Oxford Lane Capital: Why You Should Buy The Preferreds Over The Commons

Summary

- Oxford Lane Capital Corporation is a closed-end fund that primarily invests in collateralized loan obligations - CLOs, targeting the riskiest components (the equity and junior debt tranches).

- In my opinion, credit risk isn't the main problem with OXLC common stock - this CEF is too well diversified. What confuses me a lot is the erosion of capital.

- The FWD distribution yield of 17.84% looks impressive, but minus the high double-digit expense ratio, you'll be getting a mid-single-digit return most of the time.

- OXLC's preferred stocks look safer than its common stock. Read on to learn why.

- I do much more than just articles at Beyond the Wall Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

The Company

Sakibul Hasan/iStock via Getty Images

Oxford Lane Capital Corporation (NASDAQ:OXLC) is a closed-end fund (CEF) that primarily invests in collateralized loan obligations ((CLOs)), which are a type of investment vehicle deriving principal and interest from a pool of non-investment grade senior-secured corporate loans. These CLOs are structured by bundling secured debt loans into different risk tranches that determine the payment order and risk level, offering the potential for higher returns with higher risk.

OXLC's investment strategy targets the riskiest components of CLOs, specifically the equity and junior debt tranches, which offer potentially higher returns compared to the debt tranches. These CLOs are mainly collateralized by portfolios of senior loans issued to companies with unrated or below-investment-grade debt.

Historically, CLOs, especially equity tranches, have shown low default rates and strong returns compared to corporate debt across various rating categories. The situation started to worsen a while ago amid the rising rates environment, as shown by FitchRating's chart below:

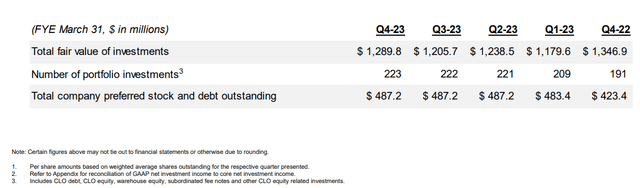

OXLC typically allocates approximately 97% of its portfolio to CLO equity tranches, but its portfolio is quite diversified with 223 investments in it as of the latest data:

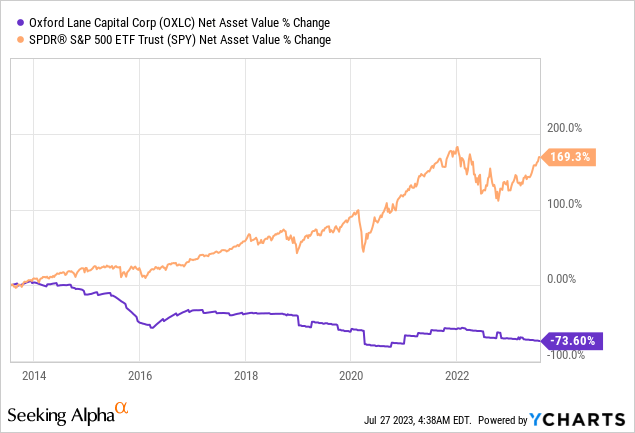

In my opinion, credit risk isn't the main problem with OXLC common stock - this CEF is too well diversified. What confuses me a lot is the erosion of capital over time - this is clearly seen in the table above ["Total fair value of investments" line] as you go from the far right end to the left. And it's not just about 2022 and 2023 when we saw the fastest tightening interest rate cycle in decades. Over the past 10 years, the fund has experienced a decline in its NAV by 73.6%, significantly underperforming the S&P 500 ETF (SPY), whose NAV went up by 169.3%:

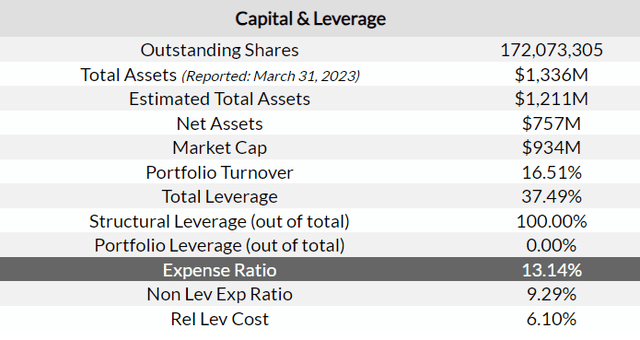

The disappointing performance can be attributed in part to the fund's relatively high expense ratio of 13.14% [including the leverage costs]:

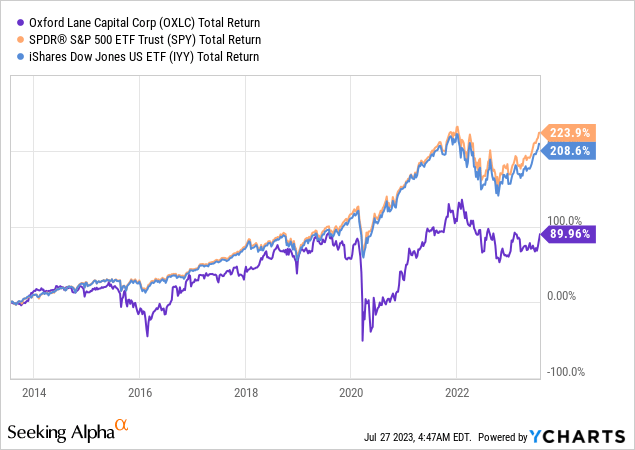

The FWD distribution yield of 17.84% that you see when you first access this CEF's profile looks impressive, but minus the high double-digit expense ratio, you'll likely be getting a mid-single-digit return most of the time. At the same time, the lack of diversification by asset class (OXLC diversifies across CLOs and related products) gives investors an unstable investment when it comes to OXLC common stock that can't outperform SPY, and even the Dow Jones ETF (IYY):

