Affiliated Managers Group: Rough Seas Ahead But Holding Steady

Summary

- Affiliated Managers Group's Q2 2023 earnings showed a year-on-year rise of 10% in earnings per share, despite $7 billion in net client cash outflows, largely from global equities.

- The firm's share price has decreased by nearly 23% over eight and a half years, underperforming compared to the S&P Index, despite the stock potentially being undervalued with a Blended P/E of 8.16x.

- The article suggests a cautious "hold" rating for investors due to concerns around net client cash outflows, underperformance compared.

Kobus Louw

Thesis

This article delves into Affiliated Managers Group, Inc.'s (NYSE:AMG) Q2 2023 earnings that showcased a combination of strengths and challenges, evaluates its performance against market trends, explores its valuation, identifies potential risks and headwinds, and ultimately suggests a cautious "hold" rating for investors.

Company Overview

Affiliated Managers Group, Inc., a well-established investment management firm, extends its services to a broad spectrum of clients such as mutual funds, institutional entities, retail customers, and affluent individuals, predominantly within the United States. The firm provides a variety of services encompassing advisory and sub-advisory for mutual funds, distributed via several platforms including independent investment advisors and key fund marketplaces. The firm boasts an array of investment products tailored to diverse styles and markets, including but not limited to, equity, emerging markets, quantitative, alternative, and fixed income offerings. Beyond this, it also undertakes asset management for a host of organizations while offering personalized investment advice and fiduciary services. Incepted in 1993, the firm is based in West Palm Beach, Florida, and has a global presence with numerous offices worldwide.

Affiliated Managers Group's Q2 2023 Earnings Highlights

Affiliated Managers Group posted a Q2 performance that delivered an adjusted EBITDA of $214 million, which encompassed $20 million in net performance fee earnings. The firm's earnings per share witnessed a year-on-year rise of 10%, standing at $4.45, the result of a boost from extra share repurchases and discrete foreign tax advantages. Despite witnessing $7 billion in net client cash outflows largely from global equities, the company still found some hints of strength in alternatives boasting about $2 billion in net inflows, primarily propelled by Pantheon EIG and Comvest's inflows from private markets.

While industry headwinds persisted and global equities continually experienced net outflows, management offered some positive reassurance in its affiliates' ability to claw back client demand, something of which, at the time of this analysis, the market does not seem to be buying into based on the -14% intraday selloff. Notwithstanding the net outflows, there were pockets of client demand evident in certain segments. The multi-asset and fixed income flows held steady, with a constant demand for fixed income strategies observed at GW&K and Artemis.

Looking forward, the firm anticipates Q3 adjusted EBITDA to land somewhere between $190 billion and $200 million, reflecting the current AUM levels and market blend, with potential net performance fee earnings hitting up to $10 million. This forecast factors in partial earnings from Veritable, but disregards any impact from Forbion.

Concerning the balance sheet and capital allocation, the firm appears primed to generate shareholder value. Recently, AMG sold off its EQT position, yielding a total of $890 million, a move that bolstered growth investments and reduced net debt. AMG also has designs to up its share repurchase activity beyond $500 million, subject to market conditions and new investment undertakings in the latter half of 2023.

Performance

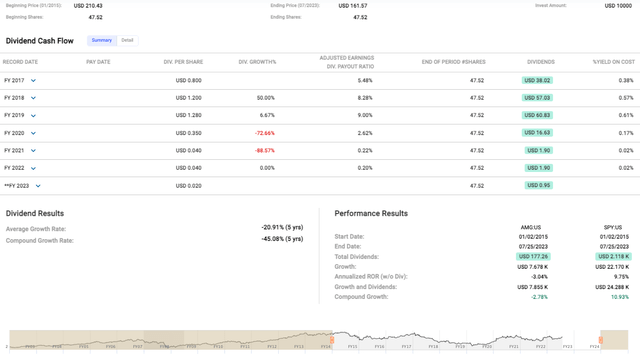

From the optics of a medium-term-investment time frame, AMG's share price has seen a decrease from its standing at $210.43 in 2015 to $161.57 as of July 25, 2023 - that's a nearly 23% drop over a period of eight and a half years. The Return on Return (ROR) also confirms the unfortunate trend. An annualized ROR without dividends of -3.04% and a compound growth of -2.78% means that the investment is not just stagnating, it's actually losing value over time.

Fast Graphs

When we compare AMG to a standard benchmark like the S&P Index, the picture becomes even bleaker. While AMG's growth and dividends stand at $7.855k (on a $10k initial investment), the S&P boasts a much healthier $24.288k. This striking difference in performance suggests that AMG is not just struggling in a vacuum, it's underperforming compared to the broader market.

Valuation

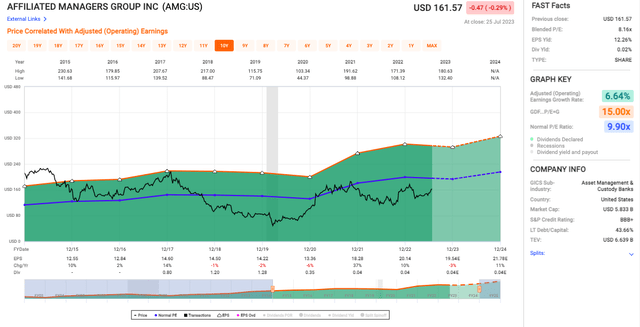

However, AMG's Blended P/E of 8.16x implies that the stock may be undervalued, considering the company's adjusted earnings growth rate of 6.64%. The market is currently paying a relatively low price for each dollar of AMG's earnings, compared to its historical P/E ratios. Notably, the stock's normal P/E ratio, a better reflection of its long-term valuation, is 9.90x, which indicates a potential upside should the market adjust to its historical averages.

Fast Graphs

Earnings Per Share (EPS) yield of 12.26% further bolsters AMG's potential undervaluation, although its dividend yield is only at an extremely modest 0.02%; income-focused investors might find other stocks more appealing.

Risks & Headwinds

Probably the first thing that caught most investors attention was the net client cash outflows which totaled $7 billion, a figure largely propelled by events in global equities. This trend is a source of disquiet. Such significant outflows could potentially become a recurring theme, creating headwinds that obstruct the company's path towards continued growth. Despite AMG's affiliates proving their mettle with impressive long-term investment performances, this recent surge of outflows in global equities may well not be a fleeting episode.

Next on the agenda is the interesting dynamic at play within AMG's liquid alternatives. Despite witnessing demand for absolute return oriented strategies, there's been a counterbalance effect due to the expiration of lockups on beta-sensitive strategies. This has essentially neutralized the net inflows, leading to a somewhat plateaued growth rate. From an analytical standpoint, this development suggests potential hurdles in their client acquisition and retention strategy.

Switching gears to the company's venture into new territories, AMG's pursuit of strategic alliances and investments in burgeoning sectors like life sciences, as evident through the Forbion transaction, is a move that exudes ambition and foresight. However, these ventures are steeped in uncertainty. There are no guarantees of success, and the potential impact on the company's future profitability remains ambiguous at best.

Final Takeaway

I would rate Affiliated Managers Group's stock as a "hold." Despite the company's undervaluation, there are serious concerns around the billions in net client cash outflows. While management's positivity about recovery and its strong balance sheet with room for growth investments are encouraging, it's also clear that the stock has underperformed compared to the S&P Index over the past years. Therefore, it seems prudent to wait and see how their client acquisition strategies and new ventures unfold in the near term before calling this one a "buy."

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.