BB Seguridade: Cheapest P/E In Its History And Paying +8% Dividends

Summary

- BB Seguridade, a Brazilian insurance and pension company, seems a good opportunity for investors seeking consistent dividends due to its strong partnership with Banco do Brasil and its focus on the agribusiness sector.

- BB Seguridade is trading at the moment at its lowest P/E multiple, which might indicate an opportunity window.

- The expected cut in Brazilian interest rates might benefit the company's operating income and overall bottom line, considering it does not solely depend on its financial results anymore.

- Despite distributing a significant portion of its profits, the company has demonstrated growth and efficiency, with a competitive advantage from Banco do Brasil's higher-income customer base.

- Potential risks include uncertainty surrounding the future contract with Banco do Brasil, low barrier to entry into the insurance market, exposure to agribusiness sector risks, and potential currency devaluation.

Poca Wander Stock

Investment thesis

BB Seguridade Participações S.A., or simply BB Seguridade (OTCPK:BBSEY), seems like a good opportunity at the moment, particularly for investors seeking consistent dividends. The company's success can be attributed to its unique characteristics and strong partnership with Banco do Brasil S.A. (OTCPK:BDORY), specifically in serving the agribusiness sector. This strategic alignment has contributed to BB Seguridade's positive performance over the past 5 years, making it an attractive choice for dividend-focused investors.

Another point to consider is the management's commitment to adequately reward shareholders through their high payout ratio, which fosters trust and loyalty among stakeholders. Despite distributing a significant portion of its profits, BB Seguridade has demonstrated an ability to sustain growth, showcasing efficiency and capacity for expansion in a non-capital-intensive business model.

In comparison to other companies in the sector, BB Seguridade's reliance on Banco do Brasil's higher-income customer base provides a competitive advantage, ensuring a higher level of service provision and customer demands. The company's concentration in the agribusiness sector offers robust growth opportunities, as the segment accounts for one-third of Banco do Brasil's loan portfolio and exhibits significant potential for increased insurance coverage.

Still, potential investors should be aware of the risks associated with this investment decision, as there is uncertainty surrounding the future contract with Banco do Brasil, the low barrier to entry into the insurance market, exposure to agribusiness sector risks, and potential currency devaluation.

A brief description of BB Seguridade

BB Seguridade is a Brazilian company that operates in the insurance and pension segments. It is a subsidiary of Banco do Brasil, one of the largest banks in Brazil. BB Seguridade was created in 2012 and acts as a holding company for various subsidiaries involved in insurance, pension, and premium bond operations.

The company offers a range of insurance products, including life, property, auto, and health insurance, as well as pension plans and savings bonds. BB Seguridade operates through its subsidiaries, such as Brasilseg, Brasilprev, Brasilcap, Brasildental, among others. BB Seguridade has a significant market presence in Brazil and is one of the leading insurance and pension companies in the country. Its operations are focused on providing financial protection and security to individuals and businesses through its insurance and pension offerings.

As I write this article, BB Seguridade has a market cap of $12.51 billion, a Dividend Yield of 9.81%, and a revenue of $849 million for the trailing twelve months.

A bit of the last quarter's results and what BB Seguridade has been doing

BB Seguridade reported strong results in May for the first quarter of this year, as expected. Overall, all business lines of the company delivered a good performance, especially Brasilseg, the insurance arm. Its nature, more exposed to agribusiness, has yielded excellent results for the company, which had a net profit of R$ 1.7 billion in 1Q23, a growth of almost 50% compared to the same period last year.

It is worth noting that one of the highlights was Brasilseg, which experienced a significant increase in issued premiums and a reduction in the loss ratio. However, on the downside, Brasildental's performance worsened, mainly due to accounting effects that now result in a one-month reporting delay. Consequently, the 1Q23 results only encompassed the months of January and February.

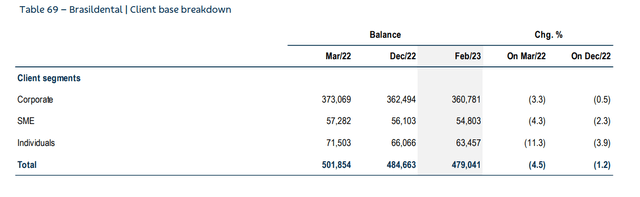

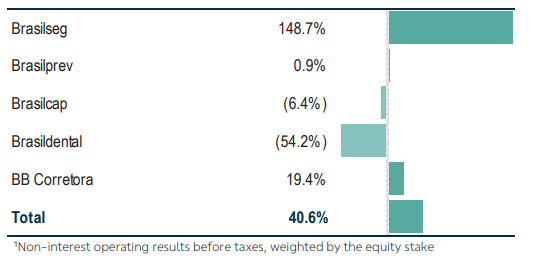

In the chart below, we highlight the non-interest operating result by unit.

