HYGW: High-Yield Bond Covered Call ETF, Strong 16.7% Yield

Summary

- HYGW invests in high-yield corporate bonds and sells covered calls.

- Doing so leads to a massive 16.7% yield, but long-term capital losses and distribution cuts.

- An overview of the fund follows.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

Viktor Aheiev/iStock via Getty Images

The iShares High Yield Corporate Bond BuyWrite Strategy ETF (BATS:HYGW) invests in high-yield corporate bonds and sells covered calls on the entirety of its holdings. The fund's covered call strategy boosts its dividend yield to a whopping 16.7%, but also reduces potential capital gains. The net effect is generally positive when bond prices are down or flat, as has been the case since the fund's inception. The net effect is generally negative when bond prices increase, as could happen when the Federal Reserve cuts rates next year.

In my opinion, bond prices are likely to increase next year, as the Federal Reserve cuts rates. HYGW is likely to underperform under said scenario, so I would not be investing in the fund at the present time. This is mostly a macro call, with HYGW being a reasonable overall investment.

HYGW - Strategy and Overview

An explanation of HYGW's strategy follows. Feel free to skip this section if you already know how the fund works, or if you read my previous coverage on the subject.

HYGW invests in high-yield corporate bonds, through an investment in the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), the industry benchmark. As such, HYGW has many of the same characteristics as HYG, including high credit risk, exposure to interest rates, etc.

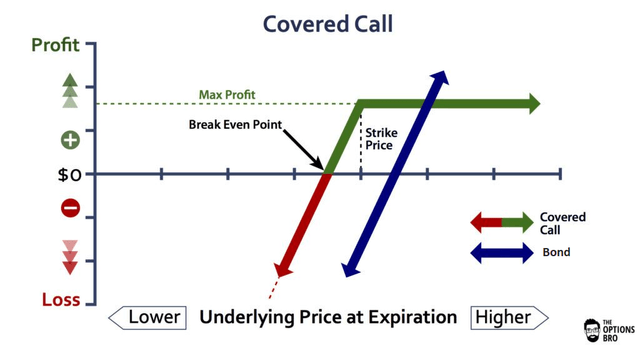

HYGW then sells covered calls on the entirety of its investment. HYGW's covered call strategy is effectively equivalent to selling almost all potential capital gains for cash, almost all of which is then distributed to shareholders in the form of distributions. Potential capital losses remain unchanged.

Profits for the strategy are as follows. Make sure to compare profits to those of simply owning the bonds outright and consider the legend.

With the above in mind, let's have a look at the fund's positives and negatives, starting with the positives.

HYGW - Positives

Strong 16.7% Distribution Yield

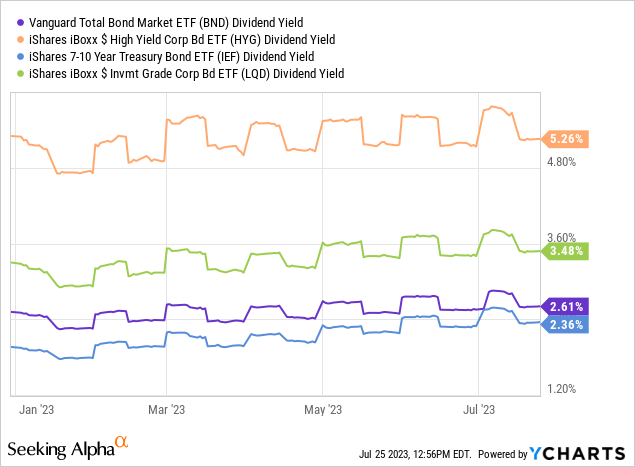

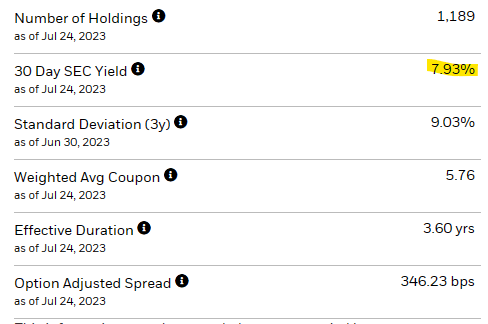

HYGW focuses on high-yield corporate bonds, which sport high interest rates, and generate lots of income for the fund. HYG has a 5.7% dividend yield and a 8.0% SEC yield, both reasonable approximations of the income generated by HYGW's underlying bond portfolio.

