Diversifying Equity Income Portfolios With VIX Carry

Summary

- Equity income is an investment strategy typically used by those seeking a steady stream of income from their stock portfolio allocations.

- Both SVOL and MLPs outperformed the benchmark, but MLPs also displayed higher volatility than any other strategy.

- Equity income strategies will continue to gain popularity among investors, especially during challenging market environments.

Sakorn Sukkasemsakorn

Introduction

Equity income investing is an increasingly popular strategy, employed by investors who are looking for a steady cash flow from their equity portfolio, especially during periods of limited expected capital appreciation for equities. Traditionally equity income investments include dividend-paying stocks, Real Estate Investment Trusts (REITs), and Master Limited Partnerships (MLPs). But as capital markets evolve there are new alternative forms of equity income that are gaining traction. In this blog, we explore Simplify's take on a novel equity income strategy using the VIX carry trade and will demonstrate that this strategy has delivered attractive risk-adjusted returns relative to the broader equity income category and that it may also serve as a reliable diversifier to a broader equity income portfolio.

Equity Income: Room for New Entrants?

Equity income is an investment strategy typically used by those seeking a steady stream of income from their stock portfolio allocations. The earliest equity income strategies owned individual or groups of stocks that regularly paid dividends, thus generating income in addition to the potential for capital gains. This strategy is characterized by two main elements: equity beta and an income stream. As time progressed and access to newer markets became more widely available, equity income strategies broadened to include REITs, energy investments in MLPs, and option selling strategies like covered call (Buy-Write) programs. But are there additional ways to obtain equity income exposure beyond these traditional strategies?

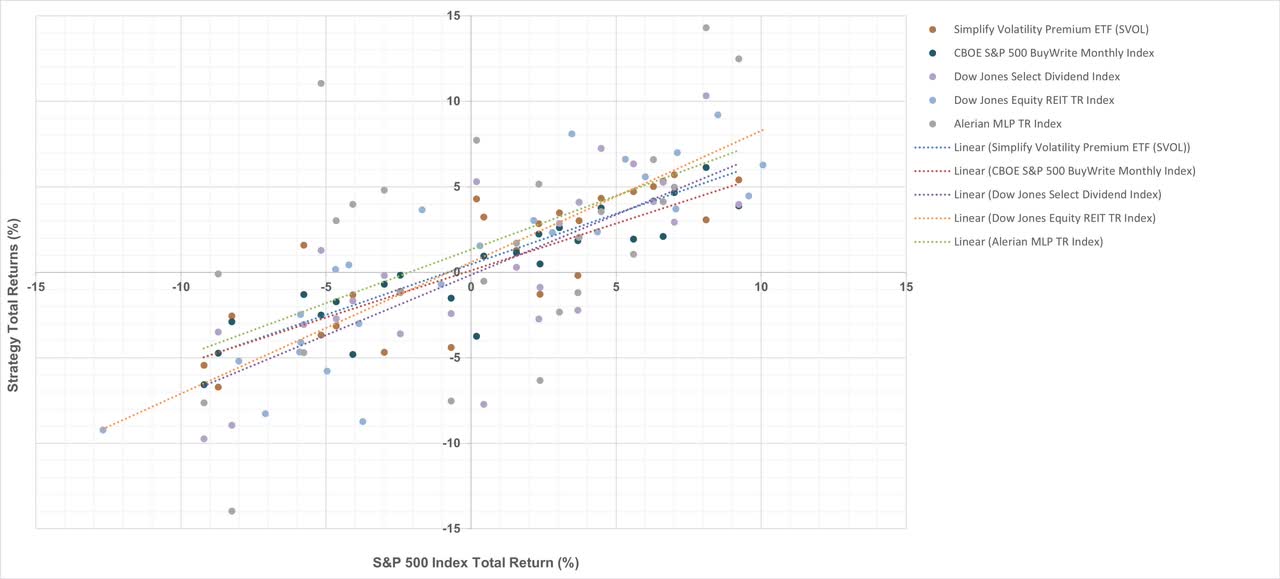

At Simplify we harness the structural roll down in the VIX term structure (see Figure 1) as a way of providing yet another distinct form of equity income to investors. This exposure is accessible through the Simplify Volatility Premium ETF (SVOL), which sells near-dated VIX futures contracts and holds the position for a short period of time before buying back the short position to close them. SVOL also holds a call option on front-month VIX exposure to hedge against potential catastrophic VIX spikes.

Figure 1: VIX Term Structure - A New Equity Income Opportunity?

