Avoiding Seagate Technology Ahead Of Earnings

Summary

- Seagate Technology Holdings is expected to announce earnings post-market tomorrow, and I would recommend avoiding the shares. I'm forecasting a decade low in operating income.

- The company's revenue, operating income, and net income have been down significantly compared to previous years, and its debt has increased by about 40% while cash has dropped by about 65%.

- Despite the possibility of the business eventually turning around, I advise against investing in Seagate due to the high risk and low dividend yield compared to risk-free alternatives.

Justin Sullivan

Seagate Technology Holdings plc (NASDAQ:STX) is going to announce earnings after market close tomorrow, and I thought I'd check to see if it's worthwhile buying back into this name. I last announced to the world that I'm selling my Seagate in an article with the monumentally original title "I'm Selling My Seagate" in early December 2020. Since then the stock is down about 10%, but the dividend would have returned a positive 4.3% return, against a gain of about 23% for the S&P 500. I absolutely hate to come off as some kind of braggart, but I'm willing to endure that in order to make a broader point. I bought the stock at about $48 when it represented a better risk-adjusted return. The message here is plain, and it's not (explicitly) that I indulge in any chance to brag that I can. It is that any investment can be a "good" one or a "bad" one, depending on the price paid. Today I want to work out whether the price on offer is likely to produce a positive outcome or not. I'll make that determination by looking at the latest financial history, by using that as the basis of a forecast, and comparing all of that to the valuation.

Those who read my stuff regularly know that I'm absolutely obsessed with making the lives of my readers as pleasant as possible. It's the first thought I have when I wake up, and the last thought I have when my head hits the pillow. One of the ways I try to improve your lives is by offering a "thesis statement" paragraph for those who want a bit more information than they get from the title and bullet points, but much less than the 1,600 words that my articles typically run. So, I'm going to continue to avoid these shares into earnings tomorrow night. I think 2023 is going to be a relatively bad year for the company. That written, I think it'll be profitable, but the risk of investing in the stock is too great, especially when you compare it to the risk free alternatives available to investors. Thus ends the thesis statement. If you read on from here, that's on you. I don't want to read any complaints in the comments section below about the bragging or bad jokes.

