AB SKF: Undervalued Company With Solid Financials

Summary

- AB SKF, a provider of bearings and power transmission solutions, reported strong Q2 FY23 results with net sales rising 14.6% due to demand in Asia and Europe.

- The company's net profit grew by 269% in Q2 FY23 compared to Q2 FY22, and its net cash flow increased by 183.3% due to inventory reduction and working capital reduction.

- Despite its strong financial performance, the company's stock is undervalued, leading to a buy rating for SKFRY. However, risks include potential economic slumps and regulatory restrictions.

Laser1987

AB SKF (OTCPK:SKFRY) works in the Industrial and Automotive segments. They provide rolling bearings, slewing bearings, thin section bearings, power transmission solutions, and services like application engineering, mechanical maintenance, and training solutions. SKFRY recently posted its Q2 FY23 results. I will do the financial and technical analysis of the company in this report. I think it is undervalued with great growth potential. Hence I assign a buy rating on SKFRY.

Financial Analysis

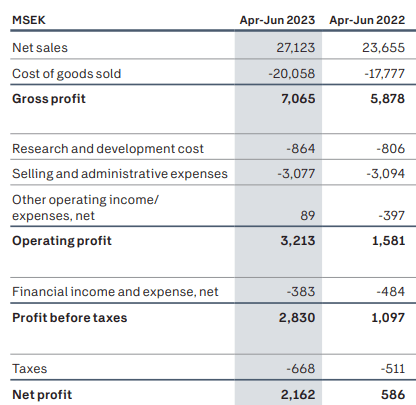

SKFRY recently posted its Q2 FY23 results. All the figures are in Swedish Krona. The net sales for Q2 FY23 were SEK 27.1 billion, a rise of 14.6% compared to Q2 FY22. I believe the revenue rose due to strong demand in Asia and Europe. The organic growth in Asia and Europe in Q2 FY23 was around 10%. I think strong demand in its aerospace, railway, and electric vehicles segments was the main reason behind the strong growth organic growth in Asia and Europe. Its adjusted operating margin in Q2 FY23 was 13.3% which was 10.5% in Q2 FY22. I believe efficient portfolio management and a higher pricing policy were the major reasons for the operating margin improvement.

SKFRY's Investor Relations

As a result of a significant increase in the operating profit and operating margin, its net profit grew by 269% in Q2 FY23 compared to Q2 FY22. In addition, it also saw a significant rise in net cash flow from operations in Q2 FY23 compared to Q2 FY22. Its net cash flow grew by 183.3%, and I believe the main reasons behind the significant rise were management's focus on inventory reduction and reduction in working capital. As a result of increased cash flow, its debt slightly declined in Q2 FY23 compared to Q1 FY23. So after analyzing and looking at the numbers, I think its financial performance in Q2 FY23 was solid. Its growth in every aspect was solid, and besides its financials, its balance sheet is also looking strong, which is an optimistic sign. Now talking about future expectations, the management expects its FY23 revenue to be around 7%-9% higher than FY22 revenue which is an optimistic sign. I believe it might achieve its revenue targets and it might even surpass its expectations. I am saying this because the businesses they work in are highly growing and are currently in demand, especially in the railway segment. In Q2 FY23, they won orders where they will provide products like wheelset bearings to various train platforms in Egypt, which I believe will boost the company's sales in the coming quarters. So, I think its growth trajectory looks solid.

Technical Analysis

SKFRY is trading at the $18.5 level. The stock price is below its 200 ema, which indicates it is in a downtrend, but despite being in a downtrend, the stock is showing some signs of reversal. Like the stock has started to make higher lows and is currently stuck in a triangle pattern, the price has tested the resistance trendline several times. Whenever a resistance or support zone has been tested several times, it starts to become weak, so the multiple testing of the resistance trendline shows that we might see a breakout in this stock very soon. So the higher lows formation and testing of the trendline might be an indication of a trend reversal. So if the price crosses its 200 ema, which is at $19.3, I think one can start buying it because I think once the price crosses the 200 ema, we might see a new uptrend in the stock.

Should One Invest In SKFRY?

Looking at SKFRY's valuation. SKFRY has an EV/Sales [FWD] ratio of 0.98x compared to the sector ratio of 1.82x, and it has a Price / Sales [FWD] ratio of 0.84x compared to the sector ratio of 1.38x. Both ratios show that SKFRY is undervalued, and despite its solid financial performance, the stock price of SKFRY has not been appreciated enough. So I think SKFRY is undervalued. So looking at its solid financial results, strong growth trajectory, and strong balance sheet. I believe it is an undervalued stock that can provide significant returns to its investors in the coming times. Hence I assign a buy rating on SKFRY.

Risk

The SKF Group has operations in a wide range of sectors and regions. The demand for the Group's products, solutions, and services could decline if there is a general economic slump worldwide or in one of the world's major economies.

Disturbances in the global financial markets could negatively impact the Group's goods and services demand.

Additionally, the SKF Group's operations may be restricted by governmental regulations, taxes, tariffs, and other trade barriers, pricing or exchange restrictions, or other policies.

Bottom Line

SKFRY has a strong balance sheet, and its quarterly result has been impressive. They are fundamentally and financially a solid company which I believe has not been appreciated enough. I believe they are undervalued and can provide good returns in the coming times. Hence I assign a buy rating on SKFRY.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.