K+S Aktiengesellschaft: Yet More Upside To Be Had Due To Tightening Spreads

Summary

- K+S, a leading fertilizer and salt company, has seen strong financial performance with gross margins above 42% and net margins over 25.8%.

- The company has minor debt and hasn't issued new shares for over 10 years.

- The company is expected to benefit from global trends such as shrinking arable land and increasing water scarcity, which increase the demand for efficient fertilizers.

- The company's diversified business and strong cash conversion also contribute to its positive outlook.

- Despite challenges such as inflation and cost exposure, I expect K+S to continue performing well and recommend buying its shares.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

Eloi_Omella

Dear readers/followers,

The time has come to provide a small update to K+S (OTCQX:KPLUY)(OTCQX:KPLUF), a fertilizer company I'm Long in - and one of the largest companies in what it does, as well as the ancillary segment/service of salt.

The company is set to report 1H23 in about 3 weeks - so I figure it's a good time to provide an update with regard to my expectations for the coming year, and perhaps more specifically the coming quarter.

Fertilizer is a segment I'm relatively heavily invested in. And I'll both remind you why I'm investing in K+S and may go in deeper here.

Let's take a look at recent results.

K+S - Plenty to like even after a recovery from trough valuation

K+S recently bounced back from lows in the company's share price, where the stock price dropped as low as €14.5 for the native ticker, in this case, SDF. Don't let yourself be fooled though. This company has exactly what you want in a fertilizer company. While its products aren't as high-tech or as "clean" as competitors Yara, because K+S works with Potash, it's still a very solid and profitable company.

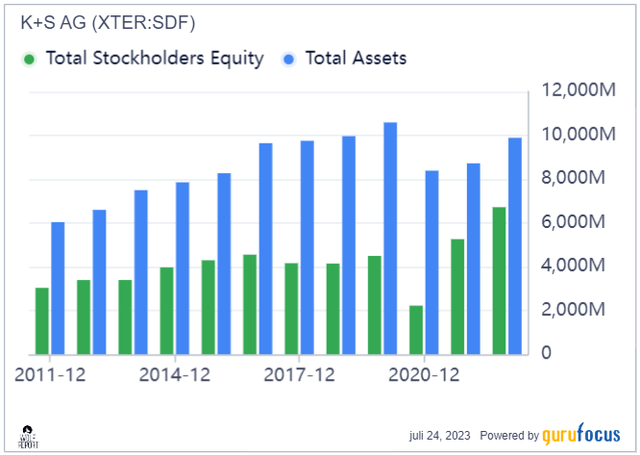

By that I mean that the company's gross margins are above 42%, its operating margin is at over 37%, and its net margin goes upwards of 25.8%, which is absolutely stellar. The company, following superb full-year results has almost no debt, currently at a 0.13x debt/EBITDA, a strong overall ROIC, and a stockholder equity that over the past few years has been catapulted upwards, landing at well above 70% of total assets at this time.

None of the shareholders have been diluted either. K+S hasn't issued new shares for over 10 years. Its business is extremely well-diversified with an EU/SA/Asia/Germany/NA mix, with Europe and Germany making up about 50% together.

KPLUY works with potassium chloride, so-called MOP, and fertilizer specialties, and like any fertilizer company, the goal is high yields and crop qualities. The company produces, refines, and supplies natural materials for communities, consumers, and numerous industrial solutions. Agri products are about 50%, with industry products at just below 50%, including about 15% of sales being de-icing salt products.

There are several megatrends that speak clearly in favor of K+S. This includes the overall shrinkage of Arable land due to among other things, the population as well as climate changes. This brings about needs, such as the need for higher efficiencies, which requires better fertilizers, and that's what the company does. 2/3 of the current world population belongs to the middle class by 2030, and in 2015, that number was only around 14%. That's a massive change, requiring significant agricultural changes.

Also, there's water. 40% will suffer from water scarcity by 2030, and 70% of all water at this time is used for agriculture - these are statistics from the United Nations, among other things, most of them very up to date (Source: World Population Clock of the Deutsche Stiftung Weltbevölkerung (dated July 2022).