2006-2022

Bloomberg

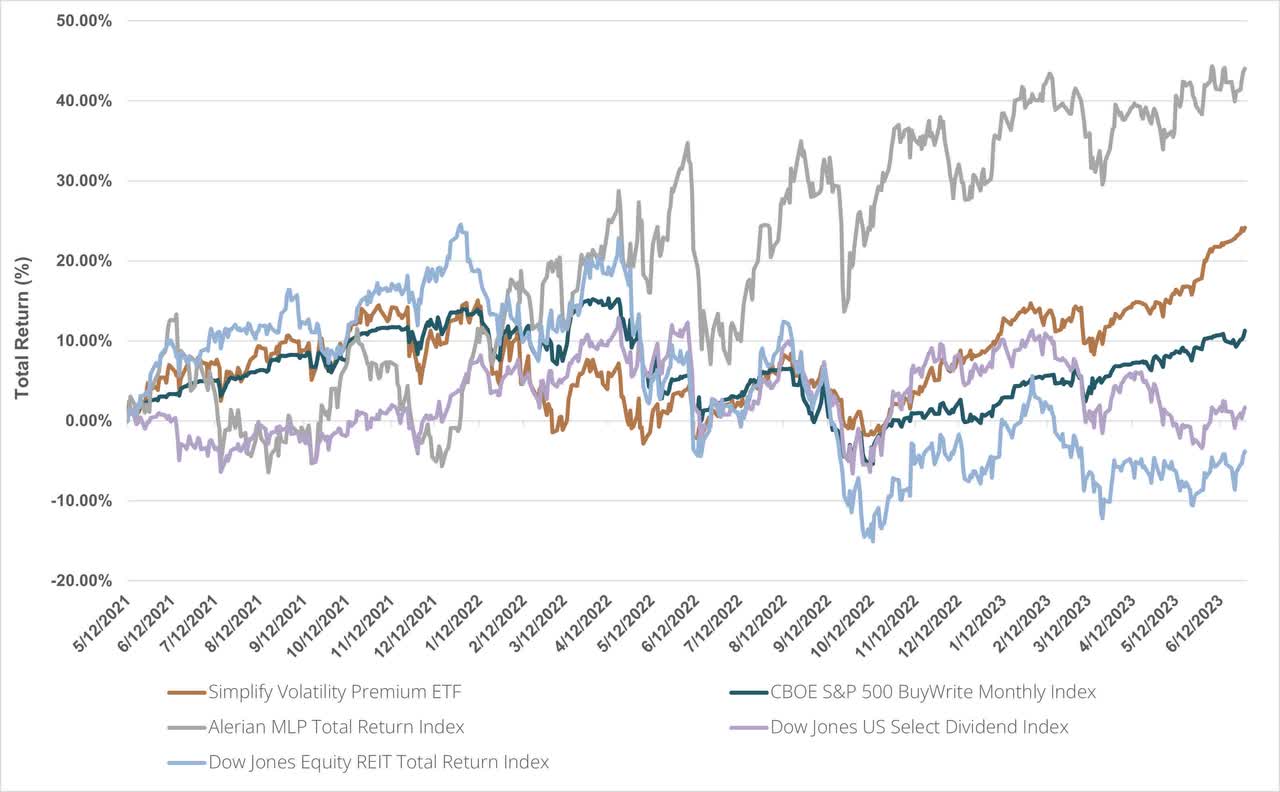

How do we know that these strategies, including VIX carry, can all be considered to be "equity income"? Figure 2 shows the monthly return scatterplots of common equity income indices, including SVOL, relative to the S&P 500 Index (SPX). Notice that all linear regressions produced a positive trendline, indicating a positive beta to the benchmark index, demonstrating that these funds are properly classified as equity income strategies.

