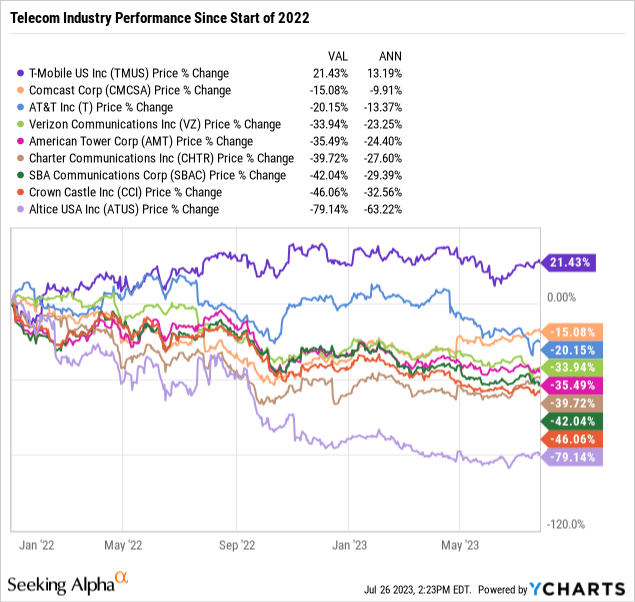

Near-term headwinds are rooted primarily in the ongoing disintermediation of legacy wireline business segments and, relatedly, the mounting competition on the two industry juggernauts (AT&T and Verizon) from within the wireless industry itself via T-Mobile, Dish, and Amazon - a disruption that we believe actually serves to further solidify the longer-term favorable competitive positioning of these cell tower REITs. Since the start of 2022, shares of AT&T are lower by more than 20% - trading near their lowest level in thirty years - while Verizon has dipped nearly 35% over that time. The traditional wireline companies have suffered even steeper declines: Charter (CHTR) has dipped nearly 40% since the start of 2022, while Altice USA (ATUS) has declined by nearly 80%. By comparison, the "pure-play" wireless carrier - T-Mobile has gained more than 20% during this time, while Comcast (CMCSA) - which has been the most aggressive in adding wireless bundling options to its service mix - has been the top-performer among the wireline companies.

Hoya Capital

The latest selloff was intensified by an expose from the WSJ alleging that century-old abandoned phone lines owned by AT&T and Verizon are leaching toxic lead into drinking water, potentially requiring costly remediation. While the cell tower REITs have limited direct exposure to issues related to the 50-100 year-old cables, these potential problems come as wireless carriers were already expected to spend about 10-20% less in 2023 compared to last year on network upgrades following an initial surge in spending related to 5G network deployment, a slowdown that is at least partially attributable to the historically aggressive monetary tightening campaign by the Federal Reserve - which has also impacted these tower REITs directly via higher interest expense. Last week, Crown Castle lowered its full-year Funds From Operations ("FFO") outlook and initiated an expense reduction strategy after it observed a "significant" slowdown in tower leasing activity.

The rate-driven moderation in FFO growth hides the underlying reacceleration in property-level "organic" rent growth seen across the sector. Due to the effects of churn related to the T-Mobile/Sprint merger, this "same-store" growth slowed from 2020-2022 to an average of 3.7% - the weakest since 2014 - but these REITs forecast an acceleration in 2023 back to an average of 5.0%. AMT expects 5% organic "same-store" tenant billings growth in the U.S. - an acceleration from the 1% growth in 2022 as the headwinds from the Sprint merger subside. CCI expects organic growth of 6.8%, consisting of 5% from towers, approximately 25% from small cells, and approximately 5% from fiber solutions. SBAC expects organic growth of 3.2% in the U.S. which reflects the delay of some of the Sprint-related churn from 2022 into 2023.

Importantly, this disintermediation has trended on a path from wired to wireless infrastructure - a path that includes the increased adoption of Fixed Wireless Access (home broadband via cell networks) - disruptions which serve to further solidify the longer-term favorable competitive positioning of these cell tower REITs. Verizon and T-Mobile reported an impressive haul of 3.5 million new FWA subscribers in 2022, representing 90% of total broadband additions for the year - growth that has continued into 2023 and which is coming largely at the expense of traditional cable operators and in areas where these “wireline” operators were previously the “only game in town” for high-speed internet. Even AT&T is coming around to the FWA story after years of being a vocal skeptic, a critique that was no doubt influenced by its heavy investment into costly wireline networks over the prior decades and the importance of its struggling legacy cable business to its profitability.

We believe the market continues to overlook this substantial shift towards wireless broadband through the accelerated rollout of FWA - which has further solidified the competitive positioning of land-based wireless networks - a market that is effectively "cornered" by the three cell tower REITs. We've long-viewed FWA - home broadband provided by cell carriers through mobile networks - as the true “killer app” of 5G wireless networks. Using a mix of traditional 4G LTE served from macro towers - and increasingly by small-cell 5G notes - wireless carriers are now competing directly with "wired" home internet providers with comparable speed and service offering - without the service appointments for "last mile" wiring into the home.