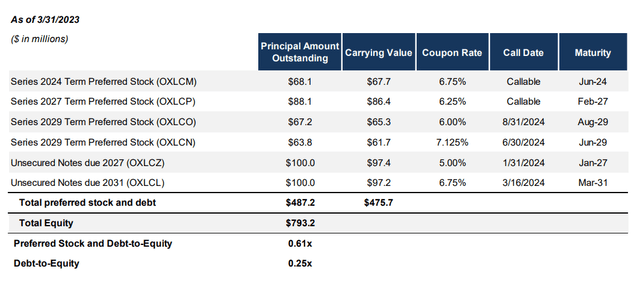

Considering OXLC's historical performance and challenges, some investors may seek alternative ways to invest in the company, knowing its credit risks are quite low. That's where preferred securities come into play.

OXLC has several of them, and also junior notes that offer relatively higher dividend yields and greater security in the capital stack compared to the common stock.

Why do OXLC's preferred stocks look safer than its common stock? A couple of points here to consider:

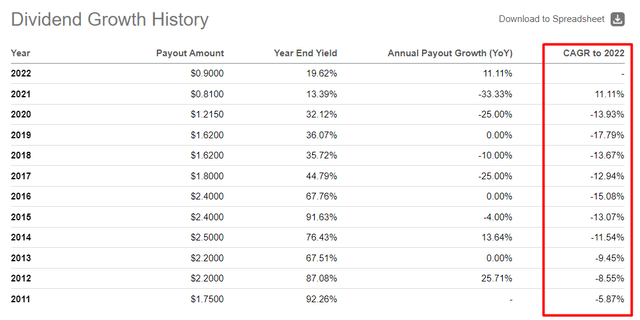

- Preference in Dividends: Preferred stockholders receive dividends before common stockholders, while the payout is fixed and tied to the coupon. Here, investors are unlikely to see what they saw the last 10 years in common stock - I'm talking about the size of the dividend:

Seeking Alpha, OXLC's dividends, author's notes

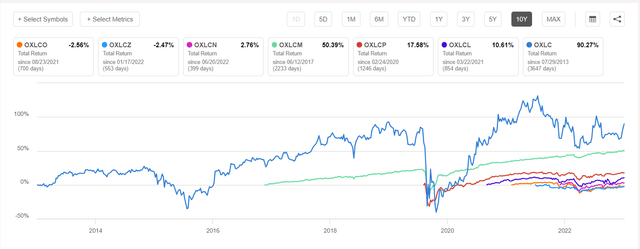

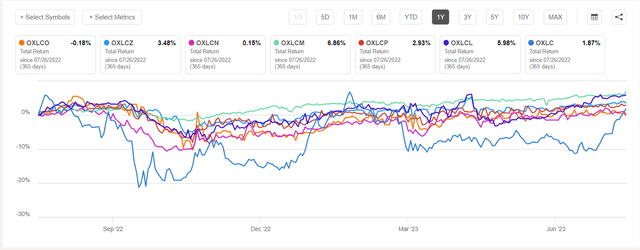

- Lower Volatility: It may be a piece of new information for some, but preferred stock behaves like a hybrid between stocks and bonds, leading to less volatility. In the case of OXLC preferred stock, we see how this rule is implemented in practice:

Yes, OXLC common stock has significantly outperformed other instruments in recent years (just relying on the same mid-single digit spread between distribution yield and expense ratio), but last year's performance demonstrated the importance of minimizing drawdowns:

Imagine you bought OXLC and managed to hold the stock for a year, but now you urgently need money and are forced to sell your position. The probability that you'll sell at a loss is higher for OXLC commons than with preferreds.

The Verdict

While CLO equity tranches have the potential to provide above-average returns, investing in OXLC has not delivered the expected results in the past. The fund's high expenses and declining performance suggest that the current trend of underperformance may persist for longer.

For investors still interested in Oxford Lane Capital, the preferred securities and junior notes could be more appealing with better security. Among the multitude of outstanding OXLC preferred shares, my favorite is the 2027 - (NASDAQ:OXLCP) issue. It's relatively liquid and, with a yield of 6.85%, offers investors more stability than the OXLC commons in these turbulent times.

Thank you for reading!

Hold On. Can't find the equity research you've been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!

This article was written by

The chief investment analyst in a small family office registered in Singapore, responsible for developing investment ideas in equities, setting parameters for investment portfolio allocation, and analyzing potential venture capital investments.

A generalist in nature, common sense investing approach. BS in Finance. The thesis description can be found in this article.

During the heyday of the IPO market, I developed an AI model [in the R statistical language] that returned an alpha of around 24% over the IPO market's return in 2021. Currently, I focus on medium-term investment ideas based on cycle analysis and fundamental analysis of individual companies and industries.

Get a free 7-day trial +25% off for up to 12 months on TrendSpider with the coupon code: DS25

**Disclaimer: Associated with Oakoff Investments, another Seeking Alpha Contributor

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

![FitchRating [May 2023]](https://static.seekingalpha.com/uploads/2023/7/27/49513514-16904462037597136.png)