Financial Snapshot

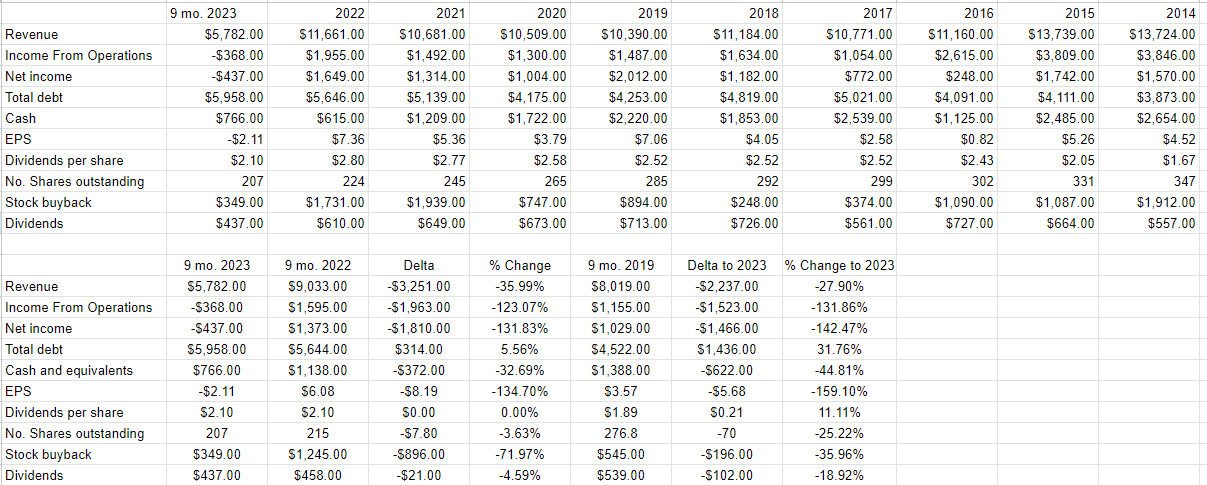

The first three quarters of this financial year have not been great in my estimation. Compared to the same time in 2022, revenue, operating income, and net income were down by 36% and a whopping 123%, and 132% respectively. About $410 million of the uptick in expenses could be considered "near one off" events, consisting of $110 million in restructuring charges and the fact that the company was fined $300 million charge for selling hard disks to Huawei (the BIS settlement). Note that this settlement involves the company paying $15 million every quarter for 5 years starting October 31st of this year. Leaving aside questions of company culture, and loyalty to "The West", I consider this to be a classic example of a corporation scoring an "own goal." Such behavior makes me wonder about the quality of management. Anyway, these two extraordinary items only account for about $410 million of the $1.96 billion drop in income from operations from last year to this. Most of the reduction can be accounted for by the $3.25 billion reduction in revenue from last year to this.

A more generous person than me might point out that 2022 was itself a banner year, and therefore comparisons to that period are unfair. Fair enough. It's true that 2022 was no 2014-2015 by any stretch, but it was quite good, relatively. That written, I feel the sudden urge to point out that the first nine months of fiscal 2023 saw revenue, operating income, and net income lower than the same time in 2019 by 28%, 132%, and 142.5% respectively. This is not a "growth" company by any means.

While on the subject of 2019, I think it's worthwhile pointing out what the capital structure looked like back then, and then juxtaposing that with how things look today. The company closed out 2019 with about $4.25 billion in total debt, and about $2.22 billion in cash. Today, the company has about $5.96 billion of doubt outstanding, and about $766 million in cash. Using the skills not so lovingly beaten into me by the good sisters at Holy Spirit School many, many decades ago, I have worked out for you that over the past four years, indebtedness has risen by about 40%, and cash has dropped by about 65%. That's troublesome in my view. This is why the company spent about $225 million on interest payments for the first three quarters of 2023.

Speaking of the uptick in interest payments, I feel obliged to point out that since 2018, the company has spent $5.9 billion on buybacks. To remind you, as of now the company has long-term debt of $5.958 billion outstanding. I also feel the need to point out that since January 1st, 2019, the share price has been volatile, and has returned a CAGR of about 8.4%. The S&P 500, by contrast, has returned a CAGR of about 13.2% over the same time period. In my view, the world today would look much better if the company hadn't taken on this debt, and was not obliged to spend $225 million on interest payments over just the most recent 3 quarters.

I could go on, but I would hate to bore you. The message is fairly straightforward in my view. The company is in a cyclical business, and many of management's decisions have made a challenging situation much worse.

Seagate Financials (Seagate investor relations)

My Very Tentative Forecast

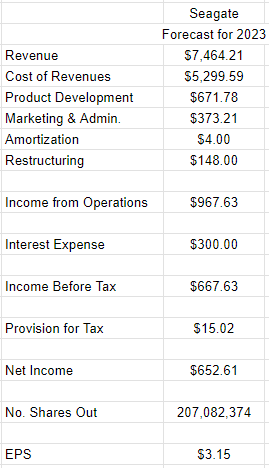

It falls to me now to try to forecast what FY 2023 is going to look like, and that involves forecasting revenue and a host of costs. In my view, the most logical approach to forecasting is to assume current trends will persist unless you get some evidence that there's a massive change afoot. So, I'm going to start my analysis with the assumption that revenue for 2023 is going to be down by the same rate as it has been so far in 2023, or 36%. So, I'm going to start with a top line of about $7.4 billion for the year 2023.

From there, I'm going to look at costs. Thankfully, with the exception of "restructuring" and "amortization expenses", these costs have been a remarkably consistent percentage of revenue. For instance, since 2014, cost of revenue has bounced very little between 70% of revenue in 2018 to 76% of revenue back in 2016. Additionally, I think this cost is more "variable" than "fixed", given that it has moved up and down throughout the past cycle, depending on whether sales were greater or lower. Product development costs in 2017 were a bit higher than average in 2017, at 11.4%, but they normally stick around 9% of revenue.

