SPYG: It's Greedy O'Clock, Time To Be Fearful

Summary

- The SPDR S&P 500 growth ETF is largely a technology-focused fund due to the majority of growth stocks being in this sector; it's currently in a period of overvaluation.

- The fund has tracked its index well, outperforming it in 2020 and 2022, but is underperforming so far in 2023; it's rated as a buy by Seeking Alpha's Quant rating system.

- Despite its merits, SPYG is outperformed by alternative funds such as QQQ, SCHG, and IWF, with QQQ performing the best.

NongAsimo

Fund Overview

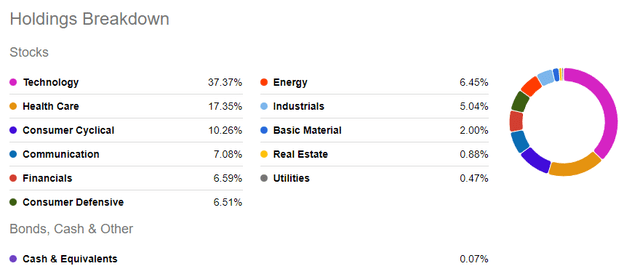

The SPDR S&P 500 growth ETF (NYSEARCA:SPYG) is a large growth-focused ETF. Technically, the fund is focused on growth companies in the S&P 500 regardless of sector, but, in practice, it is a focused technology fund because that is where the bulk of the growth stocks are. A look at the sector breakdown shows this.

Is Growth Overvalued?

Growth stocks have been making a comeback this year, we need to ask ourselves if growth is overvalued? This fund holds hundreds of stocks, so the question is on a macro level. I think the VIX is a good place to start.

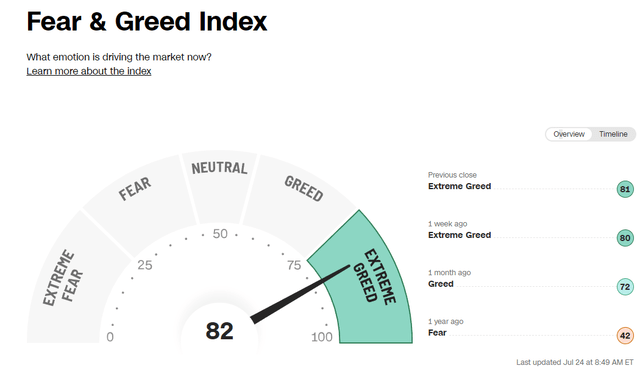

For those unaware, the VIX is an index that investors use to gauge fear in the stock market. The VIX is at its lowest point in the pandemic, but it is still above its pre-pandemic levels. YTD the VIX has gone down 34%. These factors tell me the market is greedy. This should be taken with a grain of salt as there has been talk that the VIX is broken and does not reflect the level of fear in the market. Another measure of investor sentiment I like to use is the fear and greed index on CNN.

As you can see from the image above, the index states we are in a period of extreme greed, and a year ago we were in a period of fear. I believe this is a strong indication that the market is in overvalued territory and long-term investors should slow down their pace of buying. Now what about fundamentals?

In my valuation of Microsoft (MSFT), I spoke about how the PS ratio has a stronger correlation to stock prices than earnings. A look at SPYG's P/S ratio shows the ratio has increased recently but is still below peaks hit both before and after the pandemic.

SPYG P/S Ratio (Seeking Alpha)

I would become skeptical of the fund moving higher at the 150 level. Today we sit at around 130, so there is approximately 15% more upside before I expect a true overvalued caused sell-off.

Long Term Performance and Outlook

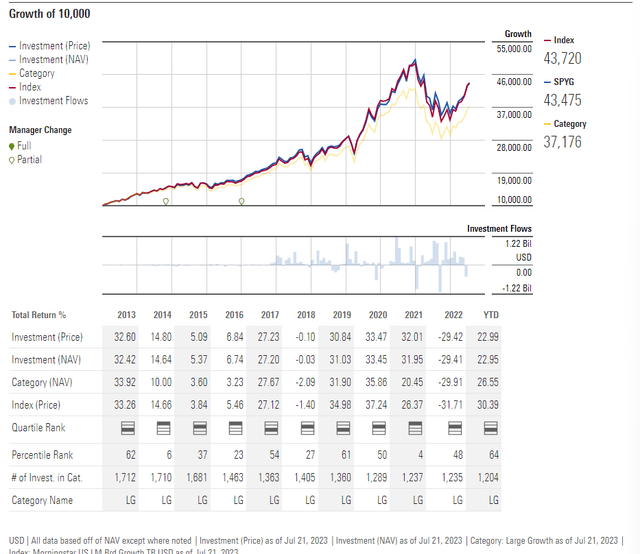

SPYG Performance (Morningstar)

The fund has tracked its index well and outperformed the index in both 2020 and 2022. So far, through 2023, the ETF is underperforming the index. Seeking Alpha's Quant rating system has the ETF in the buy category. The fund earned top marks in momentum, expenses, and liquidity.

Alternative Funds

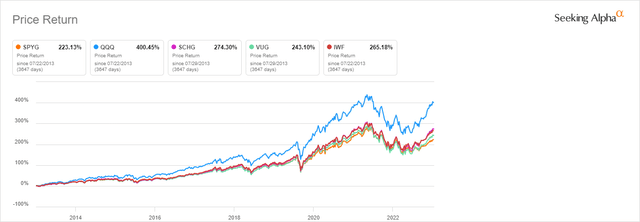

SPYG operates in a competitive category, QQQ (QQQ) is the main alternative that comes to mind, but other options include VUG (VUG), SCHG (SCHG), and IWF (IWF).

Against QQQ, SPYG has an expense ratio that is five times less than QQQ's, but in terms of performance, QQQ blows SPYG away. YTD QQQ has almost doubled SPYG's performance and historically, QQQ outperforms SPYG by a significant margin.

SCHG ties SPYG for the lowest expense ratio at 4 basis points, but unlike QQQ, has a more mixed record of performance, underperforming SPYG in years 2015, 2016, 2018, and 2022. So far, in 2023, SCHG is almost 15 percentage points higher than SPYG and is of a similar size in AUM.

The Vanguard Growth ETF (VUG) also ties for the lowest expense ratio at 4 basis points but has underperformed SPYG most years.

IWF has an expense ratio just under QQQ's at 0.18% and, like QQQ, has outperformed SPYG most years.

When comparing the funds together, it seems clear QQQ has historically been the superior fund. With SCHG and IWF a distant 2nd and 3rd.

10-year ETF comparison (Seeking Alpha)

Conclusion

The market sentiment and fundamental valuation analysis indicate we should be approaching a peak soon, and so I believe investors should sit on the sideline for now. Overall SPYG is not a bad fund to own, but there are superior alternatives. As the above analysis shows, QQQ is superior by a wide margin and for that reason I am rating SPYG a sell. I believe replacing SPYG with a better fund is the best choice available.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)