Interestingly, the "counterpunch" strategy used by Comcast, Charter, and Altice is to get into the wireless carrier business themselves, offering bundled wireless services options at steep discounts to existing subscribers. While these "mobile virtual network operators" (MVNO) networks have traditionally "rented" capacity from existing cell carriers, these carriers are incentivized to offload capacity from high-cost third-party networks onto first-party networks. Comcast recently begun deploying their own 5G radios on cell towers while Charter is currently running tests on 5G networks in one market, opening the door to the dynamic that these wireline cable operators will increasingly become more active "customers" of cell tower REITs. MoffettNathanson noted (registration required) in a recent report that the cable industry accounted for nearly 75% of total industry phone net additions in Q1 2023.

Competition from Above?

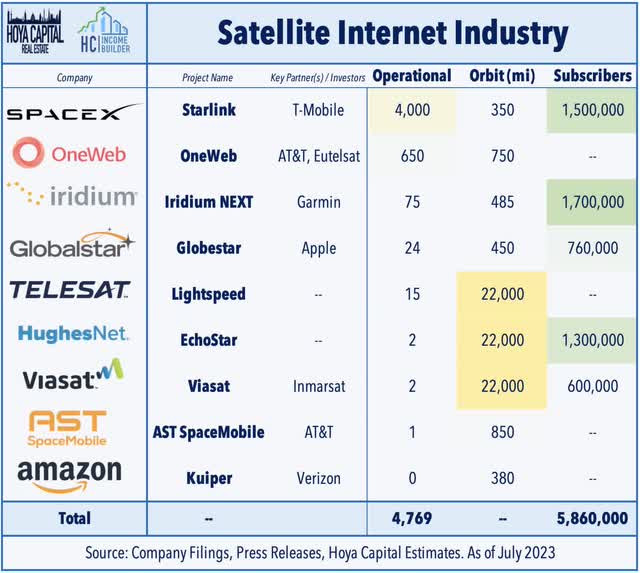

Concurrent with the shift from wired to ground-based wireless over the past several years, we've seen the emergence of next-generation satellite technologies, which has come with concern that these next Low Earth Orbit ("LEO") networks could eventually compete directly with cell tower REITs. The focus on LEO was amplified last year when Apple (AAPL) launched its new iPhone lineup that is capable of sending "emergency" text messages over satellite networks - the first satellite-based connectivity offered in a consumer cell phone. Several carriers have subsequently announced partnerships with Low Earth Orbit satellite services, including a deal between T-Mobile and SpaceX's Starlink to develop sat-to-cell service utilizing its next-generation satellites, which could theoretically provide 2G/3G-quality service that goes beyond the emergency text capabilities that are currently available. AT&T, meanwhile, has partnered with AST SpaceMobile (ASTS) to provide emergency satellite-based connectivity for FirstNet, the company’s public safety network, and plans to launch a consumer application that would incorporate satellite connectivity. Verizon has recently teamed-up with Amazon's yet-to-be-launched Project Kuiper program with an initial focus on providing backhaul to connect rural cell tower equipment.

Satellite internet has been around for decades through providers including EchoStar's (SATS) HughesNet and Viasat (VSAT) that use geostationary satellites that are roughly 20k miles from earth, but LEO systems can theoretically provide broadband-like speeds through "constellations" of satellites that are several hundred miles above Earth. Starlink - which has already deployed roughly 3,000 LEO satellites and recently surpassed 1.5M subscribers - is one of a handful of companies working on LEO broadband and related technologies. LEO networks are an improvement over older geostationary technology, but there remain unavoidable physical and technical limitations - including its high power consumption, higher latency, and line-of-sight requirements that will limit its use-case to niche applications that lack better options. We see a higher likelihood that LEO networks will be customers or perhaps partners rather than competitors to tower REITs with satellite networks providing backhaul connectivity between towers while ground-based 5G networks facilitate the "last-mile" connectivity.

Cell Tower REIT Stock Performance

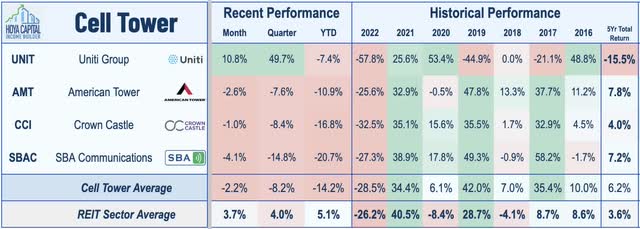

As noted above, Cell Tower REITs have been one of the weakest-performing property sectors since early 2022, an uncharacteristic stretch of poor performance following a half-decade of industry-leading returns. The Hoya Capital Cell Tower REIT Index is lower by 15% so far in 2023 after dipping by 29% in 2022, underperforming the broad-based Vanguard Real Estate ETF (VNQ), which has gained 4.6% so far this year and lagging the S&P 500 (SPY), which has gained nearly 20%. The two-year stretch of underperformance follows a streak of six-straight years of outperformance from 2015 through 2020, which was the second-longest streak in REIT sector history behind the nine-straight years of outperformance from the Manufactured Housing REIT sector from 2013-2021.