This requires the best possible fertilizers to make sure that humans don't starve. And this is what K+S has proven that the company can do.

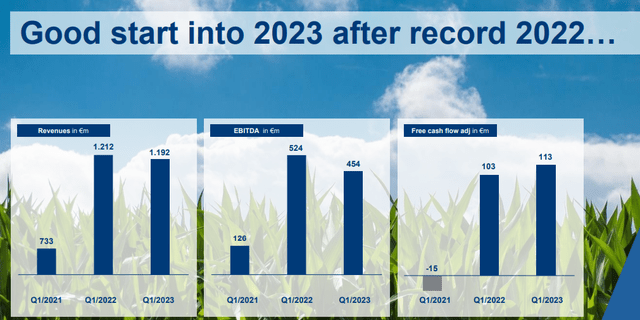

2023 has seen a good start, despite a massively difficult comp.

EBITDA naturally saw a decline for the year, with about €100M less than YoY. Selling prices, like for Yara (OTCPK:YARIY) saw a decline, but in this case, it was due to delayed deliveries due to logistical issues, not declining demand - though there was some of that wait-and-see attitude on the part of customers as well.

The company has inflation and cost exposure. Offset is done through things like industry pricing - which did offset lower volumes, but the company can't control all of its pricing, given the commoditized nature of the entire industry. FX and inventory effects saw positives here.

Like its peer Yara, the company continues to see positives going forward this year. Agri profitability is at record levels. Corn profitability, for instance, is at levels not before seein' in over 20-30 years. With much of the world's potash production behind the iron curtain since the Russo-Belarusian shut out, pricing is expected to continue to be high here. Even before the war, there was a tightness to potash and the market was at a limit - with how things are now, the market is stretched thin, and this is what we're seeing here.

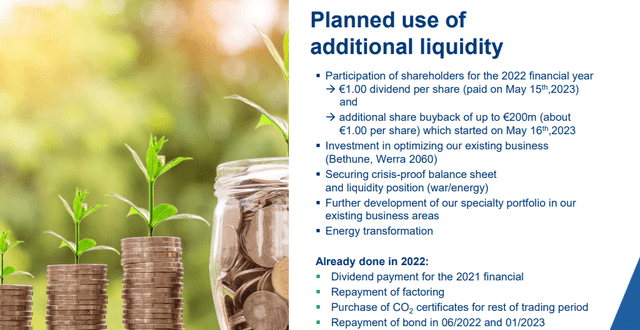

In short, K+S is seeing some impressive fundamentals and trends in the near future. The company has already decided on the use of its significant liquidity at this point.

The combination of share buybacks and dividends is of course a positive, and the company had ample opportunity to do attractively-priced share buybacks in the last few months when the share price cratered.

That is also when I bought most of my new shares, lowering my overall cost basis for the company.

Remember, even based on optimism, we won't see full recovery for potash until 2026E, and this is a very good upside for K&S given their current position. I've reviewed company operations on a more basic level in previous articles - and refer you to these for a more high-level overview of things like their salt operations or various asset lifetimes/forecast. The company has, simply put, a very attractive asset base that's set to continue to produce commodities for its sales for decades to come.

With the backdrop of the macro that we're seeing at this time, there is no negative scenario that I consider likely enough to materialize.

That's why I'm not using cash-secured puts or buy-write-covered calls for K+S. I'm using straight common share buys, which I only do if my conviction for the company is at a very high overall level. If I believe there is a chance for more downside, I go for alternative investment strategies. I might even look at the debt. Here, I'm looking at the common - and it's my belief that the value-oriented investor should do the same.

My expectations for 2Q23 are for the positives to continue. Yara has already confirmed a tightness in nitrogen. 2Q23 saw falling prices for Yara fertilizer as well but the improved outlook the company is seeing is broad. K+S also shares Yara's strong cash conversion despite a low-margin environment. Due to a combination of macro, costs, and climate, K+S has gone from being a relatively ho-hum company to one of the better potentials in the entire sector. The improved demand, tighter potash and overall fertilizer markets, and well-oiled operations of K+S are, as I see it likely to result in only one net result.