In regard to amortization, restructuring expenses, and interest expenses, I'm going to make a simplifying assumption that these will just be "full year" versions of the first three quarters. For example, the company has paid $225 million in interest for the first nine months of the year, or $75 million per quarter. I'm going to assume the interest expense comes in at $300 million for the year. Of these three, only interest expenses are material. Given all of the above, my forecast for operating income for 2023 is $967 million, which is a decade low. Income before tax is $667 million according to my forecast. Proving that the company doesn't come to Ireland for the craic, the vast majority of this is taxed at a very low rate, leaving net income for the year of about $652 million. As of the latest 10-Q there were 207,082,374 million shares outstanding. Using those arithmetic skills once again, I'm forecasting EPS for the year of about $3.15. You read it here first.

Much of this forecast depends upon whether or not the "cost of revenue" expense is indeed more variable or fixed.

My Seagate 2022 Forecast (Seagate filings, author calculations)

The Stock

I'd still be willing to buy this stock at the right price, and so it's now time to work out whether it makes sense to pick up some shares on the cheap, given that this business will likely eventually turn around.

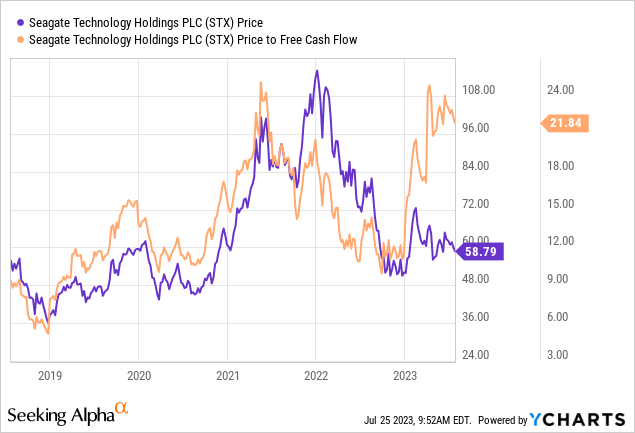

I determine whether or not shares are cheap enough based on a few factors, ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, free cash flow, and the like. I previously sold my Seagate when the shares hit a price to free cash flow of 16.7 times. Fast forward to the present, and the shares are about 30% more expensive on that basis, per the following:

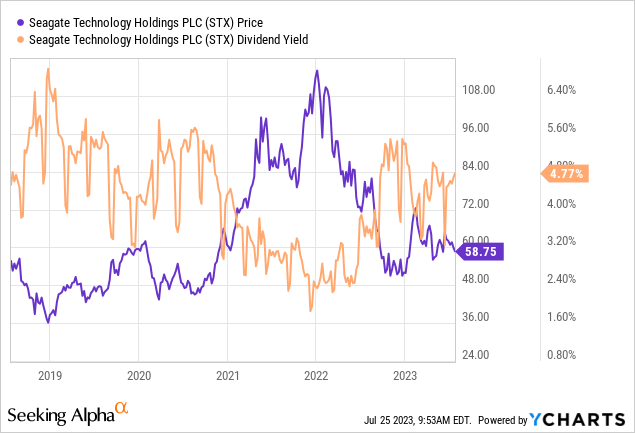

I'll admit that the dividend yield is fairly decent, but it's still below the 1-year risk free rate by about 70 basis points, and is only about 90 basis points greater than the 10-year risk free rate.

Paying more, and getting less is not my idea of a great bargain. Investors are taking on a great deal of risk with this fairly volatile investment, and in that circumstance, they should expect a much greater dividend yield. We're not seeking "returns." We're seeking "risk-adjusted returns", and given the above, I'm going to continue to eschew these shares. The market may be very pleasantly surprised by what happens after market close tomorrow night, but I think any gains from current levels will be temporary. I'd rather sit out of that party, and invest in risk free instruments for the time being.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.