HYGW's covered call strategy generates lots of premiums, which are distributed to shareholders, boosting distributions further. Premiums amount to around 10.0%, for a total distribution yield of 16.7% (from annualizing its latest monthly distribution). As option premiums and fund distributions are volatile these are very rough figures, but we can be certain that fund distributions are very high, and higher than those of HYG, and most of the fund's peers.

Data by YCharts

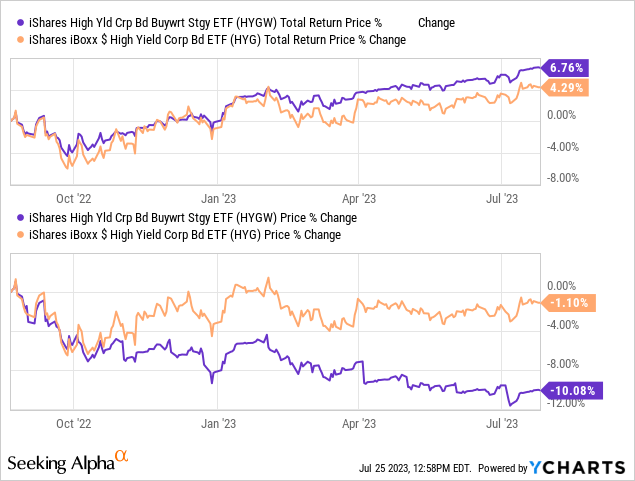

Strong distribution yields are a significant benefit for the fund and its shareholders, and one which is particularly impactful when capital gains are low or non-existent. Expect the fund to outperform when high-yield bond prices are flat or down, as has been the case since the fund's inception:

Data by YCharts

HYGW's strong 16.7% distribution yield, and attendant outperformance when high-yield bond prices are flat or down, is a significant benefit for the fund and its shareholders.

High Option Prices and Premiums

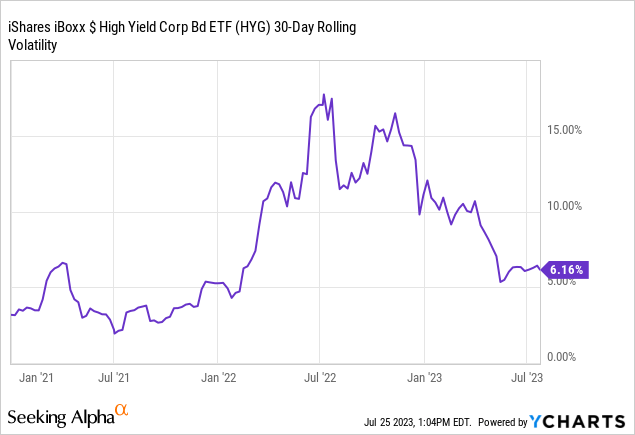

Option prices and premiums are dependent on many factors. Key among these is volatility, with higher volatility meaning higher option prices, as it increases the chance of an option finishing in the money.

Right now, due to aggressive Federal Reserve hikes, bond volatility is higher than average, leading to above-average option premiums. Volatility was much higher in 2022, however.

Data by YCharts

Due to the above, the premiums generated by HYGW are quite high, directly benefitting the fund and its investors right now. In my opinion, it makes sense to focus on covered call funds when option premiums are particularly attractive, as they are right now.

HYGW - Risks and Downsides

Long-Term Capital and Distribution Erosion

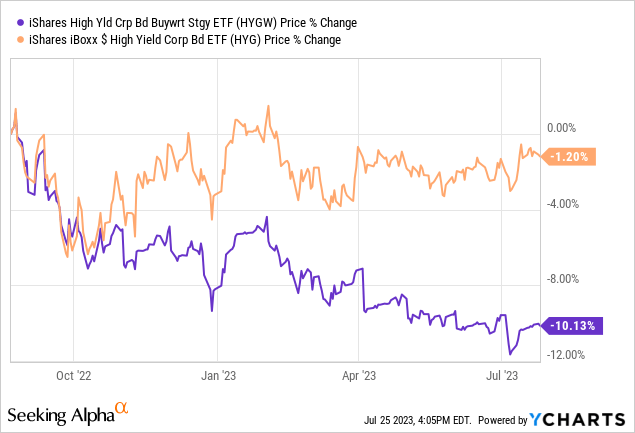

HYGW's covered call strategy significantly limits upside potential, while downside potential remains unchanged. Due to this, the fund has trouble recovering from any realized losses, leading to long-term capital depletion. HYGW's share price has decreased by 10.1% since inception, broadly in-line with expectations.