Non-interest operating results¹ (Investor Relations)

Brasilseg

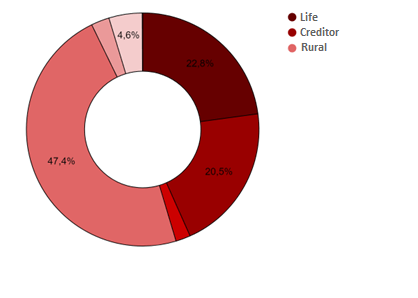

It's also interesting to note that almost half of the issued premiums, specifically 47.4%, originate from rural sources. This indicates how important the agricultural sector is in contributing to Brasilseg's overall performance. The inclusion of agricultural insurance, rural pledges, and other related products in their portfolio showcases their strategic focus on serving the rural community and meeting their specific insurance needs.

Please refer to the chart below for further details.

Premiums issued by source. (Investor Relations)

In this context, we observe that insurance is mainly concentrated in three products: life, creditor, and rural insurance. It's great to note that all three segments are demonstrating favorable performance, with a notable emphasis on the robustness of the agribusiness sector.

The anticipation of a record-breaking harvest for this year brings significant advantages to BB Seguridade, as it enjoys increased premiums and a reduced loss ratio. It is essential to consider the adverse effects of last year's severe drought in the Southern region, which impacted a portion of the crops. Despite this challenge, BB Seguridade has managed to navigate through it effectively.

Regarding the upcoming quarters, I have quite a positive outlook regarding Brasilseg's performance.

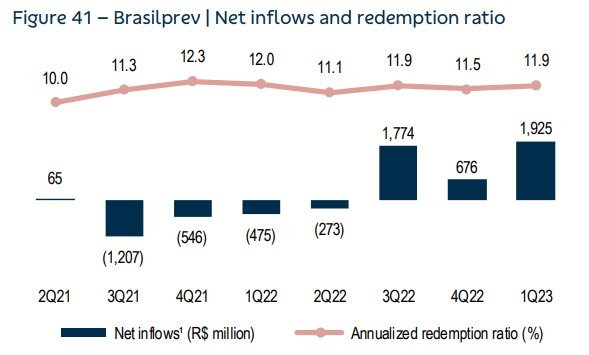

Brasilprev

In my opinion, it is impressive to see BB Seguridade's pension segment experiencing a net inflow of R$ 1.9 billion in 1Q23, which is a substantial increase compared to the withdrawals of R$ 475 million recorded in the previous year. This change in trend is noteworthy, especially when considering the consistent withdrawals observed in pension products a year ago, as depicted in the chart.

Investor Relations

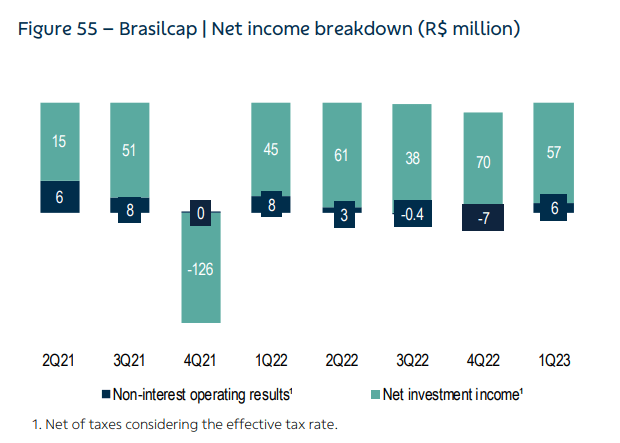

Brasilcap

The capitalization segment had a performance in line with the previous quarters, showing no significant fluctuations in 1Q23, as we can see from the chart below.

Investor Relations

Brasildental

In the case of Brasildental, there was a reduction in the results due to an accounting effect where the company now reports numbers with a one-month lag. In other words, the results presented for 1Q23 only account for the months of January and February, excluding March.

During this period, Brasildental witnessed a significant decline of 4.5 million clients, particularly in the individual segment. This decline, in my view, can be attributed to multiple factors, such as price hikes, an unfavorable economic climate, and heightened competition.

In my opinion, the success of BB Seguridade can be attributed to its unique characteristics and its strong partnership with Banco do Brasil, particularly in serving the agribusiness sector. This strategic alignment has, without doubt, contributed to the company's positive performance. In addition to that, it's easy to notice the management team's relentless efforts in generating value for the shareholders. Their commitment to maintaining a high payout ratio demonstrates their dedication to adequately rewarding investors, which is crucial in building trust and loyalty among stakeholders.

One aspect that particularly impresses me is the company's ability to sustain growth despite distributing a significant portion of its profits. The fact that BB Seguridade's business model is not capital-intensive also strengthens the case for efficiency and capacity for expansion.