Figure 2: Equity Income Regression Analysis

Monthly Total Return, 6/30/2021 - 6/30/2023

Enhancing Risk-Adjusted Returns Through Equity Income

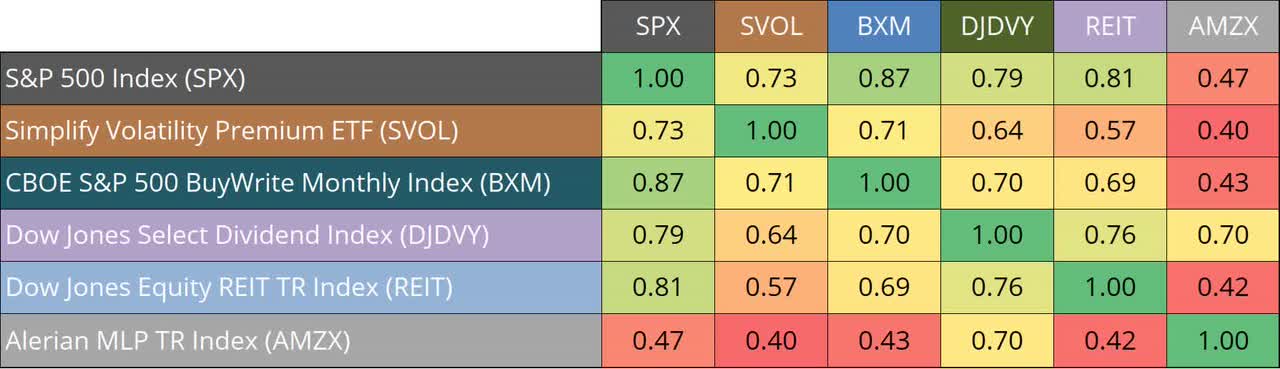

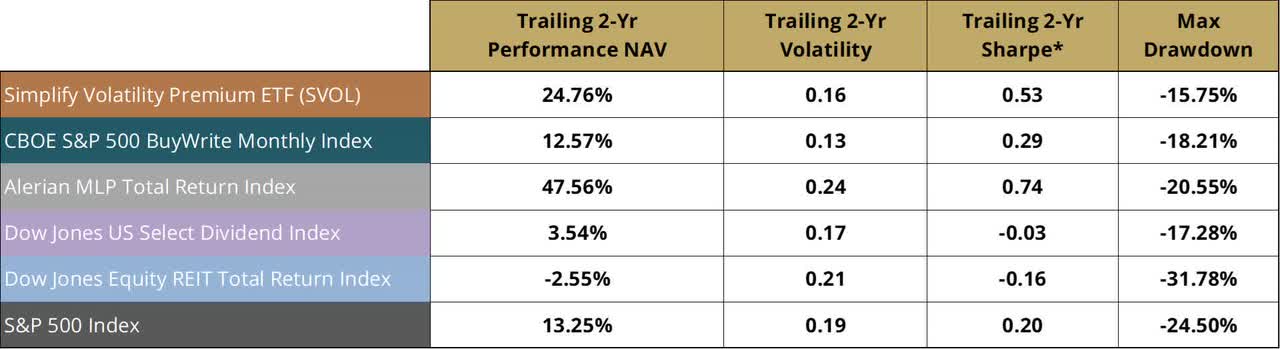

Now that we have introduced the short VIX carry concept as implemented in SVOL, let's examine the strategy's potential as an equity income alternative. In Figure 3, we present the cumulative total returns of each strategy since SVOL's inception date. We then expand the return lens to some key risk and reward statistics in Figure 4, displaying the 2-year volatility, Sharpe ratios, and max drawdowns for each strategy. REITs and US Dividends, the two strategies that underperformed the S&P 500 benchmark, both displayed negative Sharpe ratios, with REITs experiencing a catastrophic drawdown in excess of 30%. Both SVOL and MLPs outperformed the benchmark during this sample, but MLPs also displayed higher volatility than any other strategy. In contrast, SVOL displayed lower drawdowns, lower volatility, and a higher Sharpe ratio than the benchmark, making it the equity income darling on a risk-adjusted basis.