Data by YCharts

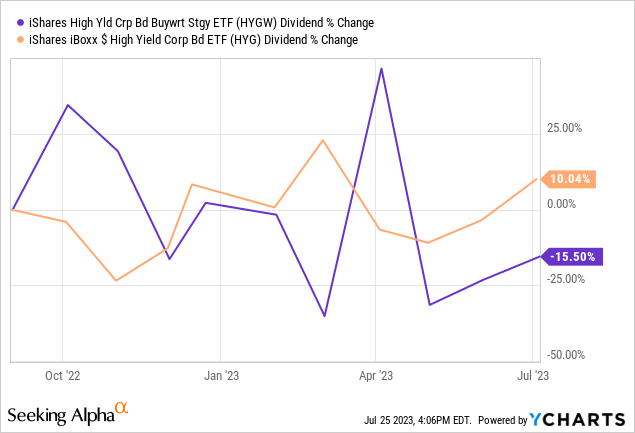

As capital goes down so does the fund's generation of income, which should lead to distribution cuts long-term. HYGW's distributions have technically decreased since inception, but distribution volatility makes these figures hard to parse.

Data by YCharts

Notwithstanding the above, I'm quite confident that HYGW's distributions will decline long-term. This, combined with long-term capital depletion, is a significant negative for the fund and its shareholders.

Complicated Investment Thesis and Expected Profits

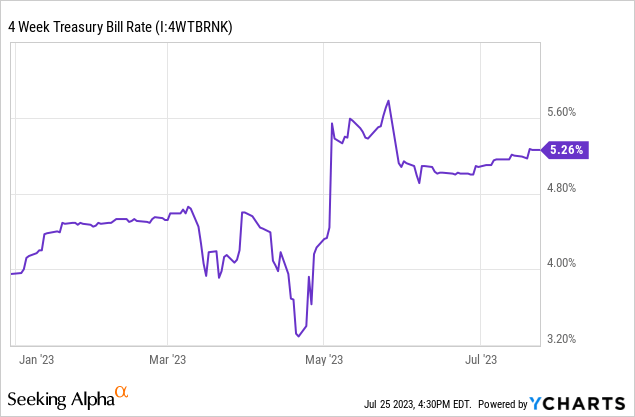

Bonds are relatively simple investments, whose expected profits are easy to forecast. T-bills yield 5.3%, so expect 5.3% in annualized returns, with little interest rate or credit risk.

Data by YCharts

HYG has a 7.9% SEC yield, so expect that much in returns, minus any defaults.

Data by YCharts

HYGW, on the other hand, is a somewhat complicated investment. It yields 16.7%, but total returns will almost certainly be lower, due to capital losses and distribution cuts. Returns are dependent on option premiums, which are dependent on high-yield bond volatility, a somewhat obscure measure. Returns are very finicky, dependent on index / security details. For instance, the fund would recover from any losses experienced by bonds before options are rolled over, very few after.

These issues make analyzing the fund difficult, especially in relation to its peers. Sure the 16.7% yield is attractive, but is that still true after accounting for capital losses and cuts? It really is difficult to tell, unless one simply extrapolates from the past, but that is a fraught thing to do, as past performance is no guarantee of future results.

HYGW's complexity is something of a negative itself, and something to keep in mind when comparing the fund to simpler, high-yield funds and ETFs. Perhaps it is better to simply buy, say, the SPDR Blackstone Senior Loan ETF (SRLN). SRLN yields 7.1%, has seen strong dividend growth these past few years, and investors don't need to worry about long-term capital depletion / dividend cuts for that fund (at least assuming the economy keeps humming along).

Conclusion

HYGW offers investors a 16.7% distribution yield, but reduced potential capital gains. With interest rates likely to decline next year, said tradeoff does not look compelling. As such, I would not be investing in the fund at the present time.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.