I also appreciate the company's proactive approach to adapting to the digital era by focusing on increasing insurance sales through digital channels like mobile applications and WhatsApp. The 16% growth in sales through these channels compared to last year's 13% suggests that their efforts are paying off. This expansion could not only lead to increased premiums but also strengthens the company's relationship with Banco do Brasil's customer base, a move that I believe will have a positive impact on their future outcomes. Overall, I believe BB Seguridade's strategies and dedication to innovation are paying dividends, which, in my opinion, is the main purpose of investing in it.

Addressing a couple of key points

Now, I'll address a couple of important questions that might help to understand the big picture and why I feel BB Seguridade is a great option for dividends.

The first point is the reason why I think BB Seguridade is more interesting than others in its sector, such as Caixa Seguridade Participações S.A. (B3: CXSE3). To give you some context, Caixa Seguridade is a Brazilian insurance and financial services company. It operates as a subsidiary of Caixa Econômica Federal, one of Brazil's largest state-owned banks. Caixa Seguridade is involved in various insurance segments, such as life insurance, property insurance, health insurance, and other financial services. On the other hand, BB Seguridade leverages Banco do Brasil's client base, which notably consists of customers with higher income levels compared to those of Caixa. Consequently, the level of service provision and customer demands are higher.

Because of this, BB Seguridade has a significant presence in pension plans, managing billions in assets. Additionally, while Caixa Seguridade is strong in housing insurance, BB Seguridade is heavily concentrated in agribusiness.

In my opinion, although the presence in housing insurance is a strong competitive advantage for Caixa Econômica Federal, I understand that this model is more dependent on credit origination, while agribusiness is more independent. In other words, if there is a reduction in the bank's credit appetite (which is natural given the increase in interest rates), Caixa Seguridade's results could be greatly affected. A similar comparison can be made with another major peer in the insurance sector, Porto Seguro S.A. (B3: PSSA3), which specializes in car insurance and is also significantly impacted when this market contracts. This contraction often occurs in scenarios of high interest rates, cooling down the acquisition of new cars by companies and individuals.