Figure 3: Equity Income Strategy Portfolios

Cumulative Total Return, 5/12/2021 - 6/30/2023

Figure 4: Equity Income Strategy Portfolios

Total Return, 5/12/2021 - 6/30/2023

Bloomberg

Diversifying an Equity Income Portfolio

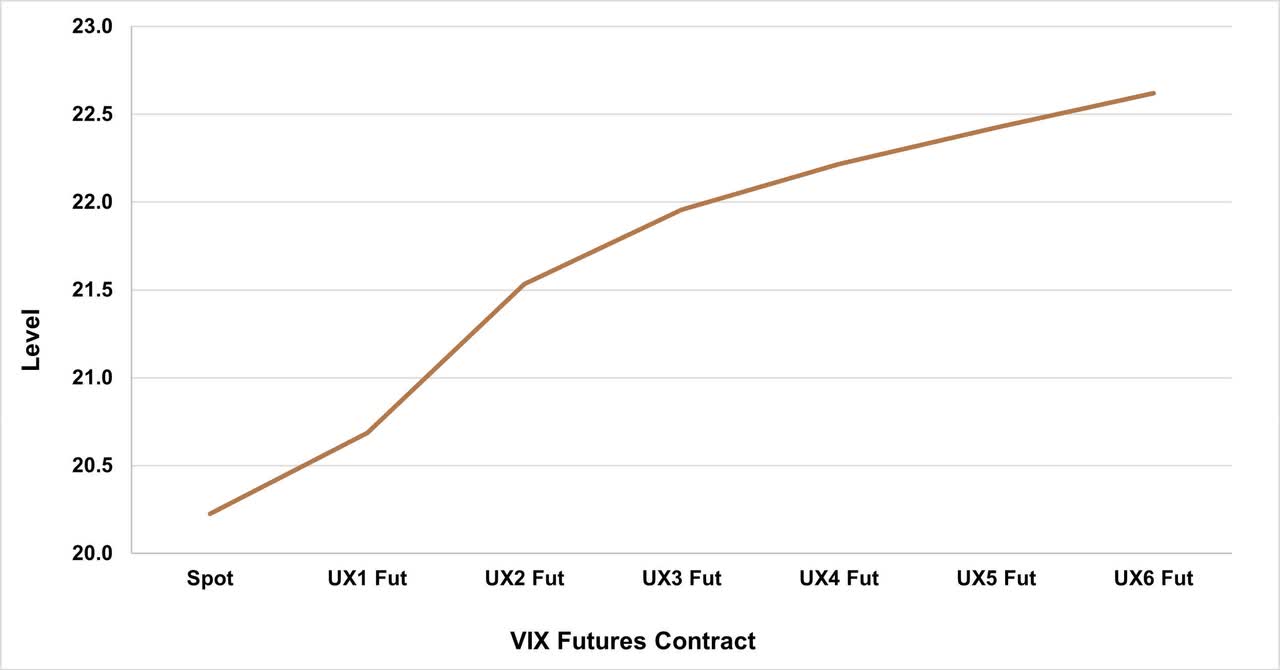

It is also worth examining how different equity income strategies interact with one another because very often, owning a diversified portfolio of strategies will be better than owning just a single name. Figure 5 demonstrates that SVOL has correlations between 0.40-0.71 with the rest of the equity income universe, which implies that there are indeed welcome diversification benefits from using VIX carry strategies in a broader equity income ensemble.

Figure 5: Equity Income Strategy Correlation Matrix

Weekly Total Return, 5/30/2021 - 6/30/2023

Conclusion

Equity income strategies will continue to gain popularity among investors, especially during challenging market environments. However, as the market landscape evolves, it is critical to explore new opportunities that can provide additional diversification benefits. The short VIX carry trade via the Simplify Volatility Premium ETF presents a compelling alternative for those seeking to enhance their equity income portfolios. By capitalizing on the volatility risk premium, SVOL has proven its potential for attractive risk-adjusted returns, while simultaneously providing diversification benefits to other traditional equity income investments.

Glossary:

Buy-Write: A strategy that refers to an investment that receives call premiums on an underlying equity position seeking to generate income.

Covered Call: A financial transaction in which the investor selling call options owns an equivalent amount of the underlying security.

Master Limited Partnerships (MLP): A business venture in the form of a publicly-traded limited partnership. It combines the tax benefits of a private partnership with the liquidity of a publicly-traded company.

Real Estate Investment Trust (REIT): A company that owns, operates, or finances income-generating real estate.

Sharpe Ratio: The ratio compares the return of an investment with its risk. It's a mathematical expression of the insight that excess returns over a period of time may signify more volatility and risk, rather than investing skill.

VIX Index: A real-time market index representing the market's expectations for volatility over the coming 30 days.

IMPORTANT INFORMATION:

Investors should carefully consider the investment objectives, risks, charges, and expenses of Exchange Traded Funds (ETFs) before investing. To obtain an ETF's prospectus containing this and other important information, please call (855) 772-8488, or visit SimplifyETFs.com. Please read the prospectus carefully before you invest.

An investment in the fund involves risk, including possible loss of principal.

The fund is actively-managed and is subject to the risk that the strategy may not produce the intended results. The fund is new and has a limited operating history to evaluate.

The use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include (i) the risk that the counterparty to a derivative transaction may not fulfill its contractual obligations; (ii) risk of mispricing or improper valuation; and (iii) the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate, or index. Derivative prices are highly volatile and may fluctuate substantially during a short period of time. The use of leverage by the Fund, such as borrowing money to purchase securities or the use of options, will cause the Fund to incur additional expenses and magnify the Fund's gains or losses. VIX futures contracts can be highly volatile and the Fund may experience sudden and large losses when buying selling or holding such instruments. VIX futures are unlike traditional futures contracts not based on a tradeable asset and it is possible to lose a portion or all of an investment.

The Fund invests in ETFs (Exchange-Traded Funds) and is therefore subject to the same risks as the underlying securities in which the ETF invests as well as entails higher expenses than if invested into the underlying ETF directly.

While the option overlay is intended to improve the Fund's performance, there is no guarantee that it will do so. Utilizing an option overlay strategy involves the risk that as the buyer of a put or call option, the Fund risks losing the entire premium invested in the option if the Fund does not exercise the option. Also, securities and options traded in over-the-counter markets may trade less frequently and in limited volumes and thus exhibit more volatility and liquidity risk.

Simplify ETFs are distributed by Foreside Financial Services, LLC. Simplify and Foreside are not related.

© 2023 Simplify ETFs. All rights reserved.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by