Despite this weak recent performance, Cell Tower REITs have still delivered total returns of 6.2%, which are roughly double that of the broader REIT Index (3.6%) over the past five years. Over the past five years, AMT has delivered the highest average annual total return at 7.8% followed by SBAC at 7.2% and CCI at 4.0%. UNIT has been a laggard over the past half-decade but has surged over 40% since reporting first-quarter results after maintaining its dividend and reiterating its intention to remain a REIT, noting that any savings from reducing its dividend as a non-REIT would be offset by higher taxes. UNIT slightly increased its FFO outlook for 2023 after finalizing several debt restructuring deals and commented that it expects to be cash-flow positive after dividends by the end of 2025.

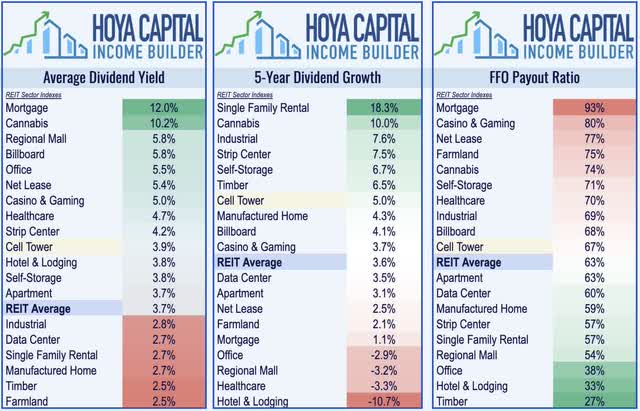

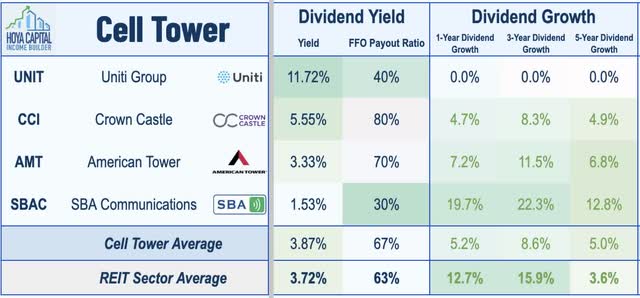

Cell Tower REIT Dividend Yields

Cell Tower REITs pay an average dividend yield of 3.9%, which is now slightly above the market-cap-weighted REIT sector average of roughly 3.7%. Cell towers were one of the few property sectors that were untouched by the wave of dividend cuts and suspensions that hit the REIT sector in 2020 and have delivered robust annual dividend growth averaging over 5% over the past five years. Cell Tower REITs retain roughly half of their free cash flow leaving ample free cash flow for external growth and additional dividend growth.

Among the three larger cell tower REITs, we note that only Crown Castle acts like a "typical REIT" when it comes to distributions, paying a relatively healthy 5.6% dividend yield, which is roughly 80% of its available cash flow. American Tower, meanwhile, pays a relatively lower 3.3% yield, while SBA Communications pays a yield of roughly 1.5%. Uniti Group pays a yield of 11.7%, but has lagged behind its peers when it comes to dividend growth and its debt heavy balance sheet has prompted calls from analyst in recent quarters to focus on debt reduction through a dividend reduction.

Takeaway: Favorable Competitive Positioning Persists

After a review of recent earnings results and telecom industry developments, we're reiterating our high-conviction positive long-term outlook on cell tower REITs despite the recent industry-wide turbulence. These near-term headwinds are rooted primarily in the ongoing disintermediation of legacy wireline business segments and, relatedly, the mounting competition on the two industry juggernauts (AT&T and Verizon) from within the wireless industry itself via T-Mobile, Dish, and Amazon. This disintermediation has trended on a path from wired to wireless infrastructure - a path that includes the increased adoption of Fixed Wireless Access (home broadband via cell networks). Competitive advantages are rarely "permanent" in the ever-evolving telecommunications industry, but we believe that these recent dynamics - notably the increased competition on the carrier side - have further solidified the favorable positioning of cell tower REITs over the next decade.

For an in-depth analysis of all real estate sectors, check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Read The Full Report on Hoya Capital Income Builder

Income Builder is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and 'Dividend Champions' across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

This article was written by

Real Estate • High Yield • Dividend Growth

Visit www.HoyaCapital.com for more information and important disclosures. Hoya Capital Research is an affiliate of Hoya Capital Real Estate ("Hoya Capital"), a research-focused Registered Investment Advisor headquartered in Rowayton, Connecticut.

Founded with a mission to make real estate more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns.

Collaborating with ETF Monkey, Retired Investor, Gen Alpha, Alex Mansour, The Sunday Investor, and Philip Eric Jones for Marketplace service - Hoya Capital Income Builder.Hoya Capital Real Estate ("Hoya Capital") is a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations is an affiliate that provides non-advisory services including research and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital has no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIET, HOMZ, CCI, UNIT, AMT, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry. This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing. The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized. Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes. Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receive compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)