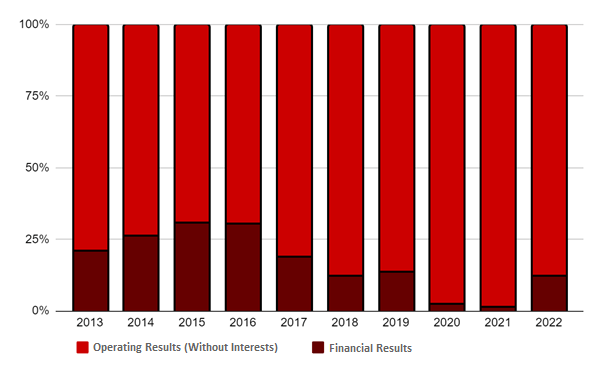

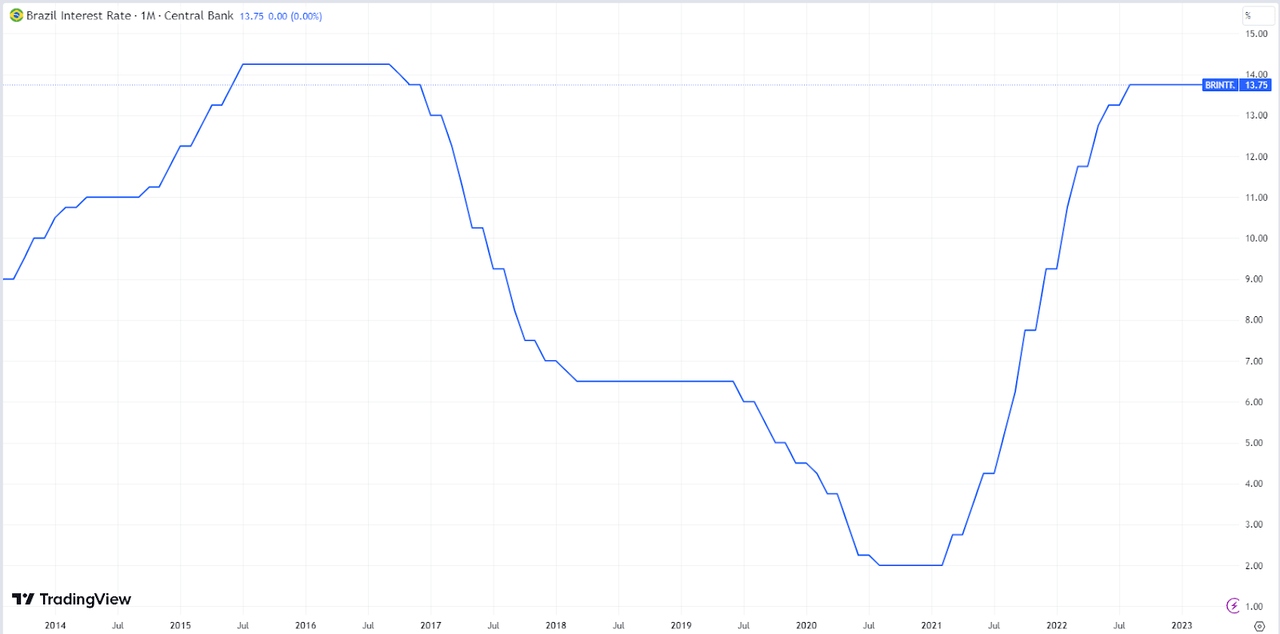

The second point is related to the expected cut in interest rates in the short to medium term. The thing is, many investors believe that a strong balance sheet comes solely from an improvement in the financial result, which is not true in my view. Currently, the financial result accounts for something close to 20% of BB Seguridade's net profit, while the rest comes from the operating results (product distribution). In this sense, although high-interest rates benefit the company, most of the net profit growth has been achieved through the issuance of insurance premiums.

Below, we can observe that, in times of high-interest rates, the financial result indeed benefits the company, but it seems increasingly less dependent on this macroeconomic factor.

BB Seguridade's consolidated results. (Investor Relations)

Brazil's interest rate over the years. (TradingView)

Forecasts and why I think BB Seguridade is a good option

In my opinion, I expect the company to continue growing, despite distributing a significant portion of its net profit (I estimate a payout of 90%, in line with previous years). The agribusiness sector, responsible for one-third of Banco do Brasil's loan portfolio, appears to be a key driver of this growth in my view, providing excellent opportunities for expansion.

It's also interesting to see that currently, only 22% of Brazil's vast agricultural area is insured, especially when developed markets have much higher insurance coverage, exceeding 80%. Given Brazil's status as an agricultural powerhouse, this significant disparity doesn't seem justified. Indeed, agribusiness has been one of the driving forces behind the company's results. In many regions of the country, BB Seguridade is the sole agro insurer, making it highly competitive in terms of pricing and loss ratio. It's worth noting that BB Seguridade's loss ratio in this segment is one of the lowest in the industry. Moreover, the company has been heavily investing in technology, aiming to enhance the distribution of its products - meaning improving retail sales - and using data to assist in reducing losses and offering products that align with customer needs.

Finally, another point is concerning the potential reduction of the Brazilian interest rates, which is kind of expected and impacts the company. As an insurance provider, a significant portion of the profit comes from financial revenues derived from the earnings generated by the float (the money retained by the insurer while claims do not occur). In this context, in an adverse economic scenario with rising interest rates, the operating results are diminished due to a decline in the number of issued premiums. However, it is partially offset by higher interest income, which tends to increase during such times.

Conversely, when we observe a more favorable economic situation with interest rate cuts that stimulate economic activity, the financial result is reduced. Nonetheless, the thriving economy presents the opportunity to issue more insurance premiums, consequently improving the operating results.

Although many believe that BB Seguridade's strong performance in recent quarters is solely linked to the rise in interest rates, I don't think this is not entirely accurate. Since 2013, almost consistently, the company has been increasing its operating results, with a progressively higher issuance of premiums, as we demonstrated in the previous section. In other words, even though lower interest rates in the future may have a negative impact on a portion of BB Seguridade's profit, the majority of profitability comes from the operating result, not the financial result.

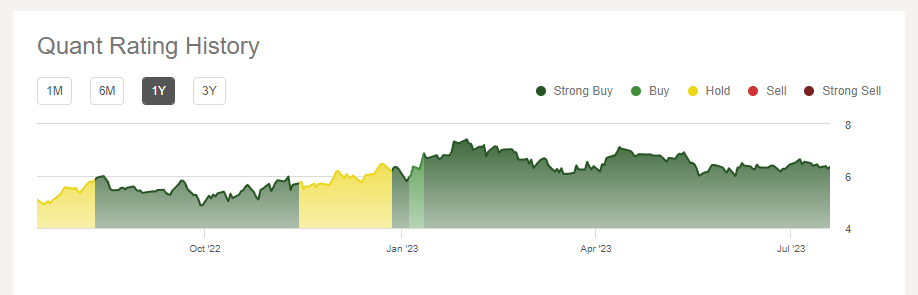

Now, to wrap my stance up, I must add that Seeking Alpha's Quant Ratings are also in line with my sentiment for BB Seguridade, showing a Strong Buy rating since August 2022. I'm actually being slightly less optimistic than them (Buy instead of Strong Buy), due to the potential risks I'll mention in another section later, but even so, we are both holding good prospects for the company.

Seeking Alpha's Quant Rating chart for BB Seguridade (Seeking Alpha)

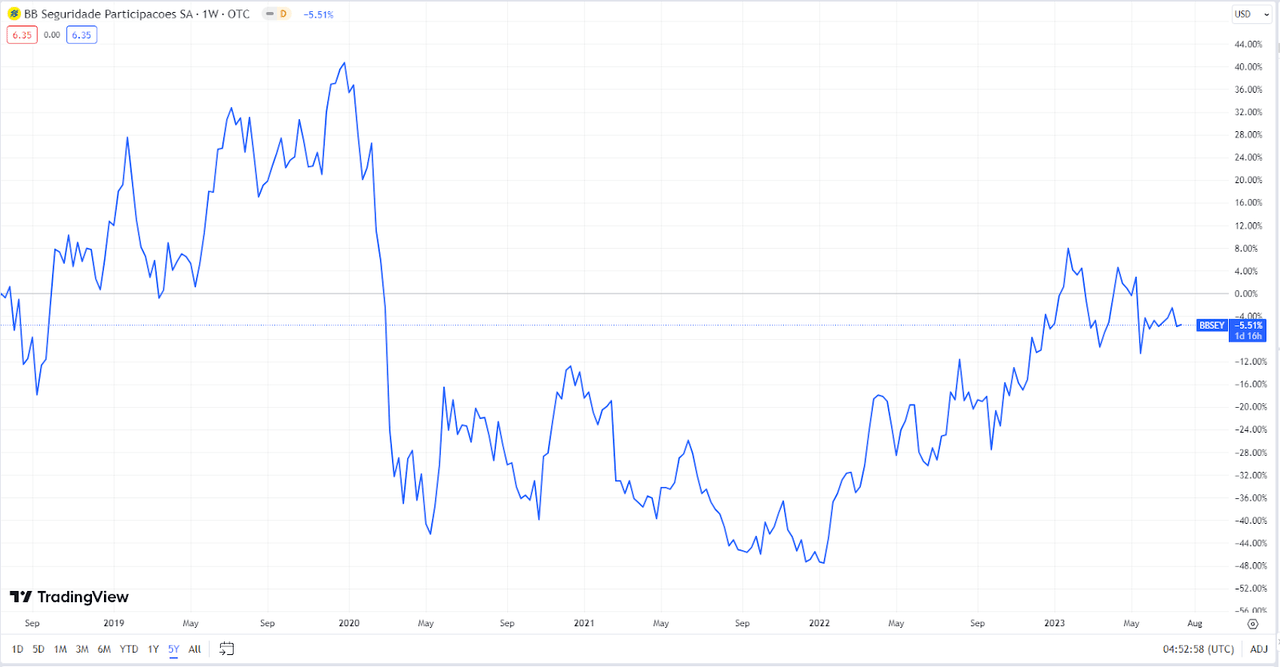

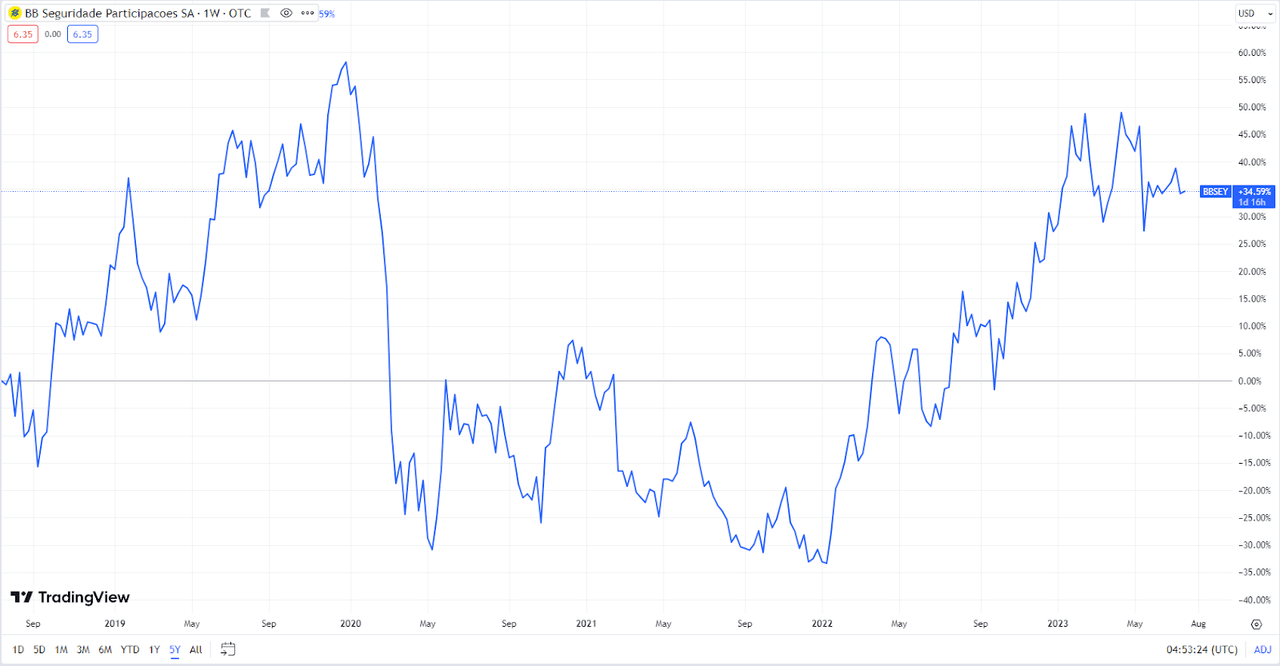

Generous dividends

BB Seguridade is known for being a great dividend payer, with many of its investors choosing the company for this sole purpose. In this company's case, the dividends are so important that they would turn a -5.51% return into a +34.59% upside in the past 5 years. As you can see from the graphs below, both are concerning BBSEY and are in the same time frame of the past 5 years, but only the second one accounts for dividends distributions.

BBSEY's returns over the past 5 years without dividends. (TradingView)

BBSEY's returns over the past 5 years account for dividends. (TradingView)

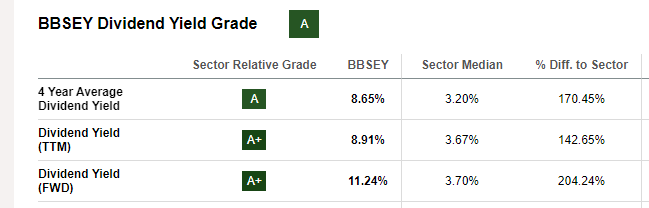

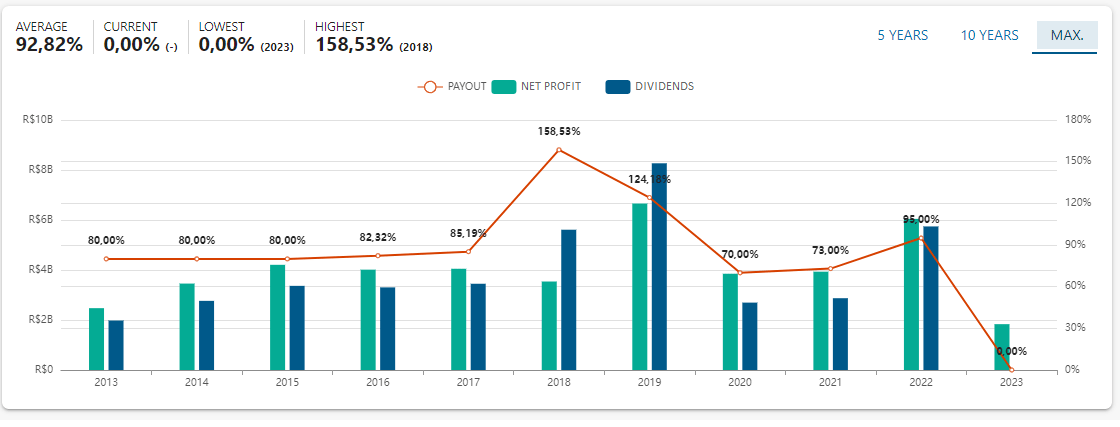

In addition to that, we can see from the images below that BB Seguridade's high dividends are not a one-time thing, it's actually the company's way of delivering returns to shareholders. According to Seeking Alpha's dividend yield grade section (first image below), BB Seguridade has a 4-year average dividend yield of 8.65%, and a forward-looking one of 11.24%, which I think is the market's way of predicting great distributions in the next 12 months.