Profit.

And I'm going to put myself in a position to partake of that profit - even if that takes years.

European capacity curtailments are now being discontinued, I expect the company to be able to fully use the improved demand, even if pricing goes down, and make this up with higher volumes.

For that reason, going into 2H23, I see the following valuation thesis as relevant for K+S.

K+S Valuation - You should be paying attention here

While the company is higher than last when I reviewed it, K+S remains a very attractive potential at this time. Triple-digit RoR over the next few years is not at all unlikely here. The right sort of development and continued demand could see, and likely will see, this stock soar far higher than we've seen so far.

People have historically not liked K+S due to the coupling of environmental trends coupled with a "dirty" operation, coupled with debt. Well, the backdrop has vastly improved, cheap eastern-European players have been knocked out of the field (and are unlikely to return in the near future), and the company has handled its debt and is almost net debt free.

So what's left is the "dirty operation" part. Potash mining, which K+S is part of, affects the atmosphere, surface water, groundwater, soil, and vegetation. It's in no way clean - but it's necessary for humans.

For me, this is not a concern when I invest - the company does its best to work with what environmental agencies and laws exist, and I look at the company from a valuation upside - and that upside is good here.

While thinned out, I believe it's fair to forecast K+S at a multiple of 17-19x P/E. At 19x, this gives us an upside of around 12% per year based on a current forecasted EPS of around €1.38-€1.4 for the next few years.

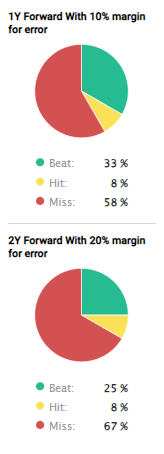

It's worth mentioning at this juncture that K+S is one of the most difficult companies to forecast that I've encountered - to where you can pretty much ignore any forecasts because they won't be accurate in any case.

SDF Forecast Accuracy (F.A.S.T graphs/FactSet)

My previous price target for this company was at €30.5. I remain much more bullish than my valued colleagues both covered by FactSet and S&P Global here. 16 analysts which are pulled by S&P Global data follow the company, averaging a €20/share PT from a range of €15/share low and €25 high. This is an upside of 8% at this time.

I justify my much higher price target based on what I've written above - the tightness of the market, increased volumes, and much of the capacity outside of most imports currently, as well as the much more positive backdrop here.

I would also like to point out here that only a year back, the company was forecasted as having a value of between €30-€42/share, so it's a fairly amazing price drop these analysts have shifted to, and impaired the company's earnings.

Because I don't agree with the severity of this drop, I remain at €30.5/share even going into 2H23 in about 3 weeks. I've added plenty of shares of K+S to where it's now 0.45% of my total portfolio, and I'll continue to add under my PT.

Here is my current thesis on the company.

Thesis

- K+S is one of the largest players in Potash remaining after Russia and Belarus are sanctioned off to most of the modern world. This makes this German fertilizer and salt giant an attractive play, and a good time for the company to flex its expansionary muscles. Despite a lack of an IG rating, I view this as an interesting play.

- In the right environment, which we have today, it's not inconceivable that the company could rise closer to its fair value, which I view as being valid close to €40/share.

- I remain at my conservative €30.5 PT based on conservative growth rates, mixed NAV/peer valuations, and conservative multiples and forecasts. This is above the average, but I consider it fair.

- I, therefore, view it as a "BUY" here.

Remember, I'm all about:

- Buying undervalued - even if that undervaluation is slight - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn't go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

My one change is that I will no longer view K+S as "cheap" here - beyond this, the company still fulfills all of my criteria for investing.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management/wealth management for a select number of clients. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of YARIY, KPLUY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved. I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks i write about. Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend witholding taxes and ways to mitigate these.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.