ManpowerGroup: 'Hold' Reiterated As Near-Term Performance Pressure Continues

Summary

- ManpowerGroup 2Q results were disappointing with lower revenue and earnings than expected, mainly due to a slowdown in hiring activity in Europe and the US.

- Despite difficulties in Europe and the US, business trends in Latin America and Asia-Pacific Middle East regions are expected to remain strong, offsetting deteriorating revenue trends.

- I expect to see a decline in revenue in FY23 due to a challenging macro environment, but a recovery is anticipated in FY24 and FY25 as the economy improves.

sturti

Summary

ManpowerGroup Inc. (NYSE:MAN) provides temporary staffing services, contract services, and training and testing of temporary and permanent workers. Readers may find my previous coverage via this link. My previous rating was a hold, as I believed the near-term share price would be significantly impacted by the short-term weakness due to the new guidance and persistently high inflation in the Europe region. I am reiterating my hold rating as I continue to see headwinds in the near-term.

Financials / Valuation

The 4.3% y/y decline in MAN's reported revenue was slightly better than the 4.5% decline expected by consensus. Revenue decreased 3.5% y/y in 2Q, worsening from the 2.2% y/y decline in 1Q when adjusted for FX. On an ex-FX basis, sales in Southern Europe were down 0.9% year over year, while sales in Northern Europe were down 6.3%. Revenue in APME rose by 4.2% y/y while Americas revenue saw 9.3% y/y decline (ex-FX). Both the company's margins and EPS have fallen short of market expectations, validating my worries about MAN's near-term prospects. The decline in permanent placements, negative operating leverage, and reinvestment activity all had a negative impact on EBITA margins, which pushed it down 110 bps to 2.7% despite selective cost cutting. EPS of $1.58 were also below the expected $1.62.

Overall, MAN's 2Q results were disappointing, with an earnings miss and weak guidance for 3Q EPS compared to pre-results expectations. In the short term, I remain concerned because MAN is still experiencing a slowdown in hiring activity in both European and United States, with particularly strong headwinds at large technology companies. The IT staffing industry as a whole, including Experis and Talent Solutions, is in decline due to fewer permanent IT job openings, less RPO activity as a result of this, and fewer managed service provider contracts. One bright spot is that growth in LatAm and APME, as well as increased outplacement activity in Right Management, are helping to offset the deteriorating revenue trends. For the rest of the year, I anticipate significant headwinds to overall revenue performance, particularly from lower permanent placement activity and negative operating leverage, both of which weigh on EPS performance.

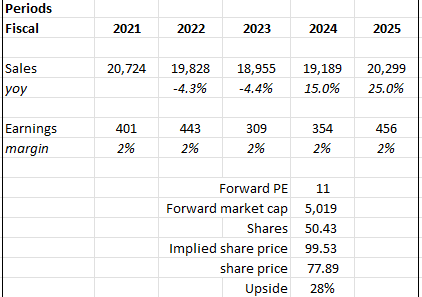

Based on my view of the business, MAN should continue to see revenue decline in FY23 as the tough macro environment weighs on demand. However, I expect the economy to turn for the better in FY24 and FY25, which should drive recovery growth for MAN, achieving FY21 revenue levels in FY25. In a normal environment, I would’ve assumed the valuation to trade at 13x (the MAN historical average), but given the higher rate environment, I assumed an 11x forward PE to be conservative. 11x forward PE is not a demanding valuation when compared against other peers that are trading at between 11x and 16x forward PE and are growing at similar rates to MAN.

Peers include:

- Kforce Inc. (KFRC)

- Korn Ferry (KFY)

- Randstad (OTCPK:RANJF)

However, I remain concerned about the near-term share price performance, which might push valuation and stock price much lower before they recover. Hence, I reiterate a hold rating for now.

Based on author's own math

Comments

Despite the difficulties in Europe and the United States, I believe that business trends in LatAm and APME will continue to be strong. Due to the normalization of the global supply chain and the reopening of China, there has been significant growth in the Asia and Latin America regions. I expect this positive development to lead to a rise in demand for temporary staffing services. With regards to profitability, I am getting more positive about the long-term margin profile as management seems to be focusing on enhancing it. For one, MAN has decided to wind down its underperforming Proservia business in Germany beginning in 3Q, which I expect to improve margins. Elsewhere, MAN has also implemented minor restructuring measures in Spain and the Nordics. I expect these actions to optimize the business and have a long-term positive impact on margins. Besides the continuous initiatives aimed at achieving SG&A savings through cost reductions in areas experiencing reduced demand and corporate functions, MAN's cloud-enabled global technology platform, PowerSuite, has also expanded to cover nearly all markets by 2023, which has made me more positive about management's commitment to furthering the company's digitization strategy to drive productivity gains and innovation by making use of data and insights. This should help further improve productivity, which generates further cost savings that could be reinvested into growth if necessary. Note that MAN has lower net margins than peers like Korn Ferry and Randstad, and I think MAN can gradually close some portion of the gap via such investments.

Risk & conclusion

The global tightening of monetary policy to combat high inflation has increased the likelihood of a recession. Given MAN nature of business, it is extremely sensitive to wild swings in economic cycles, hence, this is prevailing key risk for MAN.

In conclusion, I maintain my neutral rating on MAN stock as the near-term performance is expected to face continued pressure. The company's 2Q results were disappointing, with lower revenue and earnings than expected, mainly driven by a slowdown in hiring activity in Europe and the United States, particularly at large technology companies. While there are positive developments in Latin America and Asia-Pacific Middle East regions, the overall macro environment remains challenging. Looking ahead, I anticipate ongoing revenue decline in FY23, but expect a recovery in FY24 and FY25 as the economy improves. Although MAN's valuation appears conservative compared to peers, the near-term share price performance remains a concern, which could lead to further declines before recovery.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.