And to show that this is not a one-time thing, the second image displays the historical payout ratio for the company since 2013. It's interesting to note that you can see that the financials of the company also increase over the years, so the dividend increase is actually derived from a healthy balance sheet, instead of sole irresponsible distribution. Some companies are just like that.

Seeking Alpha

BB Seguridade's historical payout ratio and net profit (StatusInvest)

Valuation and price multiples

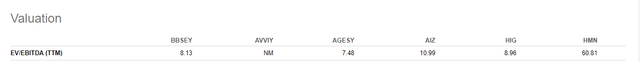

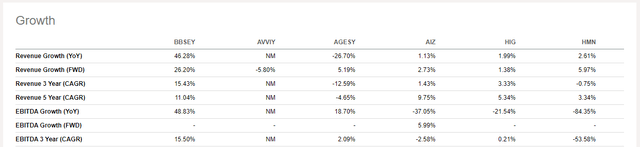

Now, when it comes to valuation and potential growth compared to its peers, BB Seguridade seems in the lead. As we can see from the image below, BB Seguridade's EV/EBITDA ratio is slightly lower than peers like Aviva plc (OTCPK:AVVIY), ageas SA/NV (OTCPK:AGESY), Assurant, Inc. (AIZ), The Hartford Financial Services Group, Inc. (HIG), and Horace Mann Educators Corporation (HMN), indicating that the company's price is in line with the sector, which has been benefiting now from increased interest rates worldwide.

BB Seguridade's EV/EBITDA against peers. (Seeking Alpha)

But, in my opinion, what makes BB Seguridade a better option now is the company's growth capabilities, both from what it has achieved in the past few years and what it might achieve in the near term. If we compare BB Seguridade's growth multiple with the same set of peers as before, we can clearly see that the company has been delivering superior results so far.

BB Seguridade's growth multiples against peers. (Seeking Alpha)

And, in my view, this will not decrease in the near term. As we saw in the section about the key points, BB Seguridade is becoming less and less dependent on high interest rates to deliver great results, as the company is becoming more efficient at distributing its insurance plans. Having said that, the expected dovish scenario in Brazil in the near term will most likely benefit what the company's been doing so far, and it will be able to increase sales and generate even more operating results.

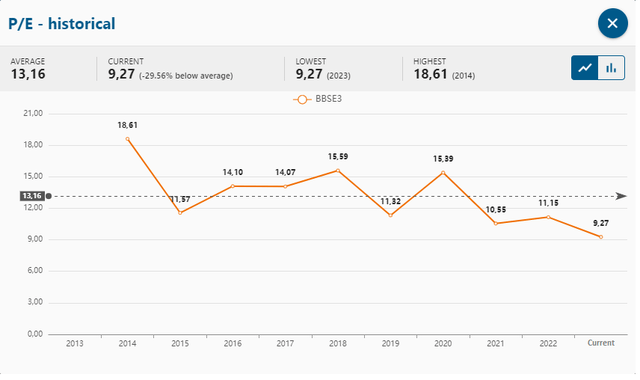

So, even if you don't plan to hold the company for decades, you can still reap what it will deliver in a couple of years ahead, both in terms of dividends and capital appreciation. Now, to wrap up my stance here, we can also compare BB Seguridade's current P/E (TTM) multiple with its own history, which we can see in the image below. The graph indicates that the company sits at its historical low when it comes to price-to-earnings (9.27) and, if we approach it in a purely statistical manner, it's the cheapest it's ever been.

BB Seguridade's historical P/E. (StatusInvest)

Potential risks to be considered

Even though investing in BB Seguridade offers potential rewards, as I mentioned so far, it also comes with several significant risks that need to be carefully considered. I listed them down in bullet points so you can easily see what you need to pay attention to if you plan to buy and hold the company's shares.

Dependency on Banco do Brasil's Customer Base: BB Seguridade heavily relies on Banco do Brasil's client base for its customer acquisition. While this partnership has been beneficial so far, it also exposes the company to the potential risks associated with any changes in the relationship between the two entities. If, for any reason, Banco do Brasil's customer base declines or the partnership terms change unfavorably, it could negatively impact BB Seguridade's revenue and profitability.

Contract Expiry Uncertainty: BB Seguridade's contract with Banco do Brasil is set to expire in 2033. Although it may seem distant, the uncertainty surrounding the future terms of the contract could create concerns for investors. If the renewal terms are less favorable or if there is a possibility of non-renewal, it could disrupt the company's operations and financial performance.

Exposure to Agribusiness Sector Risks: BB Seguridade's primary market is the agribusiness sector, which can offer substantial opportunities, given Brazil's significant agricultural industry. However, agribusiness is exposed to inherent risks, such as dependency on governmental incentives and regulations, fluctuations in the cost of goods, volatility in commodity prices, and vulnerability to climate events (such as droughts or floods). Any adverse changes in these factors could impact this industry and consequently drive insurance claims up.

Low Barrier to Entry: Lastly, the insurance market lacks significant barriers to entry, allowing new competitors to enter the industry relatively easily. This constant threat of new entrants competing for market share puts BB Seguridade at risk of losing its position and market dominance.

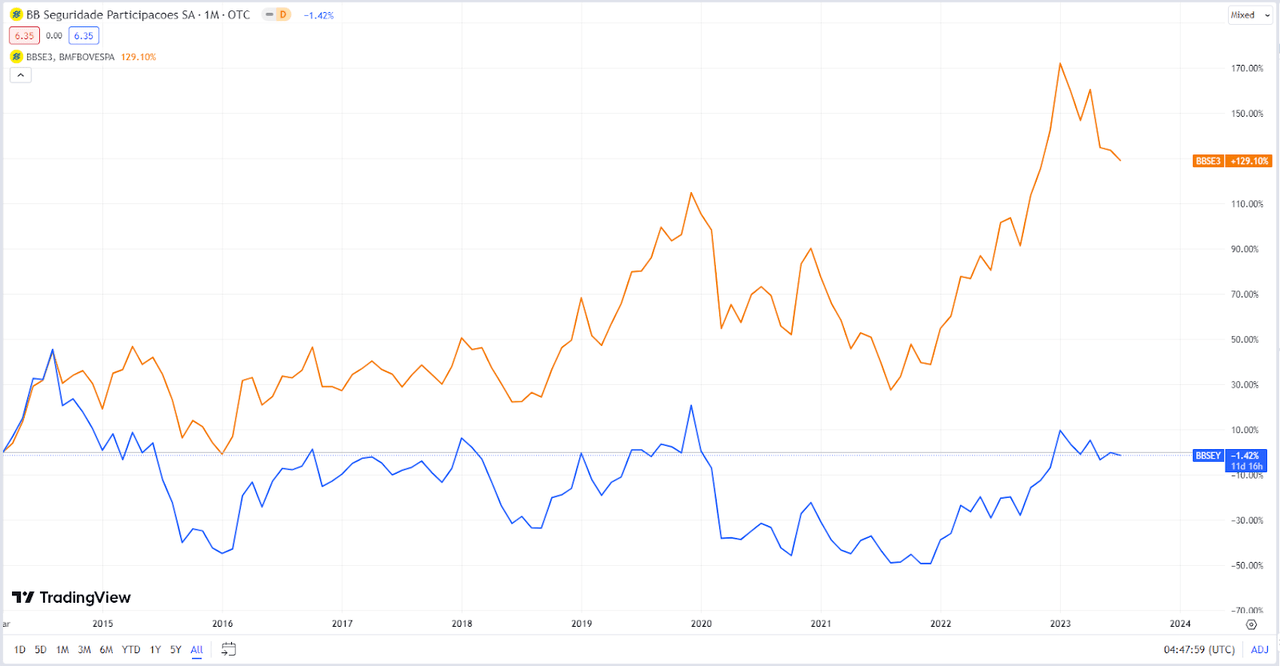

Currency Risk: Want it or not, BB Seguridade is a Brazilian company that generates all its revenue in R$. So, if you are from the US or any other developed country that has a consistently lower inflation rate, there is a chance that the Brazilian currency will depreciate against the Dollar or the Euro, for example. Please check the graph below.

The graph below displays the total returns over the last 9 years for the tickers BBSE3 (stock traded in R$) and BBSEY (traded in US$). As you can see, BB Seguridade has been a relatively good stock pick for Brazilians, providing a return of +129.10% over the period, which gives us a CAGR of 9.64%. I said "relatively" because the overall Brazilian index (IBOV) delivered the exact same results, so no alpha for this period. On the other hand, for the stock traded in the US stock market, which accounts for the Brazilian currency deterioration against the Dollar, has delivered poor results (-1.42% even with dividends).

Total returns over the past 9 years for BBSE3 (R$) and BBSEY (US$) (TradingView)

So, even though my stance for this analysis is a buy one, I advise investors, especially those from developed markets, to be careful if holding this stock for the long term. My buy stance here is due to the current opportunity that the stock might be presenting, considering the potential for generous dividend distributions and maybe an appreciation in share price over the next couple of years.

Conclusion

In conclusion, BB Seguridade's success can be attributed to its unique characteristics and strong partnership with Banco do Brasil, particularly in serving the agribusiness sector. The company's strategic alignment and management team's efforts to generate value for shareholders have contributed to its positive performance over the past 5 years. Despite distributing a significant portion of its profits, BB Seguridade has been able to sustain growth, showcasing its efficiency and capacity for expansion.

I am impressed by the company's proactive approach to adapting to the digital era, focusing on increasing insurance sales through digital channels and using data to better serve customers. This expansion not only leads to increased premiums but also strengthens its relationship with Banco do Brasil's customer base, which is a great sign for future results.

However, potential investors should be aware of the risks associated with investing in BB Seguridade. The company's heavy reliance on Banco do Brasil's structure, uncertainty surrounding the future contract with the bank, exposure to agribusiness sector risks, and the low barrier to entry in the insurance market are crucial factors to consider. Additionally, currency risk could pose challenges for investors from countries with lower inflation rates, as BB Seguridade generates all its revenue in Brazilian Real.

Overall, BB Seguridade's strong performance, commitment to dividends, and potential for growth make it an attractive option for income-seeking investors. However, cautious consideration of the risks involved is essential for those looking to hold the stock for the long term. Despite the risks, I maintain a buy stance for now, considering the current opportunities in generous dividend distributions and possible share price appreciation in the coming